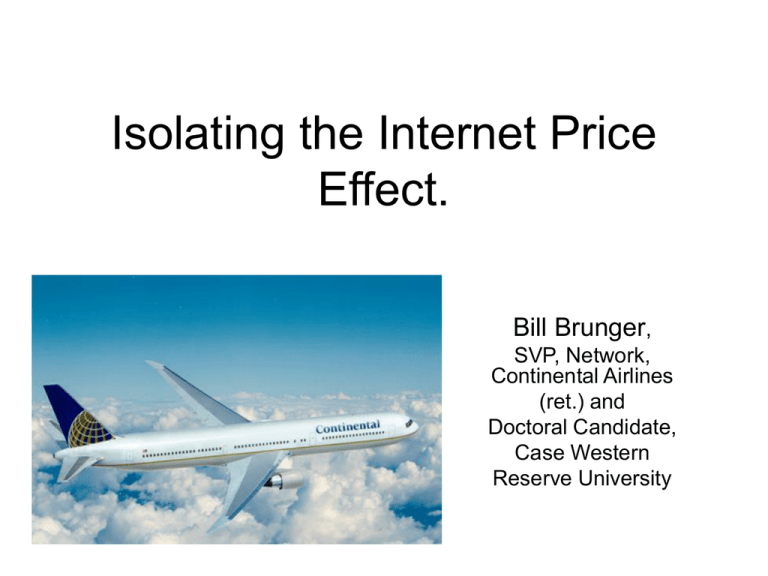

Bill Brunger

advertisement

Isolating the Internet Price Effect. Bill Brunger, SVP, Network, Continental Airlines (ret.) and Doctoral Candidate, Case Western Reserve University Motivation: So What Has Happened? (Some level of causality seems obvious) Percent of Continental Airlines Domestic Tickets sold through Internet 1998 1999 2000 2001 2002 2003 2004 2005 Continental Airlines' Average Yield in 2004 Cents 1998 1999 2000 2001 2002 2003 2004 2005 Domestic US Low Cost Carrier growth. 1Q-06 4Q-04 4Q-03 4Q-02 4Q-01 4Q-00 4Q-99 4Q-98 4Q-97 4Q-96 4Q-95 4Q-94 4Q-93 4Q-92 4Q-91 4Q-90 4Q-89 4Q-88 4Q-87 4Q-86 4Q-85 4Q-84 4Q-83 4Q-82 4Q-81 Low Cost Carrier Mix of ASMs Industry Structure obviously changed… 30.0% 25.0% 20.0% 15.0% 10.0% 5.0% 0.0% Easier to See by Taking Southwest and America West Out… Rise of Internet Wave I 10.0% 8.0% Wave II 6.0% 4.0% 2.0% Domestic US Low Cost Carrier growth (No WN,HP). 1Q-06 4Q-04 4Q-03 4Q-02 4Q-01 4Q-00 4Q-99 4Q-98 4Q-97 4Q-96 4Q-95 4Q-94 4Q-93 4Q-92 4Q-91 4Q-90 4Q-89 4Q-88 4Q-87 4Q-86 4Q-85 4Q-84 4Q-83 4Q-82 0.0% 4Q-81 Low Cost Carrier Mix of ASMs 12.0% Most customers believe that Airline Pricing Behavior Changed • But I’m not sure… • We still match and go on sale and run off-peak sales and amuse ourselves with our alphabet soup of fares and restrictions… • And DCA3 and PFS et al. limited “Internet-only” and channel-specific activity… • There have been relatively few innovations: Priceline/Hotwire, weekly specials, clubs,… The Costs of Distribution Definitely Changed… Continental Airlines' Average Distribution Expense as a Percent of Fare Paid 1998 1999 2000 2001 2002 2003 2004 But other cost changes overwhelmed it… Crude Oil and Jet Fuel Price Trend September 28, 2005 $140 WTI: Crack Spread: Jet Fuel: $120 $66.35 $58.01 $124.36 $100 Jet Fuel/W TI Crack Spread W TI Crude $60 $40 Sep-05 Jul-05 May-05 Mar-05 Jan-05 Nov-04 Sep-04 Jul-04 May-04 Mar-04 Jan-04 Nov-03 Sep-03 Jul-03 May-03 Mar-03 Jan-03 Nov-02 Sep-02 Jul-02 May-02 $0 Mar-02 $20 Jan-02 ($ per BBL) $80 Distribution Became More Concentrated!!!! We Had Expected Fragmentation And, most importantly, Customers Changed Expectations & Behaviors Preliminary Qualitative Study • Method – 15 open-ended interviews; all referrals; mixed demography and geography, and – All were “Experienced travelers” • All had purchased in the pre-Internet time • Limitation: homogeneity of age; all between about 30 and 60. • Advantage: Perspective; Most previous studies have been on students (who never used a TA) or clients of a particular firm • Data – Analyzed using Glaser and Strauss – Initial set of codes from literature (11): search duration, dynamics, range, timing, fare levels, fit, loyalty, and adjectives and descriptors of control, trust, choice and cooperation; evidence of co-production – Final set (50) cluster into 6 categories weatherhead.case.edu/edm/archive/details.cfm?id=10288&topic=23 Or Google: Brunger Impact Airline Five Findings 1. 2. 3. 4. 5. Switch was not perceived primarily about lower fares; about control & transparency/search breadth. Unexpectedly, the actual search protocols that most respondents perform are quite simple. - Effects of trip type, FFP status & demography? Some formed new levels of “involvement” with the Search. Some became “search enthusiasts”. For some, enabled, facilitated, reinforced rich new set of traditional (and web) social interactions. Change with respect to timing, specifically the decision about when to purchase the ticket. & They Believe that They Find Lower Fares Can We See Evidence of the Change? Yield by Channel Online Agencies Travel Agents But this is primarily a market segmentation effect… Fare Paid for "clearly LEISURE" Itineraries (Net of all fees; fares and inventory w ere the same) February '06 / June '06 On Average, Internet Agency customers pay 11.5% less EWR-RDU EWR-PHX EWR-LAX EWR-ORL IAH-SEA IAH-ORD IAH-LGA CLE-SFO Traditional TA CLE-LAS EWR-RDU EWR-PHX EWR-LAX EWR-ORL IAH-SEA IAH-ORD IAH-LGA CLE-SFO CLE-LAS Internet Agency What am I going to look at next? Customers who use Internet/OnlineTravel Agencies (OTAs) to purchase leisure trips pay significantly less (11.5% in our sample) for similar itineraries in the same markets than those who purchase through traditional travel agencies even though the fares and inventory offered by the airlines are identical. The purpose of this study is to examine this Internet Price Effect (IPE). Other than Transparency Effects, what could account for 11.5% differential in the IPE? • • • • • Trip characteristics Customer differences Market structure The “Value” of the seat Then the question is, controlling for these attributes, does IPE persist? What do I expect to find??? Using My Regression Equation: FP= ß0 + ß1*DC + ß2*TC+ ß3*CD + ß4*MS + ß5*OpV + ε Previous Regression-based Studies of Airlines and Distribution • • • • • • Borenstein, S., and Rose, N. 1994. Competition and Price Dispersion in the U.S. Airline Industry. Journal of Political Economy, 102 (4): 653-682. Clemons, E., Hann, I., and Hitt, L. 2002. Price dispersion and differentiation in online travel: An empirical investigation. Management Science, 48 (4), April: 534-549. Granados, N., Gupta, A., Kauffman, R. 2006. Internet-enabled Market transparency: Impact of price elasticity of demand in the air travel industry. Working paper, Carlson School of Management, University of Minnesota, May 8, 2006. Lane, L. 2003. Price Discrimination in the U.S. Domestic Airline Industry: The Effect of the Internet. Unpublished Third Year Research Project, EDM Program, Weatherhead School of Management, Case Western Reserve University. Sengupta, A., and Wiggins, S. 2006. Airline Pricing, Price Dispersion and Ticket Characteristics On and Off the Internet. Working paper #0607, NET Institute, Texas A&M University, November, 2006. Stavins, J. 2001. Price Discrimination in the Airline Market: The Effect of Market Concentration. Review of Economics and Statistics, 83, February: 200-202. Some Very Early Findings… • • • • Continental’s Top-25 Markets June,2006, every nonstop simple roundtrip Only “clearly leisure” OTA and Traditional Agencies (No CO.com) • Group size < 9; Coach cabin only • CO “shipped” the same Fares and Inventory to all channels! Preliminary Run: Statistics by Channel Fare ap gs ls pkd pkh orig none si go pl hi sh sz dist lcc leis abf pp opv opv7 Booked through Travel Agents 21706 Obs. Mean Std. Dv. Skew Kurt. 294.65 109.39 1.81 7.49 66.7 53.8 2.07 6.38 2.3 1.5 1.11 0.57 7.6 8.0 9.61 184.24 0.600 0.490 -0.41 -1.83 0.336 0.472 0.69 -1.52 0.829 0.376 -1.75 1.07 0.228 0.419 1.30 -0.31 0.057 0.232 3.82 12.60 0.031 0.174 5.38 26.91 0.030 0.171 5.49 28.18 0.363 0.153 0.92 -0.33 41.0 22.1 0.69 -1.07 2625.0 1809.2 0.39 -1.35 1434.6 667.8 0.46 -1.36 27.7 16.5 -0.36 -1.10 0.408 0.08 -0.63 -0.10 285.1 67.3 0.32 -1.37 19.1 6.5 -0.59 -0.40 274.92 128.96 0.70 1.85 505.24 253.61 0.33 -0.05 std.err. 0.02 0.03 Booked at OLAs 25543 Obs. Mean Std. Dv. Skew Kurt. 266.23 83.11 0.80 1.34 54.3 39.4 2.26 9.59 2.4 1.4 1.03 0.58 7.4 8.5 9.84 168.30 0.604 0.489 -0.43 -1.82 0.322 0.467 0.76 -1.42 0.687 0.464 -0.81 -1.35 0.176 0.381 1.70 0.88 0.011 0.105 9.29 84.34 0.003 0.058 17.15 292.07 0.003 0.050 19.90 394.19 0.367 0.157 0.94 -0.25 41.1 22.5 0.71 -1.04 2476.8 1702.2 0.55 -1.02 1510.0 645.5 0.38 -1.36 26.4 17.4 -0.20 -1.29 0.401 0.08 -0.50 0.06 287.0 68.7 0.22 -1.42 19.5 6.4 -0.61 -0.24 241.2 109.26 0.36 0.04 472.5 256.32 0.43 -0.03 std.err. 0.015 0.031 Diff. Means (OLA-TA) -28.42 -12.4 0.0 -0.2 0.004 -0.014 -0.142 -0.051 -0.046 -0.028 -0.028 0.004 0.1 -148.1 75.4 -1.3 -0.007 1.9 0.5 -33.71 -32.77 Regression Coefficients Intercept ota ap gs ls pkd pkh orig none si go pl hi sh sz dist lcc leis abf pp opv adj.R 2 Model 1 Beta s.e. 1.039 0.002 -0.108 0.002 0.039 Model 2 Beta s.e. 1.136 0.003 -0.125 0.002 -0.001 0.000 -0.011 0.001 -0.002 0.000 0.043 0.002 0.017 0.003 0.111 Model 3 Beta s.e. 1.054 0.004 -0.100 0.002 -0.001 0.000 -0.007 0.001 -0.001 0.000 0.045 0.002 0.018 0.002 0.055 0.003 0.025 0.003 0.106 0.007 0.153 0.009 0.227 0.010 0.138 Model 4 Beta s.e. 1.116 0.020 -0.096 0.002 -0.001 0.000 -0.012 0.001 -0.001 0.000 0.044 0.002 0.014 0.002 0.056 0.003 0.030 0.003 0.111 0.007 0.157 0.009 0.232 0.010 0.131 0.024 -0.002 0.000 0.000 0.000 0.000 0.000 -0.001 0.000 0.293 0.019 0.000 0.000 -0.003 0.000 Model 5 Beta s.e. 1.191 0.015 -0.047 0.002 -0.001 0.000 -0.009 0.001 0.000 0.000 -0.004 0.002 -0.011 0.002 0.019 0.002 0.009 0.002 0.051 0.005 0.071 0.007 0.152 0.007 0.245 0.018 -0.003 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.237 0.014 -0.002 0.000 -0.001 0.000 0.002 0.000 0.153 0.537 DV = fare paid as percent of mean; All coefficients significant at .01 level except the red