Risk transfer

advertisement

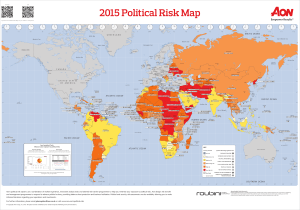

Aon Group Limited From Reinsurance to ART Dr. Alan Punter Aon Capital Markets, London 21st September, 2000 Alternative Risk and Alternative Transfer Aon Group Limited Insurance and reinsurance have a long history circa 2000 BC: Predecessor of marine insurance practised in Babylon - “bottomry” involved a loan on the security of a ship, but if the ship was lost the loan was not repaid. 1370: The first reinsurance transaction, as documented by Gustav Cruciger, who described how an insurer obtained reinsurance on a voyage it was insuring from Genoa, Italy, to Sluys, Netherlands. 1654 Bodlean library contains entries from insurance broker’s account book listing deals. 1688: Lloyd’s coffee house advertised in London Gazette. 1863: The formation of Swiss Re and Munich Re (in 1880) are widely considered to be the start of the modern “professional reinsurance” industry in continental Europe. 2 Aon Group Limited World Insurance Market 1998 premiums (US$ billions) Life Non-life Total North America 368 411 779 Latin America 11 28 39 Americas Western Europe Central / Eastern Europe 379 South and East Asia Middle East 818 399 286 685 4 11 15 Europe Japan 439 402 297 699 361 92 453 74 33 107 4 7 11 Asia 439 132 571 Africa 22 7 29 Oceania 22 15 37 World 1,264 891 2,155 3 Aon Group Limited US Insurance Results 1999 Net income after taxes fell from $30.8 bn in 1998 to $22.2 bn in 1999 Combined ratio up from 105.6% in 1998 to 107.9% in 1999 Rate of return on average net worth fell from 8.5% in 1998 to 6.4% in 1999 Problems: poor premium growth weak profitability due to rising incurred losses and loss-adjustment expenses falling investment income 4 Aon Group Limited European reinsurers results 1999 “Very sorry picture” (Standard & Poor’s) Estimated average combined ratio of 131% for 1999 (109% in 1998) Record number of catastrophes in 1999 (including eight of over $1 billion) Weak premium rates, to continue in 2000 late occurrence of December 1999 European storms many multi-year contracts signed at 1/1/99 to cover Y2K issues High Aviation claims Retrocession recovery problems 5 Aon Group Limited Why do insurers buy reinsurance? Ancient Widen book of business - quota share Smooth earnings - excess of loss Off balance sheet “fund” Modern Liquidity Protect ratings & franchise Balance sheet management Enhance return on capital 6 Aon Group Limited The landscape of risk is changing ... Increasing exposures Natural perils 40 of the fastest 50 growing cities are in earthquake zones half off the world’s population lives in coastal regions, many of them exposed to the dangers of rising sea levels, repeated flooding and cyclones (World Disasters Report 1999) Man-made perils business interdependency critical reliance on integrated IT (communications and processing) systems brand values and reputation risk 7 Aon Group Limited The landscape of risk is changing ... Broadening view of risk “Risk is Risk” traditional insurance risks growth of capital markets and derivatives or financial and market risks (interest rates, exchange rates, commodity prices, credit, weather) operational risks (everything else - strategy, business, technology, legal, political, people, etc.) 8 Aon Group Limited The landscape of risk is changing ... Change in the financing of risk (Re)Insurance does not appear to deliver: clarity of cover certainty of payment, timing and amount … and has a high frictional cost Increasing use of non-traditional forms of risk financing growth of captives, blended solutions Convergence with capital markets catastrophe bonds CatEPuts® 9 Aon Group Limited Intellectual convergence Financial hedges Cat Bonds Capital markets Securitisation Contingent capital - CatEPuts ART solutions Multi-line Insurance Guaranteed Cost markets Insurance policy Traditional Risk Transfer ART / ARF Traditional Risk Financing 10 Aon Group Limited What does “Alternative” mean? Any mechanism used to substitute for traditional risk transfer products offered by re/insurers A planned approach to financing risk involving: Alternative risks not traditionally reinsurable eg. interest rate or commodity exposure, brand image Alternative structures, not reinsurance contracts eg. weather derivatives, catastrophe bonds Alternative markets, not Insurers or Reinsurers eg. capital market entities such as pension funds, banks and fund managers 11 Aon Group Limited Common Objectives of ART Buyers Risk retention Efficient use of capital Long term continuity and pricing stability Specified historic / future loss problem smoothing P&L insulation Managing volatility and adding liquidity Unlock potential profit in long tail exposures Insurance of traditionally ‘uninsurable’ risks 12 Aon Group Limited Common Solution Characteristics & Features Solution not product driven, with alignment of interests (tailored to match client needs & market appetite) Multi-risk or aggregate nature of coverage (blending) Finite, aggregate limits of liability (per occ, annual, term) Multi-year contractual commitment Profit sharing, often with investment income Transparency Converged Banking / Insurance / Capital techniques Generally, reinsured’s upside (i.e. reinsurer’s downside) is limited in some way 13 Aon Group Limited Trends & Future Development of ART Continued growth of many forms of self insurance (i.e. larger retentions, insurance co. captive formation, ‘finite’ risk programmes) Increasingly buyers require flexible, bespoke, broader applications Accountancy treatment, taxation treatment and legal contracts need to be analysed carefully Techniques and instruments need to be fully tested in real circumstances New deals are moving away from insurance principles of insurable interest and indemnity Whilst market remains soft, low financial incentive for buyers to be too adventurous (current appear expensive) 14 Aon Group Limited ART Markets: Characteristics The major financial organisations including Professional (re)insurers (ACE, AIG, Allianz, Axa Global Risks / Paribas, Bankers Trust, Chubb, Citicorp / Travellers, Custom Risk Solutions (RSA, Ace, Aon), ERC Frankona, General Re, Gerling, Liberty Re, Munich American Risk Partners, QBE, Scandinavian Re, Stockton Re, Swiss Re New Markets, Transatlantic Re, Winterthur / Credit Suisse, XL / Pareto, Zurich Centre Solutions) Global carriers Finance houses / merchant banks / capital markets Strong balance sheets Proven commitment to long term partnerships Proven commitment to tailor-made (customised) solutions 15 Aon Group Limited Most Efficient use of Risk Capital ? Identify risks and trading objectives Perform risk analysis and evaluation of data Quantitatively identify optimal solution Placement and Negotiation Retain Traditional ART Capital Markets 16 Aon Group Limited Alternative Risk Transfer & Financing Structures in Context - Annual Placings Capital Markets Financing Cashflow SM Contingent Equity Programmes (CatEPut ) Catastrophe Bonds Integrated Risk (FX / Gradual Pollution) Tens Weather Derivatives / Commodities Blended / Multiple Trigger / Residual Value Loss Portfolio Transfer Multi-line / Multi-year Captives Thousands Insurance Risk Transfer Millions Motor / Property / Liability - QS, surplus, risk & cat XL etc Contracts Placed Annually Worldwide Traditional (Re)Insurance 17 Aon Group Limited Developments in Insurance ART Self-insurance Retrospectively rated plans (retros) Captive insurance company, rent-a-captive and protected cell company Finite or financial insurance Multi-line, multi-year, aggregate or blended and integrated programmes Enterprise-wide risk management 18 Aon Group Limited Developments in Reinsurance ART Financial reinsurance Insurance derivatives Contingent capital (debt and equity) Double triggers Catastrophe Bonds 19 Aon Group Limited Functions of financial reinsurance Smoothing of fluctuations in cedent’s loss experience over a period of years Optimisation of balance sheet structure and reported ratios, such as solvency or reserve adequacy Expansion of underwriting capacity, by ceding premiums and/or technical reserves Increase in retentions Facilitation of acquisitions, mergers and corporate restructuring 20 Aon Group Limited Summary of financial reinsurance contracts Type of contract Time dimension Type of risk Benefits Loss Portfolio Transfer Retrospective Timing risk Accelerate income Underwriting risk Discount reserves Improve solvency Adverse Development Cover (or retrospective aggregate excess of loss) Retrospective Underwriting risk Transfer of aggregate risk Timing risk Credit risk Finite (or Financial) Quota Share Prospective Spread Loss Treaty (or prospective aggregate excess of loss) Prospective ‘Blended’ cover Prospective Surplus relief Increase capacity Improve solvency Timing risk Underwriting risk Underwriting risk Non-traditional risks Smooth and protect reported annual results Transfer risk of portfolio aggregation Smooth and protect annual reported results 21 Aon Group Limited Insurance-linked securitisation Risk liquidity Contingent Surplus Notes (CSN) Catastrophe Equity Puts (CatEPuts) Risk transfer Chicago Board of Trade options Double trigger Catastrophe Bonds 22 Aon Group Limited Contingent Surplus Notes - CSN Nationwide Mutual Insurance Company of Ohio, Surplus Notes deal in 1995 $400 million raised and deposited in trust fund Noteholders receive returns equal to yield on government bonds plus 23/8%, but run risk of Nationwide drawing down cash from trust fund and converting into surplus notes (like preference shares) Nationwide can draw funds down under wide conditions Arkwright Mutual did similar $100 m deal in 1996 23 Aon Group Limited Contingent capital - CatEPutSM RLI Catastrophe Equity PutSM 3-year agreement brokered by Aon Re Services RLI pays annual option premium to Centre Re Trigger is major California quake, then: Centre Re buys up to $50 million convertible non-voting preference shares in RLI RLI pays annual dividends on preference shares RLI converts preference shares into full-voting common equity after 3 to 4 years (but has option to repurchase at original issue price) 24 Aon Group Limited The CatEPutSM Structure Option premium Before option exercised INVESTOR RLI Option rights Preferred shares When option exercised INVESTOR RLI Cash Common shares At conversion date INVESTOR RLI Preferred shares 25 Aon Group Limited CatEPuts - features Post-event capital negotiated at pre-event terms Pre-event option premium lower cost than traditional reinsurance protects shareholder value mitigates dilutive effects of upper layer reinsurance Post-event balance sheet recovery favourable treatment by ratings agencies no reinstatement no profit & loss protection 26 Aon Group Limited Extract from RLI Corp. 1996 R&A What are the benefits (of the CatEPut) to shareholders? A: First, this is an extremely cost-effective level of security ... a fraction of the price for a similar layer of reinsurance. But by improving our ability to withstand a momentous catastrophic event, we have also fortified shareholder value. Even if such a disaster occurs, our earning power would remain intact at its current level. Likewise the ability of RLI to pay dividends and rise in value has also been shielded. 27 Aon Group Limited Double Trigger - Examples European multi-line insurance company suffered combined effect of not only poor returns from its stock and bonds investment portfolio, but also large underwriting loss bought reinsurance programme that links retained losses to underlying financial criteria CSAA reinsurance contract triggered by two elements occurrence of a major catastrophe fall in level of equity index CLM reinsurance contract responds if CLM suffers from both a significant fall in the price of equities and adverse underwriting results 28 Aon Group Limited Catastrophe or “Act of God” Bonds Issued by insurer (or corporate) In the event of a pre-defined catastrophe bondholders may be forced to: forfeit some or all of their interest repayments; or forfeit some or all of their principal; or delay/defer receipt of interest or principal 29 Aon Group Limited USAA / Residential Re I (1997) Raised $400 million in cover through private placement of $477 million in bonds by Residential Re, Cayman Islands Oversubscribed by factor 2plus Trigger was single US East Coast hurricane intensity 3, 4 or 5 Indemnity of 80% of USAA’s losses $500 m excess of $1 bn Two tranches: A-1 $164 million principal protected, LIBOR + 273 bps A-2 $313 million principal-at-risk, LIBOR + 576 bps 30 Aon Group Limited Investor base for USAA bond issue 18% 8% 3% Money managers Mutual funds Hedge funds Life insurers Reinsurers Others 15% 44% 12% 31 Aon Group Limited Done Deals Deal Date Completed Insured or Cedent Investors Advisors Deal Description Issue Size ($ 000's) Type 85,000 Risk Transfer Perils Covered 1 1994 Hannover Re Institutions Citibank Cat XL Retrocession 2 June 1994 HHRF C Manhattan Aon Cat Line of Credit 3 September 1994 FWUA (Florida Fund) Chemical Bank None Cat Line of Credit 1,000,000 Contingent Capital Florida Wind 4 September 1994 Florida RPC JUA J.P. Morgan None Cat Line of Credit 1,500,000 Contingent Capital Florida Wind 5 February 1995 Nationwide Institutions J.P. M, SB 6 Late 1995 AIG Institutions AIG Contingent Surplus Notes 400,000 Contingent Capital Surplus Protection 10,000 Risk Transfer Cat XL 7 April 1996 Arkwright Institutions ML, MS Contingent Surplus Notes 100,000 Contingent Capital PML Protection 8 July 1996 State Auto C Manhattan None Catastrophe Line of Credit 100,000 Contingent Capital PML Protection 9 October 1996 RLI Centre Re Aon CatEPut Institutions Citibank Proportional Reinsurance 100,000 Risk Transfer GS Property Surplus Share 10 December 1996 Hannover Re 11 December 1996 St. Paul (George Town Re) Institutions PML Protection 500,000 Contingent Capital Hawaii Wind 50,000 Contingent Capital PML Protection 50,000 Risk Transfer US Windstorm 130,000 Risk Transfer European Hail 12 January 1997 Winterthur Institutions CSFB Cat XL 13 March 1997 Reliance Institutions Sedgwick Cat XL - Multi-line 14 March 1997 Horace Mann Centre Re Aon CatEPut 15 June 1997 USAA (Res'l Re) Institutions ML,GS,Lehman Cat XL 400,000 Risk Transfer Florida Windstorm 16 July 1997 Swiss Re Institutions CSFB Cat XL 122,000 Risk Transfer California E’quake 17 July 1997 LaSalle Re Swiss Re Aon CatEPut 100,000 Contingent Capital PML Protection Institutions GS, Swiss Re Cat XL 18 December 1997 Tokio Marine (Parametric) 40,000 Risk Transfer 100,000 Contingent Capital PML Protection 90,000 Risk Transfer Japanese E’quake 32 Aon Group Limited Done Deals Deal Issue Size ($ 000's) Type Date Completed Insured or Cedent Investors Advisors Deal Description 19 February 1998 RAM Re PMI Group, Inc. None LOC Credit Enhancement 40,000 Contingent Capital 20 March 1998 Centre Re (Trinity Re) Institutions GS, Chase Cat XL 75,000 Risk Transfer 21 April 1998 Mitsui Institutions Swiss Re Cat XL - Swap 30,000 Risk Transfer 22 May 1998 Reliance Institutions Sedgwick Option on Cat Notes 50,000 Risk Transfer 23 June 1998 CNA (HF Re) Institutions Hedge FinancialCat XL 24 June 1998 Arrow Re Goldman Sachs Direct 25 June 1998 USAA (Res'l Re II) Institutions ML, GS, LehmanCat XL 26 June 1998 Yasuda(Pacific Re) Institutions Aon Cat XL 80,000 Risk Transfer 27 June 1998 AXA Re Institutions Axa / Paribas Cat XL 25,000 Risk Transfer 28 July 1998 USF&G (Mosaic Re) Institutions GS, EWB Cat XL 54,000 Risk Transfer 29 July 1998 XL Re Institutions GS, Aon Cat XL 100,000 Risk Transfer US Wind and EQ 30 September 1998 Toyota Motor Credit Institutions GS Residual Value Excess 566,300 Risk Transfer Res Value of Car Leases 31 December 1998 Centre Re Institutions GS, Chase Cat XL 32 December 1998 Allianz (Gemini Re) Institutions GS Option on Second Cat XL 33 December 1998 CNA Institutions Soc. Gen. Cat XL 34 January 1999 Horace Mann Centre Re Aon CatEPut 35 January 1999 Constitution Re Re/Institutions GS, EWB Cat XL 10,000 Risk Transfer 36 February 1999 St. Paul Re (Mosaic Re II)Institutions GS, EWB Cat XL 45,000 Risk Transfer US Wind and Earthquake 37 March 1999 Kemper (Domestic Inc.) Reinsurers Aon Cat XL - Equity 20,000 Risk Transfer Mid-Western EQ March 1999 Kemper (Domestic Inc.) Institutions Aon Cat XL 80,000 Risk Transfer Mid-Western EQ 38 March 1999 Gerling (SECTRS 1999-1)Institutions GS Credit Reinsurance 39 April 1999 Sorema (Halyard Re) ML, Aon Cat XL 40 May 1999 Oriental Land (Concentric Re/Institutions Ltd) GS Cat XL 100,000 Risk Transfer Japanese Earthquake 41 May 1999 Oriental Land (Circle Maihama) Re/Institutions GS Extendible Debt 100,000 Contingent Capital Japanese Earthquake 42 May 1999 Intrepid Re Aon CatEPut 100,000 Contingent Capital PML Protection 43 May 1999 USAA (Residential Re III) Inst. Investors GS, ML, LehmanCat XL 200,000 Risk Transfer Florida Windstorm 44 June 1999 Gerling Institutions Aon, GS Cat XL 45 October 1999 Koch Energy Inst. Investors GS Weather Contracts 46 November 1999 American Re Inst. Investors AM Re, ML, SSBCat XL 194,000 Risk Transfer US Wind and Earthquake 47 November 1999 Gerling Institutions Aon, GS 100,000 Risk Transfer Japanese Earthquake Institutions Insurers Contingent Capital Cat XL Total capacity added Perils Covered PML Protection Japanese Earthquake 85,000 Risk Transfer 300,000 Contingent Capital PML Protection 450,000 Risk Transfer Florida Windstorm Japanese Wind US Wind and Earthquake 54,000 Risk Transfer 150,000 Risk Transfer European Wind 25,000 Risk Transfer 100,000 Contingent Capital 463,000 Risk Transfer 17,000 Risk Transfer PML Protection European Credit Risk Japan/US Wind and EQ 80,000 Risk Transfer US Wind and EQ 50,000 Risk Transfer Weather Risk 5,535,300 33 Aon Group Limited What investors want Clarity of trigger mechanism No moral hazard Quality exposure data Objective risk assessment Rated investments Liquidity Diversification (low beta plus) … and excess returns! 34 Aon Group Limited What sellers want Access to new source(s) of secure risk capital Certainty of cover Minimum basis risk Contract structure - probably (re)insurance Fair price, cost effective transaction Confidentiality Longer-term capacity and price Strategic capital and balance sheet management 35 Aon Group Limited Rethinking (re)insurance Product showing lack of growth global non-life insurance premiums only grew by 0.2% in real terms in 1997 (Swiss Re) Service not highly rated insurers, brokers and other service providers all given ‘D’ grades in 1999 Quality Scorecard published at US RIMS in 1999 Risk is becoming a Boardroom issue (Cadbury, Greenbury, Hampel, Turnbull) but insurance is not mentioned in corporate Report & Accounts “Traditional insurance does not provide protection against 80% of risks faced by companies” (Bob Cooney, XL) 36 Aon Group Limited What risks are clients concerned about? Per cent 34 Loss of reputation 30 System failure through Y2K 25 Brand/trademarks 21 Intellectual property erosion Fraud 14 Terrorism 9 Climatic 7 Credit risk 7 Class action 5 Currency risk 5 Claims against directs & officers 2 Genetically modified organisms 2 Stress claims against employees 0 0 Source: Airmic/Lloyd’s 5 10 15 20 25 30 35 40 37 Aon Group Limited Rethinking (re)insurance Why do we limit ourselves to traditional property / casualty exposures ? Microsoft Market capitalisation US$ 400 billion Plant, property & equipment US$ 1.5 billion Cash US$ 14 billion Reputation risk Total value of FTSE 100 companies was £1.37 trillion in 1998 “Goodwill” accounted for 71% of total value in 1998 (44% in 1988) Research by Interbrand and Citibank 38 Aon Group Limited Rethinking (re)insurance Why do we need insurable interest ? Example On 4th July 1993 the Sumitomo Chemical Company plant in Niihama, Japan exploded Spot prices for computer memory chips rose by 50% because Sumitomo plant made 65% of the world’s supply of epoxy cresol novolac resin used to seal most computer chips into their plastic packages Sumitomo can buy property and business interruption cover on their plant Question Why can’t any other economically interested parties, e.g. computer manufacturers, buy the same insurance policy on the same terms and conditions? 39 Aon Group Limited Rethinking (re)insurance Why does cover have to indemnity-based ? Example Oriental Land, operators of Disney themepark in Japan, have borrowed to finance further development of the site Any disruption to revenues from existing site will impair their ability to service this debt Answer Oriental Land have issued a catastrophe bond to the capital markets that pays up to $100 million in the event of an earthquake in the region around the themepark Trigger is occurrence of earthquake Payment amount determined by epicentre and size of earthquake 40 Aon Group Limited Concentric Re - Parametric trigger If the event happens then client is paid, regardless of whether he has actually sustained a loss or not Inner Circle Inner Ring Chiba Tokyo The pay out is linked to the epicentre and magnitude of quake in three concentric rings (JMA scale) Malhama Boso Yokohama Peninsula 6.5 inner circle, Outer Ring Izu 7.1 inner ring, 7.6 outer ring Peninsula 41 Aon Group Limited Illustrative Terms and Conditions 100% 75% 50% Inner Circle Inner Ring 25% Outer Ring 0% 6.5 6.6 6.7 6.8 6.9 7.0 7.1 7.2 7.3 7.4 7.5 7.6 7.7 7.8 7.9 JMA Magnitude Trigger: Physical, based on earthquake magnitude, location and depth • Magnitude - Sliding scale based on magnitudes > 6.5 • Location - Three circles (Inner Circle, Middle Ring, Outer Ring) in the Southern Kanto region of Japan defined by latitude and longitude • Depth - Shallow earthquakes only, 60km or less • Reporting Agency - Japan Meteorological Agency (JMA) • Development period - [30] days 42 Aon Group Limited Traditional Risk Transfer, ART & Capital Market Solutions should be considered in combination Capital Markets Facultative Reinsurance 3rd Cat 2nd Cat Surplus Share Retention ART Debt Excess Reinsurance Equity 4th Cat 1st Cat Cat Retention 43 Aon Group Limited Any questions? 8 Devonshire Square London EC2M 4PL Direct tel: 020 7216 3400 Direct fax: 020 7375 1760 Email: alan.punter@aon.co.uk 44