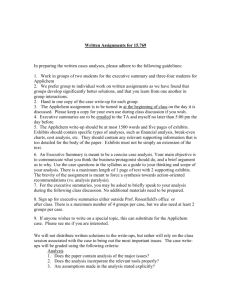

Case Analysis Directions

advertisement

Financial Analysis 95-711 Fall 2002 Case Analysis Guideline Overview The first session of class choose a public company on which to base your semester long case analysis assignments. I must approve your choice of companies and no two people may choose the same company. I suggest you choose a company that you may someday like to work for or invest in. The sooner you choose a company the better since your first assignment is due at the beginning of the Second session. The company you choose must have been in business for at least 3 years. Product based firms are generally easier to analyze. Because we are not addressing the special issues of financial institutions (banks, stockbrokers, etc.) you are not permitted to choose this type of company. Four times during the semester you will be given a series of questions to answer about your chosen company. You will be required to provide appropriate attribution of sources you used to derive information for your answer along with URL’s, article titles, etc. You should include the relevant information from these outside sources within the answer and provide exhibits as necessary. You may not choose AOL – which is the class case or Microsoft which has been analyzed to death! Do not be tempted to simply answer the questions – this would be considered a marginal effort. You should interpret your answer and include relevant background information as it relates to the class discussion. You should make it clear where you are answering the assigned questions and should provide background information on the industry and market and financials where appropriate. Include charts, graphs and diagrams where they provide greater insight. Sources for all information require proper attribution including URL’s, copies of articles and page numbers, etc. I should be able to easily locate where the information was found. If you are using information from a printed source as opposed to the Internet, you should provide this information in the appendix of your report. Show all your calculations and note the source of the original data. Do not simply pull pre-calculated ratios, etc. from a website or other sources for your company. In some cases, comparative data ratios can be used but make sure you note the source and check that the ratio uses the same formula you used. Your best sources of original data are Security and Exchange Commission (SEC) filings like 10K’s and the company’s annual reports. You will have to do some research to answer most questions. After doing the research you still may not find with the information you think you need. Do not make stuff up. Briefly explain the research you did and if necessary, you may make some reasonable assumptions that you will explain in the write up to answer the questions. If you believe that a question is not applicable to your company, it is not adequate to say that it is not applicable. You have to explain why it is not germane to the company and how it might have affected the company. Do not “cut and paste” any text directly from a website or copy directly from an article. This is plagiarism and you run the risk of failing the course. You may quote or provide charts or other graphics with proper attribution. You will be graded on your writing. Written communication is important in business. Your report should contain proper spelling, grammar, sentence structure, and paragraphing and that the content should flow logically. Typing: The assignment should be typed using Word. A cover page containing the relevant case assignment number, the name of the company and the and your name is required. I’d like 12-point type but can live with 10-point if necessary. Length: There is no minimum or maximum length. While you should be thorough, you should make your paper as concise and coherent as possible. Exhibits: Exhibits should be used to support your argument and not as an extension of the report. If you are using a printed article that cannot be transmitted electronically to the “drop box” you should bring a copy to class with the same cover page as you used for your case report. Proofreading: Please proofread your paper. It should be of the same quality that you would provide to the management of a business with which you were dealing professionally. Run spell check, watch headings at the bottom of the page, paginate your document. Do No assignments will be accepted after the beginning of the class in which they are due. You should keep a set of notes to refer to during our discussions of the analysis. Sources of information Primary sources of information will be SEC filings and Annual Reports for your chosen companies and their competitors. You should not confine yourselves to these sources however. The following are some additional suggestions. Securities and Exchange http://www.sec.gov/cgi-bin/srch-edgar IBM Patent Website http://www.patents.ibm.com US Patent & Trademark Office http://www.uspto.gov Fedstats One Stop Shopping for Federal Statistics http://www.fedstats.gov/ Trade Associations on the Net (AON) http://www.ipl.org/ref/AON/ Hoovers on Line – go through CMU Library Portal for greater access. http://www.hoovers.com/ Standard Industrial Codes (SIC) http://bamboo.tc.pw.com/EdgarScan/sic_list.html Market Guide Inc. - stock lookup http://fool.marketguide.com/MGI/home.asp U.S. Department of Commerce - Resources http://osecnt13.osec.doc.gov/public.nsf/docs/resources Companies not Eligible for Analysis Fall 2002 Amazon Companies not Eligible for Analysis Fall 2002 Accenture Adobe AMS Apple(aapl) Applied Materials (AMAT). banana republic Borland Business Objects Cerner Checkpoint Software Coca Cola Colegate Palmolive Computer Associates Doubleclick EDS E-Piphany Exxon Mobile Freemarkets Gateway GE Heinz Home Depot Interwoven Intuit Johnson & Johnson Lockheed Martin LSI Logistics Lucent MacroMedia Marriott Mercury Interactive MRO NOKIA Nortel Nvidia Palm Pixar Playboy Qualcomm ROSS Systems Inc SBC Communications SouthWest Airline Sybase Symmantec Target Unisys UPS Veritas Vitria Wendy's Xerox Yahoo