Industrial Relations in Luxembourg: the dynamics of worker

advertisement

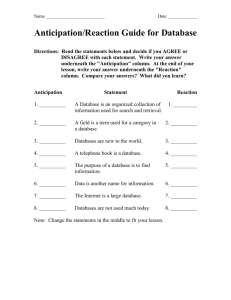

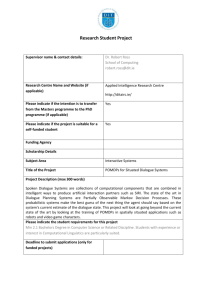

R ESPONSIBLE RESTRUCTURING IN THE E UROPEAN BANKING SECTOR : C OMPARATIVE PERSPECTIVE AND LESSONS LEARNT B RUS S ELS , N ATI ONAL S EM I NAR EUROSOFIN, 11 F EBRUARY 2 0 1 5 D R VAS S I L K I ROV, PATRI CK T HI LL LIS ER , L U X EM BOURG INTERNATIONAL CONFERENCE 2015 S OCIAL DIALOGUE C ONTRIBUTION S TRUCTURE IN THE FINANCIAL TO ANTICIPATION SECTOR AND EUROSOFIN OF THE PRESENTATION • Objective of the presentation • Methodology of the research • The drivers and processes of restructuring • Sectoral social dialogue and restructuring • Enterprise level dialogue and restructuring • Conclusions and policy implications IN E UROPE: RESTRUCTURING PROJECT 2 INTERNATIONAL CONFERENCE 2015 S OCIAL DIALOGUE C ONTRIBUTION IN THE FINANCIAL TO ANTICIPATION SECTOR AND IN E UROPE: RESTRUCTURING EUROSOFIN 1. O BJECTIVE The focus of our paper resides in the better understanding of social dialogue in the banking sector in Europe in terms of anticipation and management of restructuring PROJECT 3 INTERNATIONAL CONFERENCE 2015 S OCIAL DIALOGUE C ONTRIBUTION 2. M ETHODOLOGY IN THE FINANCIAL TO ANTICIPATION SECTOR AND IN 4 E UROPE: RESTRUCTURING EUROSOFIN PROJECT AND DATA • Qualitative based methodology • Desk-research – relevant reports, documents of social partners, collective labour agreements, press; • In-depth interviews based on a common guideline, transcribed and analysed - sectoral unions, sectoral employers, enterprise level unions, HR managers, experts – in five EU countries; • Discussions of the preliminary results with the stakeholders at national seminars held in 2014. INTERNATIONAL CONFERENCE 2015 S OCIAL DIALOGUE C ONTRIBUTION R ESTRUCTURING – IN THE FINANCIAL TO ANTICIPATION SECTOR AND IN E UROPE: 5 RESTRUCTURING EUROSOFIN PROJECT DEFINITION AND CONTEXT • Modification of the company workforce, both quantitative (number of jobs) and qualitative (skills, qualifications), following changes in company structure, organization or production processes (European Commission, 2008). • Not a new phenomenon, but there is evidence that its scope and speed have increased in the European Union since the beginning of the financial and economic crisis started in 2008 – 2009 • Different policies and measures in the European Union members – in order to mitigate the negative consequences for employees, economies and territories, often as a result of social dialogue. INTERNATIONAL CONFERENCE 2015 S OCIAL DIALOGUE C ONTRIBUTION T HE COMPARATIVE EXERCISE – IN THE FINANCIAL TO ANTICIPATION SECTOR AND IN E UROPE: RESTRUCTURING EUROSOFIN PROJECT LIMITS AND APPROACH • Difficulties to compare practices embedded in the history and institutions • Larger or narrower focus? • Importance of the elements • Different path dependency and role of institutions 6 INTERNATIONAL CONFERENCE 2015 S OCIAL DIALOGUE C ONTRIBUTION IN THE FINANCIAL TO ANTICIPATION SECTOR AND IN 7 E UROPE: RESTRUCTURING EUROSOFIN PROJECT 3. T HE IMPORTANCE OF THE BANKING SECTOR IN E UROPE • Long term national history – change of ownership, concentration, internationalisation, single market... • Major employer and contributor to the GDP in Europe but experiencing difficulties… • Changing employment models and skills… INTERNATIONAL CONFERENCE 2015 S OCIAL DIALOGUE C ONTRIBUTION FACTS IN THE FINANCIAL TO ANTICIPATION SECTOR AND IN 8 E UROPE: RESTRUCTURING EUROSOFIN PROJECT AND FIGURES FOR THE COUNTRIES EXAMINED Processes/Drivers Austria France Romania Luxembourg UK Concentration 809 (40% decreased, compared to the 1980s) 390 banks in 2013 (1556 banks in 1984) 40 banks in 2013 (40 in 2004) 149 in 2014 332 in 2010 (595 in 1986) Changes Privatization in the 1980s and 1990s Permanent change Privatization in the 1990s Rapid internationalisation during the 1980s and 1990s Processes related Domestic employment relatively stable and employment in the subsidiaries in decline after period of strong growth Relatively stable employment, Retiring population in France – a buffer to jobs preservation Significant employment decrease since 2008 - 2009 Job losses in the banking sector partially compensated by the development of the professionals of the financial services (PSF) and the fund industry The October 27 1986 ‘Big Bang’: a massive deregulation of financial markets, rapid growth of the financial sector since then Significant job losses since the crisis INTERNATIONAL CONFERENCE 2015 S OCIAL DIALOGUE C ONTRIBUTION 4. T HE IN THE FINANCIAL TO ANTICIPATION SECTOR AND IN 9 E UROPE: RESTRUCTURING EUROSOFIN PROJECT RESTRUCTURING DRIVERS • Effects of the crisis • The (new) regulations • New technologies and expectations of the clients • Outsourcing Mitsubishi UFJ Financial Group Inc. will trial the device in two branches in Tokyo . INTERNATIONAL CONFERENCE 2015 S OCIAL DIALOGUE C ONTRIBUTION I MPACT IN THE FINANCIAL TO ANTICIPATION SECTOR AND IN 10 E UROPE: RESTRUCTURING EUROSOFIN PROJECT IN THE COUNTRIES EXAMINED Processes/Drivers Austria France Romania Luxembourg Effects of the Crisis ++ (decrease of activity, risk of the operations in CEEC, state support) + (minor impacts) ++ (decrease of the activity) ++some impact +++ serious job of the crisis (e.g. losses public support+++) New regulations ++ impact on compliance ++ + impacts ++ (especially the automatic exchange and the abolition of the banking secrecy) +++ New technologies +++ +++ () + (yes, but still a smooth change) ++ Outsourcing insourcing +++ (strong impact on noncore and core activities) + (some outsourcing is taking place) ++ (Romania is benefiting from in-sourcing) + (some outsourcing is taking place) +++ (strong impact, but no concrete estimations) ++ Impacts on current and future restructuring UK INTERNATIONAL CONFERENCE 2015 S OCIAL DIALOGUE C ONTRIBUTION S OCIAL DIALOGUE AND IR IN THE FINANCIAL TO ANTICIPATION SECTOR AND IN 11 E UROPE: RESTRUCTURING EUROSOFIN PROJECT IN THE SECTOR Sectoral Collective Bargaining and Social Dialogue E n t e r p p r i s e S D + United Kingdom - Romania France Luxembourg Austria Country models of employment relations - + INTERNATIONAL CONFERENCE 2015 S OCIAL DIALOGUE C ONTRIBUTION IR IN THE FINANCIAL TO ANTICIPATION SECTOR AND IN 12 E UROPE: RESTRUCTURING EUROSOFIN PROJECT DATA FOR THE SECTOR Austria Trade unions France GPA-DJP, union of Several unions white-collars present, CFDT, CFE CGC, CGT, Romania Luxembourg FSAB (Cartel-Alfa) ALEBA LCGB UK Unite the Union OGB-L CGT FO, CFTC Trade union density About 25%, lower 9%, higher than than the average the average Employers’ organisations Five different employer organizations L’Association Française des Banques (AFB) (Commercial banks) and the Fédération Bancaire Française (FBF the whole banking sector) About 15% of the employees working in the insurance and banking industry Council of the Banking Employers in Romania (CPBR), since April 2014 38 – 39% trade union density of ALEBA, no data about the two other unions ABBL 30,5% (2006) No INTERNATIONAL CONFERENCE 2015 S OCIAL DIALOGUE C ONTRIBUTION IR DATA FOR THE SECTOR IN THE FINANCIAL TO ANTICIPATION SECTOR AND IN 13 E UROPE: RESTRUCTURING EUROSOFIN PROJECT - 2 Austria France Romania Luxembourg Sectoral level dialogue Yes, 5 subbranch agreements are negotiated Yes No, except skills Yes institutionalized dialogue in the field of professional training no Company level dialogue Yes, in most banks Yes, in most banks Yes, in most banks Yes, in most banks Yes, in major banks Collective bargaining coverage Almost 100% 98,7 % of the employees covered (estimation 2007) 40% of the employees are covered by CLA 100%, extension 38,1% of the sectoral collective agreement UK INTERNATIONAL CONFERENCE 2015 S OCIAL DIALOGUE C ONTRIBUTION A NTICIPATION IN THE FINANCIAL TO ANTICIPATION SECTOR AND IN 14 E UROPE: RESTRUCTURING EUROSOFIN PROJECT AND MANAGEMENT OF RESTRUCTURING : PHASES Sectoral level Anticipation Management Company Level Addressing the consequences INTERNATIONAL CONFERENCE 2015 S OCIAL DIALOGUE C ONTRIBUTION S ELECTED IN THE FINANCIAL TO ANTICIPATION SECTOR AND IN E UROPE: 15 RESTRUCTURING EUROSOFIN PROJECT MEASURES / PRACTICES TO ADDRESS RESTRUCTURING Measures/practices Austria France Luxembourg Romania UK Anticipation/sectoral level No Observatory of the professions; IFBL analysis on future skills No No CLA for the commercial bank sector Anticipation/company level No GPEC agreements The case of the large French bank – BNP Paribas Some company plans that envisage downsize – however the speed of restructuring is high (BRD) No Support to transitions New development – e.g. work foundations; +++ Some internal measures in the big groups (e.g. BNPParibas), projects such as Fit for Finance Rare, e.g. in the case of BCR Erste Selection pools in LGB Early retirement schems INTERNATIONAL CONFERENCE 2015 S OCIAL DIALOGUE C ONTRIBUTION P OLICY IN THE FINANCIAL TO ANTICIPATION SECTOR AND IN 16 E UROPE: RESTRUCTURING EUROSOFIN PROJECT IMPLICATIONS • Reinforcement of anticipation at sectoral and company level – necessary but not always easy; • Management of restructuring – importance of the internal mobility and internal labour markets, adaptation of jobs and skills, agreements to support transitions, role of the collective bargaining at both levels, international coordination… • Addressing consequences – supporting transitions, reintegrating dismissed back to the labour market – issues of responsibilities and roles of stakeholders INTERNATIONAL CONFERENCE 2015 S OCIAL DIALOGUE C ONTRIBUTION IN THE FINANCIAL TO ANTICIPATION SECTOR AND IN EUROSOFIN Thanks for your attention For more information: patrick.Thill@ceps.lu vassil.kirov@gmail.com http:///eurosofin.ceps.lu E UROPE: RESTRUCTURING PROJECT 17