Mortgages - dedeklegacy.cz

advertisement

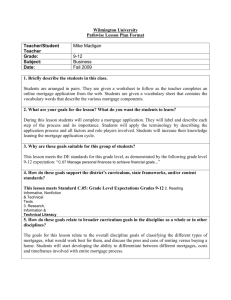

Institute of Economic Studies Faculty of Social Sciences Charles University in Prague Lesson 4 Mortgages Financial Instruments Definitions Mortgages are various types of long-term financial instruments that intermediate housing financing Balloon mortgage is characterized by instalments that cover only interest payments and the original balance is repaid at maturity of the mortgage Potential problem with repayment of the entire balance at maturity (disastrous consequences during the Great Depression) Level-payment (traditional, annuity) mortgage is characterized by equal instalments that are made up of an interest payment and a repayment of part of the original mortgage balance 1 𝐻0 Mortgages 𝐴 𝐴 𝐴 2 3 T-1 𝐴 T 𝑇 … term of the mortgage 𝐻0 … original mortgage balance 𝐴 … regular instalment (made up of interest payment and principal repayment) 2 Annuity formula Fair value principle requires the equality between the mortgage loan and the present value of all instalments discounted at a given mortgage rate 𝑇 𝐻0 = 𝑡=1 𝐴 1+𝑟 𝑡 1 1 =𝐴× 1− 𝑟 (1 + 𝑟)𝑇 𝑟(1 + 𝑟)𝑇 𝐴 = 𝐻0 × = 𝐻0 × 𝑎 𝑇 (𝑟) (1 + 𝑟)𝑇 −1 𝑎 𝑇 … annuity factor for the period T Decomposition of the regular instalment In each period a fixed mortgage payment consists of interest paid on an outstanding mortgage balance and repayment of a portion of the outstanding mortgage balance 𝐴 = 𝑟 × 𝐻𝑡−1 + 𝐻𝑡−1 − 𝐻𝑡 Formula for the remaining mortgage balance (at the end of the period t) (1 + 𝑟)𝑇 −(1 + 𝑟)𝑡 𝐻𝑡 = 𝐻0 × (1 + 𝑟)𝑇 −1 Formulas for the interest payment and the principal repayment (in the period t) 𝑡−1 𝑇 𝑡−1 𝑟𝐻𝑡−1 = 𝐻0 × Mortgages 𝑟 × (1 + 𝑟) −(1 + 𝑟) (1 + 𝑟)𝑇 −1 𝐻𝑡−1 − 𝐻𝑡 = 𝐻0 × 𝑟 × (1 + 𝑟) (1 + 𝑟)𝑇 −1 3 Payment calendar (annuity approach) Payment calendar is a table arranging all mortgage cash flows 1 Beginning balance 𝐻0 R𝐞𝐠𝐮𝐥𝐚𝐫 𝐢𝐧𝐬𝐭𝐚𝐥𝐦𝐞𝐧𝐭 A 𝐈𝐧𝐭𝐞𝐫𝐞𝐬𝐭 payment 𝐼1 = 𝑟 × 𝐻0 𝐏𝐫𝐢𝐧𝐜𝐢𝐩𝐚𝐥 repayment 𝑃1 = 𝐴 − 𝐼1 Unpaid balance 𝐻1 = 𝐻0 − 𝑃1 2 𝐻1 A 𝐼2 = 𝑟 × 𝐻1 𝑃2 = 𝐴 − 𝐼2 𝐻2 = 𝐻1 − 𝑃2 ... ..... ..... ..... ..... ..... T 𝐻𝑇−1 A 𝑃𝑇 = 𝐴 − 𝐼𝑇 0 T𝐢𝐦𝐞 𝐼𝑇 = 𝑟 × 𝐻𝑇−1 Compilation of payment calendar Mortgages Calculation of fixed regular instalment using the annuity formula Calculation of interest payment as a product of the beginning balance and the mortgage rate Calculation of principal repayment by deducting the interest payment from the regular instalment Calculation of unpaid balance by deducting the principal repayment from the beginning balance Unpaid balance becomes the beginning balance in the next period 4 Payment calendar (synthetic approach) Sequence of prepaid mortgages 𝐻1 𝐻2 𝐴 𝐴 1 𝐴 2 𝐻1 𝐻0 3 𝐻2 T-1 𝐴 T 𝐻𝑇−1 𝐴 = 𝐻0 × 𝑎 𝑇 = 𝐻1 × 𝑎 𝑇−1 = . . . = 𝐻𝑇−1 × 𝑎1 Compilation of payment calendar 1 Beginning balance 𝐻0 𝐀𝐧𝐧𝐮𝐢𝐭𝐲 𝐟𝐚𝐜𝐭𝐨𝐫 𝑎𝑇 2 𝐻1 𝑎 𝑇−1 ... ..... ..... T 𝐻𝑇−1 𝑎1 T𝐢𝐦𝐞 Mortgages 𝐑𝐞𝐠𝐮𝐥𝐚𝐫 instalment 𝐴 = 𝐻0 × 𝑎 𝑇 𝐴 = 𝐻1 × 𝑎 𝑇−1 Interest payment 𝐼1 𝐏𝐫𝐢𝐧𝐜𝐢𝐩𝐚𝐥 repayment 𝑃1 Unpaid Balance 𝐻1 𝐼2 𝑃2 𝐻2 ..... ..... 𝑃𝑇 0 ..... 𝐴 = 𝐻𝑇−1 × 𝑎1 𝐼𝑇 Calculation of annuity factor Calculation of regular instalment as a product of the beginning balance and the annuity factor Decomposition of the instalment into interest and principal payments Unpaid balance becomes the beginning balance in the next period 5 Three components of mortgage cash flow Interest payment Scheduled principal repayment Prepayments – payments in excess of regularly scheduled repayments Π𝑡 = 𝑝𝑡 × 𝐻𝑡−1 − 𝐴𝑡 Π𝑡 … 𝑝𝑡 … 𝐻𝑡−1 𝐴𝑡 … prepayments in the period t prepayment rate in the period t mortgage balance at the beginning of the period t scheduled principal repayment in the period t Reasons for exercising prepayment option Right of the borrower to pay off a part or all of the mortgage at any time Default on meeting mortgage obligation (the property is repossessed, sold and proceeds are used to pay off the mortgage) Social: change of employment, divorce, insured natural disaster, etc. Prepayment risks Contraction risk: declining mortgage rates speed up prepayments investors are forced to reinvest unplanned cash at lower market rates Extension risk: rising mortgage rates slow down prepayments investors are deprived of cash that could be invested at higher market rates Mortgages 6 Tilt (erosion) effect 120 𝜌 … real mortgage rate 𝜋 … rate of inflation 𝑟 = 1+𝜌 × 1+𝜋 −1 =𝜌+𝜋 100 Percent Inflation progressively erodes (tilts) the purchasing power of principal repayments The tilt can be addressed by including expected inflation in mortgage rates 𝜋 = 10% 80 60 40 20 0 0 2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 Year Affordability problem High mortgage rates with incorporated inflation result in high real value of instalments at the beginning of the mortgage life reduced affordability of mortgages for large segments of population In stalment (%) 250 Term of the mortgage: 20 years Real mortgage rate: 4 % Nominal mortgage rate = real rate + inflation rate 200 150 100 50 0 0 1 2 3 4 5 6 7 8 9 10 Inflation (%) Mortgages 7 Definition In the GPM plan the stream of instalments grows at the rate of inflation which leaves the real value of instalments unchanged 𝐴𝑡 = 𝐺0 × 1 + 𝜋 𝑡 Pricing equation 𝑇 𝐻0 = 𝑡=1 𝐴𝑡 1+𝑟 𝑇 𝑡 = 𝑡=1 𝐴𝑡 … regular instalment in the GPM plan 𝐺0 … real instalment (paid in the absence of inflation) 𝜋 … rate of inflation 𝐺0 × (1 + 𝜋)𝑡 1 1 = 𝐺 × 1 − 0 1 + 𝜌 𝑡 × (1 + 𝜋)𝑡 𝜌 (1 + 𝜌)𝑇 𝐺0 = 𝐻0 × 𝑎 𝑇 (𝜌) Payment calendar – price-level adjusted mortgage (PLAM) T𝐢𝐦𝐞 𝑡 Real beginning balance 𝐻𝑡−1 𝐑𝐞𝐚𝐥 instalment 𝐴 𝐑𝐞𝐚𝐥 𝐮𝐧𝐩𝐚𝐢𝐝 balance 𝐻𝑡 Price index 𝑃𝑡 𝐑𝐞𝐠𝐮𝐥𝐚𝐫 instalment 𝐴 × 𝑃𝑡 𝑃0 Effective unpaid balance 𝐻𝑡 × 𝑃𝑡 𝑃0 Potential drawbacks of the GPM plan Small instalments at the beginning but high instalments at the end of the mortgage life potential problem for households whose income cannot keep pace with inflation Negative amortization means that instalments are insufficient to cover interest so outstanding mortgage is increased by unpaid interest Mortgages 8 Definition The mortgage is provided and repaid in a currency which is different from the currency of the country in which the borrower is resident The mortgage payments may be made in domestic currency but their size changes in line with changes in the exchange rate of foreign currency The charged interest rate is based on foreign interest rates relevant to the currency in which the mortgage is denominated Incentives Significantly lower interest rates on foreign currency then interest rates on domestic currency Prospects for strengthening of domestic currency against foreign currency (borrower's cost of repaying the mortgage is less in terms of domestic currency) Risks of open exchange rate position Open currency position (currency mismatch) – revenues in one currency are used for paying expenditure in another currency The mortgage borrower is exposed to the risk of the weakening of domestic currency (he/she makes a capital loss) Mortgages 9 Definition Various techniques of financial engineering in which individual assets (mortgages, credit card receivables bank loans and other) are pooled and used as source of cash flow for the creation of new securities called assetbacked securities (ABS) Securitization with mortgages gives rise to mortgage-backed securities (MBS) or collateralized mortgage obligations (CMO) Participants in securitization Originator Mortgage 1 SPV (conduit) Pool Mortgage 1 MBS 1 MBS Investor 1 Price Price Mortgage X Investors Mortgage X MBS Y Investor Z Originator: provides mortgage loans and arranges them in a pool Conduit: buys the pool that is used as collateral for the issuance of MBS Investor: invests in various risky classes of MBS Mortgages 10 Definition Agency deals are backed to some extent by guarantees of government or government-sponsored institutions (in USA Fannie Mac, Freddie Mac, Ginnie Mae) Major concern of investors is the prepayment risk Sequential pay structures A set of bond classes with specified rules for tranching of the collateral Principal (both scheduled and prepaid) is distributed first to the bond class A until it is completely paid off, then all principal payments are made to bond class B until it is completely paid off and so on Interest is distributed to each class on the basis of the principal outstanding Instruments Passthrough securities are MBS which redirect the cash flow from an underlying pool on a pro rata basis to all holders Stripped MBS separate the distribution of interest payment (IO class) and principal repayment (PO class) Other innovations: PAC or TAC bond, companion bond, accrual bond, floater, inverse floater and others Mortgages 11 Definition MBS issued by private conduits without any government guarantees Major concern of investors is the credit and default risk Forms of credit enhancement Excess spread is the difference between an average interest rate paid by the mortgage pool and an average interest rates paid to the MBS holders Over-collateralization is the difference between the market value of the mortgage pool and the market value of MBS issued to investors Third party guarantees are provided by private financial institutions Diversification means the application of various concentration limits (per borrower, size of loans, industry, geographical region, etc.) Subordination structures A set of bond classes with priority rules for absorbing losses from the underlying pool of mortgages Equity class junior class mezzanine class senior class Higher level classes has a prior claim over lower level classes, they start absorbing losses only after the lower classes are completely wiped out The higher the class, the better its credit rating and the lower its yield Mortgages 12 Advantages Reducing funding costs (securitization means secured lending, desired credit rating assigned to MBS can be achieved by credit enhancements) Managing corporate risk (credit or interest rate risks are removed by selling the pool of risky mortgages) Managing regulatory capital (lower retained risk with the originator results in lower requirements for regulatory capital) Critiques Lax underwriting standards (originate-and-distribute practices reduce motivation to asses properly the credit quality of borrowers) Greater opaqueness of risk exposures (securitization structures are too complicated to be understood by investors, high complexity leads to overreliance on the ratings assigned by rating agencies) Flawed incentives (rating agencies are paid primarily by those who are the issuers of MBS rather then by those who are the investors in MBS) Reduced effectiveness of monetary policy (securitization allows borrowers direct access to end lenders thus reducing the traditional role of banks in the financial intermediation) Mortgages 13 © O. D. LECTURING LEGACY See you in the next lecture Mortgages 14