Potential Alternative Strategies

advertisement

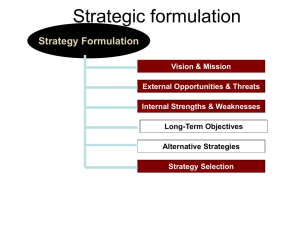

Strategic formulation Strategy Formulation Vision & Mission External Opportunities & Threats Internal Strengths & Weaknesses Long term objectives Alternative Strategies Strategy Selection Strategies in Action Strategies for taking the hill won’t necessarily hold it. – Amar Bhide The early bird may get the worm, but the second mouse gets the cheese. – Unknown Types of Generic Strategies • Integration Strategies: related to industrial value chain • Intensive Strategies: markets size and market share • Diversification Strategies: a movement into other business areas • Defensive Strategies: related to those when company is in “trouble” Types of Strategies Forward Integration Integration Strategies Backward Integration Horizontal Integration Forward Integration Strategies Attempts to gain control over: Distributors and Retailers should be adopted when: Current distributors – expensive or unreliable Availability of quality distributors – limited Firm competing in industry expected to grow markedly Firm has both capital & HR to manage new business of distribution Current distributors have high profit margins Backward Integration Strategies Control of Firm’s suppliers should be adopted when: Current suppliers – expensive or unreliable # of suppliers is small; # of competitors is large High growth in industry sector Firm has both capital & HR to manage new business Stable prices are important Current suppliers have high profit margins Horizontal Integration Strategies Control of Firm’s Competitors should be adopted when: Gain “lawful” monopolistic characteristics with out government challenge Competes in growing industry Increased economies of scale – a major competitive advantage by increase in size Faltering due to lack of managerial expertise or need for particular resource Types of Strategies Market Penetration Intensive Strategies Market Development Product Development Market Penetration Strategies: Increased Market Share of Present products/services or Present markets Strategy should be adopted when : Current markets not saturated Rate of present customers can be increased significantly Shares of competitors declining; industry sales increasing Increased economies of scale (increase units of production cause reduction in average cost to produce a unit) provide major competitive advantage Market Development Strategies: New Markets -- Present products/services to new geographic areas Strategy should be adopted when : New channels of distribution – reliable, inexpensive, good quality When Firm is successful at what it does Untapped/unsaturated markets Excess production capacity Basic industry rapidly becoming global Product Development Strategies: Increased Sales -- Improving present products/services or developing new products/services Strategy should be adopted when : Products in maturity stage of life cycle Industry characterized by rapid technological development Competitors offer better-quality products @ comparable prices Strong R&D capabilities Types of Strategies Related Diversification Diversification Strategies Unrelated Diversification Related Diversification Preferred To Capitalize on: • Combining the related activities of separate businesses into a single operation to lower costs • Cross-business collaboration to create competitively valuable resource strengths and capabilities Related Diversification May be Effective When: • An organization competes in a no-growth or a slow growth industry • New, but related, products have seasonal sales levels that counterbalance an organization’s existing peaks and valleys • An organization’s products are currently in the declining stage of the product’s life cycle Unrelated Diversification • Favours capitalising on a portfolio of businesses that are capable of delivering excellent financial performance • Entails hunting to acquire companies: – Whose assets are undervalued – That are financially distressed – With high growth potential but are short on investment capital Unrelated Diversification May be Effective When: • An organization’s current distribution channels can be used to market new products to existing customers • An organization has the capital and managerial talent to compete successfully in a new industry • An organization’s basic industry is experiencing declining annual sales and profits • An organization has the opportunity to purchase an unrelated business as an attractive investment opportunity Types of Strategies Retrenchment Defensive Strategies Divestiture Liquidation Defensive Strategies Retrenchment: reduce Costs & assets to reverse declining sales & profit Divesture: Selling a division or part of an organization Liquidation: Sell Company’s assets, in parts, for only their tangible worth; not for their copyrights … Retrenchment Strategies Guidelines -Failed to meet objectives & goals consistency; has distinctive competencies Firm is one of weaker competitors Inefficiency, low profitability, poor employee morale, pressure for stockholders Strategic managers have failed Rapid growth in size; major internal reorganization necessary Divestiture Strategies Guidelines -Retrenchment failed to attain improvements Division needs more resources than are available Division responsible for firm’s overall poor performance Division is a mis-fit with organization Large amount of cash is needed and cannot be raised through other sources Liquidation Strategies Guidelines -Retrenchment & divestiture failed Only alternative is bankruptcy Minimize stockholder loss by selling firm’s assets Michael Porter’s Generic Strategies Cost Leadership Strategies Differentiation Strategies Focus Strategies Generic Strategies Low Cost strategy: the basic idea underprice competitors or offer a better value thereby gain market share and sales driving some competitors out of the market entirely. Cost Leadership: lowest/best price • Ways of ensuring total costs across value chain are lower than competitors’ total costs 1. Perform value chain activities more efficiently than rivals and control factors that drive costs 2. Revamp the firm’s overall value chain to eliminate or bypass some cost-producing activities Cost Leadership: lowest/best price • Can be especially effective when: 1. Price competition among rivals is vigorous 2. Rival’s products are identical and supplies are readily available 3. Most buyers use the product in the same way 4. Buyers are large and have significant power 5. Industry newcomers use low prices to attract buyers Differentiation: Unique products producing products that are considered unique allows a firm to charge higher prices gain customer loyalty risk associated with differentiation strategy: unique product may not be valued highly enough by customers to justify the higher price.: Some of the requirements for a successful differentiation strategy: strong coordination among the R&D and marketing functions substantial amenities to attract scientists and creative people. Differentiation • Can be especially effective when: 1. There are many ways to differentiate and many buyers perceive the value of the differences 2. Buyer needs and uses are diverse 3. Few rival firms are following a similar differentiation approach 4. Technology change is fast paced and competition revolves around evolving product features Generic Strategies Focused Strategies (Type 4 & 5) two types: producing products and services that fulfill the needs of small groups of consumers (niche market). products or services to a small range (niche) of customers at the lowest price available on the market. (focused differentiation) Focused Strategy • Can be especially effective when: 1. The target market niche is large, profitable, and growing 2. Industry leaders do not consider the niche crucial 3. Industry leaders consider the niche too costly or difficult to meet 4. The industry has many different niches and segments 5. Few, if any, other rivals are attempting to specialize in the same target segment Using Information Systems to Achieve Competitive Advantage • Low-cost leadership Use information systems to achieve the lowest operational costs and the lowest prices E.g., Walmart • Inventory replenishment system sends orders to suppliers when purchase recorded at cash register • Minimizes inventory at warehouses, operating costs • Efficient customer response system Using Information Systems to Achieve Competitive Advantage • Example • Supermarkets and large retail stores such as Walmart use sales data captured at the checkout counter to determine which items have sold and need to be reordered. • Walmart’s continuous replenishment system transmits orders to restock directly to its suppliers. The system enables Walmart to keep costs low while fine-tuning its merchandise to meet customer demands. Using Information Systems to Achieve Competitive Advantage • Product differentiation Use information systems to enable new products and services, or greatly change the customer convenience in using your existing products and services E.g., Google’s continuous innovations, Apple’s iPhone Use information systems to customize, personalize products to fit specifications of individual consumers • E.g., Nike’s iD program for customized sneakers Using Information Systems to Achieve Competitive Advantage • Focus on market niche Use information systems to enable specific market focus, and serve narrow target market better than competitors • Analyzes customer buying habits, preferences • Advertising pitches to smaller and smaller target markets E.g., Hilton Hotel’s OnQ System • Analyzes data collected on guests to determine preferences and guest’s profitability Using Information Systems to Achieve Competitive Advantage • Strengthen customer and supplier intimacy Strong linkages to customers and suppliers increase switching costs and loyalty Toyota: uses IS to facilitate direct access from suppliers to production schedules • Permits suppliers to decide how and when to ship supplies to plants, allowing more lead time in producing goods. Amazon: keeps track of user preferences for purchases, and recommends titles purchased by others Using Information Systems to Achieve Competitive Advantage • Successfully using IS to achieve competitive advantage requires precise coordination of: – technology, – organizations, – and people Question • Describe three of the following types of generic strategies: integration, intensive, diversification or defensive (9 marks) • Explain, using suitable example, when any two of these strategies could be used. (8 marks) • Discuss the type of strategy: integration, intensive, diversification or defensive, which you would consider to be most appropriate for the D.I.T. in the current economic climate. (13 marks) Questions • Describe three of the following types of generic strategies: integration, intensive, diversification or defensive (10 marks) • Describe two of Porter’s strategies’s: low-cost, differentiation and focus. (8 marks) • Explain the relationship between these two strategies and the size of the market. (6 marks) • Compare, using examples, any one of the generic strategies with any one of Porter’s strategies (6 marks)