Identification

advertisement

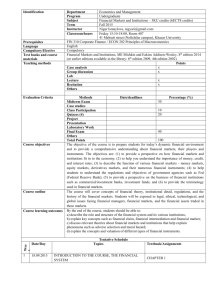

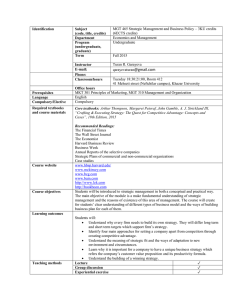

Identification Prerequisites Language Compulsory/Elective Required textbooks and course materials Course website Course outline Course objectives Learning outcomes Teaching methods Evaluation FİN 440:Financial Markets and Institutions – 3KU credits Subject (6ECTS credits) (code, title, credits) Economics and Management Department Undergraduate Program (undergraduate, graduate) Fall, 2012 Term Nigar Ismaylova Instructor nignazim@hotmail.com E-mail: Phone: Bashir Safaroglu122, ROOM # 34, WDN 10:30 – 13:30 Classroom/hours Office hours FIN 310: Fundamentals of Financial Management English Compulsory Financial Markets and Institutions, ME Mishkin and Eakins Addison-Wesley, 4th edition The outline are: (1) to provide a perspective on how financial markets and institutions fit in to the economy; (2) to help you understand the importance of money, credit, and interest rates; (3) to describe the function of various financial markets - money markets, equity markets, derivatives markets, and their numerous financial instruments; (4) to help students to understand the regulations and objectives of government agencies such as Fed (Federal Reserve Bank); (5) to provide a perspective on the business of financial institutions such as commercial/investment banks, investment funds; and (6) to provide the terminology used in financial markets. The objective of the course is to introduce students to the institutions and markets that form the worldwide economic system of trading financial and real assets. The course will cover concepts of financial theory, institutional detail, regulations, and the history of the financial markets. Students will be exposed to legal, ethical, technological, and global issues facing financial managers, financial markets, and the financial assets traded in these markets. Lecture Group discussion Experiential exercise Case analysis Recitation Course paper Others Methods Midterm Exam Case studies Class Participation Assignment and quizzes Project Presentation/Group Discussion Final Exam Others Total X X X X Date/deadlines Policy Tentative Schedule Percentage (%) 30 10 25 35 100 Week 1 Date/Day (tentative) 19.09.2012 Textbook/Assignments Topics INTRODUCTION TO THE COURSE, THE FINANCIAL SYSTEM 2 3 4 26.09.2012 03.10.2012 10.10.2012 HOW INTEREST RATES ARE DETERMINED UNDERSTANDING MONEY MARKETS 5 6 7 8 17.10.2012 24.10.2012 31.10.2012 07.11.2012 UNDERSTANDING MORTGAGE MARKETS UNDERSTANDING STOCK MARKETS Midterm Exam 9 14.11.2012 10 11 21.11.2012 28.11.2012 THE INTERNATIONAL FINANCIAL SYSTEM IN-DEPTH REVIEW OF CHAPTERS 1-8 IN PREPARATION OF THE MIDTERM EXAMINATION. MID-TERM EXAM (CHAPTER 1-8) HEDGING WITH FINANCIAL DERIVATIVES UNDERSTANDING INTEREST RATE DERIVATIVE MARKETS 12 UNDERSTANDING OF BOND MARKETS UNDERSTANDING FOREIGN EXCHANGE MARKETS 05.12.2012 UNDERSTANDING EQUITY MARKETS THEORY OF FINANCIAL STRUCTURE 13 14 15 16 17 12.12.2012 19.12.2012 26.12.2012 Will be announced Will be announced Will be announced COMMERCIAL BANK OPERATIONS FINANCIAL BANK INSTITUTIONS: SECURITIES OPERATIONS NON-BANK DEPOSITARY AND INSURANCE INTERMEDIARIES : THRIFT OPERATIONS NON-BANK DEPOSITARY AND INSURANCE INTERMEDIARIES : CREDIT UNIONS NON-BANK DEPOSITARY AND INSURANCE INTERMEDIARIES : INSURANCE OPERATIONS OTHER NON-BANK FINANCIAL INTERMEDIARIES: CONSUMER FINANCE OPERATIONS OTHER NON-BANK FINANCIAL INTERMEDIARIES: PENSION FUND OPERATIONS COURSE OVERVIEW, PREPARATION FOR FINALTERM EXAM FINAL CHAPTER 1 CHAPTER 2 CHAPTER 3 CHAPTER 4, Quizze #1 (Chapter 1-3) CHAPTER 5 CHAPTER 6. CHAPTER 7. Quizze #2 (Chapter 4-6) CHAPTER 8. CHAPTER 1-8 CHAPTER 9, CHAPTER 10. CHAPTER 11, CHAPTER 12 QUIZZE #3 (CHAPTER 9-11) CHAPTER 13 CHAPTER 14, CHAPTER 15 CHAPTER 16, CHAPTER 17 Quizze #4 (Chapter 12-14) CHAPTER 18, CHAPTER 19 Quizze #5 (Chapter 15-17) CHAPTER 9-18