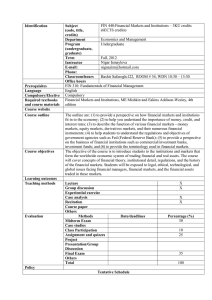

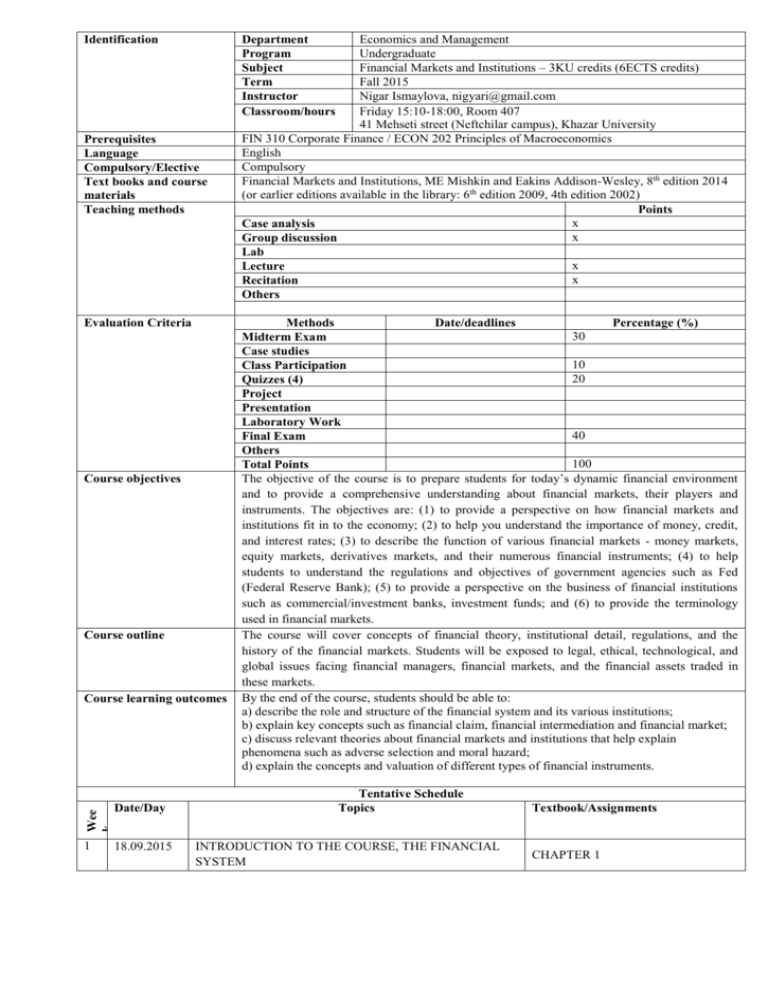

Identification - Khazar University

advertisement

Identification Prerequisites Language Compulsory/Elective Text books and course materials Teaching methods Evaluation Criteria Course objectives Course outline Wee k Course learning outcomes 1 Date/Day 18.09.2015 Economics and Management Undergraduate Financial Markets and Institutions – 3KU credits (6ECTS credits) Fall 2015 Nigar Ismaylova, nigyari@gmail.com Friday 15:10-18:00, Room 407 41 Mehseti street (Neftchilar campus), Khazar University FIN 310 Corporate Finance / ECON 202 Principles of Macroeconomics English Compulsory Financial Markets and Institutions, ME Mishkin and Eakins Addison-Wesley, 8th edition 2014 (or earlier editions available in the library: 6th edition 2009, 4th edition 2002) Points x Case analysis x Group discussion Lab x Lecture x Recitation Others Department Program Subject Term Instructor Classroom/hours Methods Date/deadlines Percentage (%) 30 Midterm Exam Case studies 10 Class Participation 20 Quizzes (4) Project Presentation Laboratory Work 40 Final Exam Others 100 Total Points The objective of the course is to prepare students for today’s dynamic financial environment and to provide a comprehensive understanding about financial markets, their players and instruments. The objectives are: (1) to provide a perspective on how financial markets and institutions fit in to the economy; (2) to help you understand the importance of money, credit, and interest rates; (3) to describe the function of various financial markets - money markets, equity markets, derivatives markets, and their numerous financial instruments; (4) to help students to understand the regulations and objectives of government agencies such as Fed (Federal Reserve Bank); (5) to provide a perspective on the business of financial institutions such as commercial/investment banks, investment funds; and (6) to provide the terminology used in financial markets. The course will cover concepts of financial theory, institutional detail, regulations, and the history of the financial markets. Students will be exposed to legal, ethical, technological, and global issues facing financial managers, financial markets, and the financial assets traded in these markets. By the end of the course, students should be able to: a) describe the role and structure of the financial system and its various institutions; b) explain key concepts such as financial claim, financial intermediation and financial market; c) discuss relevant theories about financial markets and institutions that help explain phenomena such as adverse selection and moral hazard; d) explain the concepts and valuation of different types of financial instruments. Tentative Schedule Topics INTRODUCTION TO THE COURSE, THE FINANCIAL SYSTEM Textbook/Assignments CHAPTER 1 2 25.09.2015 HOLIDAY 3 2.10.2015 HOW INTEREST RATES ARE DETERMINED UNDERSTANDING MONEY MARKETS CHAPTER 2 CHAPTER 3 4 9.10.2015 UNDERSTANDING OF BOND MARKETS CHAPTER 4, Quiz #1 (Chapter 1-3) 5 16.10.2015 UNDERSTANDING MORTGAGE MARKETS CHAPTER 5 6 23.10.2015 UNDERSTANDING STOCK MARKETS CHAPTER 6. 7 30.10.2015 UNDERSTANDING FOREIGN EXCHANGE MARKETS CHAPTER 7. Quiz #2 (Chapter 4-6) 8 6.11.2015 THE INTERNATIONAL FINANCIAL SYSTEM IN-DEPTH REVIEW OF CHAPTERS 1-8 PREPARATION FOR MIDTERM EXAMINATION. CHAPTER 8. CHAPTER 1-8 9 13.11.2015 10 20.11.2015 MID-TERM EXAM (CHAPTER 1-8) HEDGING WITH FINANCIAL DERIVATIVES UNDERSTANDING INTEREST RATE DERIVATIVE MARKETS UNDERSTANDING EQUITY MARKETS THEORY OF FINANCIAL STRUCTURE 11 27.11.2015 12 4.12.2015 COMMERCIAL BANK OPERATIONS 13 11.12.2015 FINANCIAL BANK INSTITUTIONS: SECURITIES OPERATIONS NON-BANK DEPOSITARY AND INSURANCE INTERMEDIARIES : THRIFT OPERATIONS NON-BANK DEPOSITARY AND INSURANCE INTERMEDIARIES : CREDIT UNIONS NON-BANK DEPOSITARY AND INSURANCE INTERMEDIARIES : INSURANCE OPERATIONS OTHER NON-BANK FINANCIAL INTERMEDIARIES: CONSUMER FINANCE OPERATIONS OTHER NON-BANK FINANCIAL INTERMEDIARIES: PENSION FUND OPERATIONS COURSE OVERVIEW, PREPARATION FOR FINAL-TERM EXAM 14 15 16 18.12.2015 25.12.2015 FINAL TERM EXAMINATION CHAPTER 9, CHAPTER 10. CHAPTER 11, CHAPTER 12 Quiz #3 (CHAPTER 9-11) CHAPTER 13 CHAPTER 14, CHAPTER 15 CHAPTER 16, CHAPTER 17 Quiz #4 (Chapter 12-15) CHAPTER 18, CHAPTER 19 CHAPTER 9-18