The UK Stewardship Code

advertisement

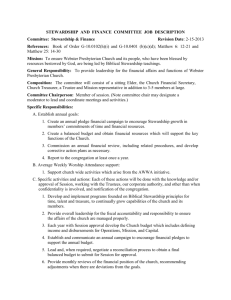

UCL FACULTY OF LAWS The UK Stewardship Code and Corporate Governance: The Untold story/ on the Road to Nowhere? Dr. Arad Reisberg Madrid, 29 January 2015 1 Our short journey tonight 1. 2. 3. 4. 5. Background and Context The UK Stewardship Code (July 2010; Sep 2012) On the Road to Nowhere? (what’s gone wrong) Back to the Main Road? Conclusions: Looking Ahead 2 3 Major Arguments 1 Putting the cart before the horse: depth and rigour were sacrificed for speediness and the need to produce a quick ‘fix’ 2 What is good in the Code is trivial; parts have taken a step backward and it is worrying too 3 The ugly truth is that the Code detracts from the real discussion to be had 3 We're on a road to nowhere Come on inside Takin' that ride to nowhere We'll take that ride Maybe you wonder where you are I don't care Here is where time is on our side Take you there...take you there … Come along and take that ride And it's all right, baby, it's all right And it's very far away But it's growing day by day And it's all right, baby, it's all right 4 1. Background and Context The UK Stewardship Code 5 Source: “Contemporary Problems in Corporate Governance” University of Gdańskconference presentation 30/31 May 2011 Dr Kevin Campbell 6 What is Shareholder Engagement? The Walker Review of corporate governance in banks and financial companies (2009): “the term ‘engagement’ relates to procedures designed to ensure that shareholders derive value from their holdings by dealing effectively with concerns about under-performance.” This includes: arrangements for monitoring investee companies arrangements for meeting as appropriate with a company’s chairman or senior management a strategy for intervention where judged appropriate, and policy on voting and voting disclosure 7 Institutional investors in the financial crisis under attack • Various commentators and regulators and others asked questions about the role of investors and specifically they asked the question: why haven’t they exercised more control over the banks they owned? • Lord Myners (the then Financial Services Secretary to the Treasury) described institutional investors as “absentee landlords” and stated that institutional investor inactivity had contributed to what he termed the “ownerless corporation” • Lindsay Tomlinson, Chairman, NAPF (March 2011) “before the financial crisis, I kept on telling everyone I met that UK corporate governance, the combined code and the way in which UK investors behaved were the best in the world and were a model for others to copy. But ever since the banks blew up in 2008, I found it a difficult line to take. I’ve gone back to my bunker. It’s hard to defend something that’s failed to badly. What could or should we have collectively have done to avert the disaster?” 8 The untold story: Best way of defence: let’s attack back • Let’s do something about it and let’s do it quickly – but, hey, we already got something in place so let’s use that! • The ISC (Institutional Shareholders’ Committee) consists of four trade bodies: NAPF, IBA IMA and ARC - share best practice; not a shareholder watchdog • ISC charged by their respective members with doing something, and that was to develop the ISC principles into an ISC Code • ISC changes the principles into a Code that operates on a comply or explain basis • Code published and ISC in dialogue with Sir David Walker about how it is going to work • When Sir David came out with his final report he thought that in order to have real bite and real standing it needed something of a regulatory imprint or sponsorship • So he recommended that it was handed over to the FRC • The FRC adopted it and it became the FRC Stewardship Code with no major changes 9 Chronology: The Birth (reproduced ?) of the UK Stewardship Code 1991 (ISC)* Statement on The Responsibilities of Institutional Shareholders in the UK * ISC = Institutional Shareholders’ Committee (re-named the Institutional Investor Committee (IIC) on 18 May 2011) 2002 ISC The Responsibilities of Institutional Shareholders and Agents: Statement of Principles November 2009 Walker Review Invited the FRC to take responsibility for the Code November 2009 ISC Statement reformatted as Code on the Responsibilities of Institutional Investors January 2010 FRC Consultation open on the ‘new’ Code; Closed in April 2012 (74 responses) July 2010 FRC Code published – closely mirrored the ISC code (The ISC Code used as basis for Code with minor amendments) April 2012 FRC Consultation on amendments open; Closed in July 2012 (65 responses) 28 September 2012 FRC Updated Code published; in effect from 1 October 2012 FRC Unless circumstances change, the FRC does not envisage proposing further changes to the Code until 2014 at the earliest 10 UK Stewardship Code (September 2012) Best Practice Guidance for UK Institutional Investors on Engagement Key Elements of Code The Stewardship Code principles are enforceable on a “comply or explain” basis (FCA Conduct of Business Sourcebook, Rule 2.2.3) The intention is that secondary institutional investors (e.g. pension funds & insurers) will assess fund managers’ record of compliance with the FRC’s principles of stewardship in determining whether to allocate or renew a fund management mandate with them Principle 1: institutional investors should publicly disclose their policy on how they will discharge their stewardship responsibilities Principle 2:Institutional investors should have a robust policy on managing conflicts of interest in relation to stewardship which should be publicly disclosed. Principle 3: Institutional investors should monitor their investee companies Principle 4: Institutional investors should establish clear guidelines on when and how they will escalate their activities (2010 version: as a method of protecting and enhancing shareholder value) Principle 5: Institutional investors should be willing to act collectively with other investors where appropriate Principle 6: Institutional investors should have a clear policy on voting and disclosure of voting activity Principle 7: Institutional investors should report periodically on their stewardship and voting activities 11 Will the UK Stewardship Code Improve Corporate Governance? Reisberg (September 2010, Cambridge) 1. Another list of boxes to tick (‘comply or explain’) 2. No definition of what ‘Stewardship’ is? (Oops, someone forgot the basics...) 3. On conflicts of interest, Stewardship Code has actually taken a step backward 4. Doesn’t address ‘hidden truth’ of share ownerships changes: (1) Non-UK investors now collectively hold >51% of UK’s equity market (2) Individual ownership has fallen to 10.2%; and (3) shorter holding periods for shares (reduced from 5 years in 1960s to less than 8 months in 2007) - pose greater challenges in terms of making investors engaged in the affairs of UK companies 5. Deficiencies that make genuine stewardship challenging for institutional investors 12 Beneficial Ownership of UK Shares, 1963 –2008 *Institutional Investors include: Insurance companies, pension funds, unit trusts ,investment trusts, other financial institutions. **Other includes share ownership other than Individuals Source: Department for Business, Innovation & Skills, (2010), A Long Term Focus for Corporate Britain –A call for evidence, p 17. 13 Source: “Contemporary Problems in Corporate Governance” University of Gdańskconference presentation 30/31 May 2011 Dr Kevin Campbell 14 3 Major Arguments 1 Putting the cart before the horse: depth and rigour were sacrificed for speediness and the need to produce a quick ‘fix’ 2 What is good in the Code is trivial; parts have taken a step backward and it is worrying too 3 The ugly truth is that the Code detracts from the real discussion to be had 15 Argument No. 1: Too quick, Forgot the Important Details… 1. It’s a Stewardship Code, but we are not going to tell you what Stewardship actually means… “The FRC is aware that there is some confusion in the UK market and overseas as to what “stewardship” means. For example, there is a perception in some quarters that the Stewardship Code is solely concerned with socially responsible investment.” “First, it has become clear that there is no common understanding of what is meant by the term “stewardship”, or of the respective roles and responsibilities of asset owners and managers. The revised Code attempts to provide greater clarity on these issues.” (FRC, Consultation Document: Revisions to the UK Stewardship Code (April 2012)) 2. Two years later: a new introductory part added to the Code (September 2012 version) entitled ‘Stewardship and the Code’: “1. Stewardship aims to promote the long term success of companies in such a way that the ultimate providers of capital also prosper. Effective stewardship benefits companies, investors and the economy as a whole. 2. In publicly listed companies responsibility for stewardship is shared. The primary responsibility rests with the board of the company, which oversees the actions of its management. Investors in the company also play an important role in holding the board to account for the fulfilment of its responsibilities.” 16 The Fuzziness of the Stewardship Concept 1. Still no definition in the Stewardship Code (September 2012): simply describes what it can help achieve; NO articulation of shareholders' "stewardship responsibilities” 2. How can you define a term by using the term itself (stewardship)? 3. Is it actually because it is hard to agree on what it means? Does it mean different things to different players? (i.e. assets manager v. owner) and isn’t this exactly what a Code is supposed to clarify? 4. Accountability to whom: is the stewardship concept ideologically weak as it is still unclear as to whom shareholders are accountable for? (Chiu, 2012) 5. If we cannot pinpoint for whom institutions should act as stewards, then it becomes difficult to judge the exercise of stewardship allowing institutions to dominate the definition of stewardship (Chiu, 2012) 6. Institutional shareholders are already subject to legal obligations of trusteeship that are imposed on them in their capacity of managing pension funds and insurance savings; what would ‘stewardship’ encompass that is not already captured in the legal relationship of trusteeship between institutional investors and their beneficiaries? 17 The Concept of Stewardship (Reisberg, 2010) • The Oxford English Dictionary “the act of taking care of or managing something, for example property, an organization, money or valuable objects” • In the context of a company Tomorrow's Company defines it as: “…the active and responsible management of entrusted resources now and in the longer term, so as to hand them on in better condition” • In other words, stewardship is the process through which shareholders, directors and others seek to influence companies in the direction of long-term, sustainable performance • The EU Corporate Governance Framework, Green Paper (April, 2011) para. 2. 1 “Shareholder engagement is generally understood as actively monitoring companies, engaging in a dialogue with the company’s board, and using shareholder rights, including voting and cooperation with other shareholders, if need be to improve the governance of the investee company in the interests of longterm value creation.” 18 Argument No. 2: What is Good in the Code is Trivial, in parts, Taken a Step Backward and Worrying too FRC: The UK Stewardship Code has widespread support from institutional investors; Unsurprising, as it is based on the pre-existing ISC Code Triviality Principle 3: Institutional investors should monitor their investee companies. Seriously? Monitor? Not have coffee together? Principle 2: Institutional investors should have a robust policy on managing conflicts of interests in relation to stewardship which should be publicly disclosed 2007 ISC Statement of Principles which the Code is based called for institutional investors to have a policy addressing how “situations where institutional shareholders and/or agents have a conflict of interest will be minimised or dealt with” FRC (Dec. 2011): reporting of how conflicts of interest are managed is frequently weak. This is a point also made by Fair Pensions in its report on fiduciary duties. Relatively few signatories state categorically they always seek to place the interest of their clients first. A step backwards 19 Argument No. 2: What is Good in the Code is Trivial, in parts, Taken a Step Backward and Worrying too The Code is an almost wholesale adoption of the ISC Code This is a code that many investors, fund managers, investment consultants and service agencies have expressed varying levels of dissatisfaction with Manifest, one of Europe’s largest proxy voting agencies: “we do not welcome adoption of the [ISC] Code as it currently stands. The revised ISC Code presented to the FRC was not made the subject of market-wide, comprehensive stakeholder input.” Why consult widely (twice) and then not implement suggestions? Example: ‘robust policy’ not a helpful term but still in Sep. 2012 version Worrying Principle 5: Institutional investors should be willing to act collectively with other investors where appropriate The assumption – in the face of decades of evidence to the contrary – that different asset managers can somehow come together through a forum to exercise collaborative stewardship. It is needed, but it will take a supreme act of leadership by institutional investors if this is to happen 20 21 Argument No. 3: The ugly Truth is that the Code Detracts From the Real important Discussion to be Had 22 Ugly Truth #1: The Real Hard Questions that Need to be Discussed 1. The Code is the most detailed attempt to date to give institutional and regulatory form to the belief that shareholders are part of the solution, not part of the problem, and that they have not just a right, but a duty, to engage with the companies in which they invest. But, is shareholder activism a ‘good thing’? “After all, before the financial crisis, institutional shareholders were arguably part of the problem rather than the solution, as they were relaxed about banks using leverage to pursue high returns on equity, tended to deride cautious management and applied pressure for high dividends and share buy-backs that depleted capital.” (Cheffins, 2010) 2. Does the Stewardship Code mistakenly concentrates monitoring in the hands of shareholders, where other stakeholders have greater incentives to monitor, thereby unnecessarily relegating the importance of other stakeholders? (Chiu, 2012) 3. Does the emphasis placed on shareholders in the Stewardship Code reflects a reluctance to take a more progressive position in corporate governance? (Chiu, 2012) 4. Is the re-emphasis placed on shareholders in the Stewardship Code path-depending rather than imaginative? (Bruner, 2010) 5. Should institutional investors micro-manage companies? The Code contains no barriers to prevent that from happening (Bainbridge, 2010) 23 Ugly Truth #2: There is No Serious Attempt to Engage Foreign Investors in the Code ►Domestic fund managers and secondary institutional investors, to whom the Stewardship Code is aimed, constitute a minority of the UK investor community today ► Shareholders who are not the Stewardship Code’s main targets, primarily overseas investors, hedge funds and private individuals now collectively dominate share registers ► What are their obligations under the Code? ► Where are they mentioned? ► How do you ‘make’ them sign to it? Source: Office of National Statistics, ‘Share Ownership Survey 2008’ (27 January 2010), 4 24 Ugly Truth #3: ‘Starting a Conversation’ Argument v. ‘Destructive’ Effect “As of December 2011 the Stewardship Code has attracted 234 signatories, including 175 asset managers, 48 asset owners and 12 service providers. This is a good start and a clear indication that the market is willing to take the concept of stewardship seriously. There is also some evidence that investors are taking account of their stewardship responsibilities in their general contact with companies, even though there is a considerable way to go in the integration of governance and investment decision‐making. The challenge is now to build on this initial success. A positive aspect of the eighteen months of the Stewardship Code has been the wide base of interest.” FRC, Impact of the Codes (December 2011, p. 20) •Principles and practices are being embedded instead of thinking about them carefully and testing them first •Missing an opportunity to go deeper and change behaviours in the long run- not debating the real important questions (see ugly truth # 1) thus missing an opportunity to affect a long rooted changes •The danger: shareholders stewardship could ultimately become a lightweight and a mere rhetoric, not actually expressing the indirect stakes and social concerns as a consistent for governance (Chiu, 2012) 25 Ugly Truth #4: Fuzzy Incentives “Shareholding is increasingly fragmented which reduces the incentives for stewardship. Institutional investors who own less than one per cent of a company do not have sufficient incentive to become good stewards: the answer to this is to get them to work together so that their combined stakes in a company make their engagement imperative.” Kay Review of UK Equity Markets and Long-Term Decision-Making (July 2012) But will the new investors’ forum to coordinate and encourage more engagement amount to much? http://www.investmentfunds.org.uk/press-centre/2014/press-release-2014-10-27/ –Last proposed in the 2009 Walker Report and IIC –Seems to place the bulk of the burden on the shoulders of investment managers; the intermediaries Kay rails against and yet he does not propose to significantly change their incentives –Kay is a member –But will it all be talk and no action? Need to wait and see “Regulation should focus more on the structure of markets, and appropriate incentives, and less on fruitless attempts to control behaviour driven by inappropriate incentives.” Kay Review of UK Equity Markets and Long-Term Decision-Making (July 2012) Completely incompatible with the incentives of investors holding short positions: what happens when investors have an economic interest via short-selling or various derivative investments in seeing the 26 stock price drop? (Bainbridge) Ugly Truth #5: Stewardship is Not in the Genetic Makeup of Institutional Shareholders and the Stewardship Code Doesn’t (or Can’t?) Tackle This Why stewardship is proving elusive for institutional investors? The short answer: Because stewardship is not in their genetic makeup. Modern investment management practices and characteristics make it extremely hard for an active, long-term ownership mindset to take hold OECD Report (February 2011) of the contributing causes of the global financial crisis concluded that institutional investors were generally not effective in monitoring investee companies • “the investment community has other pressing challenges. Pension deficits have to be filled, asset managers face a squeeze on margins and changing views on ‘appropriate’ investment allocation are having a profound effect on their business models.” FRC Chairman, Baroness Hogg (ICGN Conference, 20 March 2012) 27 Ugly Truth #6: Let’s dispel the myth about compliance FRC: Adherence to the UK Stewardship Code is “a success story”: •The concept of stewardship is being considered at the European level by EFAMA (representative association for the European investment management industry) and globally by the OECD •FRC had been working to promote the Code with overseas investors as well as with sovereign wealth funds •By March 2011: 147 signatories to the Code, including some from outside of the UK; 40% of the market; 25 out of 30 top investors in equity markets •By December 2011 - 234 signatories, including 175 asset managers, 48 asset owners and 12 service providers “This level of take-up indicates that the concept of stewardship is being taken seriously. Importantly there has been a wide base of support for the Stewardship Code including from both large and small institutional investors.” FRC, Impact of the Codes (December 2011, p. 20) •By 14 October 2012: 259 Signatories: 189 Asset Managers, 56 Asset Owners, 14 Service Providers 28 Ugly Truth #6: Let’s look at the various findings more closely 1. What is the impact of the Code on the quality of engagement? “As to whether the Stewardship Code has yet had an impact on the quality of engagement, there are mixed signals. Many companies the FRC spoke to said that they had not seen any notable increase in the number of investors wishing to engage with them particularly outside the upper reaches of the FTSE Index ‐ but others said that where engagement took place the quality had improved, with investors showing an interest in a wider range of governance, capital raising and strategic issues.” FRC, Impact of the Codes (December 2011, p. 5) “not enough effective engagement is taking place on issues of substance Some chairmen have complained that too much engagement takes the form of discussion about quantitative analysis rather than business fundamentals. BIS: A Long Term Focus for Corporate Britain (October 2010, p. 20) 29 Ugly Truth #6: Let’s look at the various findings more closely 2. Has the Code made any impact on the attitude of companies? “some investors feel that boards do not take engagement seriously” BIS: A Long Term Focus for Corporate Britain (October 2010, p. 20) “Shareholder views on the attitude of companies are similarly mixed. There is anecdotal evidence that some companies are making a greater effort to engage, with more chairmen taking the initiative of contacting key shareholders. Yet there is also criticism that some companies are becoming less responsive to shareholder votes and more inclined to ignore a significant ‘oppose’ vote as long as they win majority support. Insofar as the Stewardship Code aims to promote better relations between companies and their shareholders, this reaction is counterproductive and ultimately risks undermining the concept of ‘comply or explain‘.” FRC, Impact of the Codes (December 2011, p. 24) 30 The ugly truth #6: A closer look reveals a somewhat different picture 3. How about the quality of disclosures made (in compliance statements/responses) with respect to the Code? ► “As might be expected with such a large and diverse group of signatories, the quality of reporting is variable.” ► “few statements provide much detail about how the signatory uses proxy voting agencies.” ► “There is also an issue around accessibility. The FRC website provides a link to all signatory statements, but these are not necessarily easily accessible via another route... A review carried out by the FRC found that over 40 per cent of statements provided no contact information whatsoever, and that many others did not include either an email address or telephone number for the contact.” FRC, Impact of the Codes (December 2011, pp. 21-22) 31 32 Back To The Main Road? 33 1. What should the FRC focus on now? Get your priorities right! 1.1 Define stewardship and enable clients and companies to differentiate between institutional investors at different points along a stewardship spectrum 1.2 Tackle the issue of foreign investors head on (you can’t entirely address it but at least offer the right incentives): • Tackle these engagement costs, by developing mechanisms to reward good stewardship, preferably with financial incentives • Incentives could include, for example, enhanced dividends or long-term tax benefits for good stewards 1.3 Be more realistic as to whom can be excepted to be engaged and what incentives are there in place - even the FRC now admits an ‘engagement deficit’ (EU Green Paper, 2011) 1.4 If not: “appropriate operational rules and obligations will need to be imposed on institutional investors, asset managers and proxy advisers to bring about effective engagement, especially regarding transparency and conflicts of interests” (EU Action Plan: 12 December 2012) 34 1. What should the FRC focus on now? (contin.) 1.5 Establish clear criteria and metrics by which clients and public can judge what is being done and thereby hold fund managers accountable “The FRC also hopes to stimulate discussion around performance metrics that can help all parties know what the Stewardship Code is achieving. “ FRC, Impact of the Codes (December 2011, p. 29) 1.6 Identify the steps needed to encourage a critical mass of beneficial owners and fund managers who take their responsibilities seriously and incentivise them properly • • • Existing EU law on acting in concert may hinder effective shareholder cooperation and should be amended Setting up shareholder cooperation fora? EU proxy solicitation system where listed companies would be required to set up a specific function on their website enabling shareholders to post information on particular agenda items and seek proxies from other shareholders. (EU Green Paper, April 2011, para. 2.4.2) 35 2. What about the the investment management industry? 2.1 2.2 2.3 Like many cases acknowledge that the answer lies else where- not in the Code itself but rather in reforming the industry itself Follow the proposed changes to the Shareholder Rights Directive, in particular on – Incentive structures for asset managers? – Monitoring asset manager engagement? Address the problem that stewardship is proving elusive for institutional investors because stewardship is not in their genetic makeup (Wong, 2010): 1) 2) 3) 4) 5) Eliminate unnecessary intermediation and strengthen internal capabilities Revamp performance metrics and other arrangements Rationalise portfolio holdings Re-orient the passive investing model Clarify fiduciary duties 2.4 The industry need to develop kite marks and scorecards to reward those who practice stewardship (Mark Goyder, Tomorrow’s Company) 2.5 Let’s talk about clients: Until we have a push from the clients, the Stewardship Code will NOT revolutionize the engagement between companies and investors. 36 3. And finally, for the rest of us… Start a debate about the real issues at stake! Slow down, don’t jump on the wagon, unless you know where we are heading 37 Well we know where we're goin' But we don't know where we've been And we know what we're knowin' But we can't say what we've seen And the future is certain Give us time to work it out 38 Any questions? 39