Cost Accounting 11/e

advertisement

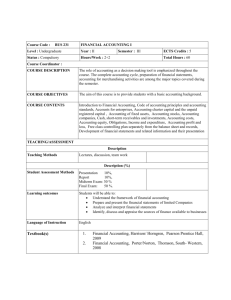

Cost-Volume-Profit Analysis Chapter 3 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3-1 Learning Objective 1 Understand the assumptions underlying cost-volume-profit (CVP) analysis. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3-2 Cost-Volume-Profit Assumptions and Terminology 1. Changes in the level of revenues and costs arise only because of changes in the number of product (or service) units produced and sold. 2. Total costs can be divided into a fixed component and a component that is variable with respect to the level of output. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3-3 Cost-Volume-Profit Assumptions and Terminology 3. When graphed, the behavior of total revenues and total costs is linear (straight-line) in relation to output units within the relevant range (and time period). 4. The unit selling price, unit variable costs, and fixed costs are known and constant. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3-4 Cost-Volume-Profit Assumptions and Terminology 5. The analysis either covers a single product or assumes that the sales mix when multiple products are sold will remain constant as the level of total units sold changes. 6. All revenues and costs can be added and compared without taking into account the time value of money. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3-5 Cost-Volume-Profit Assumptions and Terminology Operating income = Total revenues from operations – Cost of goods sold and operating costs (excluding income taxes) Net income = Operating income – Income taxes ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3-6 Learning Objective 2 Explain the features of CVP analysis. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3-7 Essentials of Cost-Volume-Profit (CVP) Analysis Example Assume that the Pants Shop can purchase pants for $32 from a local factory; other variable costs amount to $10 per unit. The local factory allows the Pants Shop to return all unsold pants and receive a full $32 refund per pair of pants within one year. The average selling price per pair of pants is $70 and total fixed costs amount to $84,000. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3-8 Essentials of Cost-Volume-Profit (CVP) Analysis Example How much revenue will the business receive if 2,500 units are sold? 2,500 × $70 = $175,000 How much variable costs will the business incur? 2,500 × $42 = $105,000 $175,000 – 105,000 – 84,000 = ($14,000) ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3-9 Essentials of Cost-Volume-Profit (CVP) Analysis Example What is the contribution margin per unit? $70 – $42 = $28 contribution margin per unit What is the total contribution margin when 2,500 pairs of pants are sold? 2,500 × $28 = $70,000 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3 - 10 Essentials of Cost-Volume-Profit (CVP) Analysis Example Contribution margin percentage (contribution margin ratio) is the contribution margin per unit divided by the selling price. What is the contribution margin percentage? $28 ÷ $70 = 40% ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3 - 11 Essentials of Cost-Volume-Profit (CVP) Analysis Example If the business sells 3,000 pairs of pants, revenues will be $210,000 and contribution margin would equal 40% × $210,000 = $84,000. FE D ER A L R E SE R V E N O TE TH ED ST AT ES M ER ICAA THEE UN U NIT ITED STAT ES OF O F AAM ERIC T H I S N O T E IS L E G A L T E N D E R F O R A L L D E B T S , P U B L I C A N D P R IV A T E L 70 7 44 62 9F 12 W A S H IN G T O N , D .C. 12 A H 293 L 70 74 46 29 F 12 S E RIES 12 19 85 O R ON NEE D DO OLLA LLAR ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3 - 12 Learning Objective 3 Determine the breakeven point and output level needed to achieve a target operating income using the equation, contribution margin, and graph methods. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3 - 13 Breakeven Point Sales – Variable expenses = Fixed expenses Total revenues = Total costs ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3 - 14 Abbreviations SP = Selling price VCU = Variable cost per unit CMU = Contribution margin per unit CM% = Contribution margin percentage FC = Fixed costs ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3 - 15 Abbreviations Q = Quantity of output units sold (and manufactured) OI = Operating income TOI = Target operating income TNI = Target net income ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3 - 16 Equation Method (Selling price × Quantity sold) – (Variable unit cost × Quantity sold) – Fixed costs = Operating income Let Q = number of units to be sold to break even $70Q – $42Q – $84,000 = 0 $28Q = $84,000 Q = $84,000 ÷ $28 = 3,000 units ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3 - 17 Contribution Margin Method $84,000 ÷ $28 = 3,000 units $84,000 ÷ 40% = $210,000 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3 - 18 $(000) Graph Method Breakeven 378 336 294 252 210 168 126 84 42 0 Fixed costs 0 1000 2000 3000 4000 5000 Units ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3 - 19 Target Operating Income (Fixed costs + Target operating income) divided either by Contribution margin percentage or Contribution margin per unit ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3 - 20 Target Operating Income Assume that management wants to have an operating income of $14,000. How many pairs of pants must be sold? ($84,000 + $14,000) ÷ $28 = 3,500 What dollar sales are needed to achieve this income? ($84,000 + $14,000) ÷ 40% = $245,000 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3 - 21 Learning Objective 5 Explain CVP analysis in decision making and how sensitivity analysis helps managers cope with uncertainty. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3 - 22 Using CVP Analysis Example Suppose the management anticipates selling 3,200 pairs of pants. Management is considering an advertising campaign that would cost $10,000. It is anticipated that the advertising will increase sales to 4,000 units. Should the business advertise? ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3 - 23 Using CVP Analysis Example 3,200 pairs of pants sold with no advertising: Contribution margin $89,600 Fixed costs 84,000 Operating income $ 5,600 4,000 pairs of pants sold with advertising: Contribution margin Fixed costs Operating income $112,000 94,000 $ 18,000 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3 - 24 Using CVP Analysis Example Instead of advertising, management is considering reducing the selling price to $61 per pair of pants. It is anticipated that this will increase sales to 4,500 units. Should management decrease the selling price per pair of pants to $61? ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3 - 25 Using CVP Analysis Example 3,200 pairs of pants sold with no change in the selling price: Operating income = $5,600 4,500 pairs of pants sold at a reduced selling price: Contribution margin: (4,500 × $19) Fixed costs Operating income ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster $85,500 84,000 $ 1,500 3 - 26 Sensitivity Analysis and Uncertainty Example Assume that the Pants Shop can sell 4,000 pairs of pants. Fixed costs are $84,000. Contribution margin ratio is 40%. At the present time the business cannot handle more than 3,500 pairs of pants. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3 - 27 Sensitivity Analysis and Uncertainty Example To satisfy a demand for 4,000 pairs, management must acquire additional space for $6,000. Should the additional space be acquired? Revenues at breakeven with existing space are $84,000 ÷ .40 = $210,000. Revenues at breakeven with additional space are $90,000 ÷ .40 = $225,000 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3 - 28 Sensitivity Analysis and Uncertainty Example Operating income at $245,000 revenues with existing space = ($245,000 × .40) – $84,000 = $14,000. (3,500 pairs of pants × $28) – $84,000 = $14,000 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3 - 29 Sensitivity Analysis and Uncertainty Example Operating income at $280,000 revenues with additional space = ($280,000 × .40) – $90,000 = $22,000. (4,000 pairs of pants × $28 contribution margin) – $90,000 = $22,000 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3 - 30 Learning Objective 6 Use CVP analysis to plan fixed and variable costs. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3 - 31 Alternative Fixed/Variable Cost Structures Example Suppose that the factory the Pants Shop is using to obtain the merchandise offers the following: Decrease the price they charge from $32 to $25 and charge an annual administrative fee of $30,000. What is the new contribution margin? ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3 - 32 Alternative Fixed/Variable Cost Structures Example $70 – ($25 + $10) = $35 Contribution margin increases from $28 to $35. What is the contribution margin percentage? $35 ÷ $70 = 50% What are the new fixed costs? $84,000 + $30,000 = $114,000 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3 - 33 Alternative Fixed/Variable Cost Structures Example Management questions what sales volume would yield an identical operating income regardless of the arrangement. 28x – 84,000 = 35x – 114,000 114,000 – 84,000 = 35x – 28x 7x = 30,000 x = 4,286 pairs of pants ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3 - 34 Alternative Fixed/Variable Cost Structures Example Cost with existing arrangement = Cost with new arrangement .60x + 84,000 = .50x + 114,000 .10x = $30,000 x = $300,000 ($300,000 × .40) – $ 84,000 = $36,000 ($300,000 × .50) – $114,000 = $36,000 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3 - 35 Operating Leverage Operating leverage describes the effects that fixed costs have on changes in operating income as changes occur in units sold. Organizations with a high proportion of fixed costs have high operating leverage. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3 - 36 Operating Leverage Example Degree of operating leverage = Contribution margin ÷ Operating income What is the degree of operating leverage of the Pants Shop at the 3,500 sales level under both arrangements? Existing arrangement: 3,500 × $28 = $98,000 contribution margin ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3 - 37 Operating Leverage Example $98,000 contribution margin – $84,000 fixed costs = $14,000 operating income $98,000 ÷ $14,000 = 7.0 New arrangement: 3,500 × $35 = $122,500 contribution margin ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3 - 38 Operating Leverage Example $122,500 contribution margin – $114,000 fixed costs = $8,500 $122,500 ÷ $8,500 = 14.4 The degree of operating leverage at a given level of sales helps managers calculate the effect of fluctuations in sales on operating income. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3 - 39 Effects of Sales Mix on Income Breakeven sales dollars is $84,000 ÷ 45.46% = $184,778 (rounding). $184,778 × 63.6% = $117,519 pants sales $184,778 × 36.4% = $ 67,259 shirt sales ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3 - 40 DISCUSSION ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 3 - 41