HOCHSCHULE FURTWANGEN UNIVERSITY Business Consulting

advertisement

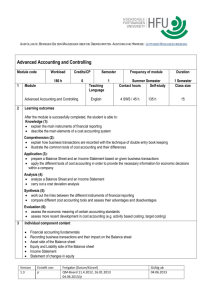

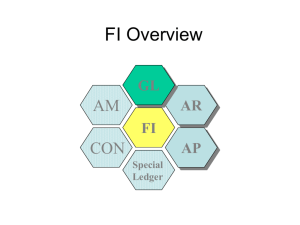

HOCHSCHULE FURTWANGEN UNIVERSITY Business Consulting Master Title Advanced Accounting and Controlling Lecturer Prof. Dr. Frank Kramer Schedule 1st Semester 4 SWS 6 credits Preparation Workload Total 180 h Presence 60 h and after-work 100 h Computer Science: medium Business Administration: high Level Basic Skills: high Key Qualifications: high Basics in Financial Accounting Prerequisites (e.g. Technique of double entry bookkeeping) Basics in Cost Accounting After attending the course the students can: Required Subject Examination and preparation 20 h Comprehension: explain how business transactions are recorded with the technique of double entry book keeping illustrate the common tools of cost accounting and their differences Learning Objectives Application: prepare a Balance Sheet and an Income Statement based on given business transactions apply the different tools of cost accounting in order to provide the necessary information for economic decisions within a company Analysis: analyse a given Balance Sheet and Income Statement criticise certain methods of cost accounting (e.g. drawbacks of Full Cost Accounting) Evaluation: assess the economic meaning of certain accounting standards compare different cost accounting tools and assess their advantages and disadvantages Content Financial Accounting I. Financial accounting fundamentals II. Recording business transactions and their impact on the Balance sheet III. Asset side of the Balance sheet IV. Equity and Liability side of the Balance sheet V. Income Statement VI. Statement of changes in equity VII. Cash-flow statement Management Accounting and Controlling I. Cost accounting fundamentals II. Basic structure of a cost accounting system Cost accumulation (Cost-type accounting) Cost allocation to cost-centres (Cost-centre accounting) Costs per unit (Cost-unit accounting) Income statement (Cost-unit period accounting) III. Cost allocation IV. Absorption costing versus Variable costing V. Normal Costing VI. Cost-volume-profit relationship VII. Information for decision making VIII. Budgeting and variance analysis IX. Investment appraisal X. Strategic versus Operational Controlling XI. Strategic controlling tools Recommended Textbooks Teaching Methods Grading Atrill, P./McLaney, E., Management accounting for decision makers, 7th edition, 2012 Atrill, P./McLaney, E., Financial accounting for decision makers, 6th edition, 2011 Bhimani, A./Horngren, Ch./Datar, S./Rajan, M.; Management and Cost Accounting, 5th edition, 2012 Harrison, W./Horngren, Ch./Thomas, C./Suwardy, T.; Financial Accounting, 8th edition, 2011. Horngren, Ch. et al., Introduction to Management Accounting, 16th edition, 2014 Libby, R./Libby, P./Short, D., Financial accounting, 7th edition, 2011 Lecture with exercises Case studies at home to be presented during the lecture Written examination Presentation/Case study