Allocation of Support Department Costs

advertisement

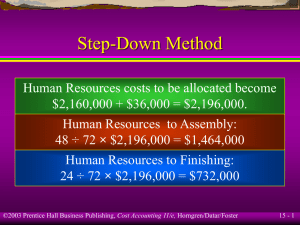

Allocation of Support Department Costs, Common Costs, and Revenues Chapter 15 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 15 - 1 Learning Objective 1 Differentiate the single-rate from the dual-rate cost-allocation method. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 15 - 2 Single-Rate and Dual-Rate Methods The single-rate cost allocation method pools together all costs in a cost pool. The dual-rate cost allocation method classifies costs in each cost pool into two cost pools – a variable-cost cost pool and a fixed-cost cost pool. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 15 - 3 Learning Objective 2 Understand how the uncertainty user managers face is affected by the choice between budgeted and actual cost-allocation rates. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 15 - 4 Budgeted versus Actual Rates Budgeted rates let the user department know in advance the cost rates they will be charged. During the budget period, the supplier department, not the user departments, bears the risk of any unfavorable cost variances. Why? ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 15 - 5 Budgeted versus Actual Rates – because the user departments do not pay for any costs that exceed the budgeted rates When actual rates are used for cost allocation, managers do not know the rates to be used until the end of the budget period. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 15 - 6 Budgeted versus Actual Usage Allocation Bases Organizations commit to infrastructure costs on the basis of a long-run planning horizon. The use of budgeted usage to allocate these fixed costs is consistent with the long-run horizon. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 15 - 7 Learning Objective 3 Allocate support department costs using the direct, step-down, and reciprocal methods. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 15 - 8 Allocating Support Departments Costs An operating department (a production department in manufacturing companies) adds value to a product or service. A support department (service department) provides the services that assist other operating and support departments in the organization. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 15 - 9 Allocating Support Departments Costs Direct method: Allocates support department costs to operating departments only. Step-down (sequential allocation) method: Allocates support department costs to other support departments and to operating departments. Reciprocal allocation method: Allocates costs by services provided among all support departments. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 15 - 10 Allocating Support Departments Costs The Canton Division of Smith Corporation has two operating departments and two support departments. Assembly and Finishing Maintenance and Human Resources ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 15 - 11 Allocating Support Departments Costs Total square feet = 255,000 Total number of employees = 95 Maintenance is allocated using square feet. Human Resources is allocated using number of employees. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 15 - 12 Allocating Support Departments Costs Maintenance Budgeted costs before allocations: $300,000 Square feet: 5,000 Number of employees: 8 Human Resources $2,160,000 30,000 15 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 15 - 13 Allocating Support Departments Costs Assembly Budgeted costs before allocations: $1,700,000 Square feet: 110,000 Number of employees: 48 Finishing $900,000 110,000 24 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 15 - 14 Direct Method Support Departments Maintenance $300,000 0% Operating Departments 110/220 $1,700,000 Assembly 24/72 $900,000 Finishing 0% Human Resources $2,160,000 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 15 - 15 Direct Method Support Departments Maintenance $300,000 0% Operating Departments $150,000 $1,700,000 Assembly $720,000 $900,000 Finishing 0% Human Resources $2,160,000 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 15 - 16 Direct Method Original costs: Maintenance Allocated: Human Resources Allocated: Total Assembly $1,700,000 150,000 Finishing $ 900,000 150,000 1,440,000 $3,290,000 720,000 $1,770,000 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 15 - 17 Step-Down Method Which support department should be allocated first? Maintenance provides 12% of its services to Human Resources. Human Resources provides 10% of its services to Maintenance. Maintenance to Human Resources: 30,000 ÷ 250,000 (or 12%) × $300,000 = $36,000 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 15 - 18 Step-Down Method Maintenance to Assembly: 110,000 ÷ 250,000 (or 44%) × $300,000 = $132,000 Maintenance to Finishing: 110,000 ÷ 250,000 (or 44%) × $300,000 = $132,000 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 15 - 19 Step-Down Method Maintenance: Human Resources: Assembly: Finishing: Costs before allocation $ 300,000 $2,160,000 $1,700,000 $ 900,000 Allocated costs ($300,000) $ 36,000 $132,000 $132,000 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 15 - 20