Professional Accountancy Organisations (PAOs)

advertisement

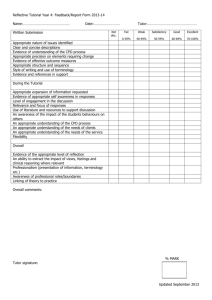

ANAN RETREAT on Good governance code for professional accountancy organisations (PAOs) Premier Training & Consulting 1 A presentation by: Emmanuel G. Ogbonnaya MSc, FCCA, FCA, CCFS, ACTI Premier Training & Consulting 2 Topic: Professional Accountancy Organisations (PAOs) obligations to students, members and the public. Premier Training & Consulting 3 PAOs’ obligation to students Fair and Transparent admission policy (recognise prior learning capabilities) Consistently applied across years Training and Teaching Procedures (emphasis on professional competence) Reviewed for relevance regularly Examination and conferment of membership (emphasis on professional competence) Harness competence and capabilities Premier Training & Consulting 4 Professional Accountancy Organisations (PAOs) Obligations to Students 1.Fair and transparent admission policy for all potential students a policy to ensure that an individual seeking to begin a programme of Professional Accounting Education that would lead to membership of a PAO is fair and transparent i.e. every student is considered on merit based on meeting the PAO’s minimum requirement for admission the policy must set out a minimum entry requirement that should be equivalent to that for admission into a recognised university degree or its equivalent; the policy must be made publicly available and can be accessed closely or remotely either electronically or in hardcopies through network of offices; Premier Training & Consulting 5 PAOs’ obligations to students cont’d it is not unusual to expect a candidate commencing a programme in accounting education to do so with some level of capabilities i.e. skills, some values, ethics and attitudes and students should be encouraged to disclose such information. Premier Training & Consulting 6 PAOs’ obligations to Students Cont’d however, of importance is the extent of these capabilities, which could also influence candidate’s entry point into professional accounting education (e.g. AAT-without first degree, NCE, OND/HND, BA/BSc), thus the capabilities that come with each of these qualifications must be assessed; PAOs have obligation to ensure that an individual embarking on a programme of professional accounting education do so with appropriate level of prior education and learning relevant to provide the necessary foundation to acquire the professional knowledge, skills, values, ethics and attitudes that are essential to become a professional accountant Premier Training & Consulting 7 PAOs’ obligations to Students cont’d They should carefully draw up training programmes for students of varying capabilities to ensure that each stream of students is provided the required accounting education programme in accordance with their strengths at entry point, which could be: post graduate entry level; post secondary school entry level; or at some point between higher education and below an undergraduate degree a fair and transparent admission policy should also recognise work experience, mature students, candidates joining the programme part-way through their career and other types of learning Premier Training & Consulting 8 PAOs’ obligation to students There might also be some other types of learning that PAOs would have to identify and recognise as an acceptable entry point/pathway into accounting education It should be said that whichever route, there should be consistency with the overall programme of professional accounting education and must be inline with the laid down accounting education programme admission policy of the PAOs concerned. Premier Training & Consulting 9 PAOs’ obligations to students cont’d In some cases PAOs will want some level of assurance that it has high enough entry point to guarantee the likely success in the programme of professional accounting education. Therefore, assessment of these entry-point obligations must be discharged with high level of professional integrity and proficiency; It is likely that some PAOs would want to assess the quality of the degree from tertiary institutions whose qualifications are tendered for admission into their professional accounting education programme. This is very important as research has shown that there is a correlation between the quality of the degree tendered for admission into professional accountancy education and the successful completion of the programme. Premier Training & Consulting 10 PAOs’ obligation to students Further, it should also be said that there need to be proper cross-checking of students’ entry qualifications not only for the authenticity but as noted earlier, to assess the standing of the institutions whose qualifications are tendered at the entry point of professional accounting education programme given the varying levels of quality of degrees from some universities. Premier Training & Consulting 11 PAOs’ obligations to students cont’d In its Framework (FW) for International Education Standards (IES) for professional accountants, the International Education Standards Board (IESB) notes that “overall objective of accounting education is to develop competent professional accountants” and sets out a number of major training headings under its educational concepts required to build competence, which is defined “as the ability to perform a work role to a defined standard with reference to working environment” FW para.12. Premier Training & Consulting 12 PAOs’ obligation to Students Cont’d to demonstrate competence in a role, the standard notes that, a professional accountant must possess the necessary: (a) professional knowledge; (b) professional skills; and (c ) professional values, ethics and attitudes. therefore, PAOs must be aware of, and should design their accounting education programme to integrate the basis for acquiring competencies built around the above for the promotion of the profession when individual professional accountancy graduates become members of PAO. The ability to meet the level of competence should be checked at entry point Premier Training & Consulting 13 PAOs obligations to students cont’d Training & Teaching Procedures: It is important to stress here a computer phraseology that says“ garbage in garbage out”; so is true of teaching & training of professional accountancy students. Poorly designed and structured training and teaching procedures will produce poorly prepared graduate members with less than average level of competence and capabilities. The effect of this will run across generations; given that one can not give what they do not have. Premier Training & Consulting 14 Training & Teaching Procedures cont’d But how should our training and teaching programmes be structured and packaged to provide the needed competencies and capabilities to PAOs’ students? This obligation can be addressed by designing teaching and training programmes that significantly highlight competencies required at various study areas; it should also create awareness to students of the related work profile in the particular study area and performance objectives in the study area as well. Premier Training & Consulting 15 Training and Teaching Procedures cont’d The mode of training and teaching has continue to change with the advent of ICT and various other information technology infrastructure that have made various training and teaching methods very interactive. As a result, the different training modes or methods must be identified including any training and teaching modules that are conducted electronically. Given the fair and transparent training and teaching methods, PAOs must designed their training and teaching modules to be consistent across the different training and teaching programmes. Premier Training & Consulting 16 Training and Teaching procedures cont’d Procedures for highlighting importance of competencies, work related profile and performance objectives is shown below: Training & Teaching Area for example: Management Accounting (or Performance Management) Competencies • • • • demonstrate the concepts and calculations for measuring performance for profit and non profit motive organisations; prepare budgets and interpret their various components; identify and demonstrate the different decision making techniques including their associated risks etc. Key job related profile on completion • • • Management Accountant; Group Accountant etc. Performance Objectives on completion • • • • Premier Training & Consulting Able to prepare financial information for management; Monitor and control budget; Communicate financial and non-financial information effectively etc. 17 PAOs’ obligations to students cont’d Training and Teaching area for example: Audit & Assurance Competencies • • • • demonstrate risk assessment procedures and determination of materiality threshold; have the knowledge and ability to explain the scope and purpose of assurance engagements; discuss and demonstrate the fundamental principles of professional ethics, values and attitudes; etc. Key job related profile on completion • • • • • External auditor Internal auditor Chief Financial Officer (CFO) Forensic accountant etc. Performance Objective on completion • • • • Premier Training & Consulting Demonstrate and able to apply professional ethics, values and attitudes; Apply the fundamental principle for collection and preservation of audit evidence; Understand and able to prepare and evaluate audit evidence etc. 18 PAOs’ obligations to students cont’d The emphasis here are competencies (as opposed to just listed the topics and areas of study in the syllabus) so that the students’ attentions are drawn. As much as possible the relevant competencies are linked to certain job related roles that students may be interested on completion (an area most PAOs’ training information fails to mention). Also for students to be made aware of the identified key performance measurement objectives that employers may use. Premier Training & Consulting 19 PAOs’ obligations to students cont’d for the training programme to be fair, PAOs must design it to ensure that a comparable level of professional competence at the point of qualification is attained by candidates from all possible entry routes whether from the secondary school, further or higher education; information about teaching and training locations e.g. training location centres, whether training could be obtained on-line from the PAO or their accredited training organisations Premier Training & Consulting 20 PAOs’ obligations to students cont’d Given the continuing relevance of work experience, PAOs’ admission policy should also include the recognition of work experience, mature candidates and those joining the part-way through their career and with the varying degrees of students capabilities. As noted before, there might be some other types of learning that PAOs might want to recognise as acceptable path into their accounting education. Premier Training & Consulting 21 PAOs’ obligations to students cont’d it should be said that which ever routes that are chosen, there should be consistency with the overall programme of professional accounting between one period and another; however, where there are updates in professional standards, legal or regulatory framework such should be reflected in the training and teaching of the PAO as soon as practicable to ensure students remain well informed of the changes. Premier Training & Consulting 22 PAOs’ obligations to students cont’d In respect of updates, PAOs should know that they have a major obligation to students by ensuring that major changes to their key training subjects are brought to their attention and arrangement made to incorporate the changes into their training programme For example, update on IFRS, ISA, or other professional standards such as ethics to professional accountants or issuance of new standards, there should have lapsed period after which the changes are incorporated into the students learning materials for example, 6 months after the effective date of the standards or changes. Premier Training & Consulting 23 PAOs’ obligations to students cont’d to provide students with the assurance of high quality of the PAO’s qualification, it is important that candidates from all possible routes achieve a comparable level of professional competence at the point of qualification; Premier Training & Consulting 24 PAOs’ obligation to Students cont’d it is very common this days to find PAOs, having some pre-admission training programme before finally admitting students (such as ANAN conversion course programme to assess the capabilities of individual students through integrated classroom coursework). This allows PAOs to gain such guarantees and ANAN has this pre-admission training programme in place i.e. conversion course. Premier Training & Consulting 25 PAOs’ obligations to students cont’d Examination and Membership conferment PAOs should design examinations that place more emphasis on students’ competencies and capabilities particularly at the point of exit (i.e. final examinations) because the final examinations precede the period of transition to membership following qualification; The professional qualifying certificates certify the holders as being competent to carry out work as professional accountants; The certificates act as assurance both to the student and the public that the holder can perform work of a professional accountant. Premier Training & Consulting 26 Examination and membership Conferment cont’d Major questions to ask by PAOs in order to identify their key obligations to students at this point preceding membership include: Do our examinations particularly, the final sections test integrated knowledge and application on, for example, financial reporting (separately, on IFRS, IPSAS and IFRS for SMEs) by students? Can students of the PAO demonstrate sufficient knowledge and understanding of the application of ISAs, ISQC, Premier Training & Consulting 27 Examination and membership conferment cont’d Can they demonstrate professional ethics, values, attitudes , understanding and are able to comply with regulatory and legal frameworks that the public looks to see in a professional accountant? With respect to financial and performance management respectively, can our newly qualified demonstrate integrated knowledge and application of the relevant concepts required in real life situations? These questions are geared toward the appropriate level of competencies and capabilities, which are generally acquired through PAO’s training and are demonstrated through training as well as through examinations. It needs to be said that more of these competencies and capabilities will become focal points at membership terrain. Premier Training & Consulting 28 Examination and membership conferment cont’d The table below summarises the recent rating of newly qualified finance professionals having a good working knowledge of different finance areas; The results point PAOs to where they should prepare students more for competence acquisition bearing in mind the more likely rewards in terms of job opportunities; financial management high rating shows how critical a tool it is for all businesses and its understanding and application is not restricted to private sector. Premier Training & Consulting 29 Rating (%age ) of newly qualified finance professionals having a good working knowledge of different finance areas 68 Stakeholders relationship management 75 Law and Taxation 80 Audit and Assurance 83 Leadership and management Strategy and innovation 86 Governance, risk and control 86 Sustainable managemnt accounting 87 Corporate reporting 93 Professionalism and ethics 94 Financial Management 0 96 10 20 30 40 50 60 70 80 90 100 Source: ACCA , the complete finance professional 2013 Premier Training & Consulting 30 PAOs’ obligations to members As other members of the accountancy profession would have noticed, professional accountants have become so dependent on their professional bodies to facilitate their development in all aspects of their professional career in order to remain relevant after qualification; This means that members are on regular basis looking out for issues and information emanating from their PAOs and these may well include courses, seminars and conferences, etc.; This may even seem more burdensome if the dependency is on more than one PAO, for example, a member of ANAN and ICAN or ACCA and ICAEW, for those who are members of more than one PAO. Premier Training & Consulting 31 PAOs’ obligations to members cont’d But why should this be the case? well there is this believe that what happens in and around the profession would more likely be known first by the PAOs; and this is said to be the case where or because the relevant regulatory bodies work closely with PAOs and would prefer to disseminate information to professional accountants through their relevant PAOs. Premier Training & Consulting 32 PAOs’ obligations to members cont’d However, it needs to be said that PAOs do not necessarily have privy to regulatory information as and when it emerges and/or the dissemination of emerging information to their members; From observations, in most cases, the major big accounting & auditing firms who, one way or another, participate in major international regulatory committees would have greater privy to emerging information in the profession than some PAOs. Premier Training & Consulting 33 PAOs’ obligations to members cont’d Also given the state of transparency in due process particularly, in respect of standard setting and amendments to existing standards by regulatory authorities, information dissemination (with the advent of internet) has been made seamless and some members are likely to have new regulatory information emerging from the relevant authorities before their PAOs. Therefore, the dependency of members on their PAOs for relevant information to assist them maintain their competencies may not anymore be contested. Premier Training & Consulting 34 PAOs’ obligations to members cont’d However, given this level of dependency on PAOs by their members, what major obligations do PAOs have to their members? The concept of lifelong learning brings a major obligation on PAOs to ensure that their members remain competent through out their career See diagram below: Premier Training & Consulting 35 PAOs’ obligations to members cont’d The concept of lifelong learning: LIFELONG LEARNING Commences following enrolment into accountancy education programme through All accountancy education training programmes Up to Becoming a qualified accountant Premier Training & Consulting and Throughout the professional accountant’s career 36 PAOs’ obligations to members cont’d In its standard, the International Education Standards (IES-7) issued by the International Education Standards Board (IESB) titledContinuing Professional Development: A Programme of Lifelong Learning and Continuing Development of Professional Competence, the standard, para.13 requires IFAC member bodies to “promote the importance of continuous improvement in competence and a commitment to lifelong learning for all professional accountants”. Premier Training & Consulting 37 PAOs’ obligations to members cont’d The standard prescribes that IFAC member bodies should: Foster a commitment to lifelong learning among professional accountants; Facilitate access to continuing professional development opportunities and resources for their members; Establish for members benchmark for developing and maintaining the professional competence necessary to protect public interests; and Premier Training & Consulting 38 PAOS’ obligations to members cont’d monitor and enforce the continuing development and maintenance of professional competence of professional accountants. However, the standard recognises the principle that it is the responsibility of each professional accountant to develop and maintain professional competence necessary to provide high quality services to their clients, employers and other stakeholders. Premier Training & Consulting 39 PAOs’ obligations to members cont’d Mandatory CPD for all Professional Accountants IES 7 para.18 notes that member bodies should require all professional accountants to develop and maintain competence relevant and appropriate to their work and professional responsibilities. However, the standard stresses that the responsibility for developing and maintaining competence rests primarily with each professional accountant. Premier Training & Consulting 40 PAOs’ obligations to members cont’d Therefore, PAOs, in organising CPD programmes is in the spirit of ensuring that members take advantage of the platform provided by them. It may seem unlikely that if professional accountants were left to provide on their own, the required level of continuing CPD it may lack cohesion and also may not sufficiently identify gaps in competence and training needs. But see below how some PAOs manage CPD activities. Premier Training & Consulting 41 PAOS’ obligations to members cont’d However, where PAOs conduct CPD programmes for their members themselves, they are required to consider what is relevant and appropriate for professional accountants. The standard requires that the following issues be considered: relevance-given the expected contributions to competence of professional accountants, acceptable CPD activities should facilitate the development of the professional knowledge, professional skills and professional values, ethics and attitudes of the professional accountant, relevant to their current and future work and professional responsibilities. Premier Training & Consulting 42 PAOS’ obligations to members cont’d Another issue to be considered is Measurement of CPD activities paras. 25, 26 IES-7, require Professional accountants to measure learning activities or outcomes to meet the member body’s (such as ANAN) CPD requirements. The standard also notes that learning activity can be measured in terms of effort or time spent, or through a valid assessment method, which measures competence achieved or developed. Premier Training & Consulting 43 PAOS’ obligations to members cont’d The issue of measurement brings on another issue of verification of CPD activities . First is the fact that CPD records must be kept be professional accountants, which document related CPD activities and can be produced when required by the PAO. This is to enable the CPD attained by the professional accountant to be verified. It is recognised that some learning activities may be measured but not verified Premier Training & Consulting 44 PAOs’ obligations to members cont’d Given that CPD is to develop the professional competence of professional accountant, the standard identifies three approaches through which CPD activities could be achieved thus: Input-based approaches these require establishment (presumably, by PAOs) of a set amount of learning activities that are considered appropriate to develop and maintain competence. Output-based approaches these are where the professional accountants are required to demonstrate, by way of outcomes, that they develop and maintain professional competence. Premier Training & Consulting 45 PAOs’ obligations to members cont’d The standard also recognises a third approach, which is a combination of the two approaches noted above. Combined approaches—these refer to methods that effectively and efficiently combine elements of the input and output based approaches, setting the amount of learning activities required and measuring the outcomes achieved. Our research shows that most PAOs adopt the combined approach, which brings in some level of flexibility and professional judgement. See ACCA and ICAEW CPD Administration tables below. Premier Training & Consulting 46 PAOs’ obligations to members cont’d However, a major obligation that rest on PAOs is to ensure that while assisting members (whichever approach adopted) to achieve their CPD activities, they are required to establish a systematic process to monitor whether professional accountants meet the CPD requirement and the system must provide for appropriate sanctions for failing to meet the requirement, including failing to report or failing to develop and maintain competence. Premier Training & Consulting 47 PAOs’ obligations to members cont’d The systematic process put in place by PAOs vary and the variants include the following: (i) PAO directly setting and administering activities that count toward CPD including training. This provides the PAO the opportunity to monitor and enforce compliance on CPD requirement; (ii) PAO permits members to attain a specific number of CPD units or hours and produce evidence that the PAO can verify; (iii) PAO in addition to providing CPD activities by itself, also permits or registers some training providers including employers as authorised CPD training providers Premier Training & Consulting 48 PAOs’ obligations to members cont’d PAOs are said to base their decision of what systematic process to adopt on the basis of cost efficient and convenient ways of administering CPD to members before adopting a CPD process. For example, ACCA has four streams through which members can satisfy their CPD requirements and these are shown in the table below. Also ICAEW has quite a different system of administering CPD on its members as shown below. Premier Training & Consulting 49 PAOs’ obligations to members cont’d Unit route Unit route-part-time or service retired ACCA approved employer route IFAC body route The unit route is for members who plan and organise their own CPD. If you follow the unit route, you are required to complete 40 relevant units of CPD each year, where one unit equals one hour of development. 21 units must be verifiable; the other 19 can be non-verifiable. It is extremely important to focus on what is relevant to your role and your career ambitions. No matter what your learning activity is, if you can answer ‘yes' to the three questions below, you can record your learning activity as verifiable CPD: Was the learning activity relevant to your career? Can you explain how you will apply the learning in the workplace? Can you provide evidence that you undertook the learning activity? If you are employed for 770 hours or less over the course of a CPD year, then you may be eligible to follow this route. For example, you might work up to 17.5 hours per week, or you might only be active in the workplace at specific points in the year. If this applies to you, then you may complete 19 units of nonverifiable CPD and set your own level of verifiable CPD. You will need to ensure that you have completed an appropriate level of CPD for your role. The most important thing to focus on is relevance to your role and your career. The following conditions apply to this route: If you are not eligible for this route, you must follow the full unit route. If you are a practising member, you may only follow this route if you are not responsible for audit or other regulatory work. You also need to be able to show that you have the support of a technical expert when carrying out your duties. You may not follow this route if you are involved in the preparation or presentation of accounts investors may rely on, or are a Non-Executive Director of a listed company. If you work for an organisation which is an ACCA Approved if you are also a member of another professional accountancy body then ACCA's CPD programme is sufficiently flexible to allow you to choose to follow your other body's CPD programme instead of ACCA's CPD programme, as long as: you are a full member of that professional accountancy body; your other member body is a member of IFAC; and your other member body's CPD policy is compliant with IFAC's International Educational Standard (IES 7). If you can answer 'yes' to these three statements, you are eligible to follow the IFAC body route, and, if doing so, can indicate this when making your annual CPD declaration to ACCA. Employer - professional development, you may achieve your CPD by participating in your organisation's employee development programme and you are not required to complete any additional CPD. You must however, complete an annual CPD declaration to ACCA stating that you have followed this route. If you have worked for an ACCA Approved Employer professional development for all or any part of a CPD year, you can indicate that you have taken the employer route when you make your annual declaration. It is your responsibility to confirm with your employer that they are an ACCA Approved Employer professional development and that you or your team are covered by the approval. ACCA maintains a list of all employers who have gained approval under the professional development stream. Premier Training & Consulting ACCA CPD ADMIN. 50 PAOs’ obligations to members cont’d What is CPD? What activities count as CPD? Providing Evidence Complete any required CPD Activity Unlike some professional bodies, we don’t dictate how much CPD members must do. There are no set hours or points to attain. You simply need to complete as much development activity as you feel is required to remain competent in your role(s). You don’t necessarily need to attend training courses to maintain CPD compliance. We recognise that people learn in different ways, through several different channels. These are the popular ways members stay up to date: Read the ICAEW email alert – it contains updates and news relevant to your role Attend a workshop, conference, seminar or webinar Read a book or journal, such as a faculty publication Participate in the ICAEW community Arrange an informal training session with a colleague ICAEW randomly select members for review on an annual basis. If you are asked for evidence, you will need to show how you have complied. Your CPD evidence will need to mirror the steps described above, and further information will be provided in the request letter: How you record your evidence is up to you, but you will need to demonstrate the three steps of reflect, act and impact. You can record evidence using ICAEW’s record form or you can keep your CPD details in Word or Excel and upload them to www.icaew.com/cpd On an ongoing basis, and using your professional judgement, you should: Reflect • reflect on the knowledge and skills required for your role(s); • consider your responsibilities and the expectations placed upon you; • identify your learning and development needs; these should be relevant to your role(s) and your future career development; they may include technical knowledge, business awareness, IT skills and ‘soft’ skills such as negotiation, time management, team leadership skills. Premier Training & Consulting ICAEW CPD ADMIN. 51 PAOs’ obligations to members cont’d What is CPD? What activities count as CPD? Providing Evidence Complete any required CPD Activity Act when appropriate, take action (reading, online research, focused discussion, courses, etc.) to keep up to date and remain fully competent. Impact • assess the effectiveness of these activities (how the learning has made you more competent and effective, what you can do now which you couldn’t do before) and consider whether your learning and development objectives have been met. ICAEW CPD ADMIN. Premier Training & Consulting 52 PAOs’ obligations to members cont’d The table below shows the different ways other PAOs i.e. ACCA and ICAEW administer their CPD Premier Training & Consulting 53 PAOs’ obligations to members cont’d IES 7 CPD Approach CPD hours CPD Programmes provision Recommends either: Input-based; Output-based; or Combination of both ACCA ICAEW Output-based but requiring individual professional accountant’s judgement Output-based but requiring individual professional accountant’s judgement 120 hours only if inputbased approach is adopted 120 hours CPD activities achieved over three (3) years 60 hours verifiable 40 hours annually 21 hours verifiable IES 7 para. 17 states that member bodies may directly provide relevant CPD programmes for professional accountants and facilitate access to programmes offered by others, encompassing all learning methods. Deploys four (4) streams for accomplishing yearly CPD requirement but ACCA does not directly provide CPD programmes but encourages acquisition through approved routes. Activities must be based on relevance on current role and career ambitions Premier Training & Consulting CPD hours or units not specified Individual judgement but CPD activities must be relevant to current role(s) and future career development. Encourages acquisition of CPD hours through several different channels but emphasis is on current roles and future career development. 54 PAOs’ obligations to members cont’d In its discussion paper titled: “A global debate on preparing accountants for finance leadership” IFAC pointed out the role and expectations of a Chief Finance Officer (CFO). It notes under the heading: “preparing professional accountants for finance leadership” the following five principles guiding the role and expectation of a CFO: be an effective organisational leader and key member of senior management; Premier Training & Consulting 55 PAOs’ obligations to members cont’d balance the responsibilities of stewardship with business partnership; act as the integrator and navigator for the organisation; be an effective leader of the finance and accounting function; and bring professional quality to the role of CFO and the organisation. Premier Training & Consulting 56 PAOs obligations to members cont’d The paper further notes four typical roles accountants in business have been found and relate to value management which encompasses: creating value- engaged in developing strategies for sustainable value creation; enabling value- supporting the governing body and senior management in making decisions and facilitating the understanding of performance of organisational functions or units; Premier Training & Consulting 57 PAOs’ obligations to members cont’d preserving value-asset and liability management, managing risk in relation to setting and achieving the organisation’s objectives and implementing and monitoring effective internal control systems; and reporting value- this, the paper notes is in respect of ensuring relevant and useful internal and external business reporting. Premier Training & Consulting 58 PAOs’ obligations to members cont’d The issues raised in the discussion paper would appear to provide some pointer to PAOs where they would have to develop their members competencies (e.g. via CPD) and also ensure reasonable knowledge and understanding of the issues by their qualifying members if they are to build competent individuals for leadership in finance and accounting role in the future for private and public sector respectively. Premier Training & Consulting 59 PAOs’ obligation to the public Accountancy profession has in the last five or so decades, witnessed a plethora of professional indiscretions and other acts of unethical practices leading to high profile corporate collapses. The concerns of investors and indeed, the public, remain that the preparers of financial statements and the auditors are all professional accountants. Questions that have become recurring in the minds of many investors and the public at large are: Where were the financial auditors (who are all professional accountants) when the indiscretions and unethical practices were perpetrated? Were they aware of the wrong doings of those charged with the governance of the corporate bodies? Premier Training & Consulting 60 PAOs’ obligations to the public What action did they take to prevent the incidents of indiscretions? What action have the accountancy regulatory bodies taken to instill ethical values in members of the PAOs that they regulate? How are ethical values and professional competence of professional accountants monitored by the PAOs including their members’ practices and the conduct of the individual members in practice or in employment? What measures should the PAOs put in place to enforce ethical values, professional skills and professional competency? Premier Training & Consulting 61 PAOs’ obligations to the public cont’d A major aspect of a professional accountant’s life that has changed in the last five decades is that which prevents him or her from operating autonomously without shepherd. Professional accountants have become globally regulated in addition to regulations required within their own jurisdictions Globally, all professional accountants are regulated through IFAC, which comprises 159 members and associates in 124 countries worldwide with approximately 2.5 million accountants across public practice, industry and commerce, public sector and education and stresses that its objective is to serve the public interest. Premier Training & Consulting 62 PAOs’ obligations to the public cont’d IFAC stresses that to serve the public interest, it aims to: strengthen the worldwide accountancy profession; and contribute to the development of strong economies by establishing and promoting: (i) adherence to high-quality professional standards; (ii) furthering the international convergence of such standards; and (iii) speaking out on public interest issues where the profession’s expertise is most relevant Premier Training & Consulting 63 PAOs’ obligations to the public cont’d While PAOs are directly working also to meet obligations placed on them for the public interest as set out in points (i) and (iii) above in their own jurisdictions, they are obliged indirectly, to also play major part in fulfilling the role required to achieve point (ii) but in this case, ensuring the smooth convergence of those standards with their local standards. It is believed that in fulfilling the three obligations noted above, PAOs would also be strengthening the world accountancy profession and contributing to the development of, and establishing a strong economies in their jurisdictions Premier Training & Consulting 64 PAOs’ obligations to the public cont’d But what role should PAOs play in ensuring adherence to high-quality professional standards? PAOs must ensure that their members understand and are able to apply the highquality international standards produced through extensive due process that have converged with their local standards For example in Nigeria: (i) do they understand and are able to apply IFRS/IAS; IFRS for SMEs; IPSAS (Cash and/or accrual basis) appropriately? Premier Training & Consulting 65 PAO’s obligations to the public cont’d for those members in practice, have they also complied with the following standards as they relate to them: Overall framework of Assurance Engagement International Standards on Quality Control (ISQC 1) International Framework for Assurance Engagements International Standards on Auditing (ISAs) International Standards on Review Engagements (ISREs) International Standards on Assurance Engagements (ISAEs) Premier Training & Consulting International Standards on related Services (ISRSEs) 66 PAO’s obligations to the public cont’d In drawing their accountancy education programmes and CPD activities, have PAOs integrated the provisions of the following IES where appropriate? IES Title 1 Entry requirements to a programme of professional accounting education 2 Content of professional accounting education programme 3 Professional skills and general education 4 Professional values, ethics and attitudes 5 Practical experience requirements 6 Assessment of professional capabilities and competence 7 Continuing professional development: a programme for lifelong learning and development of professional competence 8 Competence requirements for audit professionals Premier Training & Consulting 67 PAO’s obligations to the public cont’d It is believed that compliance and adherence to the various high quality standards shown above as well as the PAO’s territorial laws and regulatory requirements, the PAO would have been serving the public interest. In addition, PAOs must not be averse to making public statements where the profession’s expertise is most relevant as well as also on issues that it judges will enhance public awareness on legal and regulatory matters e.g. the recent publication by ANAN on “Whistle Blowing”. Premier Training & Consulting 68 Conclusion Contents of this presentation shown on slides 4 to 68 are the various obligations of Professional Accountancy Organisations (PAOs) to their: Students Members; and the Public. Premier Training & Consulting 69 End Thank you for Listening Emmanuel Ogbonnaya CEO/Director, Technical & Training (PTC) Premier Training & Consulting 70