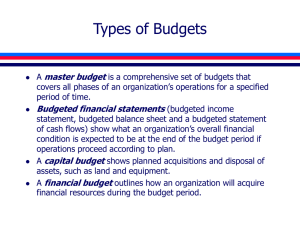

BBA PROGRAM Managerial Accounting Fall 2022-2023 Budgetary Planning and Control Slide 10-2 Budgets ▪ Formal documents that quantify a company’s plans for achieving its goals ▪ For many companies, the entire planning and control process is built around budgets. Slide 10-3 Use of Budgets in Planning ▪ Budgets enhance communication and coordination ▪ Process forces managers to consider their goals and objectives carefully ▪ Managers must specify means of achieving goals and objectives Slide 10-4 Use of Budgets in Control Process ▪ Provide a basis for evaluating performance ▪ Essential to assess the performance of managers and their operations ▪ Performance evaluation compares actual with planned or budgeted performance Slide 10-5 Use of Budgets in Control Significant deviations from planned performance associated with three potential causes: 1. The budget was poorly conceived 2. Conditions have changed 3. Managers have done a particularly good or poor job managing operations Slide 10-6 Developing the Budget Budgets are prepared for: ▪ Departments ▪ Divisions of a company ▪ For the entire company Budget Committee ▪ Responsible for approval of various budgets ▪ Made up of senior managers (Presidents, CFO, controller, etc.) ▪ Typically works with departments to develop realistic plans Slide 10-7 Budget Time Period ▪ Managers must decide on a budget period - Short run budgets prepared for a month, a quarter, or a year - Long run budgets prepared for a threeyear or five-year period ▪ Generally, the longer the time frame the less detailed the budget Slide 10-8 Components of the Master Budget The master budget includes: Sales budget Production budget Direct materials purchases budget Direct labor budget Manufacturing overhead budget Selling and administrative expense budget ▪ Capital acquisitions budget ▪ Cash budget ▪ ▪ ▪ ▪ ▪ ▪ Slide 10-9 Master Budget Slide 10-10 Master Budget Sales Budget Quantity 1,500 SP / Unit 350 Total Sales Ending Inventory 525,000 Collect P1 393,750 Collect P2 131,250 Beginning Inventory Ending Inventory 1,000 500 2,000 DM / Unit Cost / U. DM 75 2,000 2 DLH rate 20 Total DL 80,000 70 Total Purchase value 287,000 Pay P1 114,800 Pay P2 172,200 Operational expenses Administrative Cash Budget P0 178,000 Collect P1 393,750 Pay P1 514,800 P1 2 4,000 MOH/Unit DLH/Unit 4,100 To produce 150,000 50 4,000 To buy MOH Budget 150 Consumption 1,500 DLH consumed DL Budget Beginning Inventory Inventory Sold Budgeted overhead Production DM Budget Production Budget 56,950 130,000 Selling 25,000 Others 15,000 Total 170,000 Budgetary Control Budgets as a Standard for Evaluation - The standard is the budgeted amount - Differences between budgeted and actual amounts are called budget variances - Budget variances should be investigated when they are material Slide 10-12 Static and Flexible Budgets ▪ Static Budget Not adjusted for the actual level of production ▪ Flexible Budget Can be adjusted for various production levels ▪ Level of activity used in flexible budget is equal to the actual activity level Slide 10-13 Investigating Budget Variances ▪ Variances are differences between budgeted and actual amounts ▪ Causes of Budget Variances - Budget may not have been well conceived - Conditions may have changed - Managers may have performed particularly well or poorly Problem 10.11 Slide 10-14 Questions ? Slide 10-15