October 14, 2011

Top Worldwide Innovations in

Payments

Changing the world one step at a time

Andy Schmidt

Research Director

Commercial Banking & Payments

© 2011 The Tower Group, Inc. May not be reproduced by any means without express permission. All rights reserved.

Agenda

Innovation Overview

- Why is it important, and why do we need it in financial services?

Views into Payments innovations by:

- Service

- Product

- Technology

© 2011 The Tower Group, Inc.

1

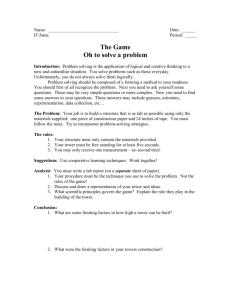

A framework for analyzing markets and

disruption

Jets & Sharks

Barriers to entry

HIGH Battleships

LOW Meteors

SLOW

Fruit Flies

Pace of technology change

RAPID

© 2011 The Tower Group, Inc.

2

Each segment displays unique dynamics

and innovation potential

Segment

Dynamics

Nature of innovation

Battleships

Dominated by few large players

Pace of the business in general is slow

Incumbents seek to maintain status quo

Unlikely; high probability of

“sustaining” evolution from

incumbents

Jets &

Sharks

Aggressive competition among sophisticated

Relationships change rapidly;

business models less so; insiderbased which can be disruptive

Meteors

Slowly evolving, with new entrants entering the

players

Fast pace of business demands advanced

technology

Incumbents know each other, and their “moves”

business

No substantial change beyond price or relationship

Incumbents can be surprised by a better

mousetrap

Fruit Flies

Constant experimentation and rapid evolution at

the margins

Most liable to be influenced by imports from other

industries

Incumbents can contribute to the experimentation

as well

High potential for disruption in

relationships and business

model; incumbents not positioned

to respond quickly

Innovation from within and

without; constant evolution of

business models and shifting

client relationships; first-mover

advantages are slim

© 2011 The Tower Group, Inc.

3

Why is innovation important in financial

services?

The basic financial services product set hasn’t changed in

nearly a century

Customers (and even regulators) are demanding change

Initiatives like SEPA and Dodd-Frank/Durbin place limits on

bank transaction revenue

Parties ranging from alternative payment providers to

wireless companies threaten to disintermediate financial

institutions

© 2011 The Tower Group, Inc.

4

Some guiding thoughts on Innovation

Being first doesn’t mean you’re the smartest

It’s perfectly okay to take someone else’s idea and build on it

Meaningful innovation often happens in small steps

Change is the only constant, so focus is required to sustain

forward momentum

© 2011 The Tower Group, Inc.

5

Service Innovations in Payments

Getting to the segment of one

© 2011 The Tower Group, Inc.

6

Special Needs, Markets, and Hours

Japan(Citibank)

- Branches are open evenings,

Saturdays, or year-round

New Zealand (ASB Bank)

- Virtual branch targeted at

Facebook users

Singapore (DBS)

- Creating a Gen-Y branch

Sweden (Swedbank)

- “Special Senior Hour” from

10-11 daily

© 2011 The Tower Group, Inc.

7

Cards & Services for Women Only

Portugal (Caixa Geral de

Depositos)

- Offering includes credit and

debit cards

South Africa (Standard

Bank)

- Offering includes cash back

on all purchase

Both cards include access to

expanded medical insurance

- Access to life insurance and

discounted medical visits

© 2011 The Tower Group, Inc.

8

Cards & Services for Women Only

© 2011 The Tower Group, Inc.

9

Card-less ATM Withdrawals

Brazil (Banco do Brasil)

South Africa (ABSA)

US* (PayPal)

Singapore** (Confidential)

Offerings have different use

cases ranging from the

mundane (paying the

gardener) to the urgent

(lost/stolen wallet)

Origination paths are

identical: SMS message from

user

* Announced October 12, 2011 ** In development

© 2011 The Tower Group, Inc.

10

New Ways to Meet Existing Needs

Bumping, wallets, and Bitcoins

© 2011 The Tower Group, Inc.

11

Bumping Phones to Make Payments

March 2010 – PayPal

announces “bump” feature

- First for Apple, then for

Android

July 2011 – PayPal

announces NFC support

- Allows any transfer of value –

and information – to and from

any NFC phones

Source: PayPal

© 2011 The Tower Group, Inc.

12

Mobile Wallets – Coming Soon to a Phone

Near You

Offerings abound:

- US (American Express,

Discover, Google, Isis,

MasterCard, Square, Visa)

- UK (O2, Orange, Vodafone)

- Denmark (TDC, Telenor,

TeliaSonera, 3Denmark)

- Singapore (Infocomm

Development Authority, DBS)

Goal is simple – to turn your

phone into a “master key”

for any payment need

Source: Square

© 2011 The Tower Group, Inc.

13

But wait – mobile wallets aren’t just for

payments

CardMobili (Portugal) offers

a mobile wallet for loyalty

and reward cards

Supports all major mobile

operating systems

Catalog includes over 2,000

cards from over 30 countries

Company has won multiple

industry awards

© 2011 The Tower Group, Inc.

14

But wait – mobile wallets aren’t just for

payments

© 2011 The Tower Group, Inc.

15

Virtual Currencies – replacing paper and

coins with bits and bytes

Transactions are often peer

to peer without the use of a

central authority

Relies upon “the network” to

self-police

Concept drives regulators

crazy

- Can’t rely on the network to

stop/filter transactions

- Proponents claim attention is

just a ploy by banks to impede

adoption

© 2011 The Tower Group, Inc.

16

Virtual Currencies – replacing paper and

coins with bits and bytes

© 2011 The Tower Group, Inc.

17

The New Bill Pay: Reverse Remote Deposit

Capture (RDC)

Allows users to take a picture of

any bill and pay it

Can add recurring payee

information or be used for

one-time bills

Uses the same optical character

recognition and image correction

technology as mobile RDC

Currently in pilot, expected to be

commercially available by year

end

Source: Mitek Systems

© 2011 The Tower Group, Inc.

18

Card.io – RDC for cards

Source: card.io website

© 2011 The Tower Group, Inc.

19

Gift Cards: Another Way to Use Points

Pilot began in December 2010

Allows Chase customers to convert

points into closed-loop gift cards

Follows growing bank interest in

creating “gift malls” for mobile

clients

Over 20 participating merchants,

including CVS, Gap, The Home

Depot, Uno

Source: Chase Gift Shelf

© 2011 The Tower Group, Inc.

20

Payments You Can Wear

US Bank MasterCard®

PayPass™ VITAband®

- Contactless payment device

- Emergency contact and

health information

“Wearable” payments

already in use in Europe

- Transit passes and ski lifts are

leading uses

Source: US Bank, VITAband

© 2011 The Tower Group, Inc.

21

Location-based offers and mobile coupons

– right deal, right place, right time

Singapore (McDonald’s) –

application identifies nearest

McDonald’s on a map and

send coupon to mobile

phone

Global (Groupon) –

leverages group-buying to

deliver significant savings to

members

© 2011 The Tower Group, Inc.

22

Sample Groupon offer – Singapore

© 2011 The Tower Group, Inc.

23

Biometrics – authentication based on

something you have

Poland (BPS) – ATMs let

customers use their fingers

rather than bank cards to

identify themselves and

access ATM services

US (iCache) – uses

fingerprint to make payment

and loyalty card data

available on a single plastic

card for a short period of

time

© 2011 The Tower Group, Inc.

24

Leveraging the Entire Smartphone

Phones that can both hear and see have no need for NFC

© 2011 The Tower Group, Inc.

25

QR Codes and Sound Leverage Existing

Smartphone Capabilities

QR (Quick Response) most

often used to drive offers or

provide information

EasyDo (Japan) adds

payment functionality and is

widely used

mFoundry (US) markets an

application used at

Starbucks

eWise payo looking to

expand use at POS

Source: TowerGroup

© 2011 The Tower Group, Inc.

26

QR Codes and Sound Leverage Existing

Smartphone Capabilities (continued)

Sound is being used in

stores and beyond

- Shopkick (US) is used in

stores to push coupons and

offers

- Zoosh (US) can be used

between devices

- PayFair (Belgium) sends

audio file from phone to POS

© 2011 The Tower Group, Inc.

27

Conclusions

Financial services institutions need to innovate to attract and

retain customers

The pace of innovation is fastest in the mobile market where

users, banks, and application developers explore – and

expand – the medium’s capabilities

Gen Y’s demands for mobile capabilities will influence their

choice in banks

Even slight improvements in existing offerings can add

significant value to target markets

© 2011 The Tower Group, Inc.

28

Questions

aschmidt@towergroup.com

© 2011 The Tower Group, Inc.

29