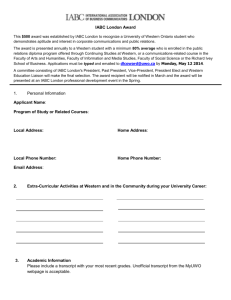

IABC Europe and Middle East Region

advertisement

Credit Crunch Crisis Communications – Beating the bad news bear Rob Briggs Chairman and Regional Director IABC Europe and Middle East Agenda • IABC Europe and Middle East – regional and international member benefits • Cracking the crunch – where did it all go wrong? • Beating the bad news bear – communicating through the crisis 2 International Association of Business Communicators (IABC) • Approx. 16,000 members in 70 countries worldwide • Professional networking association • Offers professional development opportunities and global contacts • Allows you to gain fresh ideas and insights • Leadership development opportunities 3 IABC Europe and Middle East Region • Approx. 700 members • 9 Chapters: – Belgium , France, Ireland, Netherlands, Russia, Scandinavia, Slovenia, Switzerland, United Kingdom, 250+ Members at Large • EME Board: – Represents Region to International Board – Provides leadership development opportunities – Provides regional professional development opportunities 4 IABC offers… • Networking opportunities • Learning and development resources • Job-searching assistance • Professional status and recognition 5 Networking opportunities – Face to Face • Local chapter meetings • Contacts with communicators both internationally and in your community • Opportunity to share specific local information (e.g., about freelancers, suppliers, clients…) (Above, left to right) Rob Briggs, Chairman , IABC Europe and Middle East Region; Aleksander Salkic, Consultant to the Mng Board Chairman, Petrol at IABC’s European Leadership Institute, June 2007, Ljubljana (Right) Rok Klancnik, Manager, Communications, Slovenian Tourist Board, Belgium at IABC’s European Leadership Institute, June 2007, Ljubljana 6 Networking opportunities – The IABC eXchange • Expand your network or share ideas, opinions and best practices online • Create your personalized profile • • Develop your own blog Form private work groups and post documents 7 Marketing opportunities – The IABC Marketplace • An exclusive service connecting consultants with prospective customers • Searchable database of IABC member consultants of all types • • Create a profile that highlights your expertise Find the right communication expert for your project 8 Job searching assistance • • On the IABC web site • Jobs added every day Communication jobs from entry level to senior • • From all over the world Customized search capability 9 Professional stature • Respected professional accreditation (Accredited Business Communicator qualification) • Global awards recognising excellence in communication (Gold Quill) • Demonstrates commitment to your profession • • Grants credibility to the profession (Over 16,000 members worldwide) Puts you in the position to give something back to your profession and your colleagues 10 Who belongs to IABC? People in… • PR • Community relations • Corporate communications • Writing and editing • Public affairs • Training • Investor relations • Video and graphic production • Marketing communications, advertising 11 Cracking the crunch - Where did it all go wrong? 12 How the crisis began •Re-marriage of retail and investment banks •Light touch regulation and short term incentives •Unregulated US mortgage market •Creating money from thin air – CDOs (collaterised debt obligations) •Cutting the CDOs with prime quality debt •Re-packaging and re-selling •Borrowing from wholesale money markets (big chunks of money) How the crisis began •US mortgages start to default •Banks unable to quantify debt •Wholesale credit markets seize up •Banks unwilling to lend to each other •Nasty game of pass the parcel •Big operations dependant on debt for day to day running •Bear Sterns the first to go How the crisis began •Merrill Lynch, Citigroup, Wachovia, Fannie Mae and Freddie Mac, Lehman Brothers, HBOS, Northern Rock, RBS – all heavily exposed to toxic debt •Banks asked to pull both ways – shore up capital reserves and start lending again •With no trust between banks, LIBOR (London Interbank Offered Rate) spread above base rate is very costly •Retail banks unable to access wholesale money on reasonable terms •Lending to both businesses and personal customers dries up The credit crunch explained Banks Lend Less Economy Slows Property Prices Fall Mark-to-Market Reduced Value of Assets Increased Unemployment Increased Defaults Vicious Spiral Cuts in interest rates don’t work! The credit crunch explained Capital Injections Banks Lend Less Economy Slows Property Prices Fall Mark-to-Market Reduced Value of Assets Bad Bank? Tax Cuts Increased Unemployment Increased Defaults Vicious Spiral Cuts in interest rates don’t work! Tricky Balancing Act • The fall in property prices is causing a contraction in credit (i.e. lower velocity of money) • Central Banks are finally filling the hole created by the credit crunch with printed money • But if prices stabilise, velocity might bottom and broad money explode • Bottom line: Central Banks have got a tricky balancing act How the executives reacted •Denial – Dick Fuld, Lehman Brothers •Unshakeable self belief in the face of adversity •Lack of contrition •Executives isolated and out of touch (in general) •Motor company executives on Capitol Hill •‘Hands up who out of you flew here commercial?’ •Some forced out; some fell on their swords •Some got massive payoffs and pensions •Heads I win, tails you lose Beating the bad news bear - Communicating through the crisis The role of the communicator Use and review existing channels • What’s currently in use? – Staff magazine? – Email culture? – Team meetings? • What are the minimum table stakes? • What are the common factors? • Who do you trust? • Where do you get your information from? Engage with the business • Design the journey – – – – – Agree need, value and options Identify key stakeholders Articulate approach Align with existing strategies and activities Obtain executive sponsorship • Business outcomes – Identify the business benefits • Definitions and metrics – Shared vision – Clear approach to measurement – Gap analysis Keep the story straight Your Story Thought-Leading Messages Key Commitments Key Commitment A Key Commitment B Key Commitment C Audience Segmented Messages Audience Key Message Supporting Messages Supporting Proof Points Tone Political Engagement • Power – Who has the influence to get the job done? – How do you influence the people that influence them? – The goodwill reservoir • Perspective – How do you perceive the end result? – How do they perceive the end result? – Outcome = Resources x Time x Money • Personality – Likes / dislikes – Communication style Finding common ground • Power – Do we know what drives the stakeholder regardless of the agenda? – Have we identified and articulated the common ground between our constituency and the stakeholder? – Have we identified genuine mutual benefit or is our case one sided? Excerpt from ‘Power, Perspective, Personality’ pamphlet, copyright 2008 The Company Agency Where’s the vision? • Perspective – Are we saying something the stakeholder won’t know? – Are we saying something new that is interesting, topical and fact based? – Are we telling any specific ‘sticky’ stories to illustrate our perspective? – Are we saying anything the stakeholder will find valuable currency to remember and use? – Are we taking the opportunity to open up a wide and longer term relationship? Excerpt from ‘Power, Perspective, Personality’ pamphlet, copyright 2008 The Company Agency People buy people • Personality – Have we prepared the business leader to not merely be an authoritative but a passionate advocate? – Is there a danger of over-familiarity or assumed friendliness? – Have the sherpas done their long-term, multilateral relationship building to ensure that the personal encounter takes place in the correct climate? – Have we prepared the business leader for open dialogue? Excerpt from ‘Power, Perspective, Personality’ pamphlet, copyright 2008 The Company Agency Selling communication counsel to the CEO Banks: Market Capitalisation 255 Market Value as of January 20th 2009, $Bn Market Value as of Q2 2007, $Bn 120 91 80 76 93 67 75 49 4.6 7.4 RBS Barclays 10.3 Deutsche Bank 16 Morgan Stanley 17 19 26 26 27 Credit Agricole Citigroup Societe Generale Unicredit Credit Suisse 215 165 108 100 116 116 68 32.5 35 35 BNP Paribas Goldman Sachs UBS 43 RBC 64 85 97 Santander JP Morgan HSBC Source: Bloomberg, Jan 20th 2009 These sizes are not directly scalable. This document has, to the extent required, been approved for the purpose of the UK Financial Services and Markets Act 2000 by the Royal Bank of Canada Investment Management (UK) Limited, which is authorised and regulated by the Financial Services Authority.. This document has been carefully prepared based on information that is believed to be accurate at the time of writing and unl ess stated specifically otherwise, is intended for general information only. It is not intended as taxation, legal, investment, banking or other professional advice. This document does not constitute an invitation to buy or the solicitation of an offer to sell securities in any jurisdiction to any person to whom it is unlawful to make such a solicitation in such jurisdiction. RBC, its affiliates and subsidiaries and their officers, directors, employees and agents are not responsible for and will not be liable to you or anyone else for any damages whatsoever (including direct, indirect, incidental, special, consequential, exemplary or punitive damages) arising out of or in connection with your reliance on this document, even if RBC, its affiliates or subsidi aries or their officers, directors, employees or agents have been advised of the possibility of these damages. A list of addresses of local legal entities may be obtained through our website at the following address: Website: www.rbcwminternational.com ®Registered trademark of Royal Bank of Canada. TM Trademark of Royal Bank of Canada. Used under licence. What can a communicator do? • Regularly updated fact sheet • Stress market fundamentals (regulatory system, political stability) • Stress business fundamentals and financial strength • RBC – 10th safest bank in the world (Global Finance) • Canada – world’s soundest banking system (World Economic Forum) What can a communicator do? • Co-ordinate internal and external communications • Use to face-to-face where possible • Leaders should be visible • Don’t cut goodwill (no taxis, no biscuits, no travel) • Invest in strategic communication • Keep close to your clients and your stakeholders Further information Website: http://europe.iabc.com Contacts Rob Briggs Chairman and Regional Director IABC Europe and Middle East Email: robertgray70@hotmail.com Phone: +44 7771 961 055 33