18 th Street and 53 rd Avenue

advertisement

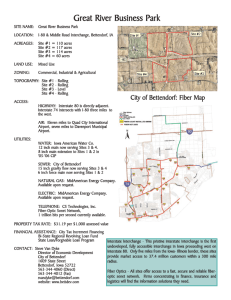

Welcome to the State of the City Address 1 Vision The City of Bettendorf is the PREMIER CITY in which to live! The City of Bettendorf is the most livable community, with rich educational, cultural, and recreational opportunities where we enjoy a vibrant riverfront and a growing, competitive business environment. 2 How We Get There • Community listening sessions/Comp Plan • Citizen Survey with national benchmarks • Bettendorf 101: City Citizen Academy • • Open communication between city government and community Annual goal setting with city council, department heads, and staff 3 Goals • • • • • Financially sound city providing quality city services Orderly growth and quality development Growing current businesses and attracting new businesses Riverfront/Downtown Developmentdestination for entertainment and living Premier Place to live in the Quad Cities 4 Goal 1 Financially Sound City Providing Quality City Services 5 Statement from Moody’s Investors Service Last time City issued bonds The assignment of the City’s Aa2 rating reflects the city’s sound financial operations supported by healthy reserves and significant revenue flexibility. 6 FY 2015/16 Budget Follows the plan established last year and continues our history of: Conservative spending Maintaining healthy cash reserves Strong fiscal planning and adherence to fiscal policies We continue to realize: Stable revenue streams Substantial growth in new single family homes Significant levy capacity available under $8.10 limit and ability to utilize other unused benefit & taxing levies. 7 Budget Highlights - FY 2015/16 Budget: Maintain the City’s Levy Rate at $12.55 • • FY 14/15 Bettendorf is one of a few Iowa cities with a General Fund levy below $8.10. This allows for future growth capacity of 61%, equating to over $5.8 million of potential property taxes. General Fund In addition, the City has the ability to levy taxes for: – – – IPERS & FICA ($1.1 million) Emergency levy of $0.27 if needed. ($515,000) Additional Transit Levy $0.56 ($1.1 million) Additional levying capacity: $8.5 million FY 15/16 $5.44 $5.04 Health Insurance 1.09 1.17 Liability Insurance 0.26 0.25 Police & Fire Pension 0.76 0.70 Transit 0.00 0.39 $5.00 $5.00 $12.55 $12.55 Debt Service Levy Rate 8 Taxes Current Year How We Compare to Other Cities? Iowa cities with populations over 10,000 in order by Taxable Value per Capita Clive West Des Moines Johnston Urbandale Bettendorf (FY 15/16 Levies) Ankeny Carroll Cedar Rapids North Liberty Iowa City Coralville Pella Waukee Davenport Ames Dubuque Council Bluffs Cedar Falls Spencer Altoona Muscatine Waterloo Des Moines Newton Keokuk Storm Lake Sioux City Burlington Ottumwa Fort Madison Average of 30 Cities Census 15,447 56,609 17,278 39,463 33,217 45,582 10,103 126,326 13,374 67,862 18,907 10,352 13,790 99,685 58,965 57,637 62,230 39,260 11,233 14,541 22,886 68,406 203,433 15,254 10,780 10,600 82,684 25,663 25,023 11,051 Taxable Value for FY 14/15 1,164,810,954 4,013,096,804 1,120,382,372 2,389,785,250 1,932,438,257 2,237,520,312 472,766,631 5,867,857,446 617,878,109 3,114,066,554 863,572,760 449,361,898 575,087,827 4,000,636,153 2,353,356,218 2,250,099,910 2,408,630,960 1,497,708,339 420,460,749 536,588,019 798,149,186 2,238,493,876 6,531,043,284 441,575,184 303,793,177 292,789,745 2,272,255,044 673,146,179 606,360,046 252,567,073 1,756,542,611 *Source: Iowa Department of Management - Local Budget Division Taxable Value per Capita 75,407 70,891 64,844 60,558 58,176 49,088 46,795 46,450 46,200 45,888 45,675 43,408 41,703 40,133 39,911 39,039 38,705 38,148 37,431 36,902 34,875 32,724 32,104 28,948 28,181 27,622 27,481 26,230 24,232 22,855 41,687 FY 13/14 Total Levy 9.98809 12.05000 11.15007 9.57000 12.55000 12.02746 12.90456 15.21621 11.03264 16.80522 13.52770 10.15104 13.50000 16.78000 10.85779 11.02586 17.75000 12.02123 11.83087 9.14369 15.67209 17.49319 16.92001 15.14762 15.90039 13.55986 16.24791 15.80427 20.30368 14.88562 13.7272 FY 14/15 Total Levy 9.98952 12.05000 11.34392 9.72000 12.55000 11.90000 11.98377 15.21621 11.03264 16.70520 13.52771 10.20000 13.50000 16.78000 10.85538 11.02588 17.75000 11.81029 11.99322 9.94369 15.67209 17.95159 16.92001 15.80910 17.05339 13.02396 16.36444 15.93632 20.89648 16.29444 13.8600 ↑ ↔ ↑ ↑ ↔ ↓ ↓ ↔ ↔ ↓ ↔ ↑ ↔ ↑ ↓ ↑ ↔ ↓ ↑ ↑ ↔ ↑ ↔ ↑ ↑ ↓ ↑ ↑ ↑ ↑ ↑ FY 14/15 General Fund Levy 7.16982 8.10000 7.57334 7.17000 5.04123 6.89000 8.10000 8.10000 8.10000 8.10000 8.10000 8.10000 8.10000 8.10000 5.83299 8.10000 8.10000 8.10000 8.10000 8.10000 8.10000 8.10000 8.10000 8.10000 8.10000 8.10000 8.10000 8.10000 8.10000 8.10000 7.8026 9 Annual Impact of Taxes & Fee Changes FY 15/16 Budget City’s Portion of Property Tax Sewer Fees $2.48 per unit + $2.25 flat fee/month ($0.20 increase) Residential Small Business Median Value: $173,600 Median Value: $500,000 +$29.05 -$313.75 +$17.60 +$45.60 (22 units/quarter) (57 units/quarter) Storm Water Fees +$4.20 +$51.87 $3.40 per ERU ($0.35 increase) (1.00 ERU/month) (12.35 ERU/month) Solid Waste Fees +$4.92 NA Total Increase of taxes & fees +$55.77 -$216.28 Total Annual Cost of Services $1,607 $13.93 per month (3% increase) (Based on 65 gal. Cart) (+$4.65 per Month) (-$18.02 per month) $6,744 10 Quad Cities Property Tax Comparison For January 1, 2013 Assessed Valuations (taxable in FY 14/15) City, School District, Tax Rate Bettendorf Median Residential Assessed Value of $173,600 Commercial Assessed Value of $500,000 City of Bettendorf, Bettendorf School District, $33.96699 per $1,000 value $3,043 $16,134 City of Davenport, Davenport School District, $40.12151 per $1,000 value $3,594 $19,058 City of Moline, School District #40, Moline Township code #8, $9.2331 per $100 value $4,881 $15,389 City of Rock Island, School District #41, South Rock Island township code #9, $9.9913 per $100 value $5,282 $16,652 11 FY 14/15 Cost of City Services & Utilities Typical $173,600 Residence FY 14/15 Comparison of Property Taxes & User Fees for Typical $173,600 Residence Including City Property Taxes, Solid Waste Fees, Sewer Fees & Storm Water Fees Sample of 33 Iowa Cities with 2010 Census populations of 10,000 or More* 2,227 Des Moines 2,282 2,202 Council Bluffs 2,130 2,081 Burlington Iowa City 2,080 Davenport 2,129 2,074 Sioux City Muscatine 2,066 Waukee 2,098 2,056 Waterloo 1,969 Fort Madison 1,913 Cedar Rapids 1,957 1,909 Newton Indianola 1,897 Storm Lake 1,668 Marion 1,803 1,661 Spencer North Liberty 1,654 Ames 1,738 1,650 West Des Moines 1,692 1,617 Cedar Falls Carroll 1,600 Johnston 1,692 1,599 Pella Dubuque 1,578 Altoona 1,551 1,474 $1,500 1,317 $2,000 1,795 $2,500 Coralville *Assumptions: Bettendorf median home value of $173,600, 65 gallon or comparable garbage cart, sewer usage of 7.33 units per month (733 cu. ft.), and a Storm Water ERU of 1.00. For cities using private solid waste collection, the cost above reflects rates provided by private haulers. --Prepared by Bettendorf finance staff with FY 14/15 tax levies and service fees from city websites and billing departments as of 10/31/14. Ankeny 2,660 $3,000 $0 Storm Water Sewer Solid Waste Property Tax 12 Ottumwa Keokuk Bettendorf Clive Urbandale $500 Mason City $1,000 Goal 2 Orderly Growth and Quality Development 13 18th Street and 53rd Avenue Opening this Summer New strip center with offices & restaurant (Falcon Ave.) Ross’ Restaurant (former Frank’s Pizza) 14 18th Street and 53rd Avenue Ground Breakings this Spring Kwik Trip Gas Station (between Ascentra & McDonalds) 6,000 sq ft auto center & multi tenant facility (18th St. & 53rd Ave.) *as seen below University of Iowa Credit Union (west of McDonalds) 15 18th Street and 53rd Avenue Medical Facilities (53rd Ave.) ORA (2014 assessment $16 million) Genesis Health Plex (2014 assessment $1.9 million) Center for Digestive Health (2014 assessment $4.3 million) *Assessments are approximate totals 16 Premiering Bettendorf A Comprehensive Plan Project is guided by a project team that includes a steering committee of Bettendorf residents, city officials, and community planning consultants from RDG Planning & Design and economists from Gruen Gruen + Associates. 17 Premiering Bettendorf 20 Years into the Future Primary Goals •A Shared Vision of the Future Provides an opportunity for residents to create a shared vision for their community. •Guidance for Decision Makers Serves as a guide for City Council, staff, and other City boards/commissions, as they set policy, make public investments, and deliberate land use decisions. •Legal Basis for Land Use Regulation Provides a legal basis for land use regulations. 18 Forest Grove Drive Paving Project $9.8M over 3 fiscal years ($7.45M Federal Funded) Includes three lanes & recreation trail from Utica Ridge Road to International Drive. Tanglefoot Lane Forest Grove Drive project similar to Tanglefoot Lane project, which was completed in 2014. Tanglefoot Lane 19 Community Improvement Program 2015 Construction Season: $13 million Forest Grove Dr Paving – 3 lanes, recreation trail total project from Utica Ridge to International (completed over two construction seasons) Hopewell Ave Paving – Complete paving to east line Century Heights 18th Addition Downtown Improvements, land acquisition, Façade program and I-74 relocation program Forest Grove Park Development Recreation Trails along Crow Creek Various improvement projects throughout the City Various Sewer and Storm Water improvement projects 20 Goal 3 Growing Current Businesses and Attracting New Businesses 21 Building Permit History Summary of Building Permits Issued by the City of Bettendorf Calendar Year All Permits Number Value 2014 3,531 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 3,500 3,416 3,294 2,951 2,700 3,095 3,420 3,680 3,717 3,397 3,247 2,980 3,392 3,487 3,740 $91,101,891 (a) New Single-Family Attached & Detached Homes Number Value 175 $67,250,930 168 145 108 115 77 96 134 154 194 146 120 85 144 143 158 $41,651,686 $36,595,105 $34,107,943 $28,361,980 $21,057,198 $24,200,996 $37,831,573 $34,873,928 $41,928,319 $30,265,151 $25,087,080 $19,495,481 $26,184,082 $24,158,546 $26,947,091 $64,197,951 $69,120,944 $81,802,346 $58,148,406 $58,504,974 $43,946,075 $78,686,737 $100,236,047 $66,134,674 $68,651,169 $57,729,471 $71,998,617 $40,678,917 $45,339,525 $44,998,573 (a) Taxes on value of permits issued in 2014 w ill be collectible in FY 16/17. 22 Duck Creek Plaza Area Duck Creek Plaza (south) was valued at $4 million prior to redevelopment. Now complete with city assistance, value should reach $12 million. HomeRidge Inn and Suites was valued at $2.3 million before it was demolished in 2014. In its place a new Hilton Garden Inn was constructed at a cost of $9.25 million. New hotel opens this spring. Also completed in 2014: Big 10 Mart $2 million. Starbucks $194,000.00 Strip mall containing Jimmy Johns ($179,900.00), Salon Aria ($118,000.00), AT&T ($73,780.00), First State Bank 23 ($170,000.00) Learning Campus In 2014, the Family Museum completed its first major renovation since the original construction in 1998. Cost $1.3 million. Attendance prior to renovation was approximately 105,000 per year. Attendance now is approximately 166,000 per year. Also in 2014, the Library completed its renovations, which included reconfiguration of public computer space, additional service desks, and expanding recreational reading area that includes a gas fireplace. Cost $1.5 million. 24 Utica Ridge Corridor •New Rock Island Arsenal Credit Union •Utica Ridge Road paved this year, five lane facility •The Lodge expected to be converted into a Hilton Double Tree Hotel 25 Other Development •Downtown and I-80/Middle Road are two top priorities for growth. •Working with a private developer on the construction of a industrial spec building measuring 60,000 (+) square feet. •First subdivision supplied with FTTH (fiber to the home) in Beaver Meadows Development on 53rd Avenue. •175 new home construction. Expect the same next year. 26 Goal 4 Riverfront and Downtown Development Destination for Entertainment and Living 27 I-74 Bridge and Corridor Project 2013 IDOT purchased 44 properties, additional partial acquisitions and construction easement only acquisitions were also purchased 2015/16 Utilities are being relocated including sewer, storm water, sanitary, fiber optic, and phone State Street, Grant Street, and Kimberly Road will be reconfigured 2017/18 Physical construction of middle section of the span 2020/21 Completion of the bridge 28 29 New I-74 Bridge 30 New I-74 Bridge 31 Downtown Streetscape Master Plan 32 Targets for Action Top Priority – Unified Downtown Vision & Plan – Bettendorf 2023/Comprehensive Economic Development Plan & Implementation Strategy – I-80 Business Park: Development – Twin Bridges: Direction/Actions – Riverfront Property Acquisition, Direction, City Role, Next Steps – Comprehensive Plan: Adoption High Priority – Annexation Strategy: Policy Direction, Actions – State Street Gas Station(s): Removal & Entrance Beautification – Technology Business Attraction Strategy – Youth Sports Complex: (Indoor/Outdoor Facility) – City Events & Festivals – Main Street Program: Direction – Residential Development Project in Downtown/Riverfront 33 Goal 5 Premier Place to Live in the Quad Cities 34 Premier Place to Live Color Run Veterans’ Day Ceremony 4th of July Parade Mayor’s Easter Egg Hunt 35 Premier Place to Live Library’s Renovation PV High School Girls Track Team State Champions Tree Planting Comp Plan Open House36 Premier Place to Live Dekhockey Crow Creek Dog Park Bettendorf Park Band Bettendorf 101: CCA 37 Awards and Achievements • 2014 Bettendorf Receives Certificate of Distinction in Performance Measurement from International City/County Management Association • 2014 Bettendorf Receives Honorable Mention as Bicycle Friendly Community from League of American Bicyclists • 2015 Bettendorf Named One of the Safest Cities in Iowa from Movoto Real Estate. •2015 Bettendorf Among the Best Small Cities in the Nation for Families from NerdWallet •2015 Bettendorf Tree City USA from The National Arbor Day Foundation. 38 Questions and Answers 39