FY 2013/14 Budget Highlights

advertisement

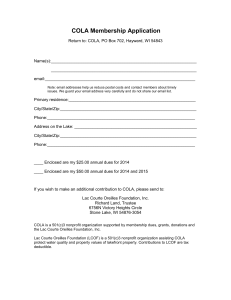

Fiscal Year 2013/14 Budget Highlights Public Information Meeting 2/25/13 $ 86.9 million 1 “Stays the course” and “follows the financial plan” we established several years ago and continues our history of: Maintaining healthy cash reserves Significant levy growth available under $8.10 and ability to implement benefit levies. Conservative spending Stable revenue streams Strong fiscal planning and adherence to fiscal policies 2 1) Continuing our conservative spending: All major City funds are balanced. Most operating budgets continue to be frozen, but adequately fund City services. We recommend an especially conservative approach in anticipation of the proposed commercial property tax rollback and capping of future growth of property tax revenue across all property classes. 3 2) Funding Aggressive CIP Program previously discussed: Supports our growing community’s infrastructure needs (New and existing Roads, Storm water improvements, Sewer expansion) Maintains and enhances our City’s Cultural and Recreation amenities (FMAS, Library, Parks, Recreation Trails, Golf improvements etc.) Impact: Maintains Debt Levy Rate at $5.00 per $1,000 assessed taxable valuation The proposed Debt Margin Ratio is approximately 76% for FY 13/14 4 3) Lastly, continuing our practice of “raising revenues incrementally” as planned during the last several years: User Fees: Recommend planned incremental increases in several Enterprise Funds’ user fees: 3% Garbage, $0.20 Sewer, $0.35 Storm water . The increased user fees will continue to allow those operations to be self-sufficient and are primarily project driven. Property Taxes: We recommend MAINTAINING the current levy rate at $12.55 Despite no increase, changes in assessed values and the state rollback formula will increase the property tax bill on a median $162,235 home by 4.3% or $42.04. Commercial properties will not see a property tax increase unless their values have increased. Maintaining the levy rate will allow the City to benefit from $890,241 of additional taxes needed to support current City operations. (45% from new construction) Bettendorf continues to realize Excellent Growth in our tax base which allows greater flexibility for budget priorities. Gross values increased $51.2M. 5 Where the money comes from FY 13/14 Net of transfers & Internal Service Funds Source Property taxes TIF revenues Other city taxes Licenses & permits Use of money Intergovernmental Charges for services Special assessments Miscellaneous Bond proceeds Other financing sources Total net of transfers Transfers in Internal Service Funds Total Budget $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ FY 12/13 22,107,379 2,105,610 8,164,850 737,310 536,324 5,893,991 11,068,606 22,667 2,098,624 10,750,000 1,432,786 64,918,147 8,369,301 6,780,934 80,068,382 Miscellaneous 3.27% Special assessments 0.03% $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ FY 13/14 22,997,618 2,078,304 8,370,792 684,310 520,419 5,478,289 11,554,221 18,167 2,126,551 10,520,000 731,000 65,079,671 8,320,940 7,339,386 80,739,997 Percent change 4.03% -1.30% 2.52% -7.19% -2.97% -7.05% 4.39% -19.85% 1.33% -2.14% -48.98% 0.25% -0.58% 0.00% 0.84% Other financing sources 1.12% Bond proceeds 16.16% Charges for services 17.75% Use of money 0.80% Licenses & permits 1.05% Intergovernmental 8.42% Property taxes 31% Other city taxes 12.86% TIF revenues 3.19% 6 Where the money goes FY 13/14 Net of transfers & Internal Service Funds Category Public Safety Public Works Debt Service Culture & Recreation Community & Economic Development General Government Capital Projects Business Type/Enterprises Total net of transfers & Internal Service Funds Transfers out Internal Service Funds Total Budget FY 12/13 10,133,198 3,275,404 13,956,647 4,224,632 2,267,377 3,752,552 16,639,268 17,595,063 71,844,141 8,369,301 6,796,178 87,009,620 FY 13/14 10,768,394 3,271,250 12,619,977 4,424,778 1,829,431 3,787,301 16,523,119 17,982,506 71,206,756 8,320,940 7,372,252 86,899,948 Percent change 6.27% -0.13% -9.58% 4.74% -19.32% 0.93% -0.70% 2.20% -0.89% -0.58% 8.48% -0.13% General Government 5.32% Community & Culture & Recreation Economic 6.21% Development 2.57% Capital Projects 23.20% Debt Service 17.72% Public Works 4.59% Public Safety 15.12% Business Type 32.82% 7 1) Maintain the City’s Levy Rate at $12.55 Bettendorf is one of a few Iowa cities with a General Fund levy below $8.10. This allows a 7% growth equating to $989,608 of potential property taxes. Bettendorf also has capacity within the “amount necessary” levies, which if implemented equates to another $4.7 million in taxes. • Police & Fire Retirement • FICA & IPERS • Other Employee Benefits (Health Insurance) • Liability Insurance FY 12/13 General Fund FY 13/14 $7.55 $7.55 Health Insurance 0 0 Liability Insurance 0 0 Police & Fire Pension 0 0 Debt Service $5.00 $5.00 $12.55 $12.55 Levy Rate 8 Residential (Rollback increased to 52.8%) Impact $100,000 Assessed Value +$25.91 ($2.16 per month) $162,235 Assessed Value (Median) +$42.04 ($3.50 per month) $250,000 Assessed Value +$64.78 ($5.40 per month) Commercial (Rollback remains 100%) Any Assessed Value Impact $0.00 (-$0.00 per month) Despite maintaining the levy rate, taxes on residential property will increase due to: 4.07% increase in the state mandated rollback on residential property (50.76% to 52.82%) 9 Taxes Current Year How We Compare to Other Cities? In order by Levy Rate of all Iowa cities with populations over 20,000, plus Clive Urbandale Clive Ames Dubuque Ankeny West Des Moines Cedar Falls Bettendorf Mason City Marion Marshalltown Burlington Cedar Rapids Clinton Muscatine Sioux City Davenport Des Moines Iowa City Council Bluffs Waterloo Fort Dodge Ottumwa Average of 23 Cities Census 39,463 15,447 58,965 57,637 45,582 56,609 39,260 33,217 28,079 34,768 27,552 25,663 126,326 26,885 22,886 82,684 99,685 203,433 67,862 62,230 68,406 25,206 25,023 55,342 *Source: Iowa Department of Management - Local Budget Division Taxable Value for FY 12/13 $ 2,257,642,565 $ 1,130,282,183 $ 2,239,846,934 $ 2,108,760,803 $ 2,077,447,740 $ 3,760,753,897 $ 1,401,199,407 $ 1,788,749,827 $ 1,008,218,704 $ 1,227,370,278 $ 775,799,102 $ 656,332,652 $ 5,687,145,890 $ 943,456,170 $ 781,443,576 $ 2,318,091,866 $ 3,947,966,201 $ 6,440,220,679 $ 2,946,951,863 $ 2,349,585,815 $ 2,290,335,896 $ 624,130,482 $ 622,356,319 $ 2,147,134,298 Taxable Value per Capita $ 57,209 $ 73,172 $ 37,986 $ 36,587 $ 45,576 $ 66,434 $ 35,690 $ 53,850 $ 35,907 $ 35,302 $ 28,158 $ 25,575 $ 45,020 $ 35,092 $ 34,145 $ 28,036 $ 39,604 $ 31,658 $ 43,426 $ 37,756 $ 33,482 $ 24,761 $ 24,871 $ 39,535 FY 12/13 Total Levy $ 9.62 $ 9.99 $ 10.72 $ 10.78 $ 12.03 $ 12.05 $ 12.20 $ 12.55 $ 13.55 $ 13.62 $ 14.28 $ 15.06 $ 15.22 $ 15.33 $ 15.67 $ 15.99 $ 16.78 $ 16.92 $ 17.27 $ 17.85 $ 18.21 $ 19.93 $ 20.34 $ 14.61 FY 12/13 General Fund Levy $ 7.17 $ 7.17 $ 5.83 $ 8.10 $ 7.03 $ 8.10 $ 8.10 $ 7.55 $ 8.10 $ 8.10 $ 8.10 $ 8.10 $ 8.10 $ 8.10 $ 8.10 $ 8.10 $ 8.10 $ 8.10 $ 8.10 $ 8.10 $ 8.10 $ 8.10 $ 8.10 $ 7.85 10 FY 2013/14 Budget Highlights 2. Provides funding for most existing City services: Maintains stable operating budgets. Largest increases resulting from Employee Health Insurance, Risk Management, Police & Fire pension, IPERS and fuel related costs. Continues close monitoring of over-time Funds Road Salt budget and liquid application program at $500,000 Funds a program to begin Emerald Ash Borer treatment on city properties. Funds wage increases for all union and non-union employees Transfer of the administration of the Section 8 program Reduction/Elimination of the Transit Loop service (Federal grant ends 6/30/13) 11 The FY 13/14 budget addresses six major issues that increased expenditures or reduced revenue. General Fund Other Funds Total Citywide Risk Management 12,888 80,369 93,257 Health Benefit 210,150 234,579 444,729 MFPRSI (26.12% to 30.12%) 211,735 0 211,735 IPERS (8.67% to 8.93%) 15,904 9,871 25,775 Wage Increases (Union Contracts, COLA, Deferred, Merit, Steps & Contracted Employees) 320,058 70,973 391,031 Major Budget Issues Condo & Coop Reclassification TOTAL 112,039 $770,735 $395,792 $1,278,566 12 Funds final year of four year contracts with all of our bargaining units Bargaining Unit FY 10/11 FY 11/12 FY 12/13 FY 13/14 Fire 0% COLA 2% Deferred 1.50% COLA 7/1/11 1.50% Deferred 1/1/12 2.75% COLA 2.90% COLA (plus 1% if pension is <35.32%) Police 2% COLA 2.35% COLA .50% Deferred 3% COLA .25% Deferred 2.75% COLA .75% Deferred AFSCME General 2% COLA 3% COLA 3.25% COLA 3.50% COLA AFSCME Library 2% COLA 3% COLA 3.25% COLA 3.50% COLA Non-Union Employees 2% COLA 3% COLA 3.25% COLA 3.50% COLA 13 Revenue source: FY 09/10 Actual FY 10/11 Actual FY 11/12 Actual FY 12/13 Estimate FY 13/14 Budget Property taxes 19,267,371 19,829,519 20,786,732 22,107,379 22,997,618 Charges for Services 14,460,857 15,468,962 16,525,874 17,760,533 18,808,207 Local Option Sales Tax 4,123,192 4,379,062 4,584,685 4,636,467 4,821,925 Road Use Tax 2,724,484 2,981,875 3,124,925 3,209,000 3,290,000 Gaming 1,684,304 1,658,400 1,608,845 1,600,000 1,624,000 Interest Earnings 935,570 583,842 604,865 576,924 559,819 Hotel/Motel Tax 781,543 803,119 738,376 805,000 805,000 Building Permits 547,500 503,290 558,417 631,000 578,000 Utility Tax 755,748 707,752 748,281 741,083 737,567 Cable Franchise 374,172 379,885 374,108 375,000 375,000 Total Major Revenues 49,043,048 50,695,706 53,055,108 55,842,386 57,997,136 Total All Revenues Net of Bond Proceeds, Other Financing Sources and Intergovernmental 51,498,057 52,901,996 54,149,370 56,824,169 58,824,145 10 Major Revenues as a % of All Revenues 95.23% 95.83% 97.98% 98.27% 98.59% 14 Year 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 Number 3,416 3,294 2,951 2,700 3,095 3,420 3,680 3,717 3,397 3,247 2,980 3,392 3,487 3,740 Value $69,120,944 $81,802,346 $58,148,406 $58,504,974 $43,946,075 $78,686,737 $100,236,047 $66,134,674 $68,651,169 $57,729,471 $71,998,617 $40,678,917 $45,339,525 $44,998,573 (a)(b) Number 145 108 115 77 96 134 154 194 146 120 85 144 143 158 Value $36,595,105 $34,107,943 $28,361,980 $21,057,198 $24,200,996 $37,831,573 $34,873,928 $41,928,319 $30,265,151 $25,087,080 $19,495,481 $26,184,082 $24,158,546 $26,947,091 (a) Commercial permits in 2012 included: DHCU Credit Union, 3230 Ridge Pointe; Office addition, 3275-3289 Utica Ridge Rd.; Plantation Development, 872-884 Tanglefoot Ln.; Ascentra Credit Union, 2339 53rd Ave; Charles A Ruhl/Russell Construction, 3252-3264 Ridge Pointe. (b) Taxes on value of permits issued in 2012 w ill be collectible in FY 14/15. 15 Fund General % of expenditures Road Use % of expenditures FY 09/10 Actual 5,267,035 26.09% 365,996 10.87% FY 10/11 Actual 5,358,631 26.49% 382,553 FY 11/12 Actual 5,514,282 26.72% 575,172 FY 12/13 Projected 5,514,282 24.59% 588,678 10.57% 17.67% 18.14% FY 13/14 Projected 5,514,282 23.94% 643,573 19.80% Gaming 681,544 85,692 98,214 57,476 121,108 Sales Tax 638,608 923,114 506,598 351,573 201,345 Vehicle 726,276 885,395 731,604 806,402 901,656 Electronic Equipment 769,568 675,351 502,844 415,604 381,559 Health Insurance 987,458 948,792 984,971 984,971 984,971 Risk Management 627,788 630,737 647,205 663,890 663,890 16 5) Health Insurance – Recommend renewal with Wellmark with 11% increase in “total projected maximum costs” vs. 7.5-10% national History of health claims: 8 year average increase 9.68% (National average 7.5-10%) Maintain Specific Stop Loss at $70K Ample cash reserves in excess of $1 million are available to fund claims up to maximum aggregate attachment point (125% of expected claims) Health Committee continues to meet regularly to monitor our existing health care plan 17 6) Liability Insurance – Total Liability Insurance up $93,257 or 13.56%. Workers Compensation Fees up: $80,887 or 19.92% Mod rate 1.05 due to Actual Losses exceeding Expected losses in one of the last three years with a “good” year dropping off Striving to manage our Work Comp insurance costs although….. Continue to have increased wages Average 10% State of Iowa published rate increases on various job classifications expected. 18 $1.565 million allocated to supplement operating budgets for: Enterprise Funds - $1,094,750 up $51,602 from $1,043,148 current year Economic Development - $215,618 Downtown Improvements - $100,000 General Fund – City Beautification $95,000, July 4th $30,000 & Emerald Ash Borer treatment $30,000 If not for Gaming Revenue, user fees would be significantly higher or property taxes would be needed to supplement budgets. 19 $1.5 million 18th St. Maplecrest to Echodale, Spruce Hills to Tech Dr., Avalon to Spruce Hills $1.3 million 3rd phase of Tanglefoot, Greenbrier to Utica Ridge 3 lanes, separated trail $1 million 1st phase of Hopewell Ave paving, Middle to east line of Century Heights to 18th addition $500,000 Utica Ridge Road: Spruce Hills to Tanglefoot Lane – 5 Lane $1.57 million Various separated trails: Middle Rd. from Devils Glen to Duck Creek; Devils Glen Rd. from Middle Rd. to Crow Creek Park $750,000 Sealcoat Reconstruction Program – Including 26th St. $1.1 million Forest Grove Rd. paving – 3 lanes, rec trail $510,000 Street Resurfacing Program $1.12 million Street Reconstruction Program $190,000 Bridge Maintenance Program $555,000 Sidewalk Program $370,000 Various Community & Economic Development projects 20 $700,000 Forest Grove Park Development $625,000 Full Depth Patching Program $300,000 Recreation Trails along Crow Creek from Devils Glen to Field Sike $260,000 Annual funding for Parks projects $267,000 Various Traffic projects $635,000 Alley Rehabilitation Program $250,000 I-80 water main extension $275,000 Miscellaneous Public Works projects $150,000 Rural Road Sealcoating Program $850,000 Downtown Improvements, Façade program and I-74 relocation program $515,000 Various city-wide projects including Library space remodel $100,000 Pavement Preservation Program $25,000 Curb & Gutter Replacement Program $15,000 Pavement Management Program 21 Community Improvement Program continued Enterprise Fund Projects: $130,800 Palmer Hills Golf Course Tee box & sand trap Improvements $20,000 Family Museum LED Lighting Replacement in Great Hall $20,800 Life Fitness Center Tennis court resurfacing and gym floor repair $90,000 22 FY 13/14 Budget funds $1,208,323 of new/replacement vehicles $147,000 Police: 4 detective vehicles, 1 crime scene van $32,000 Community Development: Pick-up with utility box $409,246 Public Works: 2 ¾ ton pick-ups, 2 1-ton pick-ups, 2 single axle dump trucks $115,000 Parks: Utility Cart, 10’ mower, zero turn mower $370,077 Storm Water: Sewer Vaccon, ¾ ton pick-up $135,000 Solid Waste: Rear load garbage packer Funds $147,600 of new/replacement electronic equipment Funds $278,000 of new/replacement capital equipment ($140,000 at QCWCC) 23 Continue to adjust user fees, when appropriate, to offset increases in the cost of programs. Solid Waste 3% effective 4/1/13 Storm Water $0.35 per ERU/mo effective 4/1/13 Sewer $0.20 per 100 cubic feet of flow effective 4/1/13 LFC Personal training fees increased 1/1/13 (PB Resolution 61-12) Palmer Hills G.C. $1 increase to 18 hole rounds, junior rounds, 18 hole carts, small range baskets, junior senior range baskets & introduction of season passes (PB Resolution 53-12) Splash Landing Introduction of $25 concession area rental fee (PB Resolution 62-12) Recreation $10 increase to adult softball teams & youth flag football, $5 increase to sports & games camp, $2.50 increase to Tot Lot (PB Resolution 57-12) Family Museum No fee increase. Fee structures will be examined in January, 2014. Transit No fee increase. 24 City of Bettendorf FY 2013/14 Budget Review Garbage Fees Size Current Monthly Fee Annualized Monthly fee beginning 4/1/2013 Monthly Increase Annualized Annual Increase 3.00% Percentage increase Monthly fee Monthly fee Monthly fee Monthly fee Monthly fee beginning beginning beginning beginning beginning 4/01/2014 4/01/2015 4/01/2016(1) 4/01/2017 4/01/2018 3.00% 3.00% 4.00% 4.00% 4.00% 32 gallon/twice per mo 6.39 76.68 6.58 0.19 78.96 2.28 6.78 6.98 7.26 7.55 7.85 32 gallon 9.57 114.84 9.86 0.29 118.32 3.48 10.16 10.46 10.88 11.31 11.77 65 gallon 12.75 153.00 13.13 0.38 157.56 4.56 13.52 13.93 14.49 15.07 15.67 95 gallon 15.94 191.28 16.42 0.48 197.04 5.76 16.91 17.42 18.12 18.84 19.60 Continue 3% increases each April 1 to balance revenues and expenditures – BREAKEVEN With the implementation of single stream recycling carts and trucks, 4% increases may be needed beginning 4/1/16. 25 City of Bettendorf FY 2013/14 Budget Review Storm Water Fees Rates beginning 4/1/2013 Current Rates Increase Beginning 4/01/2014 0.35 Rate Increase Beginning 4/01/2015 Beginning 4/01/2016 Beginning 4/01/2017 Beginning 4/01/2018 0.35 0.35 0.35 0.11 0.12 Rate per ERU 2.35 2.70 0.35 3.05 3.40 3.75 3.86 3.98 Monthly Cost per Average ERU of 1.25 2.94 3.38 0.44 3.81 4.25 4.69 4.83 4.98 35.25 40.50 5.28 45.75 51.00 56.25 57.90 59.70 Annual Cost per Average ERU of 1.25 Note: Fee increases are primarily project driven. See CIP for details. Storm Water Rates with Planned Increases Previous Rate $0.35 $0.35 Increase $0.35 $0.50 $1.50 FY 07/08 $0.35 $2.00 $2.00 $2.00 $2.00 $2.35 $2.70 $3.05 FY 08/09 FY 09/10 FY 10/11 FY 11/12 FY 12/13 FY 13/14 FY 14/15 3% $0.11 3% $0.12 $0.35 $3.40 $3.75 $3.86 FY 15/16 FY 16/17 FY 17/18 Fee increases are primarily project driven. See CIP for details. 26 $1.3 million Stafford Creek Bank Stabilization 18th to Crow Creek Rd., Tanglefoot – Maplecrest $300,000 Middle Rd. – Stafford Creek Culvert $1.3 million Small storm sewers, sewer linings, intake repair $490,000 Hopewell Creek detention at school $400,000 Blackbird Creek bank stabilization $435,000 Duck Creek stabilization, various phases $730,000 Greenway Creek stabilization, Terrace Park Dr. to Golden Valley Dr. $300,000 West Pigeon Creek bank stabilization $720,000 Pigeon Creek bank stabilization – 53rd to Crow Creek $549,000 Small storm water projects 27 City of Bettendorf FY 2013/14 Budget Review Sewer Fees Current Rates Rates Beginning 4/1/2013 Increase Beginning 4/01/2014 0.20 Rate Increase 0.20 0.20 0.09 0.08 0.20 2.28 2.48 2.68 2.76 2.84 13.78 15.25 1.47 16.71 18.18 19.64 20.23 20.82 165.36 182.96 17.64 200.55 218.14 235.73 242.77 249.81 Increase $.20 $0.20 $1.68 $1.68 $1.68 FY 07/08 FY FY FY 08/09 09/10 10/11 Beginning 4/01/2018 2.08 Previous Rate $1.48 Beginning 4/01/2017 0.20 Sewer Rates with Planned Increases $0.20 Beginning 4/01/2016 1.88 Rate per 100 cu.ft. Monthly Cost of Average Usage (7.33 cu.ft. per month) Annual Cost of Average Usage Beginning 4/01/2015 $1.68 $0.20 $1.88 $0.20 $2.08 3% 3% $0.20 $2.28 $2.48 $2.68 $2.76 Fee increases are primarily project driven. See CIP for details. FY FY FY FY FY FY FY 11/12 12/13 13/14 14/15 15/16 16/17 17/18 28 $3.5 million I-80 interceptor sewer from Forest Grove to Indiana, lift station & pumps $250,000 Infiltration & Inflow analysis and city-wide improvements $535,000 Chimney seals, manhole rehab, sewer televising, pipe lining, etc. $5.16 million Joint sewer improvements •$300,000: Debt service estimate on joint sanitary sewer improvements with Davenport. 29 Residential Small Business Median Value: $162,235 Median Value: $253,510 City’s Portion of Property Tax +$42.04 No Change Sewer Fees +$17.64 +$45.60 $2.08 per unit ($0.20 increase) Storm Water Fees $2.70 per ERU ($0.35 increase) Solid Waste Fees (22 units/quarter) +$4.20 (57 units/quarter) +$51.87 (1.00 ERU) (12.35 ERU) +$4.56 NA Total Increase +$68.44 +$97.47 Total Annual Cost of Services $1,411 $13.13 per month (3% increase) (Based on 65 gal. Cart) (+$5.79 per Month) (+$8.12 per month) $4,056 30 FY 12/13 Cost of City Services & Utilities for Typical $162,235 Residence $2,500 2,333 Including City Property Taxes, Solid Waste Fees, Sewer Fees & Storm Water Fees for a sample of 30 Iowa Cities with 2010 Census populations of 10,000 or More* 1,843 1,848 1,871 Muscatine Waukee Ankeny 2,045 1,971 1,826 Waterloo Council Bluffs 1,790 Davenport 1,961 1,789 1,697 Burlington Sioux City 1,685 1,628 Newton 1,654 1,599 Coralville Cedar Falls 1,566 Ames Storm Lake 1,458 Spencer 1,557 1,428 Johnston 1,506 1,422 Pella Fort Madison 1,400 Altoona 1,504 1,390 Dubuque West Des Moines 1,344 1,474 1,342 1,295 Clive Bettendorf 1,290 $1,500 Urbandale Property Tax Cedar Rapids Solid Waste $2,000 1,935 Sewer Iowa City Storm Water Ottumwa Des Moines Keokuk North Liberty $500 Carroll $1,000 $0 *Assumptions: Bettendorf median home value of $162,235, 65 gallon or comparable garbage cart, sewer usage of 7.33 units per month (733 cu. ft.), and a Storm Water ERU of 1.00. For cities using private solid waste collection, the cost above reflects rates provided by Waste Management of Iowa. --Prepared by Bettendorf finance staff with FY 12/13 tax levies and service fees from city websites and billing departments as of 10/24/2012. 31 A budget that maintains the current levy rate at $12.55. Despite this, homeowners will see a slight increase in the City portion of their tax bills in FY 2013/14 due to the increase in the rollback. Commercial property owners will not see a change in the City portion of their tax bills unless their assessed value has changed. 32 Quote from Moody’s Investors Service April 2012 – “The assignment of the City’s Aa1 rating reflects the city’s sound financial operations supported by solid reserves and significant revenue flexibility. City finances are expected to remain healthy due to the existence of solid cash reserves, management’s adherence to a formal General Fund balance policy, and significant operating margin within the tax rate limit. Financial operations have consistently remained sound as the city’s General Fund has posted annual surpluses over the past ten years.” 33 Questions and Answers 34