Here the marginal costs are increasing.

advertisement

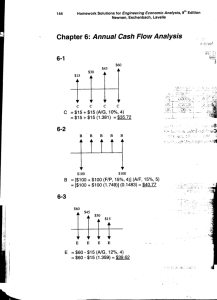

Matakuliah Tahun : D0762 – Ekonomi Teknik : 2009 Replacement Analysis Course Outline 10 Replacement Analysis • When should a new truck replace the existing truck? • When should a process be redesigned? • When should a product be redesigned? The most common question asked in industry is: when should the existing be replaced? Engineering Economic Analysis - Ninth Edition Newnan/Eschenbach/Lavelle Copyright 2004 by Oxford University Press, Inc. 2 Replacement Analysis Terms • Defender: the existing equipment, building, or decision previously implemented • Challenger: the proposed replacement currently under consideration Engineering Economic Analysis - Ninth Edition Newnan/Eschenbach/Lavelle Copyright 2004 by Oxford University Press, Inc. 3 Aspects of Replacement Analysis 1. Using available data to determine the analysis technique 2. Determining the base comparison between alternatives 3. Using analysis techniques when: 1.Defender marginal cost can be computed and is increasing 2.Defender marginal cost can be computed and is not increasing 3.Defender marginal cost is not available 4. Considering possible future challengers 4 5. After-tax analysis Engineering Economic Analysis - Ninth Edition Newnan/Eschenbach/Lavelle Copyright 2004 by Oxford University Press, Inc. The Replacement Problem • Engineers replace the existing due to: – Obsolescence: technological change – Depletion: loss of market value – Deterioration: wear that is overly expensive to repair Shall the defender be replaced now or be maintained for one or more periods? Engineering Economic Analysis - Ninth Edition Newnan/Eschenbach/Lavelle Copyright 2004 by Oxford University Press, Inc. 5 Issues (Consider Before Starting) – If a unit fails, must it be removed permanently from service, or repaired? – Are standby units available if the system fails? – Do components or units fail independently of the failure of other components? – Is there a budget constraint? – If the unit can be repaired after failure, is there a constraint on the capacity of the repair facility? Engineering Economic Analysis - Ninth Edition Newnan/Eschenbach/Lavelle Copyright 2004 by Oxford University Press, Inc. 6 Issues (Continued) – Is only one replacement allowed over the planning horizon? Are subsequent replacements allowed at any time during the study period? – Is there more than one replacement unit (price and quality combination) available at a given point in time? – Do future replacement units differ over time? Are technological improvements considered? – Is preventative maintenance included in the model? Engineering Economic Analysis - Ninth Edition Newnan/Eschenbach/Lavelle Copyright 2004 by Oxford University Press, Inc. 7 Issues (Continued) – Are periodic operating and maintenance costs constant or variable over time? – Is the planning horizon finite or infinite? – Are consequences other than economic effects considered? (i.e., sociotechnical issues) – Are income tax consequences considered? – Is “inflation” considered? – Does replacement occur simultaneously with retirement, or are there non-zero lead times? – Are cash flow estimates deterministic or stochastic? Engineering Economic Analysis - Ninth Edition Newnan/Eschenbach/Lavelle Copyright 2004 by Oxford University Press, Inc. 8 Replacement Analysis Decision Chart Where Compare Defender Marginal Defender Marginal Defender Best 1 Available Increasing Next-year EUAC at Cost Life 2 Available Not increasing EUAC at Life EUAC at Cost Life 3 Not available EUAC over Useful Life EUAC at Cost Life Engineering Economic Analysis - Ninth Edition Newnan/Eschenbach/Lavelle Copyright 2004 by Oxford University Press, Inc. 9 What Is the Basic Comparison? • Identify the defender and the best challenger – Product – Machine – Process – Personnel – Mix Decision Criteria leads to one of the following: If the defender is more economical, it should be retained. If the challenger is more economical, it should be installed. Engineering Economic Analysis - Ninth Edition Newnan/Eschenbach/Lavelle Copyright 2004 by Oxford University Press, Inc. 10 Example 12-1 Minimum Cost Life of the Challenger •EUAC Equivalent Uniform Annual Cost Year EUAC of Capital Recovery Costs EUAC of Maintenance and Repair Costs EUAC of Operating Costs Initial year -7500 0 -500 -900 -400 $0.00 $432.69 $853.87 $1,263.56 $1,661.82 $2,048.71 $2,424.30 $2,788.67 $3,141.93 $3,484.18 $3,815.55 $4,136.17 $4,446.19 $4,745.75 $5,035.01 $500.00 $692.31 $879.50 $1,061.58 $1,238.59 $1,410.54 $1,577.47 $1,739.41 $1,896.41 $2,048.53 $2,195.80 $2,338.30 $2,476.08 $2,609.22 $2,737.78 Arithmetic gradient 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 EUAC Total Interest rate 8% $8,100.00 $4,205.77 $2,910.25 $2,264.41 $1,878.42 $1,622.37 $1,440.54 $1,305.11 $1,200.60 $1,117.72 $1,050.57 $995.21 $948.91 $909.73 $876.22 $8,600.00 $5,330.77 $4,643.62 $4,589.55 $4,778.84 $5,081.62 $5,442.31 $5,833.19 $6,238.94 $6,650.43 $7,061.93 $7,469.68 $7,871.18 $8,264.69 $8,649.02 <-----MIN EUAC is the number of years at which asset cost in minimized. Cost EUAC plot $10,000.00 $9,000.00 $8,000.00 $7,000.00 $6,000.00 $5,000.00 $4,000.00 $3,000.00 $2,000.00 $1,000.00 $0.00 Capital Recovery Maintenance and Repair Operating Total 0 5 10 15 20 Year Engineering Economic Analysis - Ninth Edition Newnan/Eschenbach/Lavelle Copyright 2004 by Oxford University Press, Inc. 11 Marginal Costs Example 12-2 Year 0 1 2 3 4 5 6 7 Incremental cost thereafter $ - Expense Cost Years Investment Cost Annual O&M Cost Annual Insurance Cost Useful Life (years) MARR $25,000.00 0 $ 2,000.00 1 $ $ 5,000.00 3 $ 1,500.00 Foregone Interest O&M Cost $3,750.00 $2,700.00 $1,950.00 $1,350.00 $ 900.00 $ 600.00 $ 450.00 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 25,000.00 18,000.00 13,000.00 9,000.00 6,000.00 4,000.00 3,000.00 2,500.00 500.00 7 15% Loss in Market Value Market Value $ $ $ $ $ $ $ 7,000.00 5,000.00 4,000.00 3,000.00 2,000.00 1,000.00 500.00 Marginal Costs are the year-byyear costs for keeping an asset. 2,000.00 2,500.00 3,000.00 3,500.00 4,000.00 4,500.00 5,000.00 This example illustrates the calculation of the marginal costs for a new item. Insurance Cost Total Marginal Cost $ 5,000.00 $ 5,000.00 $ 5,000.00 $ 6,500.00 $ 8,000.00 $ 9,500.00 $11,000.00 $17,750.00 $15,200.00 $13,950.00 $14,350.00 $14,900.00 $15,600.00 $16,950.00 Engineering Economic Analysis - Ninth Edition Newnan/Eschenbach/Lavelle Copyright 2004 by Oxford University Press, Inc. 12 Marginal Cost Data Defender Example 12-3 Year 0 1 2 3 4 5 6 7 Expense Cost Years Investment Cost Annual O&M Cost Annual Insurance Cost Useful Life (years) MARR $15,000.00 0 Incremental cost thereafter $ - $10,000.00 1 $ 1,500.00 $ 15,000.00 14,000.00 13,000.00 12,000.00 11,000.00 10,000.00 $ - Here the marginal costs are increasing. 5 15% Loss in Market Value Market Value $ $ $ $ $ $ - Is the marginal cost of defender increasing? $ $ $ $ $ 1,000.00 1,000.00 1,000.00 1,000.00 1,000.00 Foregone Interest O&M Cost Insurance Cost $2,250.00 $2,100.00 $1,950.00 $1,800.00 $1,650.00 $10,000.00 $11,500.00 $13,000.00 $14,500.00 $16,000.00 $ $ $ $ $ - Total Marginal Cost $13,250.00 $14,600.00 $15,950.00 $17,300.00 $18,650.00 Engineering Economic Analysis - Ninth Edition Newnan/Eschenbach/Lavelle Copyright 2004 by Oxford University Press, Inc. 13 Replacement Analysis Technique #1 Defender marginal costs are increasing Challenger • $ 25,000.00 0 Incremental cost thereafter $ - $ 2,000.00 1 $ 500.00 $ 5,000.00 3 $ 1,500.00 Expense Replace when the marginal cost of ownership of the defender is more than the EUAC of the challenger. Investment Cost Annual O&M Cost Annual Insurance Cost Useful Life (years) MARR Year 0 1 2 3 4 5 6 7 Market Value $ $ $ $ $ $ $ $ 25,000.00 18,000.00 13,000.00 9,000.00 6,000.00 4,000.00 3,000.00 2,500.00 Cost Years Example 12-4 7 15% Loss in Market Value $ $ $ $ $ $ $ 7,000.00 5,000.00 4,000.00 3,000.00 2,000.00 1,000.00 500.00 Foregone Interest $ $ $ $ $ $ $ 3,750.00 2,700.00 1,950.00 1,350.00 900.00 600.00 450.00 O&M Cost $ $ $ $ $ $ $ Insurance Cost 2,000.00 2,500.00 3,000.00 3,500.00 4,000.00 4,500.00 5,000.00 $ $ $ $ $ $ $ 5,000.00 5,000.00 5,000.00 6,500.00 8,000.00 9,500.00 11,000.00 Total Marginal Cost $ $ $ $ $ $ $ 17,750.00 15,200.00 13,950.00 14,350.00 14,900.00 15,600.00 16,950.00 EUAC through year $17,750.00 $16,563.95 $15,811.20 $15,518.57 $15,426.83 $15,446.61 $15,582.46 Min EUAC <----MIN Defender $ 15,000.00 0 Incremental cost thereafter $ - $ 10,000.00 1 $ 1,500.00 $ - Expense Investment Cost Annual O&M Cost Annual Insurance Cost Useful Life (years) MARR Year 0 1 2 3 4 5 6 7 Market Value $ $ $ $ $ $ 15,000.00 14,000.00 13,000.00 12,000.00 11,000.00 10,000.00 Cost $ Years 5 15% Loss in Market Value $ $ $ $ $ 1,000.00 1,000.00 1,000.00 1,000.00 1,000.00 Foregone Interest $ $ $ $ $ 2,250.00 2,100.00 1,950.00 1,800.00 1,650.00 O&M Cost $ $ $ $ $ 10,000.00 11,500.00 13,000.00 14,500.00 16,000.00 Insurance Cost $ $ $ $ $ - Total Marginal Cost $ $ $ $ $ Engineering Economic Analysis - Ninth Edition Newnan/Eschenbach/Lavelle Copyright 2004 by Oxford University Press, Inc. 13,250.00 14,600.00 15,950.00 17,300.00 18,650.00 Challenger Minimum EUAC Results $15,426.83 $15,426.83 $15,426.83 $15,426.83 $15,426.83 $15,426.83 $15,426.83 Replace Replace Replace 14 Analysis Technique # 1 • Appropriate when replacement repeatability assumptions hold • The best challenger will be available in all subsequent years at the same economic cost • The period of needed service is infinite These assumptions appear to be rather restrictive. Engineering Economic Analysis - Ninth Edition Newnan/Eschenbach/Lavelle Copyright 2004 by Oxford University Press, Inc. 15 Relaxing the Restrictions • This spreadsheet considers that: – The best challenger is available in subsequent years at the same economic cost – The project life is known and limited Based on Example 12-4 Interest rate Project life 15% 4 Keep Defender - Years >>>>>>>> >>>>>>>> Years 0 1 2 3 4 5 6 7 8 9 10 0 0 $13,250.00 $13,877.91 $14,474.62 $15,040.45 $15,575.80 1 $17,750.00 $15,343.02 $14,992.98 $15,130.57 $15,442.32 $15,824.17 2 $16,563.95 $15,301.84 $15,034.44 $15,140.86 $15,414.63 $15,767.77 3 $15,811.20 $15,031.11 $14,873.60 $15,004.82 $15,282.29 $15,635.35 Install and keep Challenger - Years 4 5 6 $15,518.57 $15,426.83 $15,446.61 $14,930.09 $14,926.65 $14,971.85 $14,813.79 $14,821.58 $14,865.67 $14,945.65 $14,942.33 $14,971.19 $15,214.37 $15,195.64 $15,207.03 $15,558.78 $15,526.33 $15,522.24 7 $15,582.46 $15,004.99 $14,899.10 $14,993.63 $15,216.06 $15,518.95 8 9 10 $15,030.12 $14,925.09 $15,011.42 $15,223.32 $15,516.27 $15,049.66 $14,945.70 $15,025.75 $15,229.25 $15,514.06 $15,065.15 $14,962.29 $15,037.42 $15,234.13 $15,512.23 Engineering Economic Analysis - Ninth Edition Newnan/Eschenbach/Lavelle Copyright 2004 by Oxford University Press, Inc. 16 Minimum Cost Life of the Defender Example 12-7 Data Depends on when in the life of the defender the analysis is computed. Year 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Partial life 10% Salvage Value at end of Year n $ 5,000.00 $ 4,000.00 $ 3,500.00 $ 3,000.00 $ 2,500.00 $ 2,000.00 $ 2,000.00 $ 2,000.00 $ 2,000.00 $ 2,000.00 $ 2,000.00 $ 2,000.00 $ 2,000.00 $ 2,000.00 $ 2,000.00 $ 2,000.00 Estimated maintenance costs for year $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 100.00 200.00 300.00 400.00 500.00 600.00 700.00 800.00 900.00 1,000.00 1,100.00 1,200.00 1,300.00 1,400.00 EUAC of Capital Recovery EUAC of Maintenance EUAC Total $1,500.00 $1,214.29 $1,104.23 $1,038.68 $991.39 $888.82 $816.22 $762.33 $720.92 $688.24 $661.89 $640.29 $622.34 $607.24 $594.42 $0.00 $47.62 $93.66 $138.12 $181.01 $222.36 $262.16 $300.45 $337.24 $372.55 $406.41 $438.84 $469.88 $499.55 $527.89 $1,500.00 $1,261.90 $1,197.89 $1,176.79 $1,172.41 $1,111.18 $1,078.38 $1,062.78 $1,058.16 $1,060.78 $1,068.29 $1,079.13 $1,092.21 $1,106.79 $1,122.31 Starting age 2 Ending age 15 Minimum EUAC EUAC of Invested Capital EUAC of Maintenance EUAC Total Minimum EUAC <-----MIN $850.00 $826.19 $803.17 $673.21 $595.70 $544.41 $508.11 $481.17 $460.46 $444.12 $430.94 $420.14 $411.17 $200.00 $247.62 $293.66 $338.12 $381.01 $422.36 $462.16 $500.45 $537.24 $572.55 $606.41 $638.84 $669.88 1,050.00 1,073.81 1,096.83 1,011.32 976.71 966.77 <-----MIN 970.27 981.61 997.70 1,016.66 1,037.35 1,058.99 1,081.05 Marginal cost $ $ $ $ $ $ $ $ $ $ $ $ $ Minimum marginal cost 250.00 <-----MIN 350.00 450.00 500.00 600.00 700.00 800.00 900.00 1,000.00 1,100.00 1,200.00 1,300.00 1,400.00 EUAC plot 1600 1400 1200 Cost • Full life Interest rate 1000 EUAC Total EUAC Total 800 600 400 200 0 0 5 10 15 20 Year Engineering Economic Analysis - Ninth Edition Newnan/Eschenbach/Lavelle Copyright 2004 by Oxford University Press, Inc. 17 Replacement Analysis Technique #2 – If the replacement repeatability assumption holds, compare EUAC of the defender asset at its minimum cost life against the EUAC of the challenger at its minimum cost life. Example 12-8 The repeatability assumptions do not hold. Interest rate Project life 15% 4 >>>>>>>> Keep Defender - Years Do not install challenger Years 0 1 2 3 4 5 6 7 8 9 10 0 0 $6,120.00 $4,043.08 $3,660.17 $3,691.20 $3,880.20 1 $8,600.00 $7,273.49 $5,355.37 $4,649.44 $4,419.25 $4,419.38 2 $5,330.77 $5,631.35 $4,597.52 $4,192.89 $4,093.89 $4,162.01 3 $4,643.62 $5,093.29 $4,352.37 $4,050.29 $3,990.05 $4,073.32 Install and keep Challenger - Years 4 5 6 $4,589.55 $4,778.84 $5,081.62 $4,986.56 $4,941.21 $4,909.43 $4,354.80 $4,376.01 $4,391.57 $4,079.51 $4,116.67 $4,144.84 $4,017.99 $4,052.04 $4,078.52 $4,091.22 $4,115.76 $4,135.22 7 $5,442.31 $4,886.13 $4,403.37 $4,166.74 $4,099.50 $4,150.88 8 9 10 $4,868.46 $4,412.54 $4,184.11 $4,116.40 $4,163.65 $4,854.72 $4,419.81 $4,198.09 $4,130.17 $4,174.17 $4,843.83 $4,425.66 $4,209.48 $4,141.52 $4,182.90 Engineering Economic Analysis - Ninth Edition Newnan/Eschenbach/Lavelle Copyright 2004 by Oxford University Press, Inc. 18 Replacement Analysis Technique #3 • Compare the EUAC of the defender over its stated life against the minimum EUAC of the challenger. •Here defining defender and challenger first costs can be an issue. •Trade-in value is not a suitable value. •Appropriate value is the market value. Engineering Economic Analysis - Ninth Edition Newnan/Eschenbach/Lavelle Copyright 2004 by Oxford University Press, Inc. 19