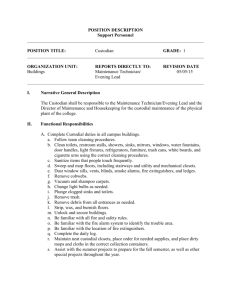

History of PSERS* Employer Contribution Rates

advertisement

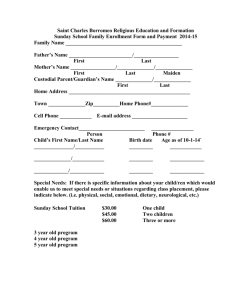

2013-2014 Preliminary Budget March 18, 2013 Previous Year’s Budget Reductions • Elimination of Teaching Positions • Special • • • • • • • • • Education/Two Elementary Elimination of Administrative Position Elimination of Technology Summer Workers Reduction of Summer Maintenance Workers Reduction of Capital Improvements Energy Curtailment Programs New Athletic/Band Fee Reduction in Variable Debt Elimination of Weekend Security Reduction of Contracted Services TOTAL REDUCTIONS $658,546 Budget Development Assumptions • No Salary Increases • All • • • • Employees No Change in Benefit Plans No Furlough/Outsourcing No Additional Programs Two New Teaching Positions • Elementary • Sp. Ed., High School Social Studies No Additional Allocations • By Building • By Department • • • No Additional Debt No New Revenue Sources No Additional State & Federal Revenue • Except PSERS Retirement Reimbursement Expenditures Salaries Benefits Salaries 41% Prof. Svcs. Property Svcs. Contracted Svcs. Supplies/Equipment Debt Service Benefits 21% Expenditures 2013-14 DESCRIPTION Salaries Employee Benefits 2012-13 PROPOSED BUDGET BUDGET $ 30,415,980 $ 30,500,751 $ INC(DEC) % INC(DEC) $ 84,771 0.28% 13,558,938 15,438,865 $ 1,879,927 13.86% Purchased Prof. Svcs. 5,452,876 5,719,740 $ 266,864 4.89% Purchased Property Svcs. 1,927,772 1,905,088 (22,684) -1.18% 10,054,668 10,393,738 $ 339,070 3.37% 2,083,664 2,168,410 $ 84,746 4.07% 447,175 438,190 $ (8,985) -2.01% Other Objects 3,183,456 3,031,792 $ (151,664) -4.76% Other Financing Uses 5,050,000 5,255,500 205,500 4.07% 2,677,545 3.71% Other Contracted Svcs. Supplies Equipment TOTAL ALL OBJECTS $ 72,174,529 $ 74,852,074 $ $ PSERS History/Projections Employer Contribution Rates 35% 30.87% 29.15% 30% 28.30% 25.80% 25% 21.31% 20% 16.93% 15% 12.36% 10% 8.65% 6.46% 6.04% 5% 4.61% 3.77% 1.94% 0% 1.09% 1.15% 4.23% 4.69% 7.13% 4.76% 4.78% 5.64% 30.14% 30.76% 30.93% Expenditure Growth - Other Special Education • Medical/Prescription Insurance • Technology Services • Charter School Tuition • Student Transportation Services • Legal Fees • Psychological Services • Revenues 1.5% 1.7% 18.5% Local State Federal Fund Balance 78.3% Revenues – Local DESCRIPTION 2012-13 BUDGET 2013-14 BUDGET $ INC(DEC) % INC(DEC) CURRENT REAL ESTATE $ 50,489,372 $ 52,155,883 $ 1,666,511 3.3% INTERIM REAL ESTATE $ 300,000 $ 250,000 $ (50,000) -16.7% PUBLIC UTILITY TAX $ 70,000 $ 70,000 $ - 0.0% EARNED INCOME $ 3,400,000 $ 3,400,000 $ - 0.0% TRANSFER TAX $ 700,000 $ 700,000 $ - 0.0% DELINQUENT TAX $ 1,250,000 $ 1,250,000 $ - 0.0% EARNINGS ON INVESTMENTS $ 101,328 $ 50,000 $ (51,328) -50.7% IDEA $ 478,614 $ 565,257 $ 86,643 18.1% RENTALS/FEES $ 150,018 $ 150,000 $ (18) 0.0% MISCELLANEOUS $ 50,000 $ 50,041 $ 41 0.0% FUND BALANCE APPROPRIATION $ 1,094,440 $ 1,243,112 $ 148,672 13.6% $ 58,083,772 $ 59,884,293 $ 1,800,521 3.1% Budget Crisis…why? Revenues Expenditures Chester County Assessment Changes $900,000 2010-11 Revenue from Changes in Tax Base 2011-12 Revenue from Changes in Tax Base $700,000 2012-13 Revenue from Changes in Tax Base 2013-14 Revenue from Change in Tax Base $500,000 $300,000 $100,000 -$100,000 -$300,000 -$500,000 -$700,000 -$900,000 West Chester Unionville Tred-Easttown Phoenixville Oxford Owen J. Roberts Octorara Kennett Great Valley Downingtown Coatesville Avon Grove CUMULATIVE IMPACT OF ASSESSMENT APPEALS SINCE 2010 KENNETT CONSOLIDATED SCHOOL DISTRICT Annual Tax Assessment Hearing Results 2010 - 2013 Municipality Original Assessment KENNETT SQUARE BOROUGH $ 12,110,550 NEW GARDEN EAST MARLBOROUGH KENNETT Total $ Lost Revenue $ Assessment Reduction 7,655,465 4,455,085 169,415,179 51,650,645 39,293,650 28,783,471 10,510,179 255,433,690 196,779,614 58,654,076 $ 402,633,729 27.746 $ $ 221,065,824 527,903,714 Millage Rate Revised Assessment 3,475,741 Net Real Estate Tax Lost - $2,350,717 $ 125,269,985 Interim Taxes, Transfer Taxes, and Interest Revenue 4,500,000 4,000,000 $3,935,501 3,500,000 3,000,000 $2,935,000 Revenue Lost 2,500,000 2,000,000 1,500,000 $1,000,000 1,000,000 500,000 0 2007 2013-14 Preliminary Budget SUMMARY Real Estate Tax Rate History Millage Rate 30 25 20 19.349 20.237 20.873 21.57 21.95 23.14 23.9537 24.7781 25.7293 26.7303 27.746 15 10 5 0 2003-04 2004-05 2005-06 2006-07 2007-08 2008-09 2009-10 2010-11 2011-12 2012-13 2013-14 Budget Shortfall $2,909,655 Tax Increase Fund Balance Expenditure Reduction Real Estate Tax Millage Analysis* Budget Budget % Increase/ 2012-13 2013-14 $0 26.7303 28.3901 1.66 6.21% $1,058,826 26.7303 27.8415 1.11 4.16% $1,094,440 26.7303 27.8230 1.09 4.09% $1,243,112 26.7303 27.7460 1.02 3.80% $2,000,000 26.7303 27.3538 0.62 2.33% $2,326,344 26.7303 27.1847 0.45 1.70% $2,500,000 26.7303 27.0947 0.36 1.36% Increase (Decrease) Fund Balance Appropriations Proposed Tax Increase Max Increase with Exceptions Increase at Act 1 Index * Net Value of a Mill - $1,929,883 Bottom Line • Proposed Real Estate Tax Increase • • • Apply for Act 1 Exceptions • • Special Education & PSERS Appropriation of Fund Balance • • 3.8% Increase 27.7460 Mills $1,243,112 Begin Process of Budget Deliberations • Finance Committee Meetings • First Monday of Every Month Long Term Planning • Initiatives to Reduce Recurring Expenditures • Prepared Statements Please hold questions to the end of all presentations PROPOSED STATE EDUCATION BUDGET PROPOSED STATE EDUCATION BUDGET COMPARISON OF KCSD PROPOSED 2013-14 BUDGET TO GOVERNOR'S PROPOSED BUDGET ACCOUNT DESCRIPTION KCSD GOVERNOR'S 2013-14 PROPOSED VARIANCE PROPOSED BUDGET INC(DEC) BASIC ED SUBSIDY $ 4,944,283 CHARTER SCHOOLS $ SPECIAL ED SUBSIDY $ EDUCATIONAL ASSISTANCE $ TRANSPORTATION SUBSIDY $ 1,525,661 $ RENTAL & SINKING FUND $ 462,000 HEALTH SERVICES $ PROPERTY TAX REDUCTION ALLOCATION 1,641,323 $ $ $ 5,110,050 1,633,616 - $ $ $ 165,767 (7,707) $ - 1,525,661 $ - $ 462,000 $ - 86,000 $ 86,000 $ - $ 1,390,637 $ 1,390,637 $ - PA ACCOUNTABILITY GRANT $ 128,446 $ 128,446 $ - SOCIAL SECURITY $ 1,160,811 $ 1,160,811 $ - RETIREMENT $ 2,493,041 $ 2,161,651 $ (331,390) TOTAL REVENUE FROM STATE SOURCES $ 13,832,202 $ 13,658,872 $ (173,330) RETIREMENT EXPENSE REDUCTION $ 5,151,821 $ 4,467,143 $ 684,678 $ 511,348 NET CHANGE TO KCSD PRELIMINARY BUDGET - $ Millage Reduction Equivalent 0.26 Reduced Millage Requirement under Governor's Proposal 2.8% Passport for Learning Block Grant • • $1.0 Billion to School Districts over 4 years Kennett’s Grant $1,829,390 • • • Year 1 – 2014-15 Grant Amount $365,878 4 Targeted Uses • School Safety • Ready by 3 • Individualized Learning • STEM Initiatives Contingent on the Privatization of State Liquor Stores MIDDLE SCHOOL PROPERTY SUBDIVISION PLAN Outsourcing Deliberations Tentative Time Line • Custodial Staff • Presentation • February • • 18, 2013 1, 2013 Board Action • April 6, 2013 Presentation • March • Committee Discussion • April • Instructional/Teaching Assistants Alternative Proposals • March • 4, 2013 • Committee Discussion • May • 18, 2013 6, 2013 Board Action • May 13, 2013 Comments and Questions Comments@kcsd.org CUSTODIAL OUTSOURCING ALTERNATIVE PROPOSAL 1 REORGANIZATION Custodial Outsourcing Alternative Proposal 1 Reorganization • • • • Elimination of 6 night custodial positions • 2 employees by attrition • 4 employees by layoffs Reduce all remaining night custodial positions from 40 hours/week to 37.5 hours/week Reorganization of remaining day and night custodial staff to maximize performance and building coverage Total estimated savings - $356,104 CUSTODIAL OUTSOURCING ALTERNATIVE PROPOSAL 2 SALARY AND BENEFIT REDUCTION Custodial Outsourcing Alternative Proposal 2 Salary and Benefit Reduction • Option 1 • • • • Major changes to existing healthcare plans for all custodial and maintenance personnel (15% cost reduction) Elimination of 2 positions through attrition Option 2 • • • • Reduction of custodial salaries by 6.5% Reduction of custodial and maintenance salaries by 5.0% Major changes to existing healthcare plans for all custodial and maintenance personnel (15% cost reduction) Elimination of 2 positions through attrition Total estimated savings - $330,000 INSTRUCTIONAL/TEACHING ASSISTANTS OUTSOURCING ANALYSIS Instructional/Teaching Assistants Outsourcing Analysis All staffing was based on equivalent existing employees’ hours and work schedule. • All qualifications of contracted employees would meet or exceed the qualifications as dictated by the District and the Pennsylvania Department of Education. • Two agencies have submitted proposals based on our solicitation. • Lead time for transition to outsourcing arrangement is 60 days after award of contract. • Instructional/Teaching Assistants Outsourcing Analysis $2,500,000 $2,000,000 $2,163,132 $172,307 $1,675,298 $681,999 $1,716,228 $1,369,805 $1,500,000 $1,000,000 $1,308,826 $500,000 $0 Employees SALARY Market Rates BENEFITS Hold Harmless Rates PSERS/SS Rate Improvement CONTRACTED Instructional/Teaching Assistants Outsourcing Analysis $900,000 $793,327 $800,000 $700,000 $487,834 $600,000 $446,904 $500,000 $400,000 $300,000 $200,000 $100,000 $0 Market Rates Hold Harmless Rates Rate Improvement SAVINGS Patient Protection and Affordable Healthcare Act if applicable would reduce savings by an estimated $104,000 DISTRICT WIDE SALARY REDUCTION All Employee Salary Reduction 2013-2014 Budgeted Salaries $537,231 $1,942,182 Total Salaries $28,773,685 $179,702 $2,469,429 $2,987,516 $20,657,625 KEA KCESPA Administration Custodial/Maintenance Confidential Food Service All Employee Salary Reduction Employee Classification Average Per Pay Reduction @ $450,000 (1.56%) Average Per Pay Reduction @ $1,000,000 (3.48%) Average Per Pay Reduction @ $1,500,000 (5.21%) KEA $39 $87 $131 KCESPA $16 $37 $55 Administration $78 $174 $261 Maintenance/ Custodial $24 $53 $79 Confidential $46 $103 $154 Food Service $18 $40 $60