Chapter 7 PowerPoint

advertisement

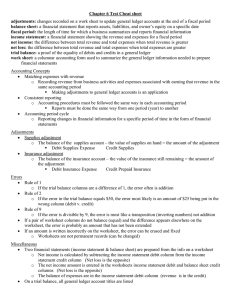

Chapter 7 WORK SHEET FOR A SERVICE BUSINESS Chapter 7 Objectives: Define accounting terms related to a work sheet for a service business organized as a proprietorship Identify accounting concepts and practices related to a work sheet for a service business organized as a proprietorship Prepare a heading and a trial balance on a work sheet Plan adjustments for supplies and prepaid insurance Complete a work sheet for a service business organized as a proprietorship Identify selected procedures for finding and correcting errors in accounting records ACCOUNTING FLOW CHART Source Document Journal Ledger Work Sheet Financial Statements Consistent Reporting The same accounting procedures are followed in the same way in each accounting period. – Same figures are calculated, same overall ratios are calculated, and same analysis used Use same set of procedures for reporting (for comparisons). Begin and end at same time. Analyze, summarize, and report financial information in a consistent manner. Ch 7-1: Creating a Work Sheet Fiscal Period The time period selected by the business to report financial information. – AKA Accounting Period Accounting Period Cycle: applied when changes in financial info (ie: profits and losses) are reported for a specific period of time in the form of financial statements Common time periods are a quarter (3 months) or a year. Most businesses use January 1 to December 31 to correspond to federal and state tax reports. May also choose time when business activity is low Encore Music: monthly for now because it is a new business – Begin on August 1-August 31 (inclusive) Worksheet: A columnar accounting form used to summarize general ledger accounts. It is prepared by the accountant in pencil. – Planning tool NOT permanent Purpose: Makes it easier for the accountant to prepare the financial statements. Four Reasons to Prepare Work Sheet 1. To summarize general ledger account balances to prove DR=CR. 2. To plan needed changes to general ledgers accounts to bring balances up to date adjustments. 3. To separate accounts for financial statements - Balance Sheet, Income Statement 4. To calculate net income or net loss for the fiscal period. PREPARING THE HEADING OF A WORK SHEET 1 2 3 1. Who???- Name of Company 2. What??? - Name of Report 3. When??? - Date of Report *Covers entire fiscal period Lesson 7-1, page 150 Columns of a Work Sheet 3. Income 1. Trial 2. 4. Balance Adjustments Statement Balance Sheet Trial Balance Figures are taken from the general ledger (in the same order they appear in ledger). All accounts are listed in order. – Listed even if they have a 0 balance Must prove equality of debit and credit columns before completing worksheet. PREPARING A TRIAL BALANCE ON A WORK SHEET 2 1. Account Titles 2. Account Balances 3. Single Rule 4. Add Totals 5. Write Totals 6. Double Rule 1 3 4 5 6 Lesson 7-1, page 151 Assign: Page 152 Work Together - will be used in Chapter 7-2, 7-3 CHAPTER 7-2 Planning Adjusting Entries on a Work Sheet Matching Expenses with Revenues This is applied when revenue from business activities and expenses associated with earning that revenue are recorded in the same accounting period. – Ie: You must account for buying something in one period and using it in another period. **Amounts that helped earn revenue for a period must be reported with expenses in the same period The ending balance of the supplies account should represent what is remaining on hand at the end of the month All supplies that have been used Reported as Supplies Expense Matching Expenses with Revenue Bought supplies on March 1, 2010 Supply Inventory- April 1, 2010 $100 $100 $100 $100 $100 $100 $100 $100 $100 $100 $100 $100 Assets:?????? $100 $100 $100 How to journalize the used supplies? Adjustments A change recorded to bring an account up to date. Assets are used to earn revenue The portion of the assets consumed/used in order to earn revenue become business expenses These used portions are no longer assets, but are NOW expenses Once adjustments are made expenses incurred to earn revenue are reported in same fiscal period as the revenue is earned and reported Matching Expenses with Revenue Work sheet is used to plan adjustments and THEN you must journalize each one Supplies Adjustment Supplies 4751 When business buys supplies – DR Asset account Supplies on hand are a value owned by business until used Value of supplies used becomes business expense Inventory of supplies shows $2187 worth. Planning Adjustments Determine amount – Account Balance 4751 (what you started with) – Inventory -2187 (what is left - asset) – Adjustment $2564 (what was used- expense) Planning Adjustment Entry and Account Balances Debit Supplies Expense Credit Supplies Original amount Amount used Supplies 4751 2564 Balance $2187 = value of supplies on hand Supplies Expense 2564 SUPPLIES ADJUSTMENT ON A WORK SHEET 2 3 1 1. Write the debit amount – in Adjustment column. 2. Write the credit amount - in Adjustment column. 3. Label the two parts of this adjustment with a small letter a in parentheses, (a). Lesson 7-2, page 155 Prepaid Insurance Insurance premium is paid in advance and turns into an expense as each day passes. When bought DR asset account Determine amount used – Account Balance, prepaid insurance – Inventory, insurance coverage remaining – Adjustment, Insurance coverage used Amount used Expense. – Debit Insurance Expense ($100) – Credit Prepaid Insurance ($100) 1200 -1100 $100 PREPAID INSURANCE ADJUSTMENT ON A WORK SHEET 2 3 1 1. Write the debit amount. 2. Write the credit amount. 3. Label the two parts of this adjustment with a small letter b in parentheses, (b). Lesson 7-2, page 156 PROVING THE ADJUSTMENTS COLUMNS OF A WORK SHEET 1. Rule a single line. 2. Add both the Adjustments Debit and Credit columns. 3. Rule double lines. 1 2 3 Lesson 7-2, page 157 Assign: Page: 158 Audit Work Together On your Own (7-1 and 7-2) ACCOUNTING FLOW CHART Source Document Journal Ledger Worksheet Financial Statements Chapter 7-1, 7-2 Review: 4 questions to ask when analyzing adjustments: 1. What is the balance of supplies/prepaid insurance? 2. What should the balance be for this account? 3. What must be done to correct? 4. What adjustments need to be made? TO DO: • Application Probs 7-1, 7-2 Explain ‘Matching Expenses with Revenue’ using this diagram – each square is $100 worth of supplies Bought on Jan. 1, 2010 Supply Inventory- May 31, 2010 Assets:?????? How to journalize the used supplies? Chapter 7-3 Extending Financial Statement Information on a Work Sheet Balance Statement: reports assets, liabilities, owner’s equity on a specific date Income Statement: reports revenue and expenses for a fiscal period Before Adjustments: Assets were overstated Expenses were understated Profit was overstated Paid too much in taxes Two Financial Statements prepared at end of fiscal period Income Statement – Revenue – Expenses Balance Sheet – Assets – Liabilities – Owner’s Equity ***MUST extend updated account balances to specified columns to create these two financial statements Figure for Income or Loss Revenue minus Expenses = Income/Loss » OR CR-DR= Net Income/Loss Assets - Liabilities = Owner’s Equity Balanced Net Income: difference between total revenue and total expenses when total revenue is greater Net Loss: difference between total revenue and total expenses when total expenses are greater EXTENDING BALANCE SHEET ACCOUNT BALANCES ON A WORK SHEET 1 2 3 1. Debit Balances without Adjustments 2. Debit Balances with Adjustments 3. Credit Balances without Adjustments Lesson 7-3, page 159 EXTENDING INCOME STATEMENT ACCOUNT BALANCES ON A WORK SHEET 1 2 3 1. Sales Balances 2. Expense Balances without Adjustments 3. Expense Balances with Adjustments Lesson 7-3, page 160 RECORDING NET INCOME, AND TOTALING AND RULING A WORK SHEET 1. Single Rule 2. Total 3. Net Income 4. Extend Net Income 5. Single Rule 6. Totals 7. Double Rule 1 4 3 6 2 5 7 Lesson 7-3, page 161 CALCULATING AND RECORDING A NET LOSS ON A WORK SHEET 1 3 2 4 1. Single Rule 2. Totals 3. Net Loss 4. Extend Net Loss Lesson 7-3, page 162 Assign: GO TO OVERLAYS Follow steps with overlays as they are read out loud Page: 163 Audit you understanding Work Together Chapter 7-4: Finding and Correcting Errors Errors: 1. Forgetting to post a line from the journal 1. Debit to supplies may not have been posted in general ledger work sheet’s trial balance will not balance 2. Transferred info incorrectly from ledger to work sheet 3. Errors in calculating/recording adjustments 4. Errors in extending amounts to Income Stmt and Balance Sheet columns All errors must be corrected before any further work is done If error is found on work sheet erase error and replace it with correction CHECKING FOR TYPICAL CALCULATION ERRORS When two column totals are not in balance, subtract the smaller total from the larger total to find the difference. Check the difference between the two amounts against the following guides. 1. The difference is 1, such as $.01, $.10, $1.00, or $10.00. 1. Add columns again 2. The difference can be divided evenly by 2. 1. Check debits/credits (recorded in same column) 2. If difference is $48, look for $24 in trial balance columns 3. The difference can be divided evenly by 9. 1. Check transposed #’s (54 and 45) 4. Check for slide ($12.00 is written as $120.00) 5. The difference is an omitted amount. 1. Look for an amount equal to the difference Lesson 7-4, page 164 CHECKING FOR ERRORS IN THE WORK SHEET Check for Errors in the Trial Balance Column – Have all general ledger account balances been copied in the Trial Balance column correctly? – Have all general ledger account balances been recorded in the correct Trial Balance column? Check for Errors in the Adjustments Columns – Do the debits equal the credits for each adjustment? – Is the amount for each adjustment correct? Check for Errors in Income Statement and Balance Sheet Columns – Has each amount been copied correctly? – Has each amount been extended to the correct column? – Has the net income/loss been calculated correctly? – Has the net income/loss been recorded in the correct column? Lesson 7-4, page 165 CORRECTING AN ERROR IN POSTING TO THE WRONG ACCOUNT If a pair of columns do not balance and error cannot be found on work sheet look for errors in posting As each entry in journal is verified, place a check mark next to it Have all amounts that need to be posted actually been posted from the general journal? – To correct complete posting and recalculate account balances and make corrections on work sheet Have all amounts been posted to the correct accounts? – To correct draw a line through entire incorrect entry in ledger • Recalculate and make corrections – Record posting in correct account • Recalculate and correct wkst CORRECTING AN ERROR IN POSTING TO THE WRONG ACCOUNT 2 1 1. Incorrect Entry 2. Correct Entry *Posted to Prepaid Insurance instead of Supplies Lesson 7-4, page 165 CORRECTING AN INCORRECT AMOUNT AND AN AMOUNT POSTED TO THE WRONG COLUMN 3 2 1 5 4 6 *Correcting an incorrect amount 1. Cross out the Incorrect Amount 2. Write in the Correct Amount 3. Compute the Correct Balance *Correcting an amount posted to the wrong column 4. Cross out the Incorrect Entry 5. Write in the Correct Entry 6. Compute the Correct Balance Lesson 7-4, page 166 Checking for Errors in General Journal Entries Do debits = credits for each entry? Is each general journal entry amount recorded in the correct column? Is info in the account title column correct for each entry? Have all transactions been recorded? Assign: Page: 167 Audit Work Together On your Own 7-3 and 7-4