mortgage-backed securities

Chapter Seven

Mortgage Markets

McGraw-Hill/Irwin 7-1 ©2009, The McGraw-Hill Companies, All Rights Reserved

Mortgages and Mortgage-Backed

Securities

•

Mortgages

are loans to individuals or businesses to purchase homes, land, or other real property

• As of Sep.2007 14 trillion of primary mortgages outstanding.

• Mortgages can be securizited or not. Currently 60 percent of home mortgages are securitized.

• Home mortgages are almost 80 percent of the total mortgage loans.

McGraw-Hill/Irwin 7-2 ©2009, The McGraw-Hill Companies, All Rights Reserved

Mortgages and Mortgage-Backed

Securities

• Many mortgages are securitized

– mortgages are packaged and sold as assets backing publicly traded or privately held debt instruments (i.e., mortgage-backed securities (MBSs) )

• Mortgages differ from bonds and stocks

1.

mortgages are backed by a specific piece of real property

-only mortgage bonds are backed by a specific piece of property that allows the lender to take ownership in the event of a default.-

2.

primary mortgages have no set size or denomination

-bonds usually have a denomination of 1,000$ or a multiple of 1,000$

3. primary mortgages generally involve only a single investor

4.

comparatively little information exists on mortgage borrowers

(which is also less extensive and unaudited)

McGraw-Hill/Irwin 7-3 ©2009, The McGraw-Hill Companies, All Rights Reserved

Primary Mortgage Market

• Four basic types of mortgages are issued by financial institutions

1. home mortgages are used to purchase one- to fourfamily dwellings

(10.75 trillion outstanding)

2. multifamily dwellings mortgages are used to purchase apartment complexes, townhouses, and condominiums

(0.78 trillion outstanding)

3. commercial mortgages are used to finance the purchase of real estate for business purposes

(2.34 trillion outstanding)

4. farm mortgages are used to finance the purchase of farms

(0.11 trillion outstanding)

McGraw-Hill/Irwin 7-4 ©2009, The McGraw-Hill Companies, All Rights Reserved

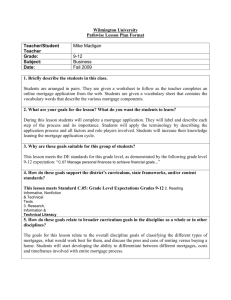

Mortgage Loans Outstanding,

2007 (Trillions of $)

$0.28

$0.07

$0.74

McGraw-Hill/Irwin

$3.46

1-4 Family Commercial

Multifamily residential Farm

7-5 ©2009, The McGraw-Hill Companies, All Rights Reserved

Mortgage Characteristics

• Most FI sell or securitize their mortgage loans in the secondary mortgage market.

• The guidelines set by the secondary market buyer for acceptability as well as the guidelines set by the FI are used to determine whether or not a morgage borrower is qualified.

• Characteristics of loans to be securizited will generally be more standardized than those that are notd to be securized.

When mortgages are not securizited, FI can be more flewible with the acceptance/rejection.

McGraw-Hill/Irwin 7-6 ©2009, The McGraw-Hill Companies, All Rights Reserved

Mortgage Characteristics

• Collateral : lenders place liens against properties that remain in place until loans are fully paid off.

• A down payment is a portion of the purchase price of the property a financial institution requires the borrower to pay up front, usually 20 pcnt. (If below, borrowers are required to purchase private mortgage insurance, PMI) (PMI is purchased by FI but paid by borrower as a part of the montly payment.)

– private mortgage insurance (PMI) is generally required when the loanto-value ratio is more than 80%

– In default, PMI issuer guarantees to pay the FI the difference between the value of the property and the balance reaining on the mortgage

– When the loan to value ratio is less than 80 percent thhe PMI payments can be stopped.

McGraw-Hill/Irwin 7-7 ©2009, The McGraw-Hill Companies, All Rights Reserved

Mortgage Characteristics

• Federally insured mortgages

– repayment is guaranteed by either the

Federal Housing Administration

(FHA) or the Veterans Administration (VA) for a fee of 0.5 percent of the loan amound.

– In order to qualify, FHA and VA applicants must meet specific requirements set by these agencies.

– FHA loans have a limit depending on location and cost of living.

• Conventional mortgages are mortgages that are not federally insured

(these are insured by private insurers, if the borrower’s down payment is less than 20 percent of the property value)

• Secondary market mortgage buyers will not generally purchase conventional mortgages that are not privately insured and that have a loan to value ratio of greater than 80 percent.

McGraw-Hill/Irwin 7-8 ©2009, The McGraw-Hill Companies, All Rights Reserved

Mortgage Characteristics

• Amortized mortgages have fixed principal and interest payments that fully pay off the mortgage by its maturity date

– fully amortized mortgage maturities are usually either 15 or 30 years.

Because of potantial interest savings 15-yearmortgages are gettin popular...

– Fıs find 15-year mortgages attractive because of the lower degree of interest rate risk on it comparing to longer periods. To attract mortgage borrowers to short term mortgage, FI generally charge a lower interest rate on a 15 year mortgage.

– Montly payments cover interest and principal and by the maturity all of the mortgage is amortized.

– Balloon payment mortgages require fixed monthly interest payments for 3 to 5 years whereupon full payment of the mortgage principal is due

McGraw-Hill/Irwin 7-9 ©2009, The McGraw-Hill Companies, All Rights Reserved

Mortgage Characteristics

– Fixed Rate versus Ballon Payment Mortgae

McGraw-Hill/Irwin 7-10 ©2009, The McGraw-Hill Companies, All Rights Reserved

Mortgage Characteristics

•

Interest rates are the most important characteristic on a mortgage. Borrowers often decide how much to borrow and from whom solely by looking at the quoted mortgage rates of several FIs.

•

Mortgage contract specify whether a fixed or variable rate of interest will be paid by the borrower.

•

Fixed-rate mortgages lock in the borrower’s interest rate

– required monthly payments are fixed over the life of the mortgage regardles of how market rates change.

– lenders assume interest rate risk

•

Adjustable-rate mortgages (ARMs) tie the borrower’s interest rate to some market interest rate or interest rate index

– required monthly payments can change over the life of the mortgage

– yearly interest rate changes are often capped (limited change)

– borrowers assume interest rate risk

– ARMs can increase default risk

McGraw-Hill/Irwin 7-11 ©2009, The McGraw-Hill Companies, All Rights Reserved

Mortgage Characteristics

•

Discount points are fees or payments made when a mortgage loan is issued

– each point costs the borrower 1 percent of the principal value

– the lender reduces the interest rate used to determine the payments on the mortgage in exchange for points paid

•

Other fees

– application fee

– title search: to ensure there are no outstanding claims agains the property

– title insurance: to protect the borrowers if there is an error in title search

– appraisal fee:

– loan origination fee

– closing agent and review fees

– other fees (e.g., VA or FHA loan guarantees and PMI)

McGraw-Hill/Irwin 7-12 ©2009, The McGraw-Hill Companies, All Rights Reserved

Mortgage Characteristics

• Mortgage refinancing

– when a borrower takes out a new mortgage and uses the proceeds to pay off an existing mortgage

– mortgages are most often refinanced when an existing mortgage has a higher interest rate than prevailing rates

– borrowers must balance the savings of a lower monthly payment with the costs (fees) of refinancing: refinancing adds transaction and recontracting costs.

– an often-cited rule of thumb is that the new interest rate should be

2 percentage points less than the refinanced mortgage rate

– Almost the same procedure apply.

McGraw-Hill/Irwin 7-13 ©2009, The McGraw-Hill Companies, All Rights Reserved

Mortgage Amortization

• Each fixed monthly payment consists partly of repayment of the principal and partly of the interest on the outstanding mortgage balance

• An amortization schedule shows how the fixed monthly payments are split between principal and interest

McGraw-Hill/Irwin 7-14 ©2009, The McGraw-Hill Companies, All Rights Reserved

Other Types of Mortgages

• New methods of creative financing have been developed by FI to attract mortgage borrowers:

1.

Automatic rate-reduction mortgages : moves only downward.

2.

Graduated-payment mortgages (GPMs) : allows to make small payments early in the life of the mortgage . Good if you expect your income to rise later on. Good also if you plan to move or refinance quickly. If no increase in income, it is risky for both party.

3.

Growing-equity mortgages (GEMs) : initial payments are same as on a conventional mortgage, but they increase over a portion or the entire life of the mortgage. In contrast to GPMs, GEMs reduces the principal on the mortgage more quickly.

McGraw-Hill/Irwin 7-15 ©2009, The McGraw-Hill Companies, All Rights Reserved

Other Types of Mortgages

4.

Second mortgages and home equity loans : Loans secured by a piece of real estate already used to secure a first mortgage. If there is a default, the second mortgage holder is paid only after the first mortgage is paid off. Provided by higher interest only...

15 pcnt of all primary mortgage holders also have second mortgages.

5.

Shared-appreciation mortgages (SAMs ): Allow a home buyer to obtain a mortgage at an interest rate below current market rates in exchange for a share given to the lender in any appreciation in the porperty value. FI has bought an option on the value of the house compared to its purchase price. Introduced in the eary 1980s....

6.

Equity-participation mortgages (EPMs ): similar to a SAM exceptthat an outside investor shares in the appreciation of the prporety rathen than the FI.

7.

Reverse-annuity mortgages (RAMs): a mortgage borrower receives regular payment.

Maturities on RAMs are generally set such that the borrower will likely die prior to maturity.

As the US population ages, RAMs are growivin in popularity. Many people retire asset rich and income poor.

McGraw-Hill/Irwin 7-16 ©2009, The McGraw-Hill Companies, All Rights Reserved

Secondary Mortgage Markets

• FIs remove mortgages from their balance sheets through one of two mechanisms

– by pooling recently originated mortgages together and selling them in the secondary market

– by securitizing mortgages (i.e., by issuing securities backed by newly originated mortgages)

• Advantages of securitization

– FIs can reduce the liquidity risk, interest rate risk, and credit risk of their loan portfolios. While Depository Institutions hold short term deposits they hold long term fixed rate mortgages in their asset portfolios subjects them to interest rate risk.

– FIs generate income from origination and service fees

McGraw-Hill/Irwin 7-17 ©2009, The McGraw-Hill Companies, All Rights Reserved

Secondary Mortgage Markets

• The secondary mortgage markets were created by the federal government to help boost US economic activity during the Great Depression.

• In secondary market there is a goverment guarantee for default.

• The U.S. government established the Federal National

Mortgage Association (FNMA or Fannie Mae) in the

1930s to buy mortgages from thrifts so they could make more mortgage loans

• FHA (Federal Housing Administration) and VA (Veterans

Administration) insured loans make securitization easier

McGraw-Hill/Irwin 7-18 ©2009, The McGraw-Hill Companies, All Rights Reserved

Secondary Mortgage Markets

• Government National Mortgage Association

(GNMA or “Ginnie Mae”) and Federal Home

Loan Mortgage Corp. (FHLMC or “Freddie Mac”) created in the 1960s

– encouraged continued expansion of the housing market

– provided direct and indirect guarantees that allow for the creation of mortgage-backed securities

• These organizations differ in the types of mortgages included in the mortgage pools, security guarantees (or insurance) and payment patterns on the securities.

McGraw-Hill/Irwin 7-19 ©2009, The McGraw-Hill Companies, All Rights Reserved

Mortgage Sales

• FIs have sold mortgages among themselves for over 100 years

• A large part of correspondent banking involves small banks selling parts of large loans to larger banks

• Large banks often sell parts of their loans (i.e., participations ) to smaller banks

•

Mortgage sales occur when an FI originates a mortgage and sells it to an outside buyer

– a loan sale is made with recourse if the loan buyer can sell the loan back to the originator should it go bad

• Mortgages are usually without recourse...

• Mortgage sales remove assets (and credit risk) from the balance sheet and allow a financial institution to achieve better asset diversification.

McGraw-Hill/Irwin 7-20 ©2009, The McGraw-Hill Companies, All Rights Reserved

Mortgage Sales

•

Mortgage sellers : money center banks, smaller banks, foreign banks, investment banks

• Mortgage sales allow FIs to manage credit risk, achieve better asset diversification, and improve their liquidity and interest rate risk positions

• FIs are encouraged to sell loans for economic and regulatory reasons

– sold mortgages can still generate fee income for the bank

– sold mortgages reduce the cost of reserve and capital requirements

•

Mortgage buyers : foreign and domestic banks, insurance companies, pension funds, closed-end bank loan mutual funds, and nonfinancial corporations

McGraw-Hill/Irwin 7-21 ©2009, The McGraw-Hill Companies, All Rights Reserved

Mortgage Backed Securities

• There are 3 different major types of mortgage backed securities.

Pass through and CMOs are securitized mortgages

• 1. Pass-through securities “pass through” promised principal and interest payments to investors

• Three agencies are directly involved in the creation of pass-through securities

– Ginnie Mae

–

Fannie Mae

– Freddie Mac

0.42 trillion dollar in 2007, 1968, goverment

1.59 trillion dollar in 2007, 1938, private

2.09 trillion dollar in 2007

• Private mortgage pass-through issuers create pass-throughs from nonconforming mortgages 2 .83 trillion dollar in 2007

• Fanniemae and Freddiemac is a stockholder owned corporation with a line of credit from the US Treasury. Its bonds are rated AAA.

McGraw-Hill/Irwin 7-22 ©2009, The McGraw-Hill Companies, All Rights Reserved

Mortgage Backed Securities

• Collateralized mortgage obligations (CMOs) are multiclass pass-throughs with multiple bond holder classes or tranches

– Unlike a pass through each bond holder class has a different guaranteed coupon

– mortgage prepayments retire only one tranche at a time, so all other trances are sequentially prepayment protected

•

Mortgage backed bonds (MBBs)

– MBBs allow FIs to raise long-term low-cost funds without removing mortgages from their balance sheets

– The cash flow on the mortgages backing the bond are not necessarily directly connected to interest and principal payments on the MBB.

McGraw-Hill/Irwin 7-23 ©2009, The McGraw-Hill Companies, All Rights Reserved

34.79

Mortgages Outstanding by

Type of Holder (%) Participants...

1.40

2.23

4.03

3.55

54.00

Mortgage Pools

Depository

Institutions

Life Insurance

Companies

Other Financial

Institutions

Mortgage

Companies

Other

McGraw-Hill/Irwin 7-24 ©2009, The McGraw-Hill Companies, All Rights Reserved

International Trends in Securitization

• Foreign investors participate in U.S. mortgage and MBS markets, but the value held has decreased since 1992

• Europe is the world’s second largest and most developed securitization market

– the United Kingdom is the biggest MBS issuer in the European market, followed by Germany

– the advent of the Euro has accentuated (stressed) the increased trend in securitization in Europe

• Mortgage lending has grown in Russia since the early

2000s because of changes in property ownership laws

McGraw-Hill/Irwin 7-25 ©2009, The McGraw-Hill Companies, All Rights Reserved

Subprime...

• A subprime mortgage borrower is one with a below normal credit rating and as such is generally charged a higher interest rate on a mortgage.

• Defaults by subprime mortgages borrowers began to affect the mortgage lending industry as a whole, as well as other parts of the economy noticeably, sending stock marktes, consumer confidence, and overall economic health lower.

• The collapse of the subprime mortgage market led financial markets and the US economy to continue to struggle through 2008.

McGraw-Hill/Irwin 7-26 ©2009, The McGraw-Hill Companies, All Rights Reserved

McGraw-Hill/Irwin 7-27 ©2009, The McGraw-Hill Companies, All Rights Reserved

Mortgage Payments

• The present value of a mortgage can be written as: j

PV

PMT j t

1

1

1

r

PMT ( PVIFA r , t

)

PV = principal amount borrowed

PMT = monthly mortgage payment

PVIFA = present value interest factor of an annuity r = monthly interest rate on the mortgage t = number of monthly payments over the life of the mortgage

• Rearrange to isolate the payment :

PMT

PV

( PVIFA r , t

)

McGraw-Hill/Irwin 7-28 ©2009, The McGraw-Hill Companies, All Rights Reserved