Chapters 10 & 11

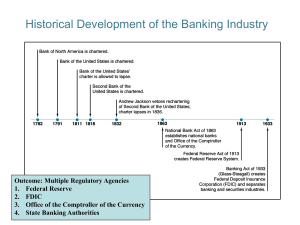

Lessons from the Great Depression

During 1930-1933, some 9000 bank failures wiped out the

savings of many depositors at commercial banks.

Lessons learned (Glass-Steagall Act) :

• FDIC insurance

• Separation of the activities of commercial banks from

investment banks (1933-1999)

• Multiple regulatory agencies with overlapping jurisdictions

© 2004 Pearson Addison-Wesley. All rights reserved

10-2

Financial Innovation

Innovation is result of search for profits

Response to Changes in Demand

Major change is huge increase in interest-rate risk starting in 1960s

Example: Adjustable-rate mortgages

Financial Derivatives

Response to Change in Supply

Major change is improvement in computer technology

1. Increases ability to collect information

2. Lowers transaction costs

Examples:

1. Bank credit and debit cards

2. Electronic banking facilities

3. Junk bonds

4. Commercial paper market

5. Securitization

10-3

Avoidance of Existing Regulations

Regulations Behind Financial Innovation

1. Reserve requirements

Tax on deposits = i r

2. Deposit-rate ceilings (Reg Q till 1980)

As i , loophole mine to escape reserve

requirement tax and deposit-rate ceilings

Examples

1. Money market mutual funds

2. Sweep accounts

© 2004 Pearson Addison-Wesley. All rights reserved

10-4

The Decline in Banks

as a Source of Finance

© 2004 Pearson Addison-Wesley. All rights reserved

10-5

Decline in Traditional Banking

Loss of Cost Advantages in Acquiring Funds

(Liabilities)

i then disintermediation because

1. Deposit rate ceilings and regulation Q

2. Money market mutual funds

3. Foreign banks have cheaper source of funds: Japanese

banks can tap large savings pool

Loss of Income Advantages on Uses of Funds

(Assets)

1. Easier to use securities markets to raise funds:

commercial paper, junk bonds, securitization

2. Finance companies more important because easier for

them to raise funds

10-6

Banks’ Response

Loss of cost advantages in raising funds and

income advantages in making loans causes

reduction in profitability in traditional banking

1. Expand lending into riskier areas: e.g., real estate

2. Expand into off-balance sheet activities

3. Creates problems for U.S. regulatory system

Similar problems for banking industry in other

countries

© 2004 Pearson Addison-Wesley. All rights reserved

10-7

Structure of the Commercial Banking

Industry

© 2004 Pearson Addison-Wesley. All rights reserved

10-8

Ten Largest U.S. Banks

© 2004 Pearson Addison-Wesley. All rights reserved

10-9

Branching Regulations

Branching Restrictions: McFadden Act and

Douglas Amendment

Very anticompetitive

Response to Branching Restrictions

1. Bank Holding Companies

A. Allowed purchases of banks outside state

B. BHCs allowed wider scope of activities by Fed

C. BHCs dominant form of corporate structure for banks

2. Automated Teller Machines

Not considered to be branch of bank, so networks

allowed

© 2004 Pearson Addison-Wesley. All rights reserved

10-10

Bank Consolidation and Number of

Banks

© 2004 Pearson Addison-Wesley. All rights reserved

10-11

Bank Consolidation and Nationwide

Banking

Bank Consolidation: Why?

1. Branching restrictions weakened

2. Development of super-regional banks

Riegle-Neal Act of 1994

1. Allows full interstate branching

2. Promotes further consolidation

Future of Industry Structure

Will become more like other countries, but not

quite:

Several thousand banks, not several hundred

© 2004 Pearson Addison-Wesley. All rights reserved

10-12

Bank Consolidation and Nationwide

Banking

Bank Consolidation: A Good Thing?

Cons:

1. Fear of decline of small banks and small business

lending

2. Rush to consolidation may increase risk taking

Pros:

1. Community banks will survive

2. Increase competition

3. Increased diversification of bank loan portfolios:

lessens likelihood of failures

© 2004 Pearson Addison-Wesley. All rights reserved

10-13

Separation of Banking and

Other Financial Service Industries

Erosion of Glass-Steagall

Fed, OCC, FDIC, allow banks to engage in underwriting

activities

Gramm-Leach-Bliley Financial Modernisation Services

Act of 1999: Repeal of Glass-Steagall

1. Allows securities firms and insurance companies to purchase banks

2. Banks allowed to underwrite insurance and engage in real estate

activities

3. OCC regulates bank subsidiaries engaged in securities

underwriting

4. Fed oversee bank holding companies under which all real estate,

insurance and large securities operations are housed

Implications: Banking institutions become larger and more complex

10-14

How Asymmetric Information

Explains Banking Regulation

1. Government Safety Net and Deposit Insurance

A. Prevents bank runs due to asymmetric information:

depositors can’t tell good from bad banks

B. Creates moral hazard incentives for banks to take on too

much risk

C. Creates adverse selection problem of crooks and risk-takers

wanting to control banks

D. Too-Big-to-Fail increases moral hazard incentives for big

banks

2. Restrictions on Asset Holdings

A. Reduces moral hazard of too much risk taking

© 2004 Pearson Addison-Wesley. All rights reserved

10-15

How Asymmetric Information

Explains Banking Regulation

3. Bank Capital Requirements

A. Reduces moral hazard: banks have more to lose when have

higher capital

B. Higher capital means more collateral for FDIC

4. Bank Supervision: Chartering and Examination

A. Reduces adverse selection problem of risk takers or crooks

owning banks

B. Reduces moral hazard by preventing risky activities

5. New Trend: Assessment of Risk Management

6. Disclosure Requirements

A. Better information reduces asymmetric information

problem

© 2004 Pearson Addison-Wesley. All rights reserved

10-16

How Asymmetric Information

Explains Banking Regulation

7. Consumer Protection

A. Standardized interest rates (APR)

B. Prevent discrimination: e.g., CRA

8. Restrictions on Competition to Reduce Risk-Taking

A. Branching restrictions

B. Separation of banking and securities industries in the past:

Glass-Steagall

International Banking Regulation

1. Bank regulation abroad similar to ours

2. Particular problem of regulating international banking

e.g., BCCI scandal

© 2004 Pearson Addison-Wesley. All rights reserved

10-17

Bank Failures

© 2004 Pearson Addison-Wesley. All rights reserved

10-18

Why a Banking Crisis in 1980s?

Early Stages

1. Decreasing profitability: banks take risk to keep profits up

2. Deregulation in 1980 and 1982, more opportunities for risk taking

3. Innovation of brokered deposits enabled circumvention of

$100,000 insurance limit

4. i , net worth of S&Ls

A. Insolvencies

B. Incentives for risk taking

Result: Failures and risky loans

Later Stages: Regulatory Forbearance

1. Regulators allow insolvent S&Ls to operate because

A. Insufficient funds

B. Sweep problems under rug

C. FHLBB cozy with S&Ls

2. Huge increase in moral hazard for zombie S&Ls: now have

incentive to “bet the bank”

3. Zombies hurt healthy S&Ls

A. Raise cost of funds

B. Lower loan rates

4. Outcome: Huge losses

© 2004 Pearson Addison-Wesley. All rights reserved

10-19

Political Economy of S&L Crisis

Explanation: Principal-Agent Problem

1. Politicians influenced by S&L lobbyists rather than public

A. Deny funds to close S&Ls

B. Legislation to relax restrictions on S&Ls

C. Competitive Bank Equality Act (CEBA) of 1987 had

inadequate amount for bailout

2. Regulators influenced by politicians and desire to avoid

blame

A. Loosened capital requirements

B. Regulatory forbearance

© 2004 Pearson Addison-Wesley. All rights reserved

10-20

Financial Institutions Reform, Recovery

and Enforcement Act (FIRREA) of 1989

1. New regulatory structure: Office of Thrift

Supervision as new regulator, FDIC takes over

FSLIC fund

2. Resolution Trust Corporation (RTC) created and

given funds to close insolvent S&Ls: cost of $100$200 billion

3. Core capital requirement from 3% to 8%

4. Reregulation: Asset restrictions like before 1982

© 2004 Pearson Addison-Wesley. All rights reserved

10-21

Federal Deposit Insurance Corporation

Improvement Act (FDICIA) of 1991

1. FDIC recapitalized with loans and higher

premiums

2. Reduce scope of deposit insurance and too-big-tofail

3. Prompt corrective action provisions

4. Risk-based premiums

5. Annual examinations and stricter reporting

6. Enhances Fed powers to regulate international

banking

© 2004 Pearson Addison-Wesley. All rights reserved

10-22