Policy on payroll management and certification

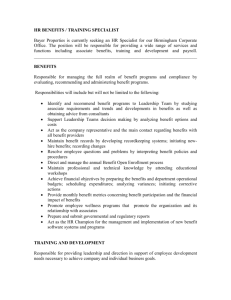

DEPARTMENT OF HIGHER

EDUCATION AND TRAINING

COLLEGE INDUCTION:

FINANCE MANAGEMENT

2015

FINANCE

Discussion Points

• BAS codes and budgets

• Financial delegations

• Flow chart for requests on Salary Related Matters

• Insurance deductions, tax deductions, court orders, salary advices, unions, medical aid and incorrect bank accounts

• Policy on payroll management, certification and pay roll distribution

• Claims and claims procedure (Travel and subsistence and CET lecturers)

• Sundry payments for CET’s

3

BAS CODES AND BUDGETS

• BAS responsibility and objective codes were created ( Annexure A )

• Budgets were allocated by VCET branch and were communicated to the relevant responsibility managers

• Cost containment measures were communicated through Financial

Circular 7 of 2015.

• Monthly cash flow statements will be issued to the VCET branch for further distribution

• SCM processes and procedures should be followed at all times when goods and services are procured

4

Financial Delegations

• In terms of the current Financial Delegations for the Department – all payments must be authorised by the relevant Responsibility

Manager (Chief Director/Director/Highest Rank Official)

• Specimen signatures was requested for all responsibility managers for audit purposes. There are however still a few outstanding. Emails were send to the relevant staff to complete the relevant document.

5

FLOW CHART FOR REQUESTS ON SALARY

RELATED MATTERS

• Office/centre send request through to Responsibility Manager of that office

• Different requests to be submitted as follows as from 1 November 2015:

• Travel and subsistence claims approved by the relevant responsibility manager:

• Original document with all supporting documents submitted for attention Ms E Ndala.

• Travel and subsistence claim form to be used ( Annexure B )

• Petrol claim form for SMS members only ( Annexure C )

• CET Lecturer claims (KZN and Western Cape)

• Claim form to be used ( Annexure D )

• Request regional offices/districts to submit a list of claims that are submitted to Head Office electronically by indicating the information as per Annexure E . The list must be submitted together with the claims in hard copy and should be emailed to the following email address: naude.s@dhet.gov.za

.

• Original CET lecturer claims should be submitted to Ms T Lefifi.

6

FLOW CHART FOR REQUESTS ON SALARY

RELATED MATTERS (Continue)

• Change of bank details of officials

• Bank form ( Annexure F ) for officials should be stamped and signed by the relevant bank of that official and should be submitted to Ms Z Khoza, email to khoza.z@dhet.gov.za

(Original document should follow when emailed).

• Please note that there are specific dates on which the system is closing for the next payment and these changes to bank accounts should reach Head Office five working days before that closing date to prevent salaries not to be paid out. Please see

Annexure G for closing dates.

• Garnishee, Termination of Insurance and Instate of Unions, standby allowances, overtime.

• Original documentation to be submitted for attention Ms V

Masingi at masingi.v@dhet.gov.za

• Termination, salary increases, service bonus payments, etc. should be directed to HR.

7

FLOW CHART FOR REQUESTS ON SALARY

RELATED MATTERS (Continue)

• Pay roll management

• Pay roll enquiries, pay sheet authorisation and pay point matters to be submitted to Mr S Sefula, email: sefula.s@dhet.gov.za

• Upon resignation of a staff member please forward the letter to HR and cc to sefula.s@dhet.gov.za

ALTHOUGH EMAILS WILL BE ACCEPTED – ORIGINAL DOCUMENTS

MUST BE SUBMITTED TO THE DIRECTORATE: FINANCIAL

SERVICES ACCEPT WHERE OTHERWISE STATED IN THE POLICY.

8

INSURANCE DEDUCTIONS, TAX DEDUCTIONS, COURT ORDERS AND

SALARY ADVICES: ACTUAL STATUS

• With the transfers not all deductions transferred according to what was expected.

Matters were addressed as far as possible and is still receiving attention where not yet resolved.

• Many bank accounts did not match the information supplied and that resulted in nonpayment

– ongoing process to rectify this.

9

Policy on payroll management and certification

•

Financial Circular 6 indicated challenges with pay roll distribution that was as a result of data ended up in a dummy file. This created many errors which is currently receiving attention. It was however, indicated that the Department requires a four month period to fix this. However, to date 70% have been corrected and it is projected that by end of October 2015, 95% of the challenges would have been addressed.

• Payroll certificates and pay slips will be couriered by the Directorate: Financial

Services to the various pay-points in the regions, once every month.

• All payroll certificates will be forwarded electronically to responsibility managers in the regions/districts to:

• ensure that a copy of the payroll certificate is certified by the regional manager confirming that all officials on this certificate are entitled to payment and that the information on the certificate is correct

• Indicate any change, amendment or incorrect information, with the pay date as the date certified.

10

Policy on payroll management and certification (Continue)

• This certified document :

• must be kept in a separate file for audit purposes at the office of the responsible manager who certified this documentation.

• a copy of this payroll certificate (with responsible manager’s certification) must be scanned/faxed to the Directorate: Financial Services within 5 days after date of payment (certification date) by means of e-mail or fax.

• Upon receipt of original pay sheets and payroll certificate, responsibility managers in the regions must:

• ensure that the various staff members in the relevant pay-point receives and signs next to their names for their pay slips on the original payroll certificate.

• Once again certify with the pay date used as the date certified.

• Keep the signed off document on file for audit purposes

• Scanned/fax the signed off payroll within 10 days after receiving the salary advices by means of e-mail or fax to the Directorate: Financial Services

11

Policy on payroll management and certification (Continue)

•

Risk of not signing for pay sheets and not certifying payroll certificates

• No signature/reason as to why a person have not signed is provided on the payroll certificate next to name of officials receiving pay sheets – if no signature/reason is appearing for two consecutive months – salary will be terminated on PERSAL for that specific person

• Pay sheets not submitted on time to Directorate: Financial Services – information will be reported to CFO.

• Pay slip distribution to date and signing of pay sheets

• Not all sections is adhering to this requirement

• This matter needs urgent attention and should be attended to with immediate effect.

• Currently pay points will remain intact until unresolved matters have been cleared

• Reason for having the relevant pay points – is for control purposes – managers should manage.

12

SUNDRY PAYMENTS

• Bank details: Bank entity maintenance form

(Annexure H) needs to be completed and submitted for all new sundry payment suppliers. It should be stamped by the relevant bank.

• Sundry payments for CET’s:

• Municipal services: Invoice and sundry payment signed by the relevant responsibility manager

• Goods and services:

• R0 – R2000: One quotation to be attached to the payment

• R2001 – R30 000: Three quotations to be attached to the payment

• Contracts to be attached where applicable.

13

Thank You

14