Chapter 3: Fixed-income securities

advertisement

Fixed-income securities

Bond pricing formula

P = C { [ 1 – 1 / (1 + i)N ] / i } + FV / (1 + i)N .

FV is the face (par) value of the bond.

C is coupon payment.

i is the period discount rate.

If coupons are paid out annually, i = YTM. If coupons are paid

out semiannually, i = YTM/2.

N is the number of periods remaining.

The first term, C { [ 1 – 1 / (1 + i)N ] / i }, is the present value of

coupon payments, i.e., an annuity.

The second term, FV / (1 + i)N, is the present value of the par.

Yield (yield to maturity, YTM)

The (quoted, stated) discount rate over a

year.

YTM, like other discount rates, has 2

components: (1) risk-free component, and (2)

risk premium.

Determined by the market.

Time-varying.

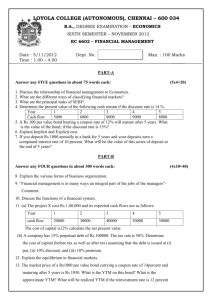

Bond pricing example, I

Suppose that you purchase on May 8 this year a Tbond matures on August 15 in 2 years. The coupon

rate is 9%. Coupon payments are made every

February 15 and August 15. That is, there are still 5

coupon payments to be collected: August this year, 2

payments next year, and 2 payments the year after

next year. The par is $1,000. The YTM is 10%.

What is the fair price of the bond?

Bond pricing example, II

08/15/Y0

02/15/Y1

08/15/Y1

02/15/Y2

08/15/Y2

Bond Quotation

Accrued Interest

20.52197802

Actual Payment

998.8745947

Cash flow

45

45

45

45

1045

Discount rate

0.05

PV

42.85714

40.81633

38.87269

37.02161

818.7848

978.3526

coupon payment * (days since last payment /

days in this period)

% Par

99.88745947

Bond pricing example, III

Calculator: 45 PMT; 1000 FV; 5 N; 5 I/Y;

CPT PV. The answer is: PV = -978.3526.

Bond quotations ignore accrued interest.

Bond buyer will pay quoted price

($978.3526) and accrued interest

($20.5220), a total of $998.8746, to the

seller.

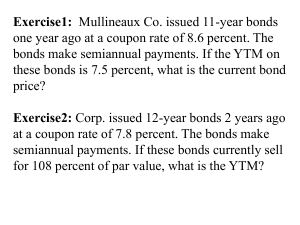

YTM example

Northern Inc. issued 12-year bonds 2 years

ago at a coupon rate of 8.4%. The

semiannual-payment bonds have just make

its coupon payments. If these bonds

currently sell for 110% of par value, what is

the YTM?

Calculator: 42 PMT; 1000 FV; 20 N; -1100

PV; CPT I/Y. The answer is: I/Y = 3.4966.

YTM = 2 × 3.4966 = 6.9932 (%).

A few observations

Bond price is a function of (1) YTM, (2) coupon (rate), and (3)

maturity.

The YTMs of various bonds move more or less in harmony

because the general interest rate environment (e.g., Fed

policies) exerts a market-wide force on every bonds (that is, the

risk-free component).

As YTMs move (in harmony), bond prices move by different

amounts.

The reason for this is that every bond has its unique coupon

(rate) and maturity specification.

It is therefore useful to study price-yield curves for different

coupon rates or different maturities.

Price-yield curves and coupon rates

Negative slopes: price and YTM have an

inverse relation.

When people say “the bond market went

down,” they mean prices are down, but

interest rates (yields, YTMs) are up.

When coupon rate = YTM, the bond has a

price of 100%.

Price-yield curves and maturity

Everything else being equal, bonds with

longer maturities have steeper price-yield

curves.

That is, the prices of long bonds are more

sensitive to interest rate changes, i.e., higher

interest rate risk.

Assignment

Use Excel to duplicate both Figure 3.3 and

3.4.

Due in a week.

Relative performance vs. a benchmark

Suppose that you are a bond manager and your

(your company’s) goal is to have good relative

performance with respect to a 20-year bond index.

After studying the interest rate environment, you

believe that interest rates will fall in the near future

(and your belief is not widely shared by investors

yet). Should you have a bond portfolio that has an

average maturity longer or shorter than 20 years?

What if you believe interest rates will rise in the near

future?