Cyclone, Inc. reports the following liabilities (in thousands) on its

advertisement

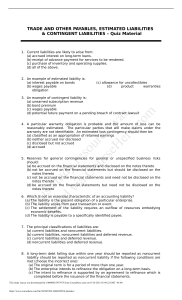

Cyclone, Inc. reports the following liabilities (in thousands) on its January 31, 2007, balance sheet and notes to the financial statements. Accounts Payable $3,263.9 Accrued pension liability 1,215.2 Accrued liabilities 1258.1 Bonds payable 1961.2 current portion of long-term debt 1992.2 income taxes payable 235.2 notes payable--long-term $5746.7 operating leases 1641.7 loans payable--long term 335.6 payroll-related liabilities 558.1 short-term borrowings 2563.6 unused operating line of credit 3337.6 warranty liability--current 1417.3 (a)Identify which of the above liabilities are likely current and which are likely long-term. say if an item fits in neither category. Explain the reasoning for you selection. Current liability (to be paid within one year) Accounts Payable $3,263.9 Accrued liabilities 1258.1 current portion of long-term debt 1992.2 income taxes payable 235.2 payroll-related liabilities 558.1 short-term borrowings 2563.6 warranty liability--current 1417.3 Long term (to be paid after one year) Accrued pension liability 1,215.2 paid after one year) Bonds payable 1961.2 (a deferred liability as the time period is not known, normally are notes payable--long-term $5746.7 loans payable--long term 335.6 Neither current nor long term, not a liability just an information as the even has not taken place or the period has not arrived, they are Operating lease Unused line of credit. (B) prepare the liabilities section of Cyclone's balance sheet as at January 31, 2007 Liabilities Current liability Accounts Payable Accrued liabilities current portion of long-term debt $3,263.9 1258.1 1992.2 income taxes payable 235.2 payroll-related liabilities 558.1 short-term borrowings 2563.6 warranty liability—current 1417.3 Total current liabiliteies ` 11288.7 Long term Accrued pension liability 1,215.2 Bonds payable 1961.2 notes payable--long-term $5746.7 loans payable--long term 335.6 Total long term liabilities 9258.7 Total liabilities 20547.1 Contingencies and commitments 0 (operating lease to be shown as footnote) 13-10 Selected comparative statement data for the giant bookseller Barnes & Noble are presented here. All balance sheet data are as of December 31 (in millions). 2004 and 2003 Net Sales $4873.6 $5951.0 Cost of goods sold 3386.6 4323.8 Net income 143.3 151.9 Accounts Receivable 74.6 60.5 Inventory 1274.6 1526.1 Total assets 3301.5 3507.3 Total Common Stockholders equity 1165.9 1259.7 Instructions Compute the following ratios for 2004. profit margin = asset turnover = return on assets= 143.3/4873.6 = 2.94% 4873.6/3301.5+3507.3/2 =4873.6/3404.4 = 1.43 times 143.3/3404.4 = 4.21% return on common stockholder's equity = Gross profit rate = 143.3/1165.9+1259.7/2 = 143.3/1212.8 = 11.82% 4873.6-3386.6/4873.6 = 30.51%