5. Reporting and Analyzing inventories

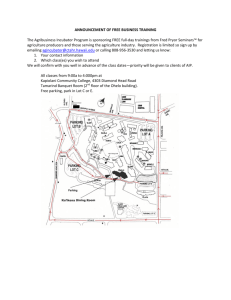

advertisement

Chapter 5 Reporting and Analyzing Inventories McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008 5-2 Conceptual Chapter Objectives C1: Identify the items making up merchandise inventory C2: Identify the costs of merchandise inventory McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008 5-3 Analytical Chapter Objectives A1: Analyze the effects of inventory methods for both financial and tax reporting A2: Analyze the effects of inventory errors on current and future financial statements A3: Assess inventory management using both inventory turnover and days’ sales in inventory McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008 5-4 Procedural Chapter Objectives P1: Compute inventory in a perpetual system using the methods of specific identification, FIFO, LIFO, and weighted average P2: Compute the lower of cost or market amount of inventory P3: Appendix 6A: Compute inventory in a periodic system using the methods of specific identification, FIFO, LIFO, and weighted average P4: Appendix 6B: Apply both the retail inventory and gross profit methods to estimate inventory. McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008 5-5 C1 Determining Inventory Items Merchandise inventory includes all goods that a company owns and holds for sale, regardless of where the goods are located when inventory is counted. Items requiring special attention include: Goods in Transit McGraw-Hill/Irwin Goods on Consignment Goods Damaged or Obsolete © The McGraw-Hill Companies, Inc., 2008 5-6 C1 Goods in Transit FOB Shipping Point Public Carrier Seller Buyer Ownership passes to the buyer here. Public Carrier Seller McGraw-Hill/Irwin FOB Destination Point Buyer © The McGraw-Hill Companies, Inc., 2008 5-7 C1 Goods on Consignment Merchandise is included in the inventory of the consignor, the owner of the inventory. Consignee Thanks for selling my inventory in your store. Consignor McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008 5-8 C1 Goods Damaged or Obsolete Damaged or obsolete goods are not counted in inventory if they cannot be sold. Cost should be reduced to net realizable value if they can be sold. McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008 5-9 C2 Determining Inventory Costs Include all expenditures necessary to bring an item to a salable condition and location. Minus Discounts and Allowances Plus Import Duties McGraw-Hill/Irwin Invoice Cost Plus Freight Plus Insurance Plus Storage © The McGraw-Hill Companies, Inc., 2008 5-10 C2 Internal Controls and Taking a Physical Count Most companies take a physical count of inventory at least once each year. When the physical count does not match the Merchandise Inventory account, an adjustment must be made. McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008 5-11 P1 Inventory Costing Under a Perpetual System Inventory affects . . . Balance Sheet Income Statement The matching principle requires matching cost of sales with sales. McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008 5-12 P1 Inventory Costing Under a Perpetual System Accounting for inventory requires several decisions . . . Costing Method Specific Identification, FIFO, LIFO, or Weighted Average Inventory System Perpetual or Periodic McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008 P1 Frequency in Use of Inventory Methods 5-13 FIFO 46% LIFO 30% Weighted Average 20% McGraw-Hill/Irwin Other 4% © The McGraw-Hill Companies, Inc., 2008 Inventory Cost Flow Assumptions P1 5-14 First-In, First-Out (FIFO) Assumes costs flow in the order incurred. Last-In, First-Out (LIFO) Assumes costs flow in the reverse order incurred. Weighted Average Assumes costs flow at an average of the costs available. McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008 5-15 P1 Inventory Costing Illustration Cost of Goods Available Aug. 1 Beg. Inventory Aug. 3 Purchased Aug. 17 Purchased Aug. 28 Purchased for Sale 10 units 15 units 20 units 10 units = = = = $ 910 $ 1,590 $ 2,300 $ 1,190 Retail Sales of Goods Aug. 14 Sales Aug. 31 Sales 20 units @ $ 130 = 23 units @ $ 150 = $ 2,600 $ 3,450 McGraw-Hill/Irwin @ @ @ @ $ $ $ $ 91 106 115 119 © The McGraw-Hill Companies, Inc., 2008 5-16 P1 Specific Identification When units are sold, the specific cost of the unit sold is added to cost of goods sold. McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008 5-17 P1 Date Aug. 1 Aug. 3 Aug. 14 Aug. 17 Aug. 28 Aug. 31 Specific Identification Purchases 10 @ $ 91 = 15 @ $ 106 = Cost of Goods Sold $ 910 $ 1,590 8 @ 20 @ $ 115 = 10 @ $ 119 = $ 91 = $ 728 12 @purchases $ 106 = $ were 1,272 $ 500 The above $ 2,300 $ 2,800 made in August. On August 14, $ 1,190 $ 3,990 a company eight 2 @ sold $ 91 = $bikes 182 @ $ 106 $91 = $and 31812 originally3 costing 14 @ $ 115 = $ 1,610 bikes originally costing $106. 4 @ McGraw-Hill/Irwin Inventory Balance $ 910 $ 2,500 $ 119 = $ 476 $ 1,404 © The McGraw-Hill Companies, Inc., 2008 5-18 P1 Date Aug. 1 Aug. 3 Aug. 14 Aug. 17 Aug. 28 Aug. 31 Specific Identification Purchases Cost of Goods Sold 10 @ $ 91 = $ 910 15 @ $ 106 = $ 1,590 8 @ $ 91 = $ Inventory Balance $ 910 $ 2,500 728 The Cost of Goods Sold12for@the$August 106 = 14$sale 1,272 $ $2,000. 20 is@ $ 115 = $ 2,300 $ 10 @ $ 119 = $@1,190 $ 8 bikes 91 = $ 728 $ 91 = $ 182 12 bikes @ 106 =2 @ $1,272 3 @ $ 106 = $ 500 2,800 3,990 318 After this sale, there are five units in inventory 14 @ $ 115 = $ 1,610 at $500: 2 bikes @ $91 = $ 182 3 bikes @ $106 = $ 318 McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008 5-19 P1 Specific Identification Date Aug. 1 Aug. 3 Aug. 14 Purchases Inventory Balance $ 910 $ 2,500 Cost of Goods Sold 10 @ $ 91 = $ 910 15 @ $ 106 = $ 1,590 8 @ $ 91 = $ 728 12 @ $ 106 = $ 1,272 Aug. 17 20 @ $ 115 = $ 2,300 Aug. 28 10 @ $ 119 = $ 1,190 Aug. 31 2 @ $ 91 = $ 182 Additional purchases were made3 on@August $ 106 17 = and $ 28. 318 $ 500 $ 2,800 $ 3,990 14 @ 31 $ were 115 =as follows: $ 1,610 The cost of the 23 items sold on August 2 @ $91 4 @ $ 119 = $ 476 $ 1,404 3 @ $106 15 @ $115 3 @ $119 McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008 5-20 P1 Date Aug. 1 Aug. 3 Aug. 14 Aug. 17 Aug. 28 Aug. 31 Specific Identification Purchases Inventory Balance $ 910 $ 2,500 Cost of Goods Sold 10 @ $ 91 = $ 910 15 @ $ 106 = $ 1,590 20 @ $ 115 = $ 2,300 10 @ $ 119 = $ 1,190 8 @ $ 91 = $ 728 12 @ $ 106 = $ 1,272 2 @ $ 91 = $ 182 3 @ $ 106 = $ 318 15 @ $ 115 = $ 1,725 3 @ $ 119 = $ 357 $ 500 $ 2,800 $ 3,990 $ 1,408 Cost of Goods Sold for August 31 = $2,582 McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008 5-21 P1 Date Aug. 1 Aug. 3 Aug. 14 Aug. 17 Aug. 28 Aug. 31 Specific Identification Purchases Inventory Balance $ 910 $ 2,500 Cost of Goods Sold 10 @ $ 91 = $ 910 15 @ $ 106 = $ 1,590 20 @ $ 115 = $ 2,300 10 @ $ 119 = $ 1,190 After the August 31 sale, there are 12 units in inventory at $1,408: 5 @ $115 7 @ $119 McGraw-Hill/Irwin 8 @ $ 91 = $ 728 12 @ $ 106 = $ 1,272 2 @ $ 91 = $ 182 3 @ $ 106 = $ 318 15 @ $ 115 = $ 1,725 3 @ $ 119 = $ 357 $ 500 $ 2,800 $ 3,990 $ 1,408 © The McGraw-Hill Companies, Inc., 2008 5-22 P1 Specific Identification Date Aug. 1 Aug. 3 Aug. 14 Purchases @ $ 91 = $ 15 @ $ 106 = $ 1,590 = $4,582 McGraw-Hill/Irwin Cost of Goods Sold 10 Aug. 17 20 @ $ 115 = Aug. 28Income 10 @ $ 119 = Statement COGS Aug. 31 Inventory Balance $ 910 $ 2,500 910 8 @ $ 91 = $ 728 12 @ $ 106 = $ 1,272 2 @ $ 91 = $ 182 3 @ $ 106 = $ 318 15 @ $ 115 = $ 1,725 3 @ $ 119 = $ $ 2,300 $ 1,190 357 $ 500 $ 2,800 $ 3,990 $ 1,408 Balance Sheet Inventory = $1,408 © The McGraw-Hill Companies, Inc., 2008 5-23 P1 Specific Identification Here are the entries to record the purchases and sales. The numbers in red are determined by the cost flow assumption used. All purchases and sales are made on credit. The selling price of inventory was as follows: 8/14 $130 8/31 150 McGraw-Hill/Irwin Aug. 3 Aug. 14 Aug. 14 Aug. 17 Aug. 28 Aug. 31 Aug. 31 Merchandise inventory 1,590 Accounts payable 1,590 Accounts receivable 2,600 Sales 2,600 Cost of goods sold 2,000 Merchandise inventory 2,000 Merchandise inventory 2,300 Accounts payable 2,300 Merchandise inventory 1,190 Accounts payable 1,190 Accounts receivable 3,450 Sales 3,450 Cost of goods sold 2,582 Merchandise inventory 2,582 © The McGraw-Hill Companies, Inc., 2008 5-24 P1 First-In, First-Out (FIFO) Oldest Costs Cost of Goods Sold Recent Costs Ending Inventory McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008 5-25 P1 Date Aug. 1 Aug. 3 First-In, First-Out (FIFO) Purchases Inventory Balance $ 910 $ 2,500 Cost of Goods Sold 10 @ $ 91 = $ 910 15 @ $ 106 = $ 1,590 Aug. 17 20 @ $ 115 = $ 2,300 The28above Aug. 10 @ purchases $ 119 = $ 1,190were Aug. 31 in August. 5 @ made 18 @ $ 2,300 $ 3,490 $ 106 = $ 530 $ 115 = $ 2,070 $ 890 On August 14, the company sold 20 bikes. McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008 5-26 P1 Date Aug. 1 Aug. 3 Aug. 14 Aug. 17 Aug. 28 Aug. 31 First-In, First-Out (FIFO) Purchases Cost of Goods Sold 10 @ $ 91 = $ 15 @ $ 106 = $ 1,590 20 @ $ 115 = Inventory Balance $ 910 $ 2,500 910 10 @ $ 91 = $ 910 10 @ $ 106 = $ 1,060 $ 2,300 The Sold for the 10 @Cost $ 119 of = Goods $ 1,190 5 @ $ 106 = August 14 sale is $1,970. 18 @ $ 115 = $ $ 530 $ 2,830 $ 4,020 530 $ 2,070 $ 1,420 After this sale, there are five units in inventory at $530: 5 @ $106 McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008 5-27 P1 Date Aug. 1 Aug. 3 Aug. 14 Aug. 17 Aug. 28 Aug. 31 First-In, First-Out (FIFO) Purchases Inventory Balance $ 910 $ 2,500 Cost of Goods Sold 10 @ $ 91 = $ 910 15 @ $ 106 = $ 1,590 20 @ $ 115 = $ 2,300 10 @ $ 119 = $ 1,190 10 @ $ 91 = $ 910 10 @ $ 106 = $ 1,060 5 @ $ 106 = $ 18 @ $ 115 = $ 2,070 $ 530 $ 2,830 $ 4,020 530 $ 1,420 Additional purchases were made on August 17 and 28. Twenty-three bikes were sold on August 31. McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008 5-28 P1 Date Aug. 1 Aug. 3 Aug. 14 Aug. 17 Aug. 28 Aug. 31 First-In, First-Out (FIFO) Purchases Inventory Balance $ 910 $ 2,500 Cost of Goods Sold 10 @ $ 91 = $ 910 15 @ $ 106 = $ 1,590 20 @ $ 115 = $ 2,300 10 @ $ 119 = $ 1,190 10 @ $ 91 = $ 910 10 @ $ 106 = $ 1,060 5 @ $ 106 = $ 18 @ $ 115 = $ 2,070 $ 530 $ 2,830 $ 4,020 530 $ 1,420 Cost of Goods Sold for August 31 = $2,600 McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008 5-29 P1 Date Aug. 1 Aug. 3 Aug. 14 Aug. 17 Aug. 28 Aug. 31 First-In, First-Out (FIFO) Purchases Inventory Balance $ 910 $ 2,500 Cost of Goods Sold 10 @ $ 91 = $ 910 15 @ $ 106 = $ 1,590 20 @ $ 115 = $ 2,300 10 @ $ 119 = $ 1,190 10 @ $ 91 = $ 910 10 @ $ 106 = $ 1,060 5 @ $ 106 = $ 18 @ $ 115 = $ 2,070 $ 530 $ 2,830 $ 4,020 530 $ 1,420 After the August 31 sale, there are 12 units in inventory at $1,420: 2 @ $115 10 @ $119 McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008 5-30 P1 Date Aug. 1 Aug. 3 Aug. 14 First-In, First-Out (FIFO) Purchases Aug. 31 Cost of Goods Sold 10 @ $ 91 = $ 15 @ $ 106 = $ 1,590 Income Statement Aug. 17 20 @ $ 115 = Aug. 28 10 @ $ 119 = COGS = $4,570 Inventory Balance $ 910 $ 2,500 910 10 @ $ 91 = $ 910 10 @ $ 106 = $ 1,060 5 @ $ 106 = $ 18 @ $ 115 = $ 2,070 $ 2,300 $ 1,190 $ 530 $ 2,830 $ 4,020 530 $ 1,420 Balance Sheet Inventory = $1,420 McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008 5-31 P1 First-In, First-Out (FIFO) Here are the entries to record the purchases and sales entries. The numbers in red are determined by the cost flow assumption used. All purchases and sales are made on credit. The selling price of inventory was as follows: 8/14 $130 8/31 150 McGraw-Hill/Irwin Aug. 3 Aug. 14 Aug. 14 Aug. 17 Aug. 28 Aug. 31 Aug. 31 Merchandise inventory 1,590 Accounts payable 1,590 Accounts receivable 2,600 Sales 2,600 Cost of goods sold 1,970 Merchandise inventory 1,970 Merchandise inventory 2,300 Accounts payable 2,300 Merchandise inventory 1,190 Accounts payable 1,190 Accounts receivable 3,450 Sales 3,450 Cost of goods sold 2,600 Merchandise inventory 2,600 © The McGraw-Hill Companies, Inc., 2008 5-32 P1 Last-In, First-Out (LIFO) Recent Costs Cost of Goods Sold Oldest Costs Ending Inventory McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008 5-33 P1 Date Aug. 1 Aug. 3 Aug. 14 Last-In, First-Out (LIFO) Purchases Inventory Balance $ 910 $ 2,500 Cost of Goods Sold 10 @ $ 91 = $ 910 15 @ $ 106 = $ 1,590 15 @ $ 106 = $ 1,590 5 @ $ 91 = $ Aug. 20 @ $ 115 = $ 2,300 The17above purchases were Aug. 28 10 @ $ 119 = $ 1,190 made Aug. 31 in August. 10 @ $ 119 = $ 1,190 $ 115 = $ 1,495 13 @ On August 14, the company sold 20 bikes. McGraw-Hill/Irwin 455 $ 455 $ 2,755 $ 3,945 $ 1,260 © The McGraw-Hill Companies, Inc., 2008 5-34 P1 Date Aug. 1 Aug. 3 Aug. 14 Aug. 17 Aug. 28 Aug. 31 Last-In, First-Out (LIFO) Purchases Cost of Goods Sold 10 @ $ 91 = $ 15 @ $ 106 = $ 1,590 20 10 Inventory Balance $ 910 $ 2,500 910 15 @ $ 106 = $ 1,590 5 @ $ 91 = $ 455 @ $ 115 = $ 2,300 The Cost of Goods Sold for the @ $ 119 = $ 1,190 August 14 sale is $$2,045. 10 @ 119 = $ 1,190 13 @ $ 115 = $ 1,495 After this sale, there are five units in inventory at $455: 5 @ $91 McGraw-Hill/Irwin $ 455 $ 2,755 $ 3,945 $ 1,260 © The McGraw-Hill Companies, Inc., 2008 5-35 P1 Date Aug. 1 Aug. 3 Aug. 14 Last-In, First-Out (LIFO) Purchases 10 @ $ 91 = 15 @ $ 106 = Cost of Goods Sold $ 910 $ 1,590 15 @ 5 @ Aug. 17 Aug. 28 Aug. 31 Inventory Balance $ 910 $ 2,500 20 @ $ 115 = $ 2,300 10 @ $ 119 = $ 1,190 10 @ $ 106 = $ 1,590 $ $ 91 = $ 119 = 455 $ 455 $ 2,755 $ 3,945 $ 1,190 13 @on$ August 115 = $ Additional purchases were made 171,495 and $28.1,260 Twenty-three bikes were sold on August 31. McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008 5-36 P1 Date Aug. 1 Aug. 3 Aug. 14 Aug. 17 Aug. 28 Aug. 31 Last-In, First-Out (LIFO) Purchases Inventory Balance $ 910 $ 2,500 Cost of Goods Sold 10 @ $ 91 = $ 910 15 @ $ 106 = $ 1,590 20 @ $ 115 = $ 2,300 10 @ $ 119 = $ 1,190 15 @ $ 106 = $ 1,590 5 @ $ 91 = $ 10 @ $ 119 = $ 1,190 13 @ $ 115 = $ 1,495 455 $ 455 $ 2,755 $ 3,945 $ 1,260 Cost of Goods Sold for August 31 = $2,685 McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008 5-37 P1 Date Aug. 1 Aug. 3 Aug. 14 Aug. 17 Aug. 28 Aug. 31 Last-In, First-Out (LIFO) Purchases Inventory Balance $ 910 $ 2,500 Cost of Goods Sold 10 @ $ 91 = $ 910 15 @ $ 106 = $ 1,590 20 @ $ 115 = $ 2,300 10 @ $ 119 = $ 1,190 15 @ $ 106 = $ 1,590 5 @ $ 91 = $ 10 @ $ 119 = $ 1,190 13 @ $ 115 = $ 1,495 455 $ 455 $ 2,755 $ 3,945 $ 1,260 After the August 31 sale, there are 12 units in inventory at $1,260: 5 @ $91 7 @ $115 McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008 5-38 P1 Date Aug. 1 Aug. 3 Aug. 14 Last-In, First-Out (LIFO) Purchases Cost of Goods Sold 10 @ $ 91 = $ 15 @ $ 106 = $ 1,590 Aug. 17Income 20 @ $ 115 = Statement Aug. 28 10 @COGS $ 119 = = $4,730 Aug. 31 Inventory Balance $ 910 $ 2,500 910 15 @ $ 106 = $ 1,590 5 @ $ 91 = $ 10 @ $ 119 = $ 1,190 13 @ $ 115 = $ 1,495 455 $ 2,300 $ 1,190 $ 455 $ 2,755 $ 3,945 $ 1,260 Balance Sheet Inventory = $1,260 McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008 5-39 P1 Last-In, First-Out (LIFO) Here are the entries to record the purchases and sales entries. The numbers in red are determined by the cost flow assumption used. All purchases and sales are made on credit. The selling price of inventory was as follows: 8/14 $130 8/31 150 McGraw-Hill/Irwin Aug. 3 Aug. 14 Aug. 14 Aug. 17 Aug. 28 Aug. 31 Aug. 31 Merchandise inventory 1,590 Accounts payable 1,590 Accounts receivable 2,600 Sales 2,600 Cost of goods sold 2,045 Merchandise inventory 2,045 Merchandise inventory 2,300 Accounts payable 2,300 Merchandise inventory 1,190 Accounts payable 1,190 Accounts receivable 3,450 Sales 3,450 Cost of goods sold 2,685 Merchandise inventory 2,685 © The McGraw-Hill Companies, Inc., 2008 5-40 P1 Weighted Average When a unit is sold, the average cost of each unit in inventory is assigned to cost of goods sold. Cost of Goods Units on hand Available for ÷ on the date of Sale sale McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008 5-41 P1 Weighted Average Date Purchases Cost of Goods Sold Aug. 1 10 @ $ 91 = $ 910 Aug. 3 15 @ $ 106 = $ 1,590 Aug. 14 20 @ $ 100 = $ 2,000 Aug. 17 20 @ $ 115 = $ 2,300 Aug. 28 above 10 @ $purchases 119 = $ 1,190were The Aug. 31 in August. 23 @ $ 114 = $ 2,622 made Inventory Balance $ 910 $ 2,500 $ 500 $ 2,800 $ 3,990 $ 1,368 On August 14, 20 bikes were sold. McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008 5-42 P1 Date Aug. 1 Aug. 3 Aug. 14 Aug. 17 Aug. 28 Aug. 31 Weighted Average 10 15 20 10 Inventory Balance Purchases Cost of Goods Sold @ $ 91 = $ 910 $ 910 @ $ 106 = $ 1,590 $ 2,500 20 @ $ 100 = $ 2,000 $ 500 @ First, $ 115 we = $need 2,300to compute the weighted $ 2,800 @ average $ 119 = cost $ 1,190 per unit of items in inventory. $ 3,990 23 @ $ 114 = $ 2,622 $ 1,368 Cost of goods available for sale Total units in inventory Weighted average cost per unit McGraw-Hill/Irwin $ $ ÷ 2,500 25 100 © The McGraw-Hill Companies, Inc., 2008 5-43 P1 Date Aug. 1 Aug. 3 Aug. 14 Aug. 17 Aug. 28 Aug. 31 Weighted Average Inventory Balance Purchases Cost of Goods Sold 10 @ $ 91 = $ 910 $ 910 15 @ $ 106 = $ 1,590 $ 2,500 20 @ $ 100 = $ 2,000 $ 500 20 @ $ 115 = $ 2,300 $ 2,800 10 $ 119 $ 1,190Sold for the August 14 $ 3,990 The@Cost of =Goods 23 @ $ 114 = $ 2,622 $ 1,368 sale is $2,000. After this sale, there are five units in inventory at $500: McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008 5-44 P1 Date Aug. 1 Aug. 3 Aug. 14 Aug. 17 Aug. 28 Aug. 31 Weighted Average Purchases Cost of Goods Sold 10 @ $ 91 = $ 910 15 @ $ 106 = $ 1,590 20 @ 20 @ $ 115 = $ 2,300 10 @ $ 119 = $ 1,190 $ 100 = $ 2,000 Inventory Balance $ 910 $ 2,500 $ 500 $ 2,800 $ 3,990 $ 1,368 23 @ $ 114 = $ 2,622 Additional purchases were made on August 17 and 28. Twenty-three bikes were sold on August 31. What is the weighted average cost per unit of items in inventory? McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008 5-45 P1 Date Aug. 1 Aug. 3 Aug. 14 Aug. 17 Aug. 28 Aug. 31 Weighted Average Purchases 10 @ $ 91 = $ 910 15 @ $ 106 = $ 1,590 20 @ $ 115 = $ 2,300 10 @ $ 119 = $ 1,190 Units Inventory 8/14 5 Purchase 8/17 20 Purchase 8/28 10 Units available for sale 35 McGraw-Hill/Irwin Cost of Goods Sold 20 @ $ 100 = $ 2,000 23 @ $ 114 = $ 2,622 Cost of goods available for sale Total units in inventory Weighted average cost per unit Inventory Balance $ 910 $ 2,500 $ 500 $ 2,800 $ 3,990 $ 1,368 $ 3,990 ÷ 35 $ 114 © The McGraw-Hill Companies, Inc., 2008 5-46 P1 Date Aug. 1 Aug. 3 Aug. 14 Aug. 17 Aug. 28 Aug. 31 Weighted Average Purchases 10 @ $ 91 = $ 910 15 @ $ 106 = $ 1,590 20 @ $ 115 = $ 2,300 10 @ $ 119 = $ 1,190 Inventory Balance Cost of Goods Sold $ 910 $ 2,500 20 @ $ 100 = $ 2,000 $ 500 $ 2,800 $ 3,990 23 @ $ 114 = $ 2,622 $ 1,368 Cost of Goods Sold for August 31 = $2,622 McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008 5-47 P1 Date Aug. 1 Aug. 3 Aug. 14 Aug. 17 Aug. 28 Aug. 31 Weighted Average Purchases 10 @ $ 91 = $ 910 15 @ $ 106 = $ 1,590 20 @ $ 115 = $ 2,300 10 @ $ 119 = $ 1,190 Inventory Balance Cost of Goods Sold $ 910 $ 2,500 20 @ $ 100 = $ 2,000 $ 500 $ 2,800 $ 3,990 23 @ $ 114 = $ 2,622 $ 1,368 After the August 31 sale, there are 12 units in inventory at $1,368: 12 @ $114 McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008 5-48 P1 Weighted Average Date Purchases Aug. 1 10 @ $ 91 = Aug. 3 15 @ $ 106 = Aug. 14 Aug. 17 Income 20 @ $ 115 = Aug.Statement 28 10 @ $COGS 119 = Aug. 31 = $4,622 $ 910 $ 1,590 $ 2,300 $ 1,190 Inventory Balance Cost of Goods Sold $ 910 $ 2,500 20 @ $ 100 = $ 2,000 $ 500 $ 2,800 $ 3,990 23 @ $ 114 = $ 2,622 $ 1,368 Balance Sheet Inventory = $1,368 McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008 5-49 P1 Weighted Average Here are the entries to record the purchases and sales entries for Trekking. The numbers in red are determined by the cost flow assumption used. All purchases and sales are made on credit. The selling price of inventory was as follows: 8/14 $130 8/31 150 McGraw-Hill/Irwin Aug. 3 Aug. 14 Aug. 14 Aug. 17 Aug. 28 Aug. 31 Aug. 31 Merchandise inventory 1,590 Accounts payable 1,590 Accounts receivable 2,600 Sales 2,600 Cost of goods sold 2,000 Merchandise inventory 2,000 Merchandise inventory 2,300 Accounts payable 2,300 Merchandise inventory 1,190 Accounts payable 1,190 Accounts receivable 3,450 Sales 3,450 Cost of goods sold 2,622 Merchandise inventory 2,622 © The McGraw-Hill Companies, Inc., 2008 5-50 A1 Financial Statement Effects of Costing Methods Because prices change, inventory methods nearly always assign different cost amounts. Trekking Company For Month Ended August 31 Specific Identification Sales $ 6,050 Cost of goods sold 4,582 Gross profit $ 1,468 Operating expenses 450 Income before taxes $ 1,018 Income tax expense (30%) 305 Net income $ 713 Balance sheet inventory McGraw-Hill/Irwin $ 1,408 $ FIFO 6,050 4,570 1,480 450 1,030 309 721 $ 1,420 $ $ $ $ $ $ $ LIFO 6,050 4,730 1,320 450 870 261 609 Weighted Average $ 6,050 4,622 $ 1,428 450 $ 978 293 $ 685 $ McGraw-Hill 1,260Companies, $ Inc., 1,368 © The 2008 5-51 A1 Financial Statement Effects of Costing Methods Advantages of Methods Weighted Average First-In, First-Out Last-In, First-Out Smoothes out price changes. Ending inventory approximates current replacement cost. Better matches current costs in cost of goods sold with revenues. McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008 A1 Tax Effects of Costing Methods 5-52 The Internal Revenue Service (IRS) identifies several acceptable methods for inventory costing for reporting taxable income. If LIFO is used for tax purposes, the IRS requires it be used in financial statements. McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008 Consistency in Using Costing Methods A1 5-53 The consistency principle requires a company to use the same accounting methods period after period so that financial statements are comparable across periods. McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008 5-54 P2 Lower of Cost or Market Inventory must be reported at market value when market is lower than cost. Defined as current replacement cost (not sales price). Consistent with the conservatism principle. McGraw-Hill/Irwin Can be applied three ways: (1) (2) (3) separately to each individual item. to major categories of assets. to the whole inventory. © The McGraw-Hill Companies, Inc., 2008 5-55 P2 Lower of Cost or Market A motorsports retailer has the following items in inventory: Per Unit Inventory Items Cycles: Roadster Sprint Category subtotal Off-Road Trax-4 Blazer Category subtotal Total McGraw-Hill/Irwin Units on Hand Cost 20 $ 8,000 10 5,000 8 5 5,000 9,000 Market Total Cost Total Market $ 7,000 6,000 $160,000 50,000 210,000 $ 140,000 60,000 200,000 6,500 7,000 40,000 45,000 85,000 $295,000 52,000 35,000 87,000 $ 287,000 © The McGraw-Hill Companies, Inc., 2008 5-56 P2 Lower of Cost or Market Here is how to compute lower of cost or market for individual inventory items. LCM Applied to Units on Inventory Items Hand Total Cost Cycles: Roadster 20 $ 160,000 Sprint 10 50,000 Category subtotal $ 210,000 $ 140,000 $ 140,000 60,000 50,000 $ 200,000 Off-Road Trax-4 Blazer Category subtotal Total $ 52,000 40,000 35,000 35,000 $ 87,000 $ 287,000 $ 265,000 McGraw-Hill/Irwin 8 5 $ 40,000 45,000 $ 85,000 $ 295,000 Total Market Items Categories Whole © The McGraw-Hill Companies, Inc., 2008 5-57 P2 Lower of Cost or Market Here is how to compute lower of cost or market for the two groups of inventory items. LCM Applied to Units on Inventory Items Hand Total Cost Cycles: Roadster 20 $ 160,000 Sprint 10 50,000 Category subtotal $ 210,000 $ 140,000 $ 140,000 60,000 50,000 $ 200,000 $ 200,000 Off-Road Trax-4 Blazer Category subtotal Total $ 52,000 40,000 35,000 35,000 $ 87,000 $ 287,000 $ 265,000 85,000 $ 285,000 McGraw-Hill/Irwin 8 5 $ 40,000 45,000 $ 85,000 $ 295,000 Total Market Items Categories Whole © The McGraw-Hill Companies, Inc., 2008 5-58 P2 Lower of Cost or Market Here is how to compute lower of cost or market for the entire inventory. LCM Applied to Units on Inventory Items Hand Total Cost Cycles: Roadster 20 $ 160,000 Sprint 10 50,000 Category subtotal $ 210,000 $ 140,000 $ 140,000 60,000 50,000 $ 200,000 $ 200,000 Off-Road Trax-4 Blazer Category subtotal Total $ 52,000 40,000 35,000 35,000 $ 87,000 $ 287,000 $ 265,000 85,000 $ 285,000 McGraw-Hill/Irwin 8 5 $ 40,000 45,000 $ 85,000 $ 295,000 Total Market Items Categories Whole $ 287,000 © The McGraw-Hill Companies, Inc., 2008 Exh. 5-59 A2 Financial Statement Effects of Inventory Errors 5.10 Income Statement Effects Inventory Error Understate ending inventory Understate beginning inventory Overstate ending inventory Overstate beginning inventory McGraw-Hill/Irwin Cost of Goods Sold Net Income Overstated Understated Understated Overstated Understated Overstated Overstated Understated © The McGraw-Hill Companies, Inc., 2008 5-60 A2 Financial Statement Effects of Inventory Errors Balance Sheet Effects Inventory Error Understate ending inventory Overstate ending inventory McGraw-Hill/Irwin Assets Equity Understated Understated Overstated Overstated © The McGraw-Hill Companies, Inc., 2008 5-61 A3 Inventory Turnover Shows how many times a company turns over its inventory during a period. Indicator of how well management is controlling the amount of inventory available. Inventory Turnover Average Inventory McGraw-Hill/Irwin = = Cost of goods sold Avg. inventory (Beg. Inv. + End Inv.) ÷ 2 © The McGraw-Hill Companies, Inc., 2008 5-62 A3 Days’ Sales in Inventory Reveals how much inventory is available in terms of the number of days’ sales. Days' Sales in Inventory McGraw-Hill/Irwin = Ending Inventory Cost of goods sold × 365 © The McGraw-Hill Companies, Inc., 2008 5-63 End of Chapter 5 McGraw-Hill/Irwin © The McGraw-Hill Companies, Inc., 2008