Money Management Test - Personal Finance Quiz

advertisement

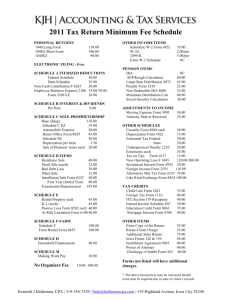

Name:___________________________________________Period:___________Date:_______________ Money Management Test True/False: Write “True” if the statement is correct. Write “False” if all or part of the statement is incorrect. (2 points each) ____1. The budgeting process starts with monitoring current spending. ____2. Most short-term goals are based on activities over the next two to three years. ____3. A common long-term goal may involve parents starting a college fund for a new born. ____4. Rent is considered a fixed expense. ____5. Flexible expenses stay about the same each month. ____6. A pawnshop offers loans to people starting their own business. ____7. Opening a checking account requires completing a signature card. ____8. A blank endorsement allows anyone to cash a check. ____9. A “smart card” stores a person’s bank balance right on the plastic card. ___10. An outstanding check refers to one written on an account with a very low balance. ___11. An advantage of using credit is impulse buying. ___12. Capital refers to a person’s assets. ___13. A steady employment record helps a person’s credit history. ___14. Installment credit usually allows a person to make additional purchases on the account. ___15. Using the 20-10 rule, a person making $30,000 a year after taxes should have no more than $8,000 or outstanding debt. Multiple Choice: Choose the most correct answer for each. (4 points each) ___16. The final phase of the budgeting process is to: a. Set personal and financial goals b. Review financial progress c. Compare your budget to what you have actually spent d. Monitor current spending. Name:___________________________________________Period:___________Date:_______________ ___17. An example of a long-term goal would be: a. Saving for retirement b. An annual vacation c. Buying a used car d. Completing college within the next six months ___18. A clearly written financial goal would be: a. “To save money for college for the next five years.” b. “To pay off credit card bills in 12 months.” c. “To establish an emergency fund of $4,000 in 18 months.” d. “To invest in an international mutual fund for retirement.” ___19. An example of fixed expense is: a. Auto Insurance b. Clothing c. An electric bill d. Educational Expenses ___20. ________ is commonly considered a flexible expense. a. Rent b. A mortgage payment c. Entertainment d. Home Insurance ___21. The highest loan rates usually occur when borrowing from a: a. Bank b. Pawnshop c. Credit-Card company d. Credit Union ___22. A ____________ is used to add funds to a bank account. a. Deposit Slip b. Check c. Signature Card d. Withdrawal Slip ___23. Obtaining cash form an ATM is similar to: a. Earning Interest on your account b. Making a Deposit c. Opening a new account d. Writing a Check Name:___________________________________________Period:___________Date:_______________ ___24. A service charge on your bank statement will result in: a. A lower balance b. A higher balance c. Earning more interest d. More outstanding checks ___25. A common advantage of using credit is: a. Less impulse buying b. Ability to obtain items now c. Lower cost for items purchased d. Lower chance of overspending ___26. A person’s regular income is referred to as: a. Character b. Capital c. Capacity d. Collateral ___27. To build credit history, a person could: a. Request to view his/her credit file b. File his/her federal income taxes on time c. Use an ATM several times a month d. Establish a steady employment record. ___28. Utility companies and medical service organizations commonly offer __________ credit. a. Single-payment b. Revolving c. Installment d. Retail ___29. Using the 20-10 rule, a person earning $1,500 a month should not have monthly credit payments that exceed: a. $30 b. $150 c. $20 d. $300 ___30. When using a credit card: a. You spend money you have b. You add money to your account c. You spend money you don’t have at that time d. You withdraw money from your savings account