Budget 21

advertisement

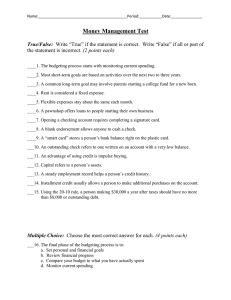

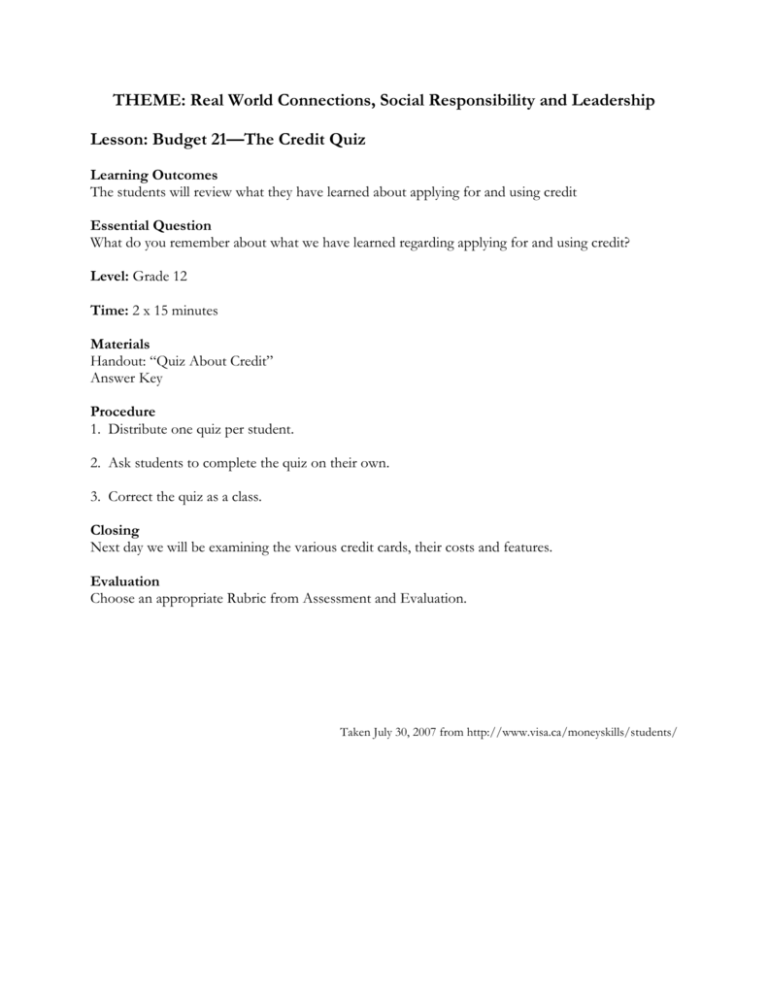

THEME: Real World Connections, Social Responsibility and Leadership Lesson: Budget 21—The Credit Quiz Learning Outcomes The students will review what they have learned about applying for and using credit Essential Question What do you remember about what we have learned regarding applying for and using credit? Level: Grade 12 Time: 2 x 15 minutes Materials Handout: “Quiz About Credit” Answer Key Procedure 1. Distribute one quiz per student. 2. Ask students to complete the quiz on their own. 3. Correct the quiz as a class. Closing Next day we will be examining the various credit cards, their costs and features. Evaluation Choose an appropriate Rubric from Assessment and Evaluation. Taken July 30, 2007 from http://www.visa.ca/moneyskills/students/ Answer Key- Quiz About Credit True or False: 1. A disadvantage of using credit is impulse buying __t___ 2. Capital refers to a person’s assets. ___t_ 3. A steady employment record helps a person’s credit history _t____ 4. Installment credit usually allows a person to make additional purchases on an account __f___ 5. Using the 20-10 rule, a person making $40,000. a year after taxes should have no more than $8000.00 outstanding debt __t___ Multiple choice: 6. A common advantage of using credit is: a. less impulse buying b. lower cost for items purchased c. ability to obtain needed items now d. lower chance of overspending 6. A person’s regular income is referred to as: a. character b. capital c. collateral d. capacity 8. To build a credit history a person could: a. establish a steady employment record b. file his or her federal income tax on time c. use an ATM several times a month d. request to view their credit file 9. Utility companies commonly offer what kind of credit? a. revolving b. single payment c. installment\retail Quiz About Credit True or False: 1. A disadvantage of using credit is impulse buying _____ 2. Capital refers to a person’s assets. ____ 3. A steady employment record helps a person’s credit history _____ 4. Installment credit usually allows a person to make additional purchases on an account._____ 5. Using the 20-10 rule, a person making $40,000. a year after taxes should have no more than $8000.00 outstanding debt _____ Multiple choice: 6. A common advantage of using credit is: a. less impulse buying b. lower cost for items purchased c. ability to obtain needed items now d. lower chance of overspending 7. A person’s regular income is referred to as: a. character b. capital c. collateral d. capacity 8. To build a credit history a person could: a. establish a steady employment record b. file his or her federal income tax on time c. use an ATM several time a month d. request to view their credit file 9. Utility companies commonly offer what kind of credit? a. revolving b. single payment c. installment\retail