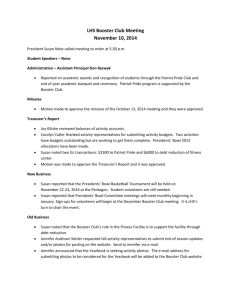

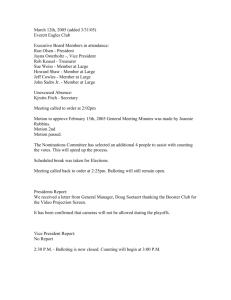

Booster club Officers

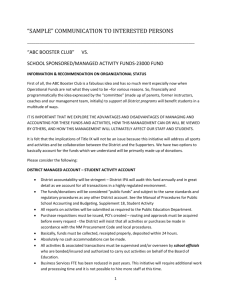

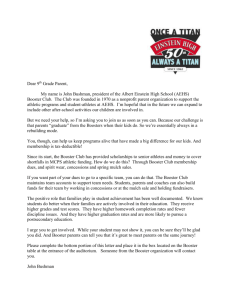

advertisement