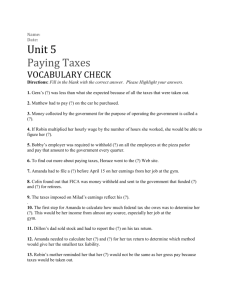

Unit 5 Test- Taxes - Joplin Business Department

advertisement

Unit 5 Test- Taxes Multiple Choice 1) Public programs such as national defense, public schools, Social Security, and fire and police protection are all paid for through ________. A) tax revenue B) capital gains C) itemized deductions D) real estate taxes 2) Federal income taxes, state income taxes, and Social Security withholdings are all ________. A) payroll taxes B) real estate taxes C) sales taxes D) capital taxes 3) The total amount of money a worker earns in a pay period is his or her ________. A) gross pay B) net pay C) adjusted gross income D) capital gain 4) You would use a 1040 or a 1040EZ to ________. A) pay local taxes B) pay sales taxes C) file a tax return D) receive an estimated tax payment 5) An employer matches employees' contributions to ________ and sends the total amount to the government. A) federal income taxes B) state income taxes C) local taxes D) FICA taxes 6) In general, your applicable tax rate and rules differ depending on which ________ you choose. A) itemized deductions B) standard deductions C) filing status D) capital gains 7) Which of the following sources of income would NOT be counted as part of an individual's gross income? A) child support payments received B) tips C) sales of assets D) revenue from rental properties 8) AGI stands for ________. A) annual gross income B) adjusted gross income C) American gross income D) annual generated income 9) The amount of the standardized deduction varies according to your ________ and whether you are over or under the age of 65. A) tax bracket B) adjusted gross income C) filing status D) capital gains 10) When filing their tax returns, some low income families will receive more money back in the form of a(n) ________ than was withheld from their paychecks. A) Earned Income Credit B) Adjusted Gross Income C) Itemized Deduction D) Exemption 11) Taxes are figured based on your earnings during which of the following time periods? A) each month B) each quarter C) the calendar year D) every two years 12) The deadline for filing your federal tax return each year is ________. A) January 1st B) December 15th C) March 15th D) April 15th 13) Which of the following states does NOT have a state personal income tax? A) New York B) Michigan C) Hawaii D) Texas 14) In general, the more money a person earns, the ________ he or she must pay taxes. A) lower the rate is at which B) higher the rate is at which C) more frequently D) less frequently 15) Shortly after the end of the year, you will receive a ________ form summarizing all of your relevant income and tax withholding information from each employer you worked for during the year. A) 1040 B) 1040EZ C) W2 D) 1099-MISC True/False 16) If you are claimed as a dependent on a parent's or guardian's tax return, then you will not be required to file your own tax return. 17) In some cases, it may be financially advantageous for a married couple to file separate tax returns. 18) Capital gains are typically taxed at a higher rate than other forms of income are. 19) Your adjusted gross income will always be greater than or equal to your total income. 20) Under current tax laws, if you paid $2,000 in interest on student loans, you can reduce your gross income by $2,000. 21) FICA stands for Federal Income Commercial Assessment. 22) FICA withholdings may be listed as OADSI on some pay stubs. 23) The cap on the amount of earnings subject to the Social Security tax increases slightly each year with inflation. 24) There is a cap on the amount of wages subject to the Medicare and Social Security taxes. 25) A self-employed worker may pay double in FICA tax what a payroll worker pays. Matching A) adjusted gross income B) gross income C) capital gain D) itemized deduction E) standard deduction 26) figured by taking an individual's total income and subtracting certain allowable amounts 27) a fixed amount anyone is allowed to subtract from his or her AGI to reduce tax liability 28) a specific expense that can be subtracted from an individual's AGI to reduce tax liability 29) the total amount of a person's income from almost any source 30) the positive difference between what you sold an asset for and what you paid for it A) real estate tax B) net pay C) tax return D) sales tax E) gross pay F) payroll tax G) tax 21) tax paid as part of the purchase price of an item 22) the total amount of money an individual takes home during a pay period 23) money for the government withheld from an individual's paycheck 24) any money collected by a government from its citizens for the purpose of operating the government 25) the total amount of money an individual earns in a pay period 26) an annual report of all information related to your income taxes 27) a tax paid to the government based on the value of the property an individual owns MATH 28) In Trisha's state, a sales tax of 6% is charged for all consumer goods except food products. Trisha is about to buy two sweaters, one that costs $29.00 and one that costs $19.00. How much will Trisha have to pay for both sweaters plus sales tax? 29) Austin is looking at the information on his pay stub. His only tax withholding was $ 15.30 for FICA. If Austin's net pay was $184.70, what was his gross pay? 30) Last year Keegan earned $14,500 in wages and another $780 in tips. Keegan also received $300 in dividend income. What was Keegan's gross income? EXTRA CREDIT: 5 pts 1. Who is your favorite teacher?