Advanced Placement Macroeconomics

advertisement

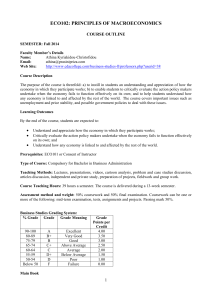

Advanced Placement Macroeconomics Mark McCormick 2013- 2014 Academic Year mark.mccormick@carrolltoncityschools.net Texts: McConnell, Campbell and Stanley Brue. Economics, 16thed. New York:McGraw-Hill, 2005. Morton, John. Advanced Placement Economics Macroeconomics Student Activities, 3rd Ed. New York: National Council on Economic Education, 2003. Course Objective: The AP Macroeconomics course is designed as an introductory college-level course in macroeconomics and as a foundation for possible future study in economics or business. The reasons for taking Advanced Placement Macroeconomics are numerous. Enrolling in AP Macroeconomics allows you to challenge yourself. If utilized correctly, you will develop the skills and study habits necessary to master college level material while insulated in a high school environment. Completing any advanced placement course will make you more competitive because colleges and universities want students with AP course work. In addition to mastering college level material, anothergoal of the course is to prepare you for the AP Macroeconomics Exam. Expectations: Students expect me to be knowledgeable in the subject, as well as prepared to teach the subject each day. You expect me to be unbiased and consistent in all aspects of my teaching as well as havegraded material completed and recorded in a timely manner. Above all, you expect me to treat you with the respect that you deserve. Students are expected to: 1) be on time to class; 2) bring their books, paper, and a writing instrument to class; 3) participate in class discussion; therefore, comments and questions relevant to the subject are welcome. For this reason, it is imperative that students read the assigned chapters. Students are responsible for material in the book that may not be covered in class. Above all, I expect to be treated with the respect that I deserve. Remember, this is an AP course and you have chosen to be here so I expect you to act accordingly. As with every society, rules, laws, or social norms regulate the behavior of individuals and the student handbook is extensive and inclusive; however, the following three are worth emphasizing. 1. Students have the right to learn in an environment that is conducive to doing so. Disruption of that right will not be tolerated. I consider working on assignments from other classes and the use of electronic devices not only rude but a disruption because you are not fully engaged in the lesson. Turn off ALL electronic equipment, (i.e., iPads, iPods, iPhones, flip phones, smart phones, Kindles, Nooks, laptops, etc.). Unacceptable behavior will be handled in accordance with the student handbook. 2. I implore you to do your own work. Cheating is a serious offense and the penalties are severe (refer to your Student Handbook). Please bear in mind that I have more respect for a mediocre student who attains his or her grade honestly, than I do for a superior student who attains his or her grade dishonestly. Integrity and honesty are two qualities that I hold in very high esteem. 3. No WHINING! Assignment Policy and Grades: There will be approximately eight (8) examinations over the course of the year. Exams will be administered the first week of each month beginning in September. A mid-term exam will be given in December and a mock AP Macro exam will be administered prior to the actual examination in order to assess your strengths and weaknesses (yes, it does count; no, it is not optional).Each monthly exam is cumulative and will be comprised solely ofmultiple-choice questions. Free response quizzes will be administeredperiodically to ensure that you are keeping up with the assigned reading and various assignments; each quiz is weighted one-halfof an exam grade. There will also be six (6) Macroeconomic Unit exercise packets (affectionately referred to as Acorn Packets). Acorn Packets will be assigned at the beginning of each unit with sections of the Acorn Packet due at various dates throughout the respective unit. Other assignments will be given throughout the semester and will be included in the final grade as necessary. They will vary and include performance tasks, readings, practice free responses, data analysis, simulations, current events, discussions, debates, etc. Fall Semester, exams andquizzes comprise 50 percent of the final grade; Acorn Packets and other assignmentscomprise 50 percent of the final grade. A state mandated End-of-Course-Test for Economics will be given at a date yet to be determined and comprises 15% of the final grade of the Spring Semester.Therefore, Spring Semester, exams and quizzes comprise 42.5 percent of the final grade; Acorn Packets and other assignments comprise 42.5 percent of the final grade. I give ample time to complete written assignments; therefore, the highest grade that can be attained for any assignment that is late is a 70 except in cases of excused tardies or absences. In cases of excused tardies or absences, it is the student’s responsibility to see me about making up missed assignments or exams. If I have to refer you for remediation, then the highest grade that can be attained on that assignment is a 50. At the end of each semester, I have the ability to assess individual grades provided you adhere to the criteria outlined in class. This is not a school policy; therefore, ANY consideration is at my discretion. Specific infractions that will result in NO considerationinclude but are not limited to less than an A in your work ethics grade, remediation, chronic lateness to class, lateness of assignments, sleeping in class, the unauthorized use of any electronic equipment (especially cell phones), chronic restroom visits, chronic disruption of class, not working on assignments, reading, working on assignments for another class, cheating, etc.Also, bear in mind that AP Macroeconomics is a weighted course at Carrollton High School; therefore, five points will be added to the final grade at the end of each semester. AP Macroeconomics Exam: The AP Macroeconomics exam contains of two sections. Section one consists of 60 multiple-choice questions of which you have 70 minutes to complete. Section two consists of three free response questions (one long and two short) of which you have 60 minutes to complete. The entire exam totals2 hours and 10 minutes in length and will be administered in May. Passing the exam with a score of three, four, or five will result in college credit at almost all colleges and universities, which will save on the cost of college in terms of both time and money (this will make your parents happy). Course Content and Schedule of Events: Unit One: Introduction to Economics (Six weeks) McConnell, Chapters 1, 2, 3, 4 and 5 Basic Economic Concepts Scarcity, choice, and opportunity cost Production possibilities curve Comparative advantage, absolute advantage, specialization, and exchange Demand, supply, and market equilibrium Concepts: Introduction to the language of economics, micro vs. macro, positive vs. normative economics, economic decision making, pitfalls of decision making, scarcity, opportunity costs, production possibilities, absolute advantage, comparative advantage, specialization, terms of trade, demand schedule, determinants of demand, individual and market demand curves, supply schedule, determinants of supply, market equilibrium, shifts in supply and demand with effects on equilibrium price and quantity. Graphs: Production possibilities curve (frontier) Demand and supply curves showing equilibrium Demand and supply curves showing shifts in demand/supply Key Terms: economics, factors of production—inputs, capital, microeconomics, macroeconomics, positive economics, normative economics, ceteris paribus, fallacy of composition, scarcity, opportunity cost, model, production possibilities, constant costs, law of increasing opportunity cost, demand, law of demand, quantity demanded, market demand, substitutes, complements, normal goods, inferior goods, supply, law of supply, quantity supplied, market equilibrium, equilibrium price, equilibrium quantity, human capital, economies of scale, progressive tax system, regressive tax system, proportional tax system Activities: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. Morton. Advanced Placement Economics, Activities 1–8. Introduction to the economic way of thinking, Chapters 1 and 2 Discussion of scarcity, opportunity costs Production possibilities, Chapter 2 Production possibilities exercises/problems Demand and problems, Chapter 3 Supply and problems Supply, demand, and equilibrium price/quantity Shifts in supply and demand Supply and demand exercises/problems Exam Unit Two: Macroeconomic Measurement and Basic Concepts (Four weeks) McConnell, Chapters 7, 8 National income accounts Circular flow Gross domestic product Components of gross domestic product Real versus nominal gross domestic product Inflation measurement and adjustment Price indices Nominal and real values Costs of inflation Unemployment Definition and measurement Types of unemployment Natural rate of unemployment Concepts: Circular flow of economic activity, inclusions and exclusions concerning gross domestic product, expenditure approach to GDP, income approach to GDP, nominal versus real GDP, phases of the business cycle, types of unemployment, full employment, measurements of inflation, types of inflation, effects of inflation, Okun’s Law, GDP Gap Graphs: Circular flow of economic activity Phases of the business cycle Key Terms: Gross domestic product, intermediate goods, final goods, multiple counting, expenditure approach, income approach, personal consumption expenditures, gross private domestic investment, net private domestic investment, government purchases, net exports, national income, consumption of fixed capital, depreciation, personal income, disposable personal income, nominal GDP, real GDP, GDP deflator, business cycle, contraction/recession, trough, expansion/recovery, peak, unemployment, inflation, labor force, unemployment rate, frictional unemployment, structural unemployment, cyclical unemployment, full-employment rate of unemployment, natural rate of unemployment, inflation, Okun’s Law, Consumer Price Index, demand-pull inflation, cost-push inflation, nominal income, real income, deflation, long-run aggregate supply curve, supply-side economics Activities: 1. Morton. Advanced Placement Economics, Activities 9-18. 2. Components of GDP, expenditure approach, income approach (Chapter 7) 3. Macroeconomic issues: business cycle, unemployment, inflation, growth 4. Nominal and real GDP 5. Types of unemployment (Chapter 8) 6. Types of inflation 7. Determining real and nominal values using price indexes 8. Effects of inflation—short play on inflation 9. Exam Unit Three: Macroeconomic Models and Fiscal Policy (Eight Weeks) McConnell, Chapters 9, 10, 11, and 12 Aggregate demand Determinants of aggregate demand Multiplier and crowding out effects Aggregate supply Short-run and long-run analyses Sticky versus flexible wages and prices Determinants of aggregate supply Macroeconomic equilibrium Real output and price level Short and long run Actual versus full employment output Economic fluctuations Concepts: marginal propensity to consume, the multiplier effect, reasons for a downward sloping aggregate demand curve, determinants of aggregate demand, aggregate supply in the short and long run, sticky versus flexible prices and wages, determination of equilibrium output and price level, actual versus full employment, utilization of resources, fiscal policy and the aggregate demand/aggregate supply model Graphs: Investment demand curve Aggregate demand and short run aggregate supply curve Aggregate demand and long run aggregate supply curve Key terms: Marginal propensity to consume, marginal propensity to save, investment, multiplier, investment schedule, leakage, injection, real balances effect, interest-rate effect, foreign purchases effect, aggregate demand, short-run aggregate supply, equilibrium price level, equilibrium real output, expansionary fiscal policy, contractionary fiscal policy, budget deficit, budget surplus, built-in stabilizer, discretionary policy, stagflation, aggregate supply shocks. Activities 1. Morton: Advanced Placement Economics, Activities 20-33 2. Introduce marginal propensity as it applies to consumption and savings (Chapter 9) 3. Multiplier effect 4. Aggregate demand and its determinants (Chapter 11) 5. Short run and long run aggregate supply 6. Sticky versus flexible wages and prices, equilibrium real output and prices 7. Supply shocks, changes in aggregate demand 8. Fiscal policy (Chapter 12) 9. Consequences of fiscal policy 10. Unit Exam Unit Four: Money, Banking, and Monetary Policy (Six Weeks) McConnell, Chapters 13, 14, 15, and 29 Money, banking, and financial markets Definition of financial assets: money, stocks, bonds Time value of money (present and future value) Measures of money supply Banks and the creation of money Money demand Money market Loanable funds market Central bank and control of the money supply Tools of central bank policy Quantity theory of money Real versus nominal interest rates Concepts: Functions of money, characteristics of money, measures of money, demand for money, the money market, the creation of money, loanable funds market, organization of the Federal Reserve, tools of monetary policy, responsibilities of the Fed, quantity theory of money Graphs: Money market Loanable funds market Key terms: medium of exchange, store of value, measure of value, M1, M2, MZM, checkable deposits, demand deposits, time deposits, legal tender, asset demand, transaction demand, balance sheet, T-account, fractional reserve banking, Federal Reserve, reserve requirement, required reserves, excess reserves, federal funds rate, prime interest rate, discount rate, open-market operations, monetary multiplier, nominal interest rate, real interest rate, FDIC, velocity of money, monetary policy and the aggregate demand/aggregate supply model. Activities: 1. Morton: Advanced Placement Economics, Activities 34–39 2. Creation of money exercise 3. Functions and types of money (Chapter 13) 4. Demand for money and money market 5. Creation of money/simulation game 6. Loanable funds market (Chapter 29) 7. Organization of the Federal Reserve (Chapter 13) 8. Tools of monetary policy (Chapter 15) 9. Consequences of monetary policy 10. Exam Unit Five: Long-Run Perspectives and Macroeconomic Debates (Four Weeks) McConnell, Chapters 16, 17, and 18 Fiscal and monetary policies Demand-side effects Supply-side effects Policy mix Government deficits and debts Inflation and unemployment Types of inflation Demand-pull inflation Cost-push inflation The Phillips Curve: short run versus long run Role of expectations Investment in human capital Investment in physical capital Growth policy and Productivity Key concepts: Combinations of the monetary and fiscal policies and their effects, international considerations, government deficits and debts, long-run aggregate supply, demand pull and cost push inflation, the inflation-unemployment relationship, expectations, Ingredients of economic growth, production possibilities analysis, growth in the AD/AS model, long- and short-run analysis, labor and productivity, technological advance Graphs: Aggregate demand/aggregate supply model Phillips curve Production possibilities curve Key terms: Crowding-out effect, net export effect, short run Phillips Curve, long run Phillips Curve, disinflation, Laffer Curve, supply-side economics, classical view, Keynesian view, monetarism Activities 1. Morton: Advanced Placement Economics, Activities 43-48. 2. Fiscal and monetary policies 3. Government budget deficits and debts (Chapter 18) 4. Short-run and long-run supply curve (Chapter 16) 5. Short run and long run Phillips Curve 6. Expectations 7. Ingredients for growth (Chapter 17) 8. Production possibilities and AD/AS analysis 9. Growth from labor productivity and technological advance 10. Macroeconomic implications 11. Exam Unit Six: International Economics (Four Weeks) McConnell, Chapters 6, 37, and 38 Balance of payments accounts Balance of trade Current account Capital account Foreign exchange market Demand for and supply of foreign exchange Exchange rate determination Currency appreciation and depreciation Net exports and capital flows Links to financial and goods markets Concepts: United States and world trade, absolute and comparative advantage, balance of payments, foreign exchange markets, implications of foreign trade, effects of domestic fiscal and monetary policies on capital flows and foreign exchange markets, use of resources, decision and policy making Graphs: Production possibilities Foreign exchange market Key terms: tariffs, quotas, subsidies, absolute advantage, comparative advantage, terms of trade, world price, domestic price, current account, balance on goods and services, trade deficit, trade surplus, capital account, official reserves, flexible exchange rates, fixed exchange rates, depreciation, appreciation, General Agreement on Tariffs and Trade (GATT), World Trade Organization (WTO), North American Free Trade Agreement (NAFTA) Activities: 1. Morton: Advanced Placement Economics, Activities 2, 49–55 2. Absolute and comparative advantage, terms of trade (Chapter 6) 3. The United States and world trade/barriers to trade (Chapters 6 and 37) 4. Absolute and comparative advantage 5. Balance of payments (Chapter 38) 6. Balance of payments 7. Foreign exchange rates 8. Implications of foreign exchange rates and economic policies 9. Mock AP Macroeconomics Exam