3-1

THE ACCOUNTING

INFORMATION

SYSTEM

3-2

Accounting, Fifth Edition

Learning Objectives

After studying this chapter, you should be able to:

3-3

1.

Analyze the effect of business transactions on the basic accounting

equation.

2.

Explain what an account is and how it helps in the recording process.

3.

Define debits and credits and explain how they are used to record

business transactions.

4.

Identify the basic steps in the recording process.

5.

Explain what a journal is and how it helps in the recording process.

6.

Explain what a ledger is and how it helps in the recording process.

7.

Explain what posting is and how it helps in the recording process.

8.

Explain the purposes of a trial balance.

9.

Classify cash activities as operating, investing, or financing.

Preview of Chapter 3

Accounting

Fifth Edition

Kimmel Weygandt Kieso

3-4

The Accounting Information System

Accounting Information System

System of

►

collecting and

►

processing transaction data and

►

communicating financial information to decision makers.

Most businesses use computerized accounting (EDP) systems.

3-5

LO 1 Analyze the effect of business transactions on the basic accounting equation.

Accounting Transactions

Transactions are economic events that require recording

in the financial statements.

3-6

Not all activities represent transactions.

Assets, liabilities, or stockholders’ equity items change as

a result of some economic event.

Dual effect on the accounting equation.

LO 1 Analyze the effect of business transactions on the basic accounting equation.

Accounting Transactions

Question: Are the following events recorded in the

accounting records?

Illustration 3-1

Purchase

computer.

Event

Criterion

Discuss guided trip

options with potential

customer.

Pay rent.

Is the financial position (assets, liabilities, or

stockholders’ equity) of the company changed?

Record/ Don’t

Record

3-7

LO 1 Analyze the effect of business transactions on the basic accounting equation.

Accounting Transactions

Analyzing Transactions

The process of identifying the specific effects of economic

events on the accounting equation.

Basic Accounting Equation

Assets

3-8

=

Liabilities

+

Stockholders’

Equity

LO 1 Analyze the effect of business transactions on the basic accounting equation.

Accounting Transactions

Analyzing Transactions

Illustration 3-2

Expanded accounting equation

3-9

LO 1 Analyze the effect of business transactions on the basic accounting equation.

Accounting Transactions

Event (1). On October 1, cash of $10,000 is invested in Sierra Corporation by

investors in exchange for $10,000 of common stock.

1. +10,000

3-10

+10,000

LO 1 Analyze the effect of business transactions on the basic accounting equation.

Accounting Transactions

Event (2). On October 1, Sierra borrowed $5,000 from Castle Bank by signing

a 3-month, 12%, $5,000 note payable.

1. +10,000

2. +5,000

3-11

+10,000

+5,000

LO 1 Analyze the effect of business transactions on the basic accounting equation.

Accounting Transactions

Event (3). On October 2, Sierra purchased equipment by paying $5,000 cash

to Superior Equipment Sales Co.

1. +10,000

2. +5,000

3. -5,000

3-12

+10,000

+5,000

+5,000

LO 1 Analyze the effect of business transactions on the basic accounting equation.

Accounting Transactions

Event (4). On October 2, Sierra received a $1,200 cash advance from R. Knox,

a client.

1. +10,000

2. +5,000

3. -5,000

4. +1,200

3-13

+10,000

+5,000

+5,000

+1,200

LO 1 Analyze the effect of business transactions on the basic accounting equation.

Accounting Transactions

Event (5). On October 3, Sierra received $10,000 in cash from Copa Company

for guide services performed.

1. +10,000

2. +5,000

3. -5,000

4. +1,200

5. +10,000

3-14

+10,000

+5,000

+5,000

+1,200

+10,000

LO 1 Analyze the effect of business transactions on the basic accounting equation.

Accounting Transactions

Event (6). On October 3, Sierra Corporation paid its office rent for the month of

October in cash, $900.

1. +10,000

2. +5,000

3. -5,000

4. +1,200

5. +10,000

6.

3-15

-900

+10,000

+5,000

+5,000

+1,200

+10,000

-900

LO 1 Analyze the effect of business transactions on the basic accounting equation.

Accounting Transactions

Event (7). On October 4, Sierra paid $600 for a one-year insurance policy that

will expire next year on September 30.

1. +10,000

+10,000

2. +5,000

3. -5,000

+5,000

+5,000

4. +1,200

+1,200

5. +10,000

6.

-900

7.

-600

3-16

+10,000

-900

+600

LO 1 Analyze the effect of business transactions on the basic accounting equation.

Accounting Transactions

Event (8). On October 5, Sierra purchased an estimated three months of

supplies on account from Aero Supply for $2,500.

1. +10,000

+10,000

2. +5,000

3. -5,000

+5,000

+5,000

4. +1,200

+1,200

5. +10,000

6.

-900

7.

-600

+10,000

-900

+600

8.

+2,500

+2,500

3-17

LO 1 Analyze the effect of business transactions on the basic accounting equation.

Accounting Transactions

Event (9). On October 9, Sierra hired four new employees to begin work on

October 15.

1. +10,000

+10,000

2. +5,000

3. -5,000

+5,000

+5,000

4. +1,200

+1,200

5. +10,000

6.

-900

7.

-600

8.

+10,000

-900

+600

+2,500

+2,500

An accounting transaction has not occurred.

3-18

LO 1 Analyze the effect of business transactions on the basic accounting equation.

Accounting Transactions

Event (10). On October 20, Sierra paid a $500 dividend.

1. +10,000

+10,000

2. +5,000

3. -5,000

+5,000

+5,000

4. +1,200

+1,200

5. +10,000

6.

-900

7.

-600

8.

10.

3-19

+10,000

-900

+600

+2,500

-500

+2,500

-500

LO 1 Analyze the effect of business transactions on the basic accounting equation.

Accounting Transactions

Event (11). Employees have worked two weeks, earning $4,000 in salaries,

which were paid on October 26.

1. +10,000

+10,000

2. +5,000

3. -5,000

+5,000

+5,000

4. +1,200

+1,200

5. +10,000

6.

-900

7.

-600

8.

10. -500

11. -4,000

3-20

+10,000

-900

+600

+2,500

+2,500

-500

-4,000

3-21

The Account

Record of increases and decreases in

a specific asset, liability, equity,

revenue, or expense item.

Debit = “Left”

Credit = “Right”

Account

An Account can

be illustrated in a

T-Account form.

3-22

Account Name

Debit / Dr.

Credit / Cr.

LO 2 Explain what an account is and how it helps in the recording process.

The Account

Debit and Credit Procedures

Double-entry system

Each transaction must affect two or more accounts to

keep the basic accounting equation in balance.

Recording done by debiting at least one account and

crediting another.

3-23

DEBITS must equal CREDITS.

LO 3 Define debits and credits and explain they are used to record business transactions.

Debit and Credit Procedures

If Debits are greater than Credits, the account will have

a debit balance.

Account Name

Debit / Dr.

Credit / Cr.

Transaction #1

$10,000

$3,000

Transaction #3

8,000

Balance

3-24

Transaction #2

$15,000

LO 3 Define debits and credits and explain they are used to record business transactions.

Debit and Credit Procedures

If Credits are greater than Debits, the account will have

a credit balance.

Account Name

Transaction #1

Balance

3-25

Debit / Dr.

Credit / Cr.

$10,000

$3,000

Transaction #2

8,000

Transaction #3

$1,000

LO 3 Define debits and credits and explain they are used to record business transactions.

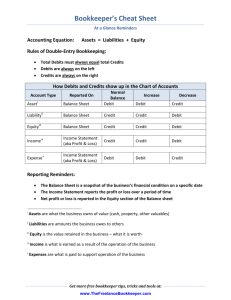

Procedures for Assets and Liabilities

Assets

Debit / Dr.

Credit / Cr.

Normal Balance

Chapter

3-23

Assets - Debits should

exceed credits.

Liabilities – Credits should

exceed debits.

Liabilities

Debit / Dr.

Credit / Cr.

Normal Balance

Chapter

3-24

3-26

LO 3 Define debits and credits and explain they are used to record business transactions.

Procedures for Stockholders’ Equity

Stockholders’ Equity

Investments by stockholders and

revenues increase stockholders’

equity (credit).

Dividends and expenses decrease

stockholder’s equity (debit).

Credit / Cr.

Debit / Dr.

Normal Balance

Chapter

3-25

Common Stock

Debit / Dr.

Retained Earnings

Credit / Cr.

Debit / Dr.

Normal Balance

Chapter

3-25

3-27

Chapter

3-25

Dividends

Credit / Cr.

Debit / Dr.

Normal Balance

Normal Balance

Credit / Cr.

Chapter

3-23

LO 3 Define debits and credits and explain they are used to record business transactions.

Procedures for Revenue and Expense

Revenue

Debit / Dr.

The purpose of earning

revenues is to benefit the

stockholders.

The effect of debits and credits

on revenue accounts is the same

as their effect on stockholders’

equity.

Expenses have the opposite

effect: expenses decrease

stockholders’ equity.

Credit / Cr.

Normal Balance

Chapter

3-26

Expense

Debit / Dr.

Normal Balance

Credit / Cr.

Chapter

3-27

3-28

LO 3 Define debits and credits and explain they are used to record business transactions.

Stockholders’ Equity Relationships

Illustration 3-15

3-29

LO 3 Define debits and credits and explain they are used to record business transactions.

Summary of Debit/Credit Rules

Liabilities

Normal

Balance

Debit

Assets

Credit / Cr.

Normal Balance

Chapter

3-24

Stockholders’ Equity

Credit / Cr.

Debit / Dr.

Debit / Dr.

Normal

Balance

Credit

Debit / Dr.

Credit / Cr.

Normal Balance

Normal Balance

Chapter

3-23

Expense

Debit / Dr.

Chapter

3-25

Revenue

Credit / Cr.

Debit / Dr.

Normal Balance

Chapter

3-27

3-30

Credit / Cr.

Normal Balance

Chapter

3-26

LO 3 Define debits and credits and explain they are used to record business transactions.

Summary of Debit/Credit Rules

Balance Sheet

Asset = Liability + Equity

Income Statement

Revenue - Expense =

Debit

Credit

3-31

LO 3 Define debits and credits and explain they are used to record business transactions.

Summary of Debit/Credit Rules

Relationship among the assets, liabilities and stockholders’

equity of a business:

Illustration 3-16

Basic

Equation

Assets = Liabilities +

Stockholders’ Equity

Expanded

Basic

Equation

The equation must be in balance after every transaction. For

every Debit there must be a Credit.

3-32

LO 3 Define debits and credits and explain they are used to record business transactions.

Summary of Debit/Credit Rules

Review Question

Debits:

a. increase both assets and liabilities.

b. decrease both assets and liabilities.

c. increase assets and decrease liabilities.

d. decrease assets and increase liabilities.

3-33

LO 3 Define debits and credits and explain they are used to record business transactions.

Summary of Debit/Credit Rules

Review Question

Accounts that normally have debit balances are:

a. assets, expenses, and revenues.

b. assets, expenses, and equity.

c. assets, liabilities, and dividends.

d. assets, dividends, and expenses.

3-34

LO 3 Define debits and credits and explain they are used to record business transactions.

3-35

Steps in the Recording Process

Illustration 3-17

Analyze each transaction

Enter transaction in a journal

Transfer journal information to

ledger accounts

Source documents, such as a sales slip, a check, a bill, or a

cash register tape, provide evidence of the transaction.

3-36

LO 4 Identify the basic steps in the recording process.

Steps in the Recording Process

The Journal

Book of original entry.

Transactions recorded in chronological order.

Contributions to the recording process:

1. Discloses the complete effects of a transaction.

2. Provides a chronological record of transactions.

3. Helps to prevent or locate errors because the debit

and credit amounts can be easily compared.

3-37

LO 5 Explain what a journal is and how it helps in the recording process.

The Journal

Journalizing - Entering transaction data in the journal.

Illustration: Presented below is information related to Sierra

Corporation.

Oct. 1 Sierra issued common stock in exchange for $10,000

cash.

1 Sierra borrowed $5,000 by signing a note.

2 Sierra purchased equipment for $5,000.

Instructions - Journalize these transactions.

3-38

LO 5 Explain what a journal is and how it helps in the recording process.

Journalizing

Oct. 1

Sierra issued common stock in exchange for

$10,000 cash.

General Journal

Date

Oct. 1

3-39

Account Title

Cash

Common stock

Ref.

Debit

Credit

10,000

10,000

LO 5 Explain what a journal is and how it helps in the recording process.

Journalizing

Oct. 1

Sierra borrowed $5,000 by signing a note.

General Journal

Date

Oct. 1

3-40

Account Title

Cash

Notes payable

Ref.

Debit

Credit

5,000

5,000

LO 5 Explain what a journal is and how it helps in the recording process.

Journalizing

Oct. 2

Sierra purchased equipment for $5,000.

General Journal

Date

Oct. 2

3-41

Account Title

Equipment

Cash

Ref.

Debit

Credit

5,000

5,000

LO 5 Explain what a journal is and how it helps in the recording process.

3-42

Steps in the Recording Process

The Ledger is comprised of the entire group of accounts

maintained by a company.

Illustration 3-19

3-43

LO 6 Explain what a ledger is and how it helps in the recording process.

Steps in the Recording Process

Chart of Accounts – listing of accounts used by a

company to record transactions.

Illustration 3-20

3-44

LO 6 Explain what a ledger is and how it helps in the recording process.

Steps in the Recording Process

Posting – the process of transferring journal entry

amounts to ledger accounts.

J1

General Journal

Date

Oct. 1

Account Title

Ref.

Debit

101

10,000

Cash

Common stock

Credit

10,000

General Ledger

Cash

Date

Oct. 1

3-45

Explanation

Stock issued

Acct. No. 101

Ref.

Debit

J1

10,000

Credit

Balance

10,000

LO 7

Steps in the Recording Process

Review Question

Posting:

a. normally occurs before journalizing.

b. transfers ledger transaction data to the journal.

c. is an optional step in the recording process.

d. transfers journal entries to ledger accounts.

3-46

LO 7 Explain what posting is and how it helps in the recording process.

3-47

The Recording Process Illustrated

Follow these steps:

1. Determine what

type of account is

involved.

2. Determine what

items increased or

decreased and by

how much.

3. Translate the

increases and

decreases into

debits and credits.

Illustration 3-21

3-48

LO 7 Explain what posting is and how it helps in the recording process.

The Recording Process Illustrated

Follow these steps:

1. Determine what

type of account is

involved.

2. Determine what

items increased or

decreased and by

how much.

3. Translate the

increases and

decreases into

debits and credits.

Illustration 3-22

3-49

LO 7 Explain what posting is and how it helps in the recording process.

The Recording Process Illustrated

Follow these steps:

1. Determine what

type of account is

involved.

2. Determine what

items increased or

decreased and by

how much.

3. Translate the

increases and

decreases into

debits and credits.

Illustration 3-23

3-50

LO 7 Explain what posting is and how it helps in the recording process.

The

Recording

Process

Illustrated

Additional

Transactions

Illustration 3-24

3-51

LO 7 Explain what posting is and how it helps in the recording process.

The

Recording

Process

Illustrated

Additional

Transactions

Illustration 3-25

3-52

LO 7 Explain what posting is and how it helps in the recording process.

The

Recording

Process

Illustrated

Additional

Transactions

Illustration 3-26

3-53

LO 7 Explain what posting is and how it helps in the recording process.

The

Recording

Process

Illustrated

Additional

Transactions

Illustration 3-27

3-54

The

Recording

Process

Illustrated

Additional

Transactions

Illustration 3-28

3-55

LO 7 Explain what posting is and how it helps in the recording process.

The Recording Process Illustrated

Additional Transactions

Illustration 3-29

3-56

LO 7 Explain what posting is and how it helps in the recording process.

The

Recording

Process

Illustrated

Additional

Transactions

Illustration 3-30

3-57

LO 7 Explain what posting is and how it helps in the recording process.

The

Recording

Process

Illustrated

Additional

Transactions

Illustration 3-31

3-58

LO 7

Summary Illustration of Journalizing

Illustration 3-32

3-59

LO 7

Summary Illustration of Journalizing

Illustration 3-32

3-60

LO 7

Summary

Illustration

of Posting

Illustration 3-33

3-61

LO 7 Explain what posting is and how it helps in the recording process.

Selected transactions from the journal of Faital Inc. during its first

month of operations are presented below. Post these transactions to T-accounts.

3-62

LO 7 Explain what posting is and how it helps in the recording process.

The Trial Balance

Trial Balance

A list of accounts and their balances at a given time.

Accounts are listed in the order in which they appear

in the ledger.

Purpose is to prove that debits

equal credits.

May also uncover errors in

journalizing and posting.

Useful in the preparation of

financial statements.

3-63

LO 8 Explain the purposes of a trial balance.

The Trial Balance

Illustration 3-34

Equal

3-64

LO 8

The Trial Balance

Limitations of a Trial Balance

The trial balance may balance even when

1. a transaction is not journalized,

2. a correct journal entry is not posted,

3. a journal entry is posted twice,

4. incorrect accounts are used in

journalizing or posting, or

Ethics Note An error is

the result of an

unintentional mistake. It

is neither ethical nor

unethical. An irregularity

is an intentional

misstatement, which

is viewed as unethical.

5. offsetting errors are made in recording

the amount of a transaction.

3-65

LO 8 Explain the purposes of a trial balance.

The Trial Balance

Review Question

A trial balance will not balance if:

3-66

a.

a correct journal entry is posted twice.

b.

the purchase of supplies on account is debited to

Supplies and credited to Cash.

c.

a $100 cash dividends is debited to the Dividends

account for $1,000 and credited to Cash for $100.

d.

a $450 payment on account is debited to Accounts

Payable for $45 and credited to Cash for $45.

LO 8 Explain the purposes of a trial balance.

The Cash account and the related cash

transactions indicate why cash changed

during October. To make this information useful for analysis it is

summarized in a statement of cash flows. The statement of cash flows

classifies each transaction as an operating activity, an investing

activity, or a financing activity.

Sierra Corporation’s:

3-67

Operating activities involve providing guide services.

Investing activities include the purchase or sale of long-lived

assets used in operating the business, or the purchase or sale

of investment securities.

Financing activities are borrowing money, issuing shares of

stock, and paying dividends.

LO 9 Classify cash activities as operating, investing, or financing.

Key Points

Transaction analysis is the same under IFRS and GAAP

however different standards sometimes impact how transactions

are recorded.

European companies rely less on historical cost and more on fair

value than U.S. companies. The double-entry system is the

basis of accounting systems worldwide.

Both the IASB and FASB go beyond the basic definitions

provided in this textbook for the key elements of financial

statements, that is, assets, liabilities, equity, revenues, and

expenses.

3-68

LO 10 Compare the procedures for the recording process under GAAP and IFRS.

Key Points

A trial balance under IFRS follows the same format as shown in

the textbook.

As shown in the textbook, dollars signs are typically used only in

the trial balance and the financial statements. The same practice

is followed under IFRS, using the currency of the country in which

the reporting company is headquartered.

3-69

LO 10 Compare the procedures for the recording process under GAAP and IFRS.

Key Points

In deciding whether the United States should adopt IFRS, some of

the issues the SEC said should be considered are:

►

Whether IFRS is sufficiently developed and consistent in

application.

3-70

►

Whether the IASB is sufficiently independent.

►

Whether IFRS is established for the benefit of investors.

LO 10 Compare the procedures for the recording process under GAAP and IFRS.

Key Points

Some of the issues the SEC said should be considered are:

►

The issues involved in educating investors about IFRS.

►

The impact of a switch to IFRS on U.S. laws and

regulations.

►

The impact on companies including changes to their

accounting systems, contractual arrangements, corporate

governance, and litigation.

►

3-71

The issues involved in educating accountants, so they can

prepare statements under IFRS.

LO 10 Compare the procedures for the recording process under GAAP and IFRS.

Looking to the Future

The basic recording process shown in this textbook is followed by

companies across the globe. It is unlikely to change in the future. The

definitional structure of assets, liabilities, equity, revenues, and

expenses may change over time as the IASB and FASB evaluate their

overall conceptual framework for establishing accounting standards.

3-72

LO 10 Compare the procedures for the recording process under GAAP and IFRS.

IFRS Practice

Which statement is correct regarding IFRS?

a) IFRS reverses the rules of debits and credits, that is, debits

are on the right and credits are on the left.

b) IFRS uses the same process for recording transactions as

GAAP.

c) The chart of accounts under IFRS is different because

revenues follow assets.

d) None of the above statements are correct.

3-73

LO 10 Compare the procedures for the recording process under GAAP and IFRS.

IFRS Practice

A trial balance:

a) is the same under IFRS and GAAP.

b) proves that transactions are recorded correctly.

c) proves that all transactions have been recorded.

d) will not balance if a correct journal entry is posted twice.

3-74

LO 10 Compare the procedures for the recording process under GAAP and IFRS.

IFRS Practice

One difference between IFRS and GAAP is that:

a) GAAP uses accrual-accounting concepts and IFRS uses

primarily the cash basis of accounting.

b) IFRS uses a different posting process than GAAP.

c) IFRS uses more fair value measurements than GAAP.

d) the limitations of a trial balance are different between IFRS

and GAAP.

3-75

LO 10 Compare the procedures for the recording process under GAAP and IFRS.

Copyright

“Copyright © 2013 John Wiley & Sons, Inc. All rights reserved.

Reproduction or translation of this work beyond that permitted in

Section 117 of the 1976 United States Copyright Act without the

express written permission of the copyright owner is unlawful.

Request for further information should be addressed to the

Permissions Department, John Wiley & Sons, Inc. The purchaser

may make back-up copies for his/her own use only and not for

distribution or resale. The Publisher assumes no responsibility for

errors, omissions, or damages, caused by the use of these

programs or from the use of the information contained herein.”

3-76