last_baro_edition_2014_version_ANG_snjv

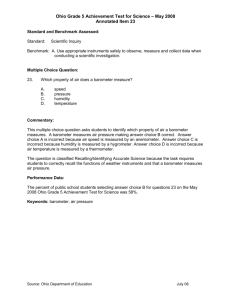

advertisement