M s

advertisement

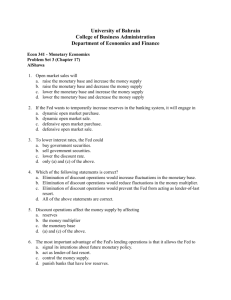

Chapter 8 Conduct of Monetary Policy: Tools, Goals, and Targets The Federal Reserve Balance Sheet Monetary Base = Currency + Reserves 2 The Federal Reserve Balance Sheet Open Market Purchase from Public The Fed Public Assets Liabilities Securities –$100 Deposits +$100 Assets Liabilities Securities Reserves +$100 +$100 Banking System Assets Reserves Liabilities Deposits +$100 +$100 Result R $100, MB $100 3 The Federal Reserve Balance Sheet Discount Loans Banking System Assets Reserves Liabilities Discount loans +$100 +$100 The Fed Assets Liabilities Discount loans Reserves +$100 +$100 Result R $100, MB $100 4 Market for Reserves and the Fed Funds Rate 1. Demand curve slopes down because iff , ER and Rd up 2. Supply curve slopes down because iff , DL , Rs 3. Equilibrium iff where Rd = Rs5 Figure 7.1: Equilibrium in the Market for Reserves Figure 7-2: Response to Open Market Operation or Change in Discount Rate 1. 2. Open market purchase, Rs shifts to right and iff id , DL , Rs shifts to right and iff 6 Figure 7-3: Response to Change in Required Reserves 1. RR , Rd shifts to right, iff 7 Tools of Monetary Policy Open Market Operations 1. 2. Dynamic: Meant to change Reserves Defensive: Meant to offset other factors affecting Reserves, typically uses repos Advantages of Open Market Operations 1. 2. 3. 4. Fed has complete control Flexible and precise Easily reversed Implemented quickly Information about the FOMC http://www.federalreserve.gov/fomc 8 Discount Loans 3 Types 1. 2. 3. Lender of Last Resort Function 1. 2. Adjustment Credit Seasonal Credit Extended Credit To prevent banking panics FDIC fund not big enough Examples: Continental Illinois and Franklin National Banks To prevent nonbank financial panics Example: 1987 stock market crash Announcement Effect 1. Problem: false signals 9 Reserve Requirements Advantages 1. Powerful effect Disadvantages 1. Small changes have very large effect on Ms 2. Raising causes liquidity problems for banks 3. Frequent changes cause uncertainty for banks 4. Tax on banks FOMC calendar and meeting minutes http://www.federalreserve.gov/fomc/#calendars 10 Goals of Monetary Policy Goals 1. 2. 3. 4. 5. 6. High employment Economic growth Price stability Interest rate stability Financial market stability Foreign exchange market stability Goals often in conflict 11 Figure 7-4: Central Bank Strategy 12 Money Supply Target 1. Md fluctuates between Md' and Md'' 2. With Mtarget at M*, i fluctuates between i' and i'' Figure 7-5: Result of Targeting on the Money Supply 13 Interest Rate Target Figure 7-6: Result of Targeting on the Interest Rate 1. Md fluctuates between Md' and Md'' 2. To set itarget at i*, Ms fluctuates between M' and M'' 14 Criteria for Choosing Targets Criteria for Intermediate Targets 1. 2. 3. Measurability Controllability Ability to predictably affect goals Interest rates aren't clearly better than Ms on criteria 1 and 2 because hard to measure and control real interest rates Criteria for Operating Targets 1. Same criteria as above Reserve aggregates and interest rates about equal on criteria 1 and 2, but for 3 if intermediate target is Ms then reserve aggregate is better 15 History of Fed Policy Procedures Early Years: Discounting as Primary Tool 1. 2. Discovery of Open Market Operations 1. Real bills doctrine Rise in discount rates in 1920: recession 1920– 1921 Made discovery when purchased bonds to get income in 1920s Great Depression 1. 2. Failure to prevent bank failures Result: sharp drop in Ms 16 History of Fed Policy Procedures Pegging of Interest Rates: 1942–1951 1. 2. To help finance war, T-bill at 3/8%, T-bond at 21/2% Fed-Treasury Accord in March 1951 Money Market Conditions: 1950s and 1960s 1. 2. Free reserves = ER DL Interest rates 17 History of Fed Policy Procedures Targeting Monetary Aggregates: 1970s 1. 2. New Operating Procedures: 1979–1982 1. 2. 3. Federal funds rate as operating target with narrow band Procyclical Ms Deemphasis on federal funds rate Nonborrowed reserves operating target The Fed still using interest rates to affect economy and inflation Deemphasis of Monetary Aggregates: 1982–Early 1990s 18 History of Fed Policy Procedures Fed Funds Targeting Again 1. Federal funds target now announced International Considerations 1. 2. M in 1985 to lower exchange rate, M in 1987 to raise it International policy coordination 19 Figure 7-7: Federal Funds Rate and Money Growth Before and After October 1979 Monetary Targeting Abroad United Kingdom 1. 2. Canada 1. 2. Targets M3 and later M0 Problems of M as monetary indicator Targets M1 till 1982, then abandons it 1988: declining π targets, M2 as guide Germany 1. 2. 3. Targets central bank money, then M3 in 1988 Allows growth outside target for 2–3 years, but then reverses overshoots 1990s: dilemma of restrain π, but keep exchange rate in EMS 21 Monetary Targeting Abroad Japan 1. Forecasts M2 + CDs 2. Innovation and deregulation makes less useful as monetary indicator 3. High money growth 1987–1989: “bubble economy,” then tight money policy 22 Inflation Targeting Lessons from Monetary Targeting 1. 2. 3. Success requires correcting overshoots Operating procedures not critical Breakdown of relationship between M and goals made M-targeting untenable; led to inflation targeting Inflation Targeting: New Zealand, U.K., Canada 1. 2. 3. Announcement of numerical π goal Commitment to price stability Communication with “Inflation Report” 23 Inflation Targeting (cont.) Lessons from Inflation Targeting 1. 2. 3. Decline in π still led to output loss Worked to keep π low Kept π in public eye—reduced political pressures for inflationary policy 24 Using a Fed Watcher Fed watcher predicts monetary tightening, i 1. 2. Acquire funds at current low i Buy $ in FX market Fed watcher predicts monetary loosening, i 1. 2. 3. Make loans now at high i Buy bonds, price rise in future Sell $ in FX market 25