SNP-M-APP-5-MO - Freedom Specialty

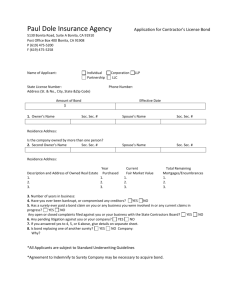

advertisement

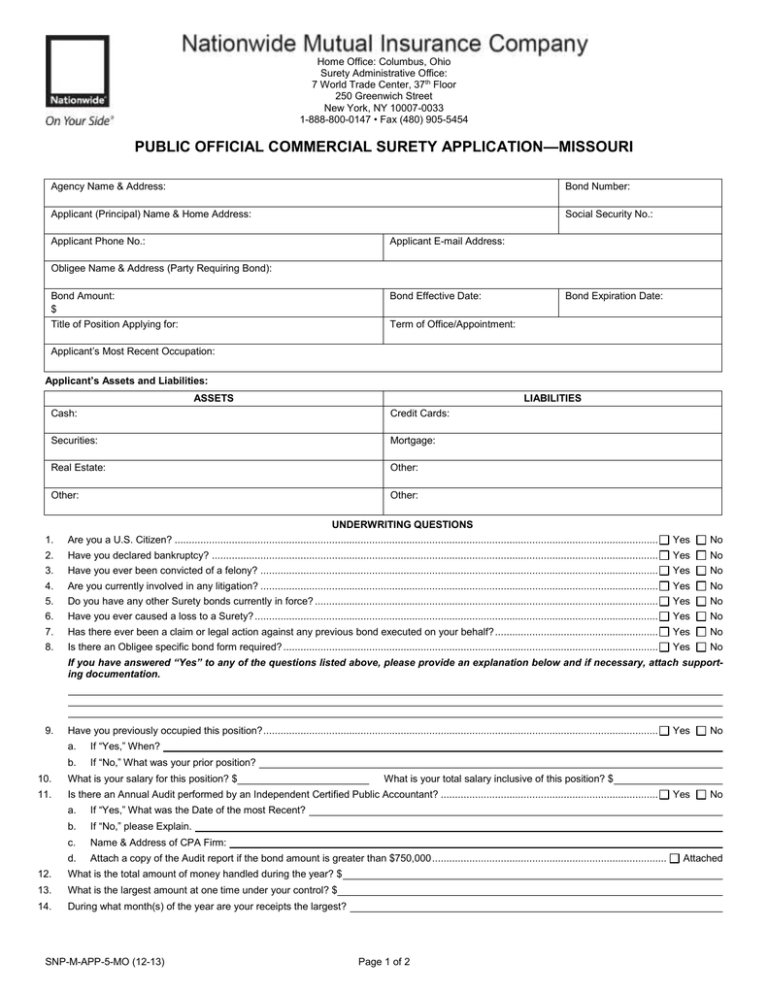

Home Office: Columbus, Ohio Surety Administrative Office: 7 World Trade Center, 37th Floor 250 Greenwich Street New York, NY 10007-0033 1-888-800-0147 • Fax (480) 905-5454 PUBLIC OFFICIAL COMMERCIAL SURETY APPLICATION—MISSOURI Agency Name & Address: Bond Number: Applicant (Principal) Name & Home Address: Social Security No.: Applicant Phone No.: Applicant E-mail Address: Obligee Name & Address (Party Requiring Bond): Bond Amount: $ Bond Effective Date: Title of Position Applying for: Term of Office/Appointment: Bond Expiration Date: Applicant’s Most Recent Occupation: Applicant’s Assets and Liabilities: ASSETS LIABILITIES Cash: Credit Cards: Securities: Mortgage: Real Estate: Other: Other: Other: UNDERWRITING QUESTIONS 1. Are you a U.S. Citizen? ......................................................................................................................................................................... Yes No 2. Have you declared bankruptcy? ............................................................................................................................................................ Yes No 3. Have you ever been convicted of a felony? ........................................................................................................................................... Yes No 4. Are you currently involved in any litigation? ........................................................................................................................................... Yes No 5. Do you have any other Surety bonds currently in force? ........................................................................................................................ Yes No 6. Have you ever caused a loss to a Surety? ............................................................................................................................................. Yes No 7. Has there ever been a claim or legal action against any previous bond executed on your behalf? ......................................................... Yes No 8. Is there an Obligee specific bond form required? ................................................................................................................................... Yes No If you have answered “Yes” to any of the questions listed above, please provide an explanation below and if necessary, attach supporting documentation. 9. Have you previously occupied this position? .......................................................................................................................................... a. If “Yes,” When? b. If “No,” What was your prior position? 10. What is your salary for this position? $ 11. Is there an Annual Audit performed by an Independent Certified Public Accountant? ............................................................................ If “Yes,” What was the Date of the most Recent? b. If “No,” please Explain. c. Name & Address of CPA Firm: d. Attach a copy of the Audit report if the bond amount is greater than $750,000 .................................................................................. What is the total amount of money handled during the year? $ 13. What is the largest amount at one time under your control? $ 14. During what month(s) of the year are your receipts the largest? SNP-M-APP-5-MO (12-13) No Yes No What is your total salary inclusive of this position? $ a. 12. Yes Page 1 of 2 Attached 15. What is the Name of the bank(s) that the funds from this position are being deposited? 16. Are you required to use a designated depository which has been previously approved by the Obligee’s governing body? .................... Yes No 17. Are funds withdrawn from this depository by check of the applicant? ..................................................................................................... Yes No 18. Is countersignature required on all checks? ........................................................................................................................................... Yes No Yes No 19. a. If “Yes,” Who provides the countersignature? b. If “No,” explain. Are bank accounts reconciled on a monthly basis by an individual not authorized to make deposits or withdrawals? ............................ a. 20. If “No,” explain. If the Applicant is a Tax Collector, Provide the Name and Address of the entity to whom the bonds will be issued, if different than above. INDEMNITY AGREEMENT The undersigned Applicant and Indemnitor(s), (all hereinafter called the Indemnitor[s]) acknowledges that all information is complete and correct and is given to induce the insurance company and its agent to execute the bond applied for. It is understood that false information may constitute misrepresentation or fraud. Authorization is given to investigate the credit, character, capacity and capital of the Indemnitor(s) for bonding purposes. Should the Nationwide Mutual Insurance Company (hereinafter called the Company) execute or procure the execution of the suretyship hereinbefore applied for, or other suretyship in lieu thereof or in connection therewith, the Indemnitor(s) do, in consideration thereof, jointly and severally and for each other undertake and agree. That the statements contained in the foregoing application are true. That the Indemnitor(s) will pay the Company, at its office in New York, New York, in advance, in each and every year, the premiums for such suretyship, or any renewal, extension, modification or continuation thereof, or Consent of Surety, requested or assented to by the Indemnitor(s), and until the Indemnitor(s) shall serve upon the Company competent written legal evidence satisfactory to it of its final discharge from such suretyship and all liability by reason thereof. And the Indemnitor(s) hereby agree that the voucher or other evidence of any payment made by the Company by reason of such suretyship be competent evidence of such payment and the propriety thereof, and of the Indemnitors’ liability therefor to the Company, and do hereby further bind themselves, their heirs, executors, administrators, successors and assigns, to indemnify and save the Company harmless, and on demand to pay it any and all claims, demands, loss and damages of every nature and kind, as well as all legal and other costs, counsel fees and expenses which the company shall at any time sustain, directly or indirectly, by reason or in consequence of such suretyship, or any renewal, extension, modification or continuation thereof, or Consent of Surety or additional suretyship, whether before or after legal proceedings by or against the Company, and whether with or without notice thereof to the Indemnitor(s). Payment by the Indemnitor(s) to the Surety should be made as soon as liability exists or is asserted, regardless of whether the Surety shall have made payment therefor, and shall be equal to the amount of the reserve set by the Surety in connection with the claim. Failure to make the payment requested by the Surety shall be a breach of this agreement. The Surety shall have the right to settle, adjust or compromise any claim related to the bonds and any amount paid in connection therewith shall be repaid by the Indemnitor(s) to the Surety, provided that in the event that the Indemnitor(s) object to the settlement, adjustment or compromise proposed by the Surety, and desire that the claim be litigated, the Surety shall have the right to demand from the Indemnitor(s) and receive in advance of denying the claim and litigating it, such cash or other security as is satisfactory in kind and amount to the Surety to be used to pay any judgments, awards, and expenses (including attorney’s fees) that may be rendered against or incurred by the Surety in connection with the claim. The Indemnitor(s) will, on the request of the Company, procure the discharge of the Company from said suretyship, and all liability by reason thereof, and any and all renewals and extensions of the same. The Company shall not be required to remove or join in the removal of any action arising upon the obligation referred to or in any way connected therewith from the State Court to the Federal Court, if there by any law practice prevailing in the State in which such action is brought fixing any penalty for such removal or providing for the revocation of the license to transact business in said State of a foreign corporation applying for such removal. The Company, and its designated agents, shall, at any and all reasonable times, have free access to the books and records of the Indemnitor(s). The Company shall have the right at any and all reasonable times to obtain from consumer credit reporting agencies, information concerning any Indemnitor(s) credit history and to ascertain from the bank, banks, or other depository with which the Indemnitor(s) do business, the amounts standing to the credit of the Indemnitor(s), and the Indemnitor(s) indebtedness to such bank, banks, or other depository, and such bank, banks, or other depository are authorized and directed to supply the Company with such information. That if the Indemnitor(s), or one or more of them be a corporation, it is specifically and beneficially interested in obtaining said bond and that the officer executing on its behalf is thereunto duly authorized with full power to bind said corporation in the premises. That no change or modification of or in the terms of this agreement shall be effective unless such change or modification is in writing and signed by the President, a Vice President, a Secretary, or an Assistant Secretary of the Company. A facsimile signature of this document shall be deemed an original signature for any and all purposes. FRAUD PREVENTION—WARNING NOTICE TO APPLICANTS: ANY PERSON WHO KNOWINGLY AND WITH INTENT TO DEFRAUD ANY INSURANCE COMPANY OR ANOTHER PERSON FILES AN APPLICATION FOR INSURANCE OR STATEMENT OF CLAIM CONTAINING ANY MATERIALLY FALSE INFORMATION, OR CONCEALS FOR THE PURPOSE OF MISLEADING, INFORMATION CONCERNING ANY FACT MATERIAL THERETO, COMMITS A FRAUDULENT INSURANCE ACT, WHICH IS A CRIME AND SUBJECTS THE PERSON TO CRIMINAL PENALTIES. IN WITNESS WHEREOF, we have signed and sealed this Agreement to be effective the Witness: By: Printed Name: Printed Name: day of , 20 . (Seal) All bond requests exceeding $750,000 require a second signature by an authorized representative of the governing body of the Obligee. The purpose of this request and signature is to verify the responses to questions 13., 17.-21. The signatory is not indemnifying the surety. Witness: Representative: Printed Name: Printed Name & Title: SNP-M-APP-5-MO (12-13) Page 2 of 2