The Financialization of the Terminal and Port Industry

advertisement

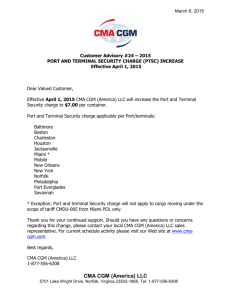

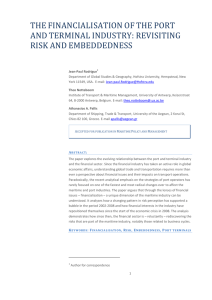

International Association of Maritime Economists (IAME) 2010 Conference, Lisbon, Portugal The Financialization of the Terminal and Port Industry: Rediscovering Risk Jean-Paul Rodrigue Paper no. 2.09.02 Department of Global Studies & Geography, Hofstra University, New York, USA Theo Notteboom ITMMA - University of Antwerp and Antwerp Maritime Academy, Belgium Athanasios Pallis Department of Shipping, Trade & Transport University of the Aegean, Chios, Greece The Financialization of the Terminal and Port Industry: Rediscovering Risk 1) Embeddedness, Spatial disconnection and Financialization 2) Finance and Leverage Upside-Down 3) Rediscovering Risk 4) Re-embedding Finance and the Port Terminal Industry 5) Conclusions: Rebalancing Trade and the Balance Sheet Finance and the Maritime Industry: An Embedded History ■ An old relationship: • Joint stock companies (17th century; VOC). • Insurance industry (e.g. Lloyd 1871). • Finance used to leverage the opportunities of international transportation. • Providing capital and mitigating risk when needed. ■ Local embeddedness: • Financial district in view of the wharves. ■ Industrial revolution and globalization • Better growth opportunities outside trade. • Separated the financial from the industry and the geography => cf. literature on port-city relations, global city networks, etc.. The Age of Discovery … of Risk: Dutch East India Company, Trade Network, 17th Century Historic Proximity of the Port / Financial District Port and Maritime Industry Finance: Who is Leveraging Whom? Investors Financial Markets Brokers Corporations Money Markets Commercial Banks Private Investors Capital Markets Mortgage Banks Investments Managers Equity Markets Merchant Banks Private Placement Finance Houses •Insurance Companies •Pension Funds •Banks •Trust Funds •Finance Houses Leasing Companies Shipping Companies Port Operators Earnings Value Propositions behind the Interest of Equity Firms in Transport Terminals Diversification (Risk mitigation value) Sectorial and geographical asset diversification. Mitigate risks linked with a specific regional or national market. Asset (Intrinsic value) Source of income (Operational value) Terminals occupy premium locations (waterfront). Globalization made terminal assets more valuable. Traffic growth linked with valuation. Same amount of land generates a higher income. Terminals as fairly liquid assets. Income (rent) linked with the traffic volume. Constant revenue stream with limited, or predictable, seasonality. Traffic growth expectations result in income growth expectations. Container Terminal Surface of the World's Major Port Holdings, 2009 N = 405 Container Terminals of the World's Four Major Port Holdings, 2009 The Financial Playground (1997-2008) At least 246 terminals acquired via M&A (some examples) New Comers (financial institutions) Goldman Sachs Wall Street Bank Deutsche Bank Prudential AIG Borealis (Canadian pension fund) Ontario Teachers Pension Fund Babcock & Brown Infrastructure Macquarie Infrastructure Mantauban SA Sovereign Funds GIC (Singapore government co) Dubai Ports World Players from within the sector (Stevedores & Shipping Companies) CMA-CGM Eurogate Holding Eurokai Hesse Natie Hutchison Port Holdings PSA Corp. Maersk Line Neptune Orient Lines Nippon Yusen Kaisha P&O Reviewing Assumptions: The Impacts of “Financialization” Physical assets seen as financial assets. Disconnection Rent-seeking strategies From market knowledge Focus on shortterm results Asset inflation High amortization Expectations of quick capital amortization. Expectations about future growth and the corresponding volumes. From long-term business cycles From outcome of actions Lack of accountability From local/ regional dynamics Lack of regional embeddedness Loss of embeddedness Assets perceived simply from their expected level of return. Lower contestability Perceived liquidity. Capacity to quickly enter and exit the market. Consolidation and Scale Increases: Major Port Terminal Acquisitions since 2005 Date Transaction 2005 DP World takes over CSX World Terminals Early 2006 PSA acquires a 20% stake in HPH Mid 2006 DP World acquires P&O Ports Mid 2006 Goldman Sachs Consortium acquires ABP End 2006 AIG acquires P&O Ports North America Early 2007 Ontario Teachers’ Pension Fund acquires OOIL Terminals Mid 2007 RREEF acquires Maher Terminals Price compared to EBITDA 14 times 17 times 19 times 14.5 times 24 times 23.5 times 25 times EBITDA = Earnings Before Interest, Taxes, Depreciation and Amortization Additional Factors of “Recklessness” in pre-crisis “bubble” (2002-2008) ■ Supply lagging behind demand • Capacity shortages in terminals and ships increasing their “market value”. • Sense of “urgency” in terminal and shipping investments. ■ Emerging terminal management model • Concessions agreements to maximize returns. • Over-bidding related to availability of finance; OPM. • “Right price’ replaced by “any price”. ■ Existing actors being “financialized” • Equity related offerings on financial markets. Shipping Equity and Equity-linked Offerings in Public Markets (2000-2007) 18,000 16,000 14,000 12,000 10,000 8,000 6,000 4,000 2,000 0 2000 2001 2002 2003 2004 2005 2006 2007 The Financial Playground: Private Equity Funds and Ferries (1995-2004) Operator PEF Buyer Year 1995 Price Paid (€ million) 160 Equity share (estimated) Min Holding Wightlink Cinven Condor Ferries 3i 1995 50 33% Moby Lines Efibanca/MPS 2000 5 4,3% Wightlink Royal Bank of Scotland 2001 270 35% Red Funnel Ferries JP Morgan 2001 105 Min Holding Condor Ferries ABN-AMRO 2002 225 Maj Holding Isle of Man Steam Packet Montagu Private Equity 2003 210 100% Wightlink Maquarie Bank 2004 350 Min Holding Condor Ferries Royal Bank of Scotland 2004 360 Maj Holding Red Funnel Ferries HBOS 2004 145 49% Moby Lines Equinox 2004 20 14% Grandi Navi Veloce Permira 2004 522 80% Sources: Baird (2009); Cruise & Ferry Info: ShipPax, Halmstad, Sweden. The Financial Playground: Private Equity Funds and Ferries (2004-8) Operator PEF Buyer Year Price Paid (€ million) Equity share (estimated) Moby Lines Clessidra 2005 50 30% Isle of Man Steam Packet Maquarie Bank 2005 315 100% Grandi Navi Veloce Investitori Associati 2006 700 87% SNCM Butler Capital Ptnrs 2006 35 38% Red Funnel Ferries Prudential 2007 300 Maj Holding Scandlines 3i / Allianz 2007 1,560 - Superfast Ferries Marfin Investment 2007 500 90% Blue Star Ferries Marfin Investment 2007 500 85% UN RoRo Kohlberg Kravis Roberts Maquarie Bank 2007 910 100% 2008 390 Maj Holding Condor Ferries Total Sources: Baird (2009); Cruise & Ferry Info: ShipPax, Halmstad, Sweden. 7,682 The Double Squeeze on Ports and Maritime Shipping in the “Post-Bubble” Period Overcapacity New terminals coming online New ships coming online (+ cancellations) Contestability for gateways Contestability for hubs Rebalancing Lower profitability Less pressures on terminal resources Less financial appeal High Re-Discovering Risk: Relations between Risk and Embeddedness Trust Risk Level FINANCE Low Information SHIPPING Low Embeddedness Level High Risk Typology in Ports, Terminals and Shipping Risk Category Type Details Technical Internal Construction and technology Market External Gross domestic product, growth, inflation, market structures, changes in supply chain management practices. Internal Business models (e.g. concentration/specialization risk), traffic demand, elasticity, pricing and capacity strategies of rivals and on alternative routes, energy cost risks External Interest rate, taxation currency, exchange rates, debt rating of the country, payment risk (customer base). Internal Capital risk (including loans availability and interest rates, revenues, payback period, grant financing) External Legal, Regulatory, Security, moral hazard Financial Political Environmental External Changes of environmental laws, unforeseen societal sensitivities Re-embedding Finance and the Port Terminal Industry 1) Risk Allocation Desire to allocate greater risks onto private sector in PPPs: • Requires clear policy goals and stable regulation. • Moral hazard risks will continue to be tested. More demanding capital markets and less access to (cheap) credit: • Focus on performance to meet financial metrics. • New projects more critically assessed. Greater consideration of cost recovery of port infrastructure investment: • From the deal / financial structure to quality of the asset. 2) Reviewing False The assumption that larger players have more information than Asymmetries smaller players: • The larger players appear to have lost the most. Re-embedding Finance and the Port Terminal Industry 3) Growth Story: Time for realism Abandoning the compound annual growth paradigm • Port traffic assumptions likely to be less backward looking. • Stronger cyclical effects than perhaps first assumed. Greater attention on market fundamentals: • Globalization or regionalization? 4) Barriers to Paying attention to competition drivers: Entry: Competition • Growth may no longer mitigate competitiveness as it did matters previously. • Transshipment a particularly vulnerable segment. 5) Amortization: Modest times Volume & pricing assumptions more modest: • Longer amortization periods. • PPP rent sharing more probable. The New Normal ■ Trend 1: Rebalancing short-term and long-term benefits • Short-term investor gains against long-term performance improvements. ■ Trend 2: Redefining public involvement • New forms of Public-Private Partnerships (PPP). • Towards a revision of conventional concession models of a landlord port authority (i.e. awarding system, performance, concession fee system, etc..) ? • Private sector has a lower tolerance to risk. ■ Trend 3: Refocus on resource management • Operations, and resources and asset optimization. The New Normal ■ Trend 4: Reassessing portfolios, vertical disintegration and consolidation • Low valuations could offer potential for mergers or acquisitions. • Shipowners’ interest in investing in terminals? ■ Trend 5: Restrictions in getting finance • Ports should be considered as long-term investments. ■ Trend 6: Dealing with mature markets • Low to moderate long-term growth perspectives. • Shift towards quality of service instead of growth. Conclusions: Rebalancing Trade and the Balance Sheet ■ Paradigm shift • Risk that was traditionally highly embedded within the industry has been obfuscated. • Port terminals as abstracted bundles of financial assets and liabilities: “Financialization”. • Better understanding: • Global trade dynamics • Financial and monetary cycles. • Capital misallocations. • Recreation of embeddedness: • Through intermodalism and supply chain integration. • Cluster formation and governance.