Quiz1areviewExec - NYU Stern School of Business

advertisement

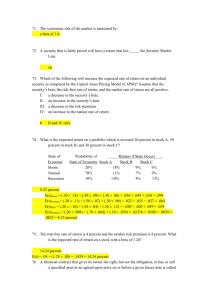

CORPORATE FINANCE REVIEW FOR QUIZ 1A Aswath Damodaran Basic Skills Needed What are the potential conflicts of interest that underlie a business and how do they manifest themselves in practice? Can you read a regression of stock returns against market returns? - How would you use the intercept to measure stock price performance? What does the slope of the regression measure? What does the R squared of the regression tell you about risk? .Can you use the beta to estimate an expected return on an investment? 2 Corporate governance.. Use common sense… Stockholder/ Managers: The essence of strong corporate governance is the same as the essence of a good democracy. Stockholders (voters) get the right to question managers, hold them accountable and change them, if they so desire. Lenders/ firm: The peril that lenders face is that, if left unprotected, stockholders will take advantage of them. If they feel unprotected, they will have to incorporate that fear into their lending decisions. Key question on any action: Will it increase the power of stockholders to hold managers accountable or lessen it? Key question on any action: Will this action protect lenders more from stockholder expropriation or less? What are the consequences? Markets/ firm: The key component of market efficiency is that market prices reflect available information and will react appropriately to new information. Key question on market efficiency: Can an investor or investors take advantage of a perceived market reaction? 3 Manager/ Stockholder conflict: Example The essence of corporate governance, as defined in corporate finance, is that stockholders have the power to choose/replace managers. Given this definition, which of the following statements best characterizes a good corporate governance system? a. b. c. d. e. Stockholders replace all managers every year Stockholders replace only bad managers every year Stockholders have the option to replace all managers every year. Stockholders have the option to replace only bad managers every year None of the above 4 Lender/ Stockholder Conflict: Example One concern that banks have when they lend to companies is that their interests are different from those of the stockholders running these companies. If you move to a system where lenders’ interests are unprotected, which of the following would you expect to observe on lending and interest rate? a. b. c. d. e. No effect on either borrowing or interest rates Lenders will lend more money and charge lower interest rates Lenders will lend less money and charge lower interest rates Lenders will lend more money and charge lower interest rates Lenders will lend less money and charge higher interest rates 5 Market Efficiency: Example There is evidence that the stock price “pops” (jumps about 10-15% from the offering price) on the offering date for initial public offerings. Given the definition of efficient markets (that the market price reflects available information), this price jump is incompatible with an efficient market. True False 6 Society/ Firm: Example Apple has come under pressure from activists for using suppliers who pay low wages to their employees. Assuming that you believe that this is not an ethical practice for an extremely profitable company, which of the following do you think is most likely to change Apple’s behavior? a. b. c. d. e. Make Apple’s top managers take a Social Responsibility (CSR) class. Introduce a motion of disapproval at Apple’s next annual meeting. Buy Apple shares, with the intent of changing its managers. Don’t buy Apple products (iPods, iPhones, iPads, Macbooks). None of the above. 7 Risk and Return: The Risk free Rate The first building block for an expected return is the risk free rate. For an investment to be riskfree, it has to deliver a guaranteed return, which then requires that two criteria be met: You can have no default risk in the entity issuing the security Your time horizon on the cash flow match up to the time horizon for the risk for the “riskfree” investment. In corporate finance, we cheat and use the long term default free rate as the risk free rate To get to a long term default free rate, we usually start with the government bond rate but have to stop and check to see, if it is in fact default free. If it is default free, that rate is the risk free rate If there is default risk, you have to capture that risk in a default spread (over and above the risk free rate) that you net out Risk free rate = Government bond rate – Default spread for the government 8 Risk and Return: The Equity Risk Premium The equity risk premium is the premium you would charge over and above the risk free rate to invest in equities as a class or in the average equity risk investment. It can be estimated using either historical data or a forward looking estimate (based on how risky assets are priced). If you do use historical data, remember To use the longest time period you can (since the standard error in the estimate is huge) To be consistent in the risk free rate that you use To use the geometric average (since it will compound over time) If you use a forward looking estimate, recognize that the number will be volatile and change over time. 9 Risk free rate & ERP: Example You are working with a Polish company on estimating its hurdle rate, in Polish Zlotys. You are consequently trying to estimate a riskfree rate and equity risk premium to use and have collected the following information: The Polish government has ten-year Zloty denominated bonds trading, with a market interest rate of 5.5% and ten-year Euro-denominated bonds trading, with a market interest rate of 3.25%. The ten-year German government Euro-denominated bonds trade at an interest rate of 1.75%. (Poland has the same local currency and foreign currency rating). The standard deviation in the Polish Government bond is 15% and the standard deviation in the Polish equity index is 21%. You have estimated a historical risk premium for Poland, using 5 years of data, of 11.5% and a historical risk premium, using 100 years of data, for the US, of 5%. 10 Part a: Estimating a risk free rate in Zlotys Step 1: Get the government bond rate in Zlotys Step 2. Estimate the default spread for the Polish government. This can be done by comparing the rate on a Euro denominated Polish bond and the German Euro bond rate. Government bond rate in Zlotys = 5.50% Default spread = 3.25% - 1.75% Step 3: Net out the default spread from the government bond rate Risk free rate = Govt bond rate – Default spread = 5.5% 1.5% = 4% 11 Part b: Estimating an Equity Risk Premium for Poland You have historical risk premiums for Poland but the time period is too short to yield a meaningful value. The historical risk premium for the US is over a longer time period, but it is for a mature market. To estimate the additional risk premium you would charge for Poland, you can start with the default spread of 1.50% that you estimated for Polish government debt. You would then need to scale it up for the additional risk in Polish equities, with the scaling factor obtained from the standard deviations of the Polish equity and bond markets. Historical premium for mature market = Country risk premium for Poland = 1.5% (21/15) = Total equity risk premium for Poland = 5.00% 2.10% 7.10% 12 Reading a Regression: The Intercept Intercept – Rf (1- Beta) = Jensen’s alpha This is what the stock actually did in a month in which the market did nothing This is what the stock was expected to do in a month in which the market did nothing Excess Return 13 A Bloomberg regression page 14 Intercept to Jensen’s Alpha: Example There are two key measurement issues to keep in mind: It is the difference between the two (the intercept and the riskfree rate (1-beta)) that matters The intercept and the riskfree rate have to be stated in the same terms – if one is monthly, the other has to be monthly as well. Estimate the Jensen’s alpha for Kraft Foods, given that the average annualized T.Bill rate over the five years was 1.2%. Intercept = 0.39% (Remember the Bloomberg number is already a %) Monthly risk free rate = 0.10% (Annual risk free rate/12 = 1.20%/12 = 0.1%) Monthly riskfree rate (1- Beta)= 0.10% (1-0.532) = 0.0468% Jensen's alpha = 0.39% - 0.0468% = 0.3432% 15 The Risk breakdown (R2): Example The R squared is the proportion of the variance in the stock that is explained by the market. It is the portion that cannot be diversified away. If you chose to invest all of your money in Kraft Foods, what proportion of the risk would you not be rewarded for? The market risk is captured by the R-squared, which is 25.7% If you choose not to be diversified, you will not get rewarded for 74.3% of the risk. 16 Using the beta: Example The regression beta is the raw beta for the firm. The adjusted beta is just that number moved towards one. Use the regression beta on the page to estimate a dollar cost of equity for Kraft Foods. The ten-year treasury bond rate is 2% and Kraft Foods gets 50% of its revenues in the United States, 20% in Europe and 30% in Asia. The equity risk premium is 6% for the US, 6.5% for Europe and 8% for Asia. Riskfree rate = 2% (US government bond rate assumed to be default free) Beta = 0.532 (The raw beta) Equity risk premium = 0.5 (6%) + 0.2(6.5%) + 0.3 (8%) = 6.70% Cost of equity = 2% + 0.532 (6.70%) = 5.5644% 17