Full Employment

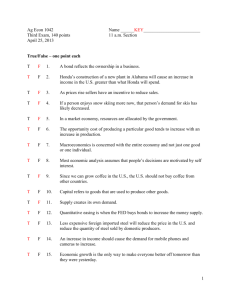

advertisement

The Jethro Project Full Employment Byron A. Ellis, PhD The Jethro Project • Full Employment is the level of employment where additional demand for goods and services cannot create more employment. • Potential Output is the level at which real output would be if there was full employment. • Aggregate Demand is the total demand for goods and services and it depends on income and wealth. • Aggregate Supply is the total level of output at each price level and it depends on firms and entrepreneurs expectations of cash flows (consumer demand). • Inflation is the rate of increase of the price level. • Involuntary Unemployment exist when employees are willing to work for current wages and cannot find work. The Jethro Project • Economic interactions are extremely complex, involving many abstractions of outputs and prices of goods and services. • Some economists, such as John Keynes and John Dewey, believed that capitalist economies lack the inherent capacity to create full employment. • Many businesses and conservatives do not support full employment because they believe it is inflationary. • Full employment shifts bargaining power from employers to laborers, mitigates poverty and narrows the inequality gap. • During World War II fears of postwar depression led to Full Employment proposals from politicians. • The Full Employment Bill of 1945 was defeated. The Jethro Project • • • • • • The Employment Act of 1946 did not have full employment as a goal, rather it dealt with corporate growth. The Humphrey-Hawkins Full Employment and Balanced Growth Act of 1978 passed but was violated and ignored. Large scale unemployment is one of the most widespread social ill; and, its effects are intergenerational. During the war years, 1941-1945, government spending reversed the dismal economic outcomes of the 1930s; in 1944 unemployment dropped to 1.7 percent. Wartime planning and coordination of aggregate demand and aggregate supply led to full employment. The Full Employment Bill of 1945 was premised on strong government intervention, planning and coordination to eliminate unemployment. The Jethro Project From William Dewald – Historical US Money Growth, Inflation and Inflation Credibility The Jethro Project • Each economy has a full employment level of output; at that level, the equilibrium between aggregate demand and aggregate supply creates enough jobs for all who wants to work. • Full employment is about governments managing aggregate demand and aggregate supply. • Aggregate demand increases when money in circulation increases. Consumption is 70 percent of gross domestic product (GDP). • Aggregate supply, or total production, increases with the expectations of increasing cash flows. • Globalization tends to remove supply constraints and minimizes price increases; it also provides new markets. • Economies expand when aggregate demand increases and contracts when aggregate demand decreases. The Jethro Project Price Level Economic Expansion AS1 AS2 P1 P0 AD2 AD1 YU1 YU2 YF Output The Jethro Project • Some economists, politicians and citizens believe that increasing effective demand causes the price level to rise. • To prevent prices (wages) from rising (inflation), the government reduces the amount of money in the economy, which raises the federal funds rate. • Federal Reserve (Fed) economists use the natural rate of unemployment, or the non-accelerating inflation rate of employment (NAIRU), to justify some level of unemployment. • Thus, the government trades employment for single digit inflation, using a process called inflation targeting. • Mainstream economists argue that unemployment is due to insufficient “employability,” lack of technical skills in periods of rapid innovations. The Jethro Project • Economist James Galbraith believes that diehard natural raters inside the Fed obstruct forceful actions on interest rate cuts, which would expand the economy and create employment. • Unemployment is not a random phenomenon, it exists by design. • The government can use fiscal and monetary policies to increase aggregate demand and supply. • Fiscal policies involves government spending, taxation, unemployment compensation, subsidies to universities, firms, farmers, citizens, and so on. • Monetary policies involves interest manipulation or addition and removal of money from circulation. • The Fed does not directly put money into circulation, rather it is the banking system that puts money into circulation, through the credit channel. The Jethro Project • • • • • • • The Federal Open Market Committee (FOMC) establishes the target rate for trading in the federal funds market. When the central bank (Fed) manipulates the federal funds rate, it affects the entire interest rate structure of the U.S. economy. When the Fed raises the federal funds rate, it removes money from the economy and causes banks to reduce lending, stifling demand and investment. When the Fed lowers the federal funds rate, it puts money into the banking system; the money does not go directly into circulation, except if the banks lend it to consumers. In 2008, prior to lowering the federal funds rate, the government began paying banks interest on reserves (IOR), to reduce banks’ hoarding costs. If the government did not pay IOR, banks would have to lend excess reserves to consumers in order to make a profit, which would have stimulated the economy. Paying IOR is another method for controlling inflation and economic expansion. The Jethro Project Price Level The Jethro Project Economic Contraction AS2 AS1 P0 P1 AD2 AD1 YU3 YU2 YU1 Output The Jethro Project • The Fed Excess Reserves graph shows an unprecedented increase in bank excess reserves. • For decades, excess reserves balances fluctuated around 7-12 billion dollar range, flat line. • If excess reserves of $2.5trillion were loaned to consumers it would create ($2.5 trillion x 1/.20 =) $12.5 trillion in demand deposits. • Fiat money, when loaned to the public, radically changes the nature of exchange and the characteristics of the production process. • More credit leads to more money in circulation, more demand and more employment. • During the 2008 Great Recession, US government loans to foreign central banks when from $40 billion in September to $600 billion in November. • So, given the high level of unemployment, why does the government loan money to foreign banks and allows US banks to hoard fiat money? The Jethro Project The Jethro Project Table 1 - Money Creation Demand Deposit (D) $2,500,000,000,000 $2,000,000,000,000 $1,600,000,000,000 $1,280,000,000,000 $1,024,000,000,000 $819,200,000,000 $655,360,000,000 $524,288,000,000 $419,430,400,000 $335,544,320,000 $268,435,456,000 $214,748,364,800 $171,798,691,840 $137,438,953,472 $109,951,162,778 " " " Reserve (20% of D) $500,000,000,000 $400,000,000,000 $320,000,000,000 $256,000,000,000 $204,800,000,000 $163,840,000,000 $131,072,000,000 $104,857,600,000 $83,886,080,000 $67,108,864,000 $53,687,091,200 $42,949,672,960 $34,359,738,368 $27,487,790,694 $21,990,232,556 " " " Loan (L) Interest (6% of L) $2,000,000,000,000 $1,600,000,000,000 $1,280,000,000,000 $1,024,000,000,000 $819,200,000,000 $655,360,000,000 $524,288,000,000 $419,430,400,000 $335,544,320,000 $268,435,456,000 $214,748,364,800 $171,798,691,840 $137,438,953,472 $109,951,162,778 $87,960,930,222 " " " $120,000,000,000 $96,000,000,000 $76,800,000,000 $61,440,000,000 $49,152,000,000 $39,321,600,000 $31,457,280,000 $25,165,824,000 $20,132,659,200 $16,106,127,360 $12,884,901,888 $10,307,921,510 $8,246,337,208 $6,597,069,767 $5,277,655,813 " " " $12,500,000,000,000 $2,500,000,000,000 $10,000,000,000,000 $600,000,000,000 The Jethro Project • During the 2008 Great Recession, the government could have preserved homeowners’ wealth by refinancing mortgages. However, government officials chose to recapitalize the banking industry instead of homeowners. • It appears that preserving the wealth of voters and maintaining effective demand was not a priority. • Stimulating effective demand through fiscal and/or monetary (credit) policies expands demand and reduces the vast army of unemployed workers. • So, why does the US government continues to allow banks to hoard excess reserves? • It is all about the misguided policy of controlling inflation at the expense of employment. The Jethro Project Questions and comments • What can citizens do? • • • Understand the job creation process, it is credit driven. Let your political representatives know that your vote is contingent on their support for full employment and the repeal of interest on reserves payments to banks. Communicate to your representatives that you know that draining money from the economy contributes to business cycles and that you will not vote for them if they do not actively oppose the Fed policy of draining money from the economy.