Puzzling Payroll Predicaments

advertisement

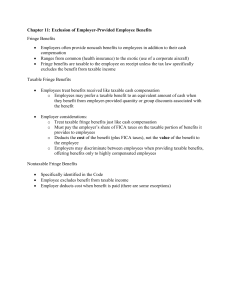

Puzzling Payroll Predicaments Laura Kushner Human Resources League of Minnesota Cities Agenda Election Judges Fringe Benefits Independent Contractor Update Minnesota Minimum Wage Law Fair Labor Standards Act Expansion of sick leave (if time) Election Judges Fringe Benefits Benefits provided to employees are taxable, unless there is a specific exemption in the tax code. Accountable Plan Business connection to the expenditure Reasonable accounting for expense Excess reimbursements or advances repaid to city Accountable Plan Example: City provides city manager with a monthly car allowance of $500. The city manager does not need to substantiate the business connection and does not need to turn in receipts or track miles. Fringe Benefits Taxable unless a specific exclusion applies; or Unless “de minimis” “De Minimis” -amount is so small that accounting for it would be administratively difficult Fringe Benefits Examples of fringe benefits excluded from income: Accident & health benefits Major medical, HRA’s, VEBA, Cafeteria Plans Achievement awards (limits) Dependent care (limits) Health Savings Accounts (limits) Athletic & Fitness Memberships Example: City has a fitness facility in community center. Employees are provided free memberships. Athletic & Fitness Memberships To be excluded from income: Substantially all of the use of the facility is by employees, spouses, and dependents No public use / access Gift Cards Example: City offers gift cards in varying amounts as incentives and prizes for participation in its wellness program. Gift Cards Treated same as cash Any amount is taxable income No “de minimis” for gift cards $5.00 gift card to Caribou = $5.00 of taxable income to employee Independent Contractors New guidance issued by DOL Strong area for compliance/audits, etc. “Economic realities” test Is the work integral part of the city? Does worker’s skill affect profit/loss? How does worker’s investment compare to employer’s investment? Work require special skill and initiative? Relationship permanent vs. indefinite? Nature and degree of employer control? Independent Contractor? City Hall Custodian City Attorney MN Minimum Wage Law Small Employer Total budget amount under $500,000 $7.25/hour (8/1/15) $7.75/hour (8/1/16) Indexed by economic indicators after that Large Employer Total budget amount over $500,000 $9.00/hour (8/1/15) $9.50/hour (8/1/16) Indexed by economic indicators after that Employees under 18 $7.25 – 8/1/2015 $7.75 -- 8/1/2016 YOUTH & MN Minimum Wage Law First 90 days of employment – IF UNDER AGE 20 $7.25/hour (8/1/2015) $7.75/hour (8/1/2016) Indexed by economic indicators after that ONE MORE THING …. Definition of Employee does NOT include:… (1) elected official or commission member (2) person ineligible for membership in PERA because: • Less than $5,100/year ($3,800 schools) • < 23 yrs, full-time student (3) under 18, <20 hrs., recreation program employee FAIR LABOR STANDARDS ACT – IT’S COMING …. Expansion of Sick Leave Benefits # 1 # 2 # 4 # 5 # 3 # 6 Resources Internal Revenue Service Lori.A.Stieber@irs.gov Public Employees Retirement Association Your City Auditor League of Minnesota Cities HRBenefits@lmc.org (E-MAIL IS OFTEN FASTEST!) 651-281-1200 800-925-1122 Ask for HR DEPT