Interest Rate

advertisement

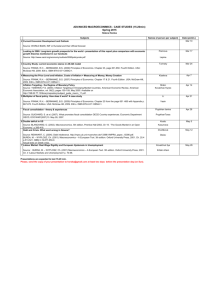

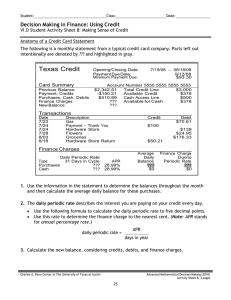

Annual Percentage Rate vs. Effective Annual Rate • APR = r m * m , where m is the number of compounding periods per year • EAR = (1+ APR / m) m - 1 5-1 Compound Interest EAR = (1+ APR / m) m - 1 APR = 6% i Periods per year ii Interest per period iii iv Value APR after (i x ii) one year v Annually compounded interest rate 1 6% 6% 1.06 6.000% 2 3 6 1.032 = 1.0609 6.090 4 1.5 6 1.0154 = 1.06136 6.136 12 .5 6 1.00512 = 1.06168 6.168 52 .1154 6 1.00115452 = 1.06180 6.180 365 .0164 6 1.000164365 = 1.06183 6.183 5-2 Continuous compounding Remember that FV = PV [ 1 + r / m ] m When m -> FV = PV * e r t Also, EAR = e r - 1 5-3 AER vs. APR example • It is just the middle of the month, but you already ran out of money. You go to Soprano’s Check Cashing, who loan you $500 now. In exchange, you will repay $570 at the end of the month. What are the Annual Percentage Rate (APR) and the Effective Annual Rate (EAR) that they charge you? 5-4 Computing the Outstanding Loan Balance 5-5 Example – monthly compounding • You just graduated from the Neeley school and bought a new car for $40,000. You finance the entire amount at 6% APR with monthly payments over 4 years. What is your monthly payment? 5-6 Inflation and Discount Rates • Key issues: – What is the difference between a real and a nominal return? – How can we convert from one to the other? • Example: Suppose we have $1,000, and Diet Coke costs $2.00 per six pack. We can buy 500 six packs. Now suppose the rate of inflation is 5%, so that the price rises to $2.10 in one year. We invest the $1,000 and it grows to $1,100 in one year. What’s our return in dollars? In six packs? 5-7 Calculating the Real Interest Rate 5-8 Calculating the Real Interest Rate 5-9 The Determinants of Interest Rates • • • • Inflation Maturity and interest rate risk Default risk Taxability 5-10 U.S. Interest Rates and Inflation Rates, 1955–2005 Interest rates are average three-month Treasury bill rates and inflation rates are based on annual increases in the U.S. Bureau of Labor Statistics’ consumer price index. Note that interest rates tend to be high when inflation is high. 5-11 Term Structure of Risk-Free U.S. Interest Rates, January 2004, 2005, and 2006 The figure shows the interest rate available from investing in risk-free U.S. Treasury securities with different investment terms. In each case, the interest rates differ depending on the horizon. (Data from U.S. Treasury STRIPS.) 5-12 Short-Term Versus Long-Term U.S. Interest Rates and Recessions One-year and ten-year U.S. Treasury rates are plotted, with the spread between them shaded in blue if the shape of the yield curve is increasing (the one-year rate is below the ten-year rate) and in red if the yield curve is inverted (the oneyear rate exceeds the ten-year rate). Gray bars show the dates of U.S. recessions. Note that inverted yield curves tend to precede recessions as determined by the National Bureau of Economic Research. In recessions, interest rates tend to fall, with short-term rates dropping further. As a result, the yield curve tends to be steep coming out of a recession. 5-13 Interest Rates on Five-Year Loans for Various Borrowers, June 2006 5-14