Chapter 21

Thrift Operations

Financial Markets and Institutions, 7e, Jeff Madura

Copyright ©2006 by South-Western, a division of Thomson Learning. All rights reserved.

1

Chapter Outline

Background on savings institutions

Sources and uses of funds

Exposure to risk

Management of interest rate risk

Valuation of a savings institution

Interaction with other financial institutions

2

Chapter Outline (cont’d)

Participation in financial markets

Performance of savings institutions

Savings institution crisis

Background on credit unions

Sources and uses of credit union funds

Credit union exposure to risk

Regulation of credit unions

3

Background on Savings Institutions

Savings institutions include savings banks and

S&Ls

S&Ls

are the most dominant type

Savings institutions are mainly concentrated in the

Northeast

The insuring agency for S&Ls is the Savings

Association Insurance Fund (SAIF)

The insuring agency for savings banks is the Bank

Insurance Fund (BIF)

Both agencies are administered by the FDIC

Savings

banks and S&Ls are very similar in their

sources and uses of funds

4

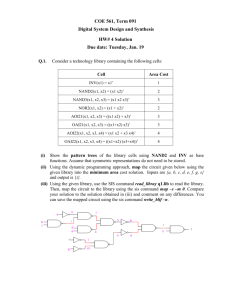

Background on Savings Institutions

(cont’d)

2%

20%

78%

More than $1

billion

Between $100

million and $1

billion

Less than $100

million

5

Background on Savings Institutions

(cont’d)

Ownership

Most

SIs are mutual (owned by depositors)

Many SIs have shifted their ownership structure from

depositors to shareholders through mutual-to-stockconversions

Allow SIs to obtain additional capital by issuing stock

Provide owners with greater potential to benefit from

performance

Make SIs more susceptible to hostile takeovers

6

Background on Savings Institutions

(cont’d)

Ownership (cont’d)

In

an acquisition, both SIs have to be stock-owned

Merger-conversion

The

number of SIs today is about one-half of the

number in 1994

The total assets of stock SIs has increased by more

than 60 percent since 1994

The total assets of mutual SIs has remained steady

since 1994

7

Background on Savings Institutions

(cont’d)

Regulation of savings institutions

Regulated at both the state and federal level

Federally chartered SIs are regulated by the Office of Thrift

Supervision (OTS)

State-chartered SIs are regulated by the state that has

chartered them

Regulatory assessment of SIs

Regulators conduct periodic onsite examinations of capital and risk

Monitoring is conducted using the CAMELS rating

Deregulation of services

Recently, SIs have been granted more flexibility to diversify

products

8

Sources of Funds (cont’d)

Borrowed funds

SIs can borrow from other depository institutions in the federal

funds market

SIs can borrow at the Fed’s discount window

SIs can borrow through repos

Capital

The capital (net worth) of SIs is composed of retained earnings

and funds obtained from issuing stock

SIs are required to maintain a minimum level of capital

9

Uses of Funds

Cash

SIs

maintain cash to satisfy reserve requirements

and accommodate withdrawal requests

Mortgages:

Are

the primary asset of SIs

Typically have long-term maturities and can be

prepaid by borrowers

Are mostly for homes or multifamily dwellings

Are subject to interest rate risk and default risk

10

Uses of Funds (cont’d)

Mortgage-backed securities

SIs

issue securities backed by mortgages

Cash flows to holders of these securities may not be

steady because of prepayment

Other securities

All

SIs invest insecurities such as Treasury bonds

and corporate bonds

Provide liquidity

Some

thrifts invested in junk bonds prior to 1989

11

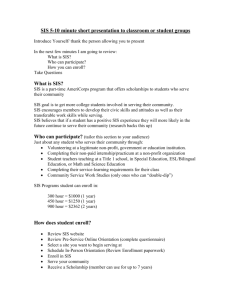

Uses of Funds (cont’d)

Single-Family

Mortgages

Multifamily

Morgages

Other Mortgages

11%

12%

Commercial Loans

50%

8%

Mortgage-Backed

Securities

Other Securities

6%

4%

4%

Consumer Loans

5%

Other Assets

12

Exposure to Risk

Liquidity risk

SIs commonly use short-term liabilities to finance long-term

assets

If new deposits are not sufficient to cover withdrawal requests,

SIs can experience liquidity problems

SIs can obtain temporary funds through repurchase agreements

or in the federal funds market

Credit risk

Conventional mortgages are the primary source of credit risk

SIs often carry the risk rather than paying for insurance

Many SIs were adversely affected by the weak economy in

2001–2002

13

Exposure to Risk (cont’d)

Interest rate risk

Many

SIs were hurt by rising interest rates in the

1980s because of their heavy concentration on fixedrate mortgages

Many SIs benefited from their exposure to interest

rate risk in the 2001–2002 period when interest rates

declined

14

Management of Interest Rate Risk

(cont’d)

Conclusions about interest rate risk

Although

strategies are useful, it is virtually

impossible to completely eliminate interest rate risk

Mortgages may be prepaid

15

Valuation of a Savings Institution

The value should change in response to

changes in its expected cash flows and to

changes in the required rate of return:

V f E (CF ), k

-

16

Valuation of a Savings Institution

(cont’d)

Factors that affect cash flows

E (CF ) f ( ECON, Rf , INDUS, MANAB)

Change

-

?

in economic growth

During periods of strong economic growth:

Consumer loan and mortgage loan demand is higher

Loan defaults are reduced

17

Valuation of a Savings Institution

(cont’d)

Factors that affect cash flows (cont’d)

Change

SIs’ cash flows are inversely related to interest rate

movements

SIs rely heavily on short-term deposits

SIs’ assets commonly have fixed rates

Change

in the risk-free interest rate

in industry conditions

SIs are exposed to regulatory constraints, technology, and

competition

18

Valuation of a Savings Institution

(cont’d)

Factors that affect cash flows (cont’d)

Change

in management abilities

Managers can attempt to make internal decisions

that will capitalize on the external forces that the

bank cannot control

Skillful managers will recognize how to revise the

composition of the SI’s assets and liabilities to

capitalize on existing economic or regulatory

conditions

19

Valuation of a Savings Institution

(cont’d)

Factors that affect the required rate of

return by investors

k f ( Rf , RP )

Change in the risk-free rate

When the risk-free rate increases, so does the return

required by investors:

Rf f ( INF, ECON, MS, DEF )

-

20

Valuation of a Savings Institution

(cont’d)

Factors that affect the required rate of

return by investors (cont’d)

Change

in the risk premium

When the risk premium increases, so does the return

required by investors:

RP f ( ECON, INDUS, MANAB)

?

-

21

Savings Institution Crisis (cont’d)

Reasons for failure (cont’d)

Losses

on loans and securities

Crisis was precipitated by unpaid loans

Major loan losses were in commercial real estate

SIs were forced to assume real estate holdings

that were sometimes worth less than half the loan

amount originally provided

Fraud

Most commonly, managers used depositors’ funds

for purchases of personal assets

22

Savings Institution Crisis (cont’d)

Reasons for failure (cont’d)

Illiquidity

SIs experienced a cash flow deficiency as a result

of loan losses

SIs were forced to offer higher interest rates on

deposits to attract more funds

The FSLIC was experiencing its own liquidity

problems, exacerbating the liquidity problem

23

Savings Institution Crisis (cont’d)

Impact of the bailout

Stronger

Many SIs are now required to maintain a higher

minimum level of capital

Higher

asset quality

SIs have been forced to maintain more

conservative asset portfolios

More

capital positions

consolidation

FIRREA allows commercial banks and other

institutions to purchase failing or healthy SIs

24

Background on Credit Unions

Credit unions are nonprofit organizations

composed of members with a common

bond

e.g.,

labor union, church, university

CUs accept deposits from members and

channel funds to those members who

want to finance the purchase of assets

25

Background on Credit Unions

(cont’d)

Ownership of credit unions

CUs

are technically owned by depositors

Deposits are called shares, which pay

dividends

CUs’ income is not taxed

CUs can be federally or state chartered

Federal CUs are growing at a faster rate

Most

CUs are very small

26

Background on Credit Unions

(cont’d)

Advantages and disadvantages of credit unions

Can

offer attractive rates to their members

Noninterest expenses are relatively low because

much of their assets is donated

Volunteer labor may not have the incentive to manage

operations efficiently

Common bond requirements restrict a given CU’s

growth

Many CUs are unable to diversify geographically

CUs have increasingly been merging

27

Sources and Uses of Credit Union

Funds

Sources of funds

Mostly from share deposits by members

Either share deposits, share certificates, or share drafts

For temporary funds, CUs can borrow from other CUs

or from the Central Liquidity Facility (CLF)

Acts as a lender similar to the Fed’s discount window

CUs

maintain capital, primarily in the form of retained

earnings

Uses of funds

The majority of funds is used for loans to members

Some CUs offer long-term mortgage loans

CUs purchase government and agency securities

28

Credit Union Exposure to Risk

Liquidity risk

CUs

can experience liquidity problems when an

unanticipated wave of withdrawal occurs without an

offsetting amount of new deposits

Credit risk

CUs

concentrate on personal loans to members

Most loans are secured

CUs with very lenient loan policies could experience

losses

29

Credit Union Exposure to Risk

(cont’d)

Interest rate risk

Maturities

on consumer loans are short term,

causing assets to be rate sensitive

Movements in interest revenues and interest

expenses are highly correlated

The spread between interest revenues and

interest expenses remains stable over time

30