Transnational corporations in international politics

advertisement

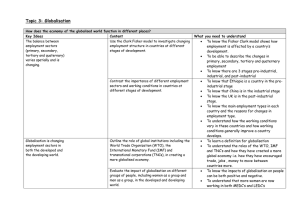

Transnational corporations SUM 3000/4000 March 7. 2006 Audun Ruud, Centre for Development and the Environment - SUM University of Oslo A Transnational corporations (TNC): is a corporation (firm) with power resources to control valueadded activities in two or more countries – even without formal equity control of the commercial activity in question Foreign Direct Investment (FDI): Financial, physical or human transfers of capital with the purpose to control management and revenues. A FDI contitutes a TNC FDI is normally related to shares of ownership beyond 50% (this is the reporting (tax) requirements in Norway). However, formal control can also be achived with significantly lower equity shares. Influence can even be exercised without any formal ownership of the unit/plant/firm in question Internationalization (Int.) refers to the extension of economic activities across national borders – for example through trade and investments. Globalization is qualitatively different as it also involves a functional integration across national borders of economic activities Internationalization creates a basis for globalization through increasing transnationalization (trans) driven by foreign investments. Int. Trans. Bilateral Barents Sea Raufoss’ supplies to Volvo Regional Nordic Council EU Global SAS Eurofighter Shell WTO There are three basic questions to be raised if we want to study (or discuss) TNCs: 1. Why do TNCs exist? 2. How do they operate? 3. What are the effects of TNC activities? My own focus is particularly on politics impacts and execution of corporate power: What kind of power is used and what is the purpose? The Power relation between a TNC and political authorities (both at home and abroad ) may be a function of: The relative interest by the authorities The share of control that the TNC concerning the TNC activities X exercises over these activities _________________________________________________________ The relative interest the TNC has for what the authorities may offer The share of control the authorities have concerning the TNC activity in question However, is it feasible only to study this power relation as simply a function of Interests and control? TNC Limitations Degree of competition and concentration in Industy Power resources Vertsland Powerresources Limitations Technology and innovation, Access to home market Management Control of natural resources Finance The corporate dependency of the host country as customer or distributor Distribution Solid infrastructure Marketing Political climate Employment Incentives Alternative global integration Competition between host countries Trade balance and foreign debt Dependence of FDI ....... Political climate Advantage TNC Changes in relative bargaining strength Advantage host country However, structural and idea-based power also influence these dynamics Different national political-economic systems: ideological base: a. The market oriented state b. The regulation oriented state c. The active developmental state d. The steering oriented state strong weak pragmatic weak pragmatic strong capitalist orientation: strong strong weaker weak What is the actual national politics for sustainable development formulated by: a. The market oriented state ? b. The regulation oriented state ? c. The active developmental state ? d. The steering oriented state ? The current international political economy creates new dynamics: Actual decisions implemented ??? International political economy; Governments) vs. one or several firms International political economy is more than just states and markets. Firms are increasingly becoming an independent political agent! (In this context I consciously ignore the civil society as the focus is on TNCs) AUTHORITIES On which level, and with what kind of policy tools? ? TNC Where and to what extent LOCAL INDUSTRY On what conditions, and with what kind of knowledge Motivations driving TNCs to see promote FDI: 1. Markets for existing resources – down the value chain 2. New - up the value chain (upstream) 3. Efficiency gains – oriented toward current activities Often, all the three drivers influence the firm simultaneously, but often at different locations of the firm (at home (HQ) or abroad (OECD or LDCs) : A continous consideration of: International ko-ordination versus national adaptation The evolution of TNCs High 3. Complex global strategy – (with growing 1. Transnational strategy service component Focus: Control of raw materials Low Export-based strategy 2. Multinational strategy Low Focus: Control of markets High The features of national politics are increasingly influenced by corporate firm-specific strategies: positive Political needs in a host country negative Economic international requirements To understand the direct impact of TNCs’ activities on sustainable development, first of all we need to understand: 1. The feature of the transnational organization Then we need to study: 2. Transnational transfers What is transferred internally within the firm – including intra-firm trade Then we need to study 3. Transnational local demand To what degree do the TNC procure goods and services locally? 4. Transnational investments What is de facto plought into local and the hosting economy/society These are four necessary, but still insufficient question to answer Sustainable Development is not created automatically? To a large extent a question of politics Cross Border Environment Management A Systemic approach : 1. environmental policies 6 Control and communication 2. environmental standards 5 environmental auditing 3. environmental guidelines 4. local procedures A vicious or a virtuous circle? a race to the top or to the bottom? Factors influencing the environmental practice of TNCs in India: (findings based on fieldworking among 53 TNCs in 1999) Policy and practices of TNC headquarters: 50 per cent Regulations 23 per cent Local Management 13 per cent NGOs 6 per cent Consumers 6 per cent Fear of accidents (only) 2 per cent Policy implications based on a survey of 53 TNCs: 1. TNCs are not necessarily using India as a dumping ground for obsolete technologies 2. Local networking within the value-chain, however, is limited 3. Path dependency is strong 4. Developmental impacts are limited: TNCs are creating ”islands of excellence in a sea of dirt”!