Chapter_05

Chapter 5

Introduction to Valuation: The Time Value of Money

Copyright © 2013 by The McGraw-Hill Companies, Inc. All rights reserved.

McGraw-Hill/Irwin

Chapter Outline

• Basic Definitions

• Future Value

• Financial Calculator

• Present Value

• Excel Spreadsheet Functions

1

Basic Definitions

• Def of time “value of money”:

• Future Value – later money on a time line

“Compounding of Single CFs”

• Present Value – earlier money on a time line

“Discounting of Single CFs”

.

• Interest rate:

– Discount rate

– Cost of capital

– Opportunity cost of capital

– Required return 2

Future Value

• How much will I have at some point in the future if I have some amount today?

• For example, you invest $100 at a 20% interest. How much do you have in 1, 2, and 3 years?

3

Future Value:

General Formula

• FV = PV(1 + r) t

– FV = future value

– PV = present value

– r = period interest rate

– t = number of periods

• (1 + r) t = future value interest factor

4

Financial Calculator:

Time Value of Money (TVM) Keys

• Texas Instruments BA-II Plus

– FV = future value

– PV = present value

– I/Y = period interest rate

– N = number of periods

– CPT and the variable you are looking for to “compute” the solution

5

The Financial Calculator

6

Issues with the Financial

Calculator

• Remember to clear the registers

(CLR TVM) before each problem

• PV and FV have opposite signs

• I/Y = period interest rate

P/Y & C/Y must equal 1 so that the I/Y is an effective period rate

Interest is entered as a percent, not a decimal

• Set decimal places to 9

• Calculator should be in END mode

(exception: annuity due = BGN) 7

Example

• You invest $5,000 today in an account that pays 12% per year. How much money will you have in 6 years?

• How much total interest, simple interest, and interest on interest did you earn?

8

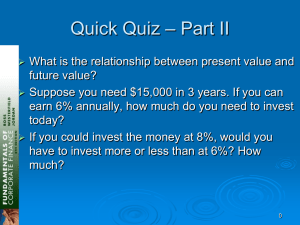

Present Value

• How much do I have to invest today to have some amount in the future?

FV = PV(1 + r) t

Rearrange the formula to solve for PV:

PV = FV / (1 + r) t

1 / (1 + r) t = present value interest factor

9

Example

• You need to have $20,000 in three years to pay for your college tuition.

If you can earn 8% per year on your money, how much do you need to invest today?

10

Example

• At what rate are you investing $100 if it becomes $150 in 6 periods?

11

Example

• It will cost you $50,000 to send your child to school. You have $25,000 now and can earn 12% per year on your investment. How long will it take to get $50,000?

12

Excel Spreadsheet Functions

• Use the following formulas for TVM calculations

=FV(rate,nper,pmt,pv)

=PV(rate,nper,pmt,fv)

=RATE(nper,pmt,pv,fv)

=NPER(rate,pmt,pv,fv)

13