Finance Case Studies

advertisement

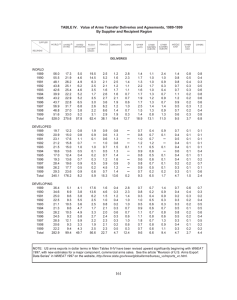

Corporate Finance Case Studies Bayern Brauerei Presentation by Group 5 MBA Fulltime 1. Rapid growth in sales Sales in thousands of DM 120.000 100.000 80.000 West East Total 60.000 40.000 20.000 0 1989 1990 1991 1992 Year Group 5 2 2002-05-10 1. Reasons for rapid growth Remarkable sales growth only in the east From 0 % in 1989 to 18.4% of sales in 1992 146 % sales growth in the east (1990-1992) 2 % sales growth from 1989 to 1992 in the west Completely new market in the east Relaxed credit terms Field inventories for distribution Marketing Manager running the business Group 5 3 2002-05-10 2. Sustainable growth 1989 Equity Retention Rate 1990 1991 1992 24,99% 25,00% 25,90% 25,55% ROE 9,72% 10,25% 6,30% 7,28% Self Sustainable Growth Rate 2,43% 1,63% 1,86% 4,98% 14,24% 9,14% Growth in Sales Group 5 4 2,56% 2002-05-10 2. Reasons for unsustainable growth Retention of profits too low Growth in sales is much higher than SSGR Lack of market research Sustainable growth only achievable through: Higher retention Otherwise: Raise new equity (Shares, etc.) Long Term Debt financing Group 5 5 2002-05-10 3. Increasing debt No increase in total debt Decreasing LTL Increase only in STL Debt is the only way to compensate growth rate Increase in Inventory Increase in Receivables Cash surplus from 6m to 12m Group 5 6 2002-05-10 4. Accounting Break Even Chart Deutsche Mark (millions) 160 Revenue 140 Total cost 120 Variable cost 100 80 60 40 Fixed cost 20 0 0 100 200 300 400 500 600 700 800 900 1000 Hectolitres of beer sold (thousands) Group 5 7 2002-05-10 5. Financial Plan 8.8m DM in Plant and Equipment 8.6m DM in Warehouse Dividends payout: 545,500.00 DM Should not be approved: There is no market for further production, if we get the same market share in the east, we are at this point now We are producing beer, distribution is not our business focus It should not be financed with STL Instead... Rather cut inventories and receivables Get receivables back to 2% 10 and net 40 Retain more earnings to finance further expansion plans Group 5 8 2002-05-10 Managerial Balance Sheet 1989 1992 Cash 6764 12% 12283 23% WCR 2549 4% 11585 21% Investments 3911 7% 3914 7% Net Assets 44162 77% 26539 49% 57386 100% 54321 100% STL LTL 3765 20306 7% 35% 7884 11066 15% 20% Equity 33315 58% 35371 65% 57386 100% 54321 100% Group 5 9 2002-05-10 6. Financially Health Profitability (ROE) is lower than growth rate and decreasing Growth in sales is higher than the SSGR Times interest ratio declines, showing high interest rates on STL Low retention rate High reliability on STL No application of financial and accounting principles Liquidity ratio from 3.71 (1989) to 1.72 (1992) Bad WCC-management Max Leiter´s compensation? Group 5 10 2002-05-10