New Competitive Advantage

From Innovation to Competitive Edge

Getting the new-market product proposition right

The New Market Proposition Problem

The low success rate of new products means that roughly 50% of the resources allocated to product development and introduction is wasted, either through cancellation or failing to achieve adequate returns 1 . For every four products that enter development, only one makes it to market.

Conclusion: new product development is expensive and risky,

A study in Harvard Business Review found that 86% of product launches were line enhancements and only 14% were new market innovations. The line enhancements generated 62% of the total revenue and 39% of total profit in the study, while the new market innovations generated 38% of the revenue and 61% of the profit.

Conclusion: but it’s worth doing for the growth and profit..

In a study of 229 electronics manufacturers’ innovation failures by Stanford, 16% of executives cited marketing, 13% cited insufficient customer benefit and 7% cited difficulty of market development.

Conclusion: ..and some of the problems can be fixed – but how?

By understanding how to get a competitive advantage

1. “3,000 Raw Ideas = 1 Commercial Success!”, Stevens and Burley, Research Technology Management, 1997

Competitive Advantage – what’s changed since 1980?

Updating competition theory for the information age

Competitive advantage is the strategic advantage that one company has over its competitors that allow it to make above-average returns

Michael Porter’s theory of Competitive Advantage is over 30 years old

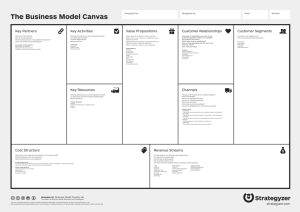

Value System

Fragmentation

• The Web has led to complex global value chains

• All parts of the chain must be satisfied for a new product to succeed

• Propositions must include answers for more of the value system

Network Effects

• The only widespread networks in 1980 were telephone networks

• Network effects lead to new competitive advantages

• Networks can be natural monopolies

Disruption

•The theory of disruptive innovation gives insights into business failure

•Disruptive innovation offers analytical tools for all types of innovation

•Disruption is difficult to spot in complex value chains

New Business

Models

• There are new, lightweight business models based on domain expertise

• Many business models have barriers to entry based on speed to market

• There has been a rapid shift to network and service-based business models

Reducing New Market Product Failure Risk

By targeting competitive advantage in the market

.. for, which requires a ..

.. whose attributes lead to..

..who need a job done, which they..

..which require a..

..with specific..

..targeting particular..

Designing propositions for competitive advantage

The methodology

Technology

Products

Proposition

• Analyse capabilities to identify differentiating attributes

• Map attributes to applications using good-enough / not-good-enough

• Create market-specific product variants that would value attributes

• Analyse competition, including substitutes, to confirm differentiators

• Determine whether products fit the RPV framework (disruptive/non disruptive)

• Ensure the product delivery capability is in place

Markets

•Make sure the value system is better off (disruptive/non-disruptive)

•Analyse potential competitor response using RPV framework

Customers

• Determine what jobs the customer is employing the product to do

• Develop the proposition around the jobs to be done

Business Model

• Make sure there is a RoI for all in value system

• Look for and create barriers to entry

• Create marketing material targeting vertical advantages

A simplified example of attribute-based product differentiation

Characteristic

Size

Mode

Operating

Temperature

Operating

Bandwidth

Operating

Frequency

Power

Output

Gain

Thermal noise

Stability

Cost

Room Temperature Maser

Attribute

Portability

Pulse ,but

CW shortly

Tunability

1.45GHz only

500

High Gain

Low Noise

<140mK

High stability

£200-£500 per unit est.

Application

Satellite phone

Medical

Scanning

Good enough

Not good enough

• The individual capabilities of the new technology are categorised

• The capabilities are combined in different ways, and with other technologies, to develop marketable attributes

• The attributes are matched to market requirements – if an attribute is not good enough, when will it be good enough?

• Potential markets are assessed for size, value and competitive offerings

• A differentiated product offering is constructed and markettested

Case Study 1: Security Protocol Developer

Technology

Markets

Products

Proposition

Marketing

Customers

The company had developed a novel fast secure assured-delivery telecoms protocol to replace TCP and IPSEC/SSL as internet protocols because of poor performance.

The company saw its target market as the large online retailers and commerce businesses that rely on security technologies like IPSEC and SSL.

The company saw its primary product as a secure end-to-end VPN technology

The company had no deliverable market proposition

The company had no sales or service capability

The company had one prospective customer, funded by the same investor, with specialist needs in a market of one.

Analysis of the technology showed that there were several widely-applicable inventions which warranted protection. Patents were filed.

I showed that this was not a job that needed doing due to other higher consumer priorities.

I identified other, larger markets including finance, satellite, media and ‘big data’ which would value particular attributes.

The company did not have the resources to take a large-scale VPN product to market.

Combining the technology capabilities differently allowed products to be created that fitted the resources of the company, in particular a custom chip.

I arranged an independent test facility to provide proof of performance. I created target propositions for each market to develop product against.

I identified the routes to market that required the least resources. This also offered much earlier revenues. I identified appropriate channels and channel approach

I identified several prospects in target markets and tested the propositions against jobs to be done.

Result: Company closed additional funding using my report and is close to first sale

Case Study 2: Waste to Energy Technology

Technology

Markets

Products

Proposition

Marketing

Customers

The company has developed a high efficiency

W2E technology based on a cupola furnace gasifier.

The company saw its target market as waste companies as an alternative to landfill. It was unable to sell the technology.

The company was focused on one part of the whole process (gasifying waste) and had not optimised to meet the needs of the customer, the electricity industry.

The company did not have the capability to assemble the complex value system required to deliver a complete solution

The company had no sales or service capability

The company had no prospective customers

Analysis of the changing waste market showed that all current technologies require subsidy, but this plant did not. This gives a competitive advantage as waste becomes a valued resource.

Large waste companies are locked into a contract-based value system which prevents adoption of technologies which are not government-approved. A new value system was required targeting commercial wastes. I established a new company to do this.

The efficiency of the technology was improved further by a change of power-generation technology. We identified a suitable vendor and designed a plant capable of delivering electricity with a high availability.

We formed a JV of three companies, including a commercial waste operator with land. We brought in the additional resources required to satisfy finance requirements.

Developed a financial model showing an IRR of over 25% without subsidy. This attracted sufficient financial interest to proceed to the next stage

We have identified several prospects in overseas markets who are waiting for the first plant to begin operation

Result: JV formed which is arranging planning permission on first site.