Cash flow from assets = cash flow to debt

advertisement

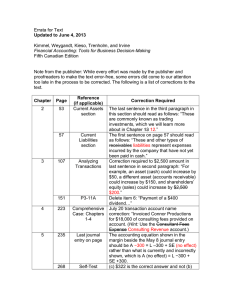

Chapter 2 Financial Statements, Taxes and Cash Flow 6-1 2-1 Chapter Objectives Understand the difference between book value (from the Balance Sheet) and market value. Understand the difference between net profit (from the Income Statement) and cash flow. Explain the differences between the average tax rate, the marginal tax rate and the flat rate. Explain the calculation of cash flow from assets, and cash flow to debt-holders and shareholders. 6-2 2-2 The Balance Sheet summary of a firm’s financial position on a given date that shows total assets = total liabilities + owners’ equity. A Equation: Assets = Liabilities + Owners’/Shareholders’ Equity. working capital = Current Assets – Current Liabilities. Net 6-3 2-3 Petro Rabighs’ Balance Sheet (Asset Side) Petro Rabighs’ Balance Sheet (thousands) Dec. 31, 2014a Cash and C.E. $ 90 Acct. Rec.c 394 Inventories 696 Prepaid Exp d 5 Accum. Tax Prepay 10 Current Assetse $1,195 Fixed Assets (@Cost)f 1030 Less: Acc. Depr. g (329) Net Fix. Assets $ 701 Investment, LT 50 Other Assets, LT 223 Total Assets b $2,169 6-4 2-4 a. How the firm stands on a specific date. b. What BW owned. c. Amounts owed by customers. d. Future expense items already paid. e. Cash/likely convertible to cash within 1 year. f. Original amount paid. g. Acc. deductions for wear and tear. Petro Rabighs’ Balance Sheet (Liability Side) Petro Rabighs’ Balance Sheet (thousands) Dec. 31, 2014 Notes Payable Acct. Payablec Accrued Taxes d Other Accrued Liab. d Current Liab. e Long-Term Debt f Shareholders’ Equity Com. Stock ($1 par) g Add Pd in Capital g Retained Earnings h Total Equity Total Liab/Equitya,b 6-5 2-5 $ 290 94 16 100 $ 500 530 a. Note, Assets = Liabilities + Equity. b. What BW owed and ownership position. c. Owed to suppliers for goods and services. d. Unpaid wages, 200 salaries, etc. 729 e. Debts payable < 1 year. 210 f. Debts payable > 1 year. $1,139 g. Original investment. $2,169 h. Earnings reinvested. Market Value versus Book Value Book value refers the price that never change as long as you own the asset. Example: if you bought a house 10 years ago for 300,000SAR, its book value for your entire period of ownership will remain 300,000SAR Market value refers the price that could be obtained in the current market place. Example: if the price of that house after 10 years is 350,000SAR then it is called market value. 6-6 2-6 The Income Statement summary of a firm’s revenues and expenses over a specified period, ending with net income or loss for the period. A Equation: Revenues – Expenses = Profit. Profit is often expressed on a per-share basis and called earnings per share (EPS). The difference between net profit and cash dividends is called retained earnings, which is added to the retained earnings account in the Balance Sheet. 6-7 2-7 Example—Income Statement of Petro Rabigh Revenue Cost of Goods Sold Depreciation EBIT(Earnings Before Interest & Tax ) Interest Taxable Income (EBT) Tax Net Profit (EAT) Dividends Addition to R/E 6-8 2-8 $4 000 2 800 200 1 000 200 800 240 $560 260 $300 Taxes Can be one of the largest cash outflows that a firm experiences. The size of the tax bill is determined by the Income Tax Assessment Act. The Tax Act is the result of political, not economic, forces. 6-9 2-9 Tax rates The average tax rate is the total tax bill divided by taxable income; that is, the percentage of income that goes in taxes. The marginal tax rate is the extra tax paid if one more dollar is earned. A flat rate is where there is only one tax rate that is the same for all income levels. It is the marginal rate that is relevant for most financial decisions. 6-10 2-10 Tax System in Saudi Arabia Types Tax rate Personal rates Company Rate Foreigner Shareholders Saudi Shareholders Both Saudi & Non-Saudi (natural gas sector) Both Saudi & Non-saudi (production of oil and Nil Flat Rate 20% 2.5% 30% 85% hydrocarbons ) 6-11 Cash Flow from Assets Equation: Cash flow from assets = cash flow to debt-holders + cash flow to shareholders. The cash flow identity or equation states that the cash flow from the firm’s assets is equal to the cash flow paid to suppliers of capital to the firm. 6-12 Cash Flow from Assets The total cash flow from assets = operating cash flow – net capital spending on noncurrent assets- addition to net working capital 6-13 Operating cash flow: the cash flow that results from day-to-day activities of producing and selling. Earnings before interest and taxes (EBIT) + Depreciation – Taxes. Net capital spending: Ending non-current assets – Beginning non-current assets + Depreciation.. Additions to net working capital (NWC): Ending NWC – Beginning NWC. Cash Flow to Debt-holders and Shareholders The cash flow to debt-holders includes any interest paid less the net new borrowing. The cash flow to shareholders includes dividends paid out by a firm less net new equity raised. 6-14 Example―Balance Sheet ($000s) Assets (‘000s) Current assets Cash Accounts receivable Inventory Total Non-current assets Net plant and equipment TOTAL ASSETS 6-15 2006 2007 $ 90 520 640 $ 1 250 $ 100 620 770 $ 1 490 1 970 2 200 $3 220 $3 690 Example―Balance Sheet ($000s) Liabilities and equity (‘000s) 2006 2007 $ 420 220 $ 640 $ Long-term debt $ 410 $ 450 Shareholders’ equity Ordinary shares Retained earnings Total TOTAL LIABILITIES AND EQUITY 580 1 590 $2 170 $3 220 580 1 790 $2 370 $3 690 Current liabilities Accounts payable Notes payable Total 6-16 520 350 $ 870 Example―Income Statement ($000s) Sales $1 420.00 Cost of goods sold 960.00 Depreciation 60.00 EBIT $400.00 Interest 40.00 Taxable income 360.00 Tax 108.00 Net profit $252.00 Dividends 52.00 Addition to retained earnings $200.00 6-17 Example―Cash Flow From Assets ($000s) 6-18 Operating cash flow: EBIT + Depreciation – Taxes $ 400.00 + 60.00 – 108.00 $352.00 Change in net working capital: Ending net working capital – Beginning net working capital $ 620.00 610.00 $ 10.00 Net capital spending: Ending non-current assets $ 2 200.00 – Beginning non-current assets – 1 970.00 + Depreciation + 60.00 $290.00 Cash flow from assets: $ 52.00 Example―Cash Flow to Debtholders and Shareholders ($000) Cash flow to debtholders: Interest paid – Net new borrowing (450-410) Cash flow to shareholders: Dividends paid – Net new equity raised (580-580) $ – 40.00 40.00 $ 0.00 $ 52.00 0.00 $52.00 Cash flow to debtholders and shareholders 6-19 $52.00 Summary and Conclusions The book values on an accounting Balance Sheet can be very different from market values. Net profit as it is computed on the Income Statement is not a cash flow, a primary reason being the deduction of depreciation (a non-cash expense). Marginal and average tax rates can be different. However it is the marginal tax rate that is relevant for most financial decisions. Cash flow from assets equals cash flow to debt-holders and shareholders. It is important not to confuse book values with market values, and accounting income with cash flow. 6-20