Accounting

Principles

Second Canadian Edition

Weygandt · Kieso · Kimmel · Trenholm

Prepared by:

Carole Bowman, Sheridan College

Revised by:

Carolyn Doering, Huron Heights SS

CHAPTER

11

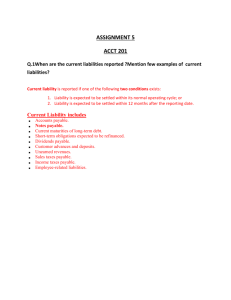

CURRENT LIABILITIES

ACCOUNTING FOR

CURRENT LIABILITIES

A current liability is a debt that can

reasonably be expected to be paid

1. from existing current assets or

in the creation of other

current liabilities and

2. within one year or the

operating cycle, whichever

is longer.

ACCOUNTING FOR CURRENT

LIABILITIES

Types of liabilities

1)

2)

3)

Definitely determinable (known

amount, payee, and due date)

Estimated (estimate the amount or

timing)

Contingent (potential liabilities that

depend on a future event such as a

pending lawsuit)

ACCOUNTING FOR

CURRENT LIABILITIES

Definitely determinable current

liabilities include:

1. Operating line of credit

2. Accounts and notes payable

3. Sales tax payable

4. Payroll and employee benefits

5. Unearned revenues

6. Current maturities of

long-term debt

OPERATING LINE OF CREDIT

A pre-authorized demand loan, allowing the

company to write cheques up to a preset limit

when needed.

Helps manage temporary cash shortfalls

Security called collateral is required (usually a

companies assets)

Disclosed by footnote and by reporting

any resulting bank overdraft as a current

liability.

NOTES PAYABLE

Notes

Payable are obligations in the form of

written promissory notes that usually require

the borrower to pay interest.

Notes payable may be used instead of accounts

payable because it supplies documentation of the

obligation in case legal remedies are needed to

collect the debt.

Notes due for payment within one year

of the balance sheet date are usually

classified as current liabilities.

NOTES PAYABLE EXAMPLE

Company B agrees to lend $100,000 to us on March 1 for 4 month note

payable at 6% interest (adjusting entries are completed each quarter)

Mar 1 Cash

100,000

Note Payable

100,000

To record issue of note payable

Mar 31 Interest Expense

500

Interest Payable

500

To record interest for one month (end of the accounting quarter)

June 30 Interest Expense

1,500

Interest Payable

1,500

To accrue interest for April, May and June (end of the quarter)

July 1 Note Payable

Interest Payable

100,000

2,000

Cash

102,000

To record payment to Company B and accrued interest

SALES TAXES PAYABLE

Sales tax is expressed as a stated percentage of

the sales price of goods sold to customers by a

retailer.

Sales tax includes the goods and service tax

(GST), provincial sales tax (PST) or harmonized

sales taxes (GST and PST combined).

The retailer (or selling company) collects the tax

from the customer when the sale occurs,

and periodically (usually monthly)

remits the collections to the government.

PAYROLL AND EMPLOYEE BENEFITS

Salaries or wages payable represent the

amounts owed to employees for a pay period.

Payroll withholdings include federal and

provincial income taxes, Canada Pension Plan

(CPP) contributions, and employment

insurance (EI) premiums.

Employees may also voluntarily authorize

withholdings for charity, retirement, medical,

or other purposes.

Payroll withholdings are remitted to

governmental taxing authorities.

PAYROLL EXAMPLE

Mar 7 Salaries and Wages Expense

100,000

CPP Payable

3,870

EI Payable

2,250

Income Taxes Payable

30,000

United Way Payable

2,445

Union Dues Payable

1,435

Salaries and Wages Payable60,000

To record payroll and deductions

There would be other JE’s to record:

the actual payment to employees

the employers share of payroll costs-EI, CPP, WSIB

to remit the payables

UNEARNED REVENUES

Unearned Revenues (advances from customers)

occur when a company receives cash before a

service is rendered.

Examples are when an airline sells a ticket for

future flights or when a lawyer receives legal fees

before work is done.

Sept 6 Cash

200,000

Unearned Hockey Ticket Revenue 200,000

To record sale of 1,000 season tickets

Sept 25 Unearned Hockey Ticket Revenue 8,000

Hockey Ticket Revenue

8,000

To record hockey ticket revenue earned

CURRENT MATURITIES OF

LONG-TERM DEBT

Another item classified as a current liability is current

maturities of long-term debt.

For example, part of a 5 year note payable must be paid

each year. The amount due that year should be

recorded as a current liability.

Current maturities of long-term debt are often identified

on the balance sheet as long-term debt due within one

year.

ESTIMATED LIABILTIES

Obligation that exists but for which the

amount and timing is uncertain.

However, the company can reasonably

estimate the liability.

Examples include property taxes and

warranty liabilities (to be discussed).

Other examples include vacation pay and

pensions.

PROPERTY TAXES

Property taxes are accrued monthly

based on the prior year’s tax bill.

When the property tax bill for the

current year is received, the company will

adjust its monthly expense for the

remainder of the year.

PROPERTY TAX EXAMPLE

Tantramar Inc. had property tax of $5520 last year. For January and February of

this year they do not know what the tax will be, so their calculation is based on last

year’s assessment (ie. an estimated liablity)

Jan 31

Property Tax Expense (5520/12)

Property Tax Payable

To accrue property tax payable (same for Feb.)

460

460

The assessment arrives in March for $6000, payable on May 31

Mar 31

May 31

June 30

Property Tax Expense (6000-920)/10

Property Tax Payable

To accrue property tax payable (repeat for April)

Property Tax Payable (460x2 +508x2)

Property Tax Expense

Prepaid Property Tax (508x7)

Cash

To pay property tax

508

508

1,936

508

3,556

6,000

Property Tax Expense

508

Prepaid Property Tax

508

To record property tax expense (repeat at the end of July to December)

PRODUCT WARRANTIES

Warranty contracts may lead to future

costs for replacement or repair of

defective units.

Using prior experience with the product,

the company estimates what the cost of

servicing the warranty will be.

Estimated warranty costs are accrued

with a debit to warranty expense and a

credit to estimated warranty liability.

CONTINGENT LIABILITIES

Contingent liabilities exist when there is

uncertainty about the outcome.

Contingencies are accrued by a debit to an

expense account and a credit to a liability

account if both of the following conditions are

met:

1. The contingency is likely, and

2. The amount of the contingency can be

reasonably estimated.

They should be disclosed in the notes to the

financial statements.

FINANCIAL STATEMENT

PRESENTATION

Each major type of current liability is listed

separately.

Often list bank loans, notes payable, and

accounts payable first, then other liabilities.

COMINCO LTD.

Current liabilities (Millions)

Bank loans and notes payable

Accounts payable and accrued liabilities

Income and resource taxes

Long-term debt due within one year

$ 5

230

36

30

$301

COPYRIGHT

Copyright © 2002 John Wiley & Sons Canada, Ltd. All rights reserved.

Reproduction or translation of this work beyond that permitted by

CANCOPY (Canadian Reprography Collective) is unlawful. Request for

further information should be addressed to the Permissions Department,

John Wiley & Sons Canada, Ltd. The purchaser may make back-up copies

for his / her own use only and not for distribution or resale. The author and

the publisher assume no responsibility for errors, omissions, or damages,

caused by the use of these programs or from the use of the information

contained herein.