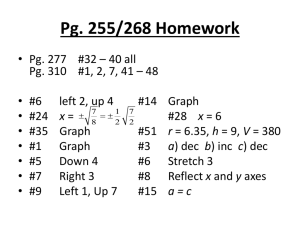

Compound Interest

advertisement

COMPOUND INTEREST Making or Spending Money SIMPLE INTEREST FORMULA If a principal of P dollars is borrowed for a period of t years at a per annum interest rate r, expressed as a decimal, then interest I charged is I Pr t This interest is not used very often. Interest is usually compounded which means interest is charged or given on the interest and the principal. Simple Interest Example COMPOUND INTEREST Payment Periods: Annually Once per year Semiannually Twice per year Quarterly Four times per year Monthly Twelve times per year Weekly Fifty two times per year Daily 365 (360 by banks) per year COMPOUND INTEREST FORMULA The amount A after t years due to a principal P invested at an annual interest rate r compounded n times per year is r A P 1 n nt A is commonly referred to as the accumulated value or future value of the account. P is called the present value. COMPOUND INTEREST Example: Investing $1000 at an annual rate of 8% compounded annually, quarterly, monthly, and daily will yield the following amounts after 1 year: Annually Quarterly Monthly Daily COMPOUND INTEREST On-line example More on-line examples COMPOUND INTEREST Tutorial Continuous Compounding The amount A after t years due to a principal P invested at an annual interest rate r compounded continuously is A Pe rt FINDING EFFECTIVE RATE OF INTEREST 1. 2. 3. 4. Definition Steps for Finding ERI: (If a P is not given, use $100) Find the value of the interest compounded annually for one year Find the value of the interest compounded for the given amount of times annually Find the interest by subtracting (Step 2 – original principal) Divide the answer by the original principal (if using 100 don’t have to because it’s already written as a percent). EFFECTIVE RATE OF INTEREST Finding Interest Video What is the Effective Rate of Interest for 5.25% compounded quarterly? Step 1: 100(1 + .0525)(1) = A A = 105.25 Step 2: .0525 100 1 4 105.35 4 Step 3: 105.35 – 100 = 5.35 Step 4: 5.35% PRESENT VALUE FORMULAS The present value P of A dollars to be received after t years, assuming a per annum interest rate r compounded n times per year, is nt r P A 1 n If the interest is compounded continuously, then P Ae rt EXAMPLES Sears charges 1.25% per month on the unpaid balance for customers with charge accounts (interest is compounded monthly). A customer charges $200 and does not pay her bill for 6 months. What is the bill at that time? EXAMPLES Tracy is contemplating the purchase of 100 shares of stock selling for $15 per share. The stock pays no dividends. Her broker says that the stock will be worth $20 per share in 2 years. What is the annual rate of return on this investment? EXAMPLES Will invests $2000 in a bond trust that pays 9% interest compounded semiannually. His friend Henry invests $2000 in a certificate of deposit (CD) that pays 8.5% compounded continuously. Who has more money after 20 years, Will or Henry? EXAMPLES How long will it take for an investment to double in value if it earns 5% compounded continuously? EXAMPLES What annual rate of interest compounded annually should you seek if you want to double your investment in 5 years? EXAMPLES On-line problems More on-line examples

![Practice Quiz Compound Interest [with answers]](http://s3.studylib.net/store/data/008331665_1-e5f9ad7c540d78db3115f167e25be91a-300x300.png)