cash_flow_office_bui..

advertisement

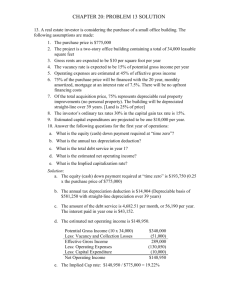

Overhead Set #5: Typical Downtown Office Building--1986 Size: 450,000 ft2 Land: 15% of total property value Depreciation: straight-line over 19 years Debt: 75% loan-to-value; interest only; 9% Price: $170.78/ft2 Effective Gross Rent: $21.73/ft2 Net Operating Income: $14.17/ft2 5:1 Gross Potential Income -Vacancy/Bad Debt Effective Gross Income -Operating Expenses Net Operating Income -Debt Service Before-Tax Cash Flow +Principal Repayment -Depreciation Taxable Income (Loss) Tax Bill (Savings) --------------------9,778,500 3,402,000 6,376,500 5,187,443 1,189,059 0 3,438,071 (2,249,014) (1,124,507) After-Tax Cash Flow 2,313,564 5:2 Important Calculations 1. Effective Gross Rent: $21.73*450,000 = $9,778,500 2. Net Operating Income: $14.17*450,000 = $6,376,500 ==> note that operating expenses are the difference between these two figures (approximately 35% of effective gross) 3. Debt Service a. Property Value: $170.78*450,000 = $76,851,000 b. Mortgage Amount: $.75*$76,851,000 = $57,638,230 c. Interest Payment: $.09*$57,638,230 = $5,187,443 ==> you now know before-tax cash flow; it is positive at $1.2 million 5:3 Important Calculations 4. Principal Repayment: $0, as loan is interest only 5. Depreciation Deduction a. Depreciable Basis: .85*$76,851,000 = $65,323,350 b. Annual deduction: $65,323,350/19 = $3,438,071 5:4 Important Calculations ==> while actual before-tax cash is positive, the large depreciation deduction allows the owner to claim the project is losing money; the taxable loss is $2.2 million ==> at the 50% top marginal bracket then in effect, the value of this taxable loss is $1.1 million ==> after-tax cash flows attributable to ownership of this building is $2.3 million, assuming full use of loss offsets 5:5 Treatment of Activities That Increase the Depreciable Basis 1. Original Depreciation--i.e., no new tenant improvements a. Depreciable Basis=(.85)*(76,851,000)=$65,323,350 as computed above b. Annual Deduction=$65,323,350/19 = $3,438,071 (in 1986) 2. Now consider the impact of $1,000,000 in new tenant improvements that increase the depreciable basis a. New Basis: +$1,000,000 b. 1,000,000/19=$52,632 ==>new line #9 = $3,438,071+$52,632=$3,490,703 5:6 Gross Potential Income -Vacancy/Bad Debt Effective Gross Income -Operating Expenses Net Operating Income -Debt Service Before-Tax Cash Flow +Principal Repayment -Depreciation Taxable Income (Loss) Tax Bill (Savings) ----9,778,500 3,402,000 6,376,500 5,187,443 1,189,059 0 3,438,071 (2,249,014) (1,124,507) 9,778,500 3,402,000 6,376,500 5,187,443 1,189,059 0 3,490,703 (2,301,644) (1,150,822) ATCF 2,313,564 1,339,881 where $1,339,881=$1,189,059+1,150,822-$1,000,000 5:7 Note: actual BTCF is $1,189,059, but do not let that affect the taxable income calculation if the item cannot be immediately expensed so that the base for taxation is reduced on a dollar-for-dollar basis Note: this is not a real estate specific issue; cash flow is $1,000,000 lower in any industry; real estate specific rules apply to what is immediately expensible and what must be capitalized or amortized. 5:8 Impact of Taxes: – Depreciation – Loan Points – Effective Tax Rate = [1 - BTIRR/ATIRR] Impact of Leverage – Positive or Negative – Breakeven Interest Rate ATIRRDebt = ATIRRProperty ATIRRDebt = BTIRRDebt(1-) BTIRRDebt = [ATIRRProperty / (1-)] 5:9 Investment Analysis Should a property be purchased? How long should it be held? How should it be financed? What are the tax implications? How risky is the investment? 5:10 Measure of Investment Performance 1. Price/SF 2. Cap Rate = NOI / Sale Price 3. Break-even Ratio = (Operating Exp + Debt Serv)/Gross Inc 4. Equity Dividend Rate = BTCF / Equity 5. Debt Coverage Ratio = NOI / Debt Service 6. Net Present Value (NPV) 7. Internal Rate of Return (IRR) BEWARE: (BTCF + Principal Repayment) / Equity (BTCF + Tax Effect) / Equity 5:11